#Free5Gtraining #3G4G5G #OpenRAN #ORANalliance #DeutscheTelekom #TelefónicaO2 #Germany #BMDS #RIMEDOLabs #Dell #ITRI #AnalogDevices

#Free5Gtraining #3G4G5G #OpenRAN #ORANalliance #DeutscheTelekom #TelefónicaO2 #Germany #BMDS #RIMEDOLabs #Dell #ITRI #AnalogDevices

#AVGO $MU $NXPI #MCHP #TXN #ADI #Semiconductors #Chips #Microchip #TexasInstruments #Broadcom #Micron #AnalogDevices

#AVGO $MU $NXPI #MCHP #TXN #ADI #Semiconductors #Chips #Microchip #TexasInstruments #Broadcom #Micron #AnalogDevices

#AnalogDevices #ASILx #automotiveEthernet #automotivefunctionalsafety #automotivemicrocontrollers #automotivesemiconductors #Bosch #Futurride #InfineonTechnologies #ISOISO26262

futurride.com/2025/07/23/i...

#AnalogDevices #ASILx #automotiveEthernet #automotivefunctionalsafety #automotivemicrocontrollers #automotivesemiconductors #Bosch #Futurride #InfineonTechnologies #ISOISO26262

futurride.com/2025/07/23/i...

StatedUntimed.com/FINANCE

#StatedUntimed #Kustafi #AnalogDevices #Finance #TimelessElegance

StatedUntimed.com/FINANCE

#StatedUntimed #Kustafi #AnalogDevices #Finance #TimelessElegance

EPS: $1.63 (Est.$1.54)

Revenue: $2.42B (Est. $2.36B)

"first quarter revenue, profitability, and earnings per share above the midpoint of our outlook, despite the challenging macro and geopolitical backdrop" - Vincent Roche, CEO

📈+4.37%

#AnalogDevices #news

EPS: $1.63 (Est.$1.54)

Revenue: $2.42B (Est. $2.36B)

"first quarter revenue, profitability, and earnings per share above the midpoint of our outlook, despite the challenging macro and geopolitical backdrop" - Vincent Roche, CEO

📈+4.37%

#AnalogDevices #news

👉查询蓝天帐号创建日期的机器人

👉查询蓝天帐号创建日期的机器人

audioxpress.com/news/idun-te...

#IDUNTechnologies a company from Switzerland,& a pioneer in brain-sensing in-ear technology, has joined forces with #AnalogDevices to advance a critical dimension in hearables.

audioxpress.com/news/idun-te...

#IDUNTechnologies a company from Switzerland,& a pioneer in brain-sensing in-ear technology, has joined forces with #AnalogDevices to advance a critical dimension in hearables.

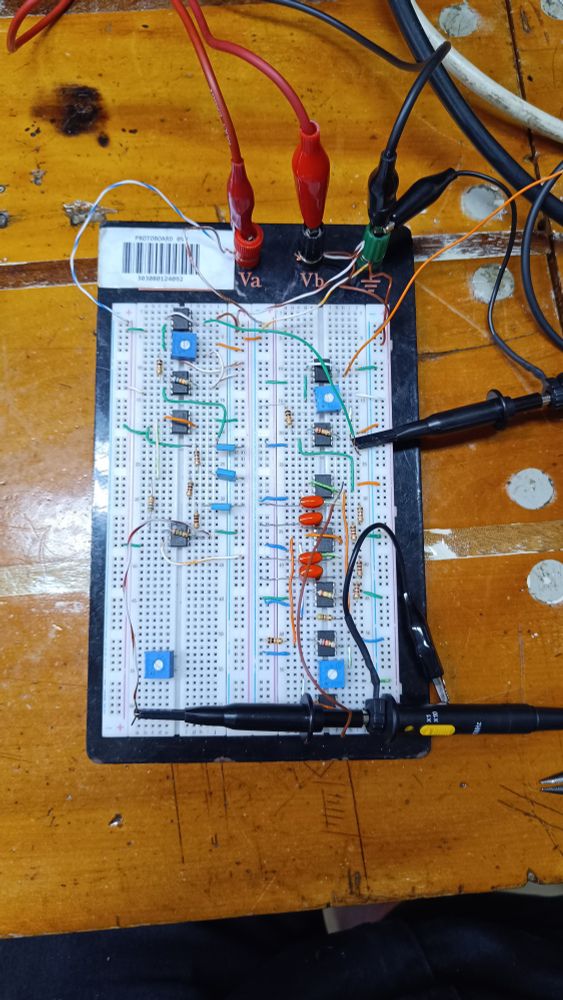

single chip

analog

computer.

[ March 1, 1978 ]

#electronics #components #analog #computer #multiplier #AnalogDevices #chip

single chip

analog

computer.

[ March 1, 1978 ]

#electronics #components #analog #computer #multiplier #AnalogDevices #chip

EPS: $1.67 (Est.$1.64)

Revenue: $2.44B (Est.$2.4B)

“ADI’s revenue, profitability, and earnings per share all finished above our guided midpoint” - Vincent Roche, CEO

📉-3%

#StockMarket #AnalogDevices

EPS: $1.67 (Est.$1.64)

Revenue: $2.44B (Est.$2.4B)

“ADI’s revenue, profitability, and earnings per share all finished above our guided midpoint” - Vincent Roche, CEO

📉-3%

#StockMarket #AnalogDevices

#electronic #analogelectronic #analogcircuits #analogdevices #texasinstrument #ampop #u741