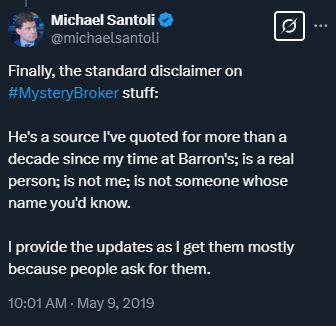

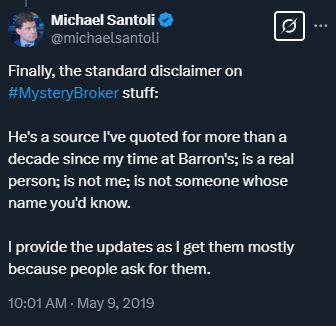

Here's some background on this source, whom I've quoted since 2009.

Here's some background on this source, whom I've quoted since 2009.

Here's some background on this source, whom I've quoted since 2009.

- Mystery Degenerate

- Mystery Degenerate

bsky.app/profile/mich...

bsky.app/profile/mich...

He's a source I've quoted for 15+ years, since my time at Barron's; is a real person; is not me; is not someone whose name you'd know.

I provide the updates as I get them, not upon request. Check the hashtag for his past market takes.

He's a source I've quoted for 15+ years, since my time at Barron's; is a real person; is not me; is not someone whose name you'd know.

I provide the updates as I get them, not upon request. Check the hashtag for his past market takes.

Meantime, #MysteryBroker adds that he's now convinced the secular bull market that began March 2009 ended either in January 2022 or this past February, giving way to a period of much more muted real equity returns.

Meantime, #MysteryBroker adds that he's now convinced the secular bull market that began March 2009 ended either in January 2022 or this past February, giving way to a period of much more muted real equity returns.

Short version: This correction is likely due for some upside relief; the markings of a bear market aren't visible.

But the clock is ticking on the secular bear market that started in 2009, expect weaker long-term returns. Thread:

More details when available.

Short version: This correction is likely due for some upside relief; the markings of a bear market aren't visible.

But the clock is ticking on the secular bear market that started in 2009, expect weaker long-term returns. Thread:

The fine print remains as it ever was....

The fine print remains as it ever was....

More details when available.

More details when available.