resist47.news — news & tools for the resistance.

#resist47 #USTariffs #USManufacturing #EconomicPolicies #ArtificialIntelligence

resist47.news — news & tools for the resistance.

#resist47 #USTariffs #USManufacturing #EconomicPolicies #ArtificialIntelligence

www.axios.com/2026/02/09/e...

www.axios.com/2026/02/09/e...

#VOTE @thedemocratsmv.bsky.social/#2026!

#VOTE @thedemocratsmv.bsky.social/#2026!

#Republicans won big in 2024 by opposing the economic policies of Joe Biden / Kamala Harris and inflation. However, #DonTheCon's signature policy, #Tariffs, is resulting in #LostJobs and #HigherPrices.

#EconomicPolicies #JoeBiden #KamalaHarris #Inflation #AtlantaJournalConstitution

#Republicans won big in 2024 by opposing the economic policies of Joe Biden / Kamala Harris and inflation. However, #DonTheCon's signature policy, #Tariffs, is resulting in #LostJobs and #HigherPrices.

#EconomicPolicies #JoeBiden #KamalaHarris #Inflation #AtlantaJournalConstitution

'The GOP says #SNAP recipients should ‘just get jobs’ — but 70% of recipients work full-time.

Rep. Jasmine Crockett is right: #SNAP is a symptom of a much bigger problem ...' #EconomicPolicies

youtube.com/shorts/aBw58...

'The GOP says #SNAP recipients should ‘just get jobs’ — but 70% of recipients work full-time.

Rep. Jasmine Crockett is right: #SNAP is a symptom of a much bigger problem ...' #EconomicPolicies

youtube.com/shorts/aBw58...

#ResistTrump

#ResistTrump

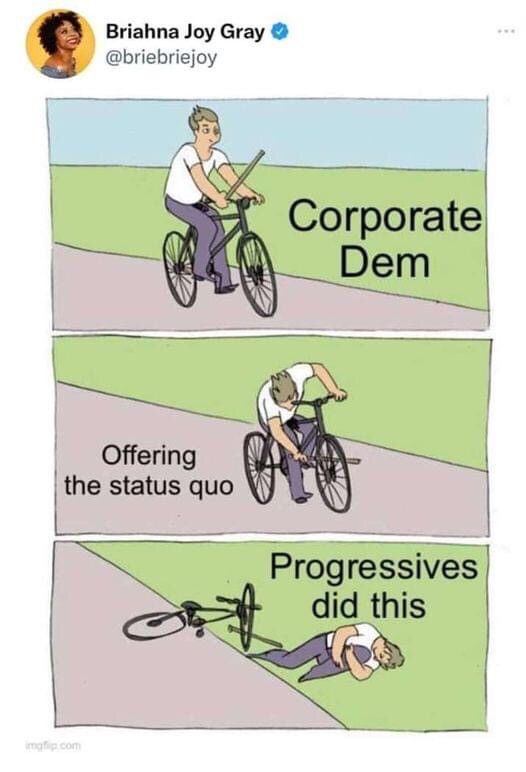

#kitchentableeconomics 🔴💀🐀🔵 #PriceGouging occurred under both #EgoJoeBiden & #HerrTrumpfenfuhrer

#Capitalists from BOTH parties in the toxic 🔵🔴 #duopoly don't PERSONALLY feel the negative effects of their #economicpolicies.

#WealthShouldNotGovern 🤑

#kitchentableeconomics 🔴💀🐀🔵 #PriceGouging occurred under both #EgoJoeBiden & #HerrTrumpfenfuhrer

#Capitalists from BOTH parties in the toxic 🔵🔴 #duopoly don't PERSONALLY feel the negative effects of their #economicpolicies.

#WealthShouldNotGovern 🤑

#kitchentableeconomics 🔴💀🐀🔵 #PriceGouging occurred under both #EgoJoeBiden & #HerrTrumpfenfuhrer

#Capitalists from BOTH parties in the toxic 🔵🔴 #duopoly don't PERSONALLY feel the negative effects of their #economicpolicies.

#WealthShouldNotGovern🤑

#kitchentableeconomics 🔴💀🐀🔵 #PriceGouging occurred under both #EgoJoeBiden & #HerrTrumpfenfuhrer

#Capitalists from BOTH parties in the toxic 🔵🔴 #duopoly don't PERSONALLY feel the negative effects of their #economicpolicies.

#WealthShouldNotGovern🤑

www.axios.com/2025/09/22/t...

www.axios.com/2025/09/22/t...

#wallst indexes post record closing highs again, with #nvidia, #tech shares higher.

#resist #boycott #conspirators […]

#wallst indexes post record closing highs again, with #nvidia, #tech shares higher.

#resist #boycott #conspirators […]

He may have the moment but scratch him and you have the same 🤑 #wealthy, white male #centrist with the same #corporate #economicpolicies that voters have rejected nation-wide.

#NONewsom2028

He may have the moment but scratch him and you have the same 🤑 #wealthy, white male #centrist with the same #corporate #economicpolicies that voters have rejected nation-wide.

#NONewsom2028

What is happening can be summed up as "Kleptocracy in action."

Trump's #EconomicPolicies are largely meaningless, but have served as a great distraction. “This is all just a con.”

What is happening can be summed up as "Kleptocracy in action."

Trump's #EconomicPolicies are largely meaningless, but have served as a great distraction. “This is all just a con.”

A mere FEW examples of Their *directives*:

A mere FEW examples of Their *directives*:

#Trump #ETFs #XRP #Cryptocurrency #EconomicPolicies #MarketImpact #InvestSmart #FinancialFuture #CryptoCommunity

#Trump #ETFs #XRP #Cryptocurrency #EconomicPolicies #MarketImpact #InvestSmart #FinancialFuture #CryptoCommunity

#Voters MUST ask 🔵 about concrete plans to address 1. #incomeinequality, 2. #laborrights, 3. strategies for #sustainableeconomics 4. ⁉️questions regarding how they intend to balance #socialjustice with #economicpolicies will be crucial.

#Voters MUST ask 🔵 about concrete plans to address 1. #incomeinequality, 2. #laborrights, 3. strategies for #sustainableeconomics 4. ⁉️questions regarding how they intend to balance #socialjustice with #economicpolicies will be crucial.

sharenobyl.com/en/topic/the...

#USTradeWar #ChinaTrade #TrumpTariff #TariffFreeze #GlobalEconomy #TradeRelations #USChinaRelations #TradeImpact #EconomicPolicies #Tariffs #USChinaTrade #InternationalTrade #GlobalTrade

sharenobyl.com/en/topic/the...

#USTradeWar #ChinaTrade #TrumpTariff #TariffFreeze #GlobalEconomy #TradeRelations #USChinaRelations #TradeImpact #EconomicPolicies #Tariffs #USChinaTrade #InternationalTrade #GlobalTrade