👉 https://www.capitalist-letters.com

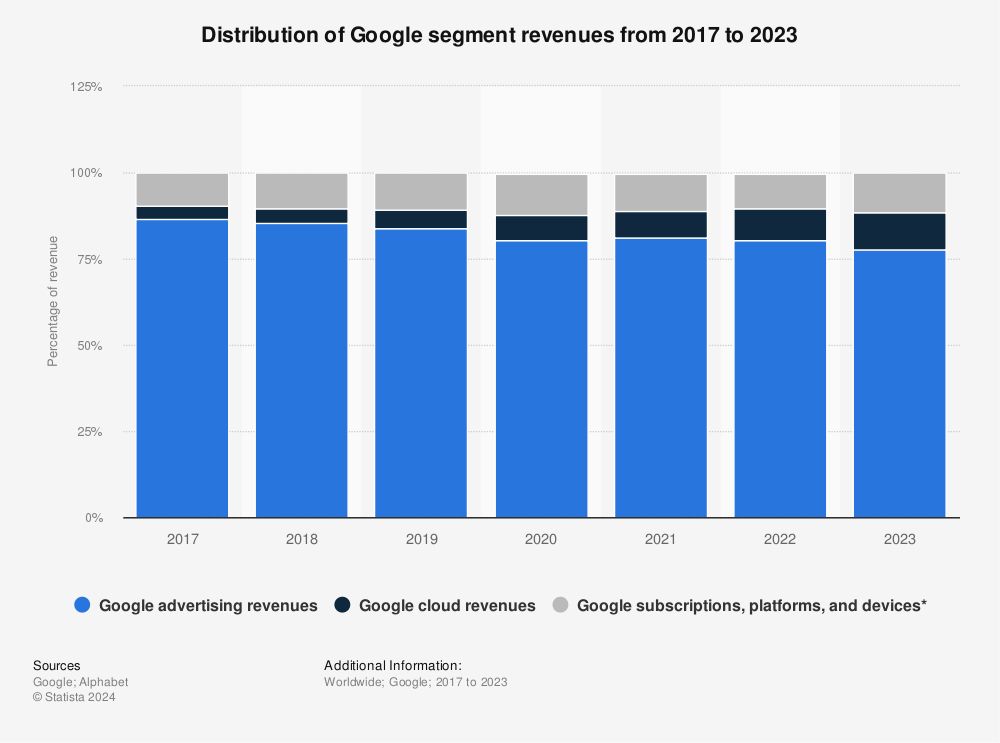

Search’s share of revenue has been consistently decreasing since 2017.

It has:

- Fastest growing cloud unit.

- Dominant streaming service.

- Leadership in quantum computing.

70% of its cloud powered by its own chips.

Long $GOOG!

Search’s share of revenue has been consistently decreasing since 2017.

It has:

- Fastest growing cloud unit.

- Dominant streaming service.

- Leadership in quantum computing.

70% of its cloud powered by its own chips.

Long $GOOG!

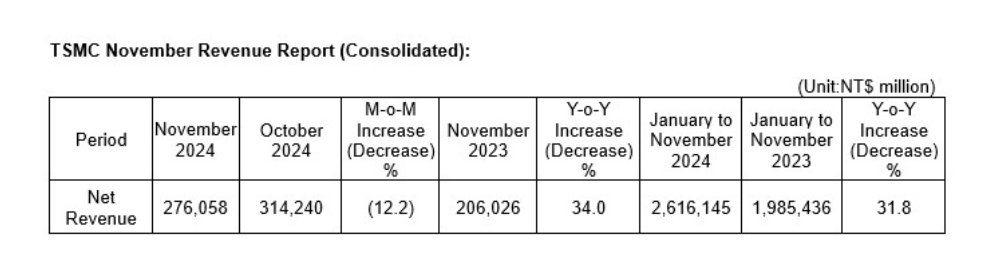

It announced 34% YoY sales growth for November.

This is just INSANE…

It manufactures all chips for $NVDA and $AAPL. It also manufactures $AMD MI300 accelerators.

It captures 95% of the whole demand for AI chips.

Long $TSM.

It announced 34% YoY sales growth for November.

This is just INSANE…

It manufactures all chips for $NVDA and $AAPL. It also manufactures $AMD MI300 accelerators.

It captures 95% of the whole demand for AI chips.

Long $TSM.

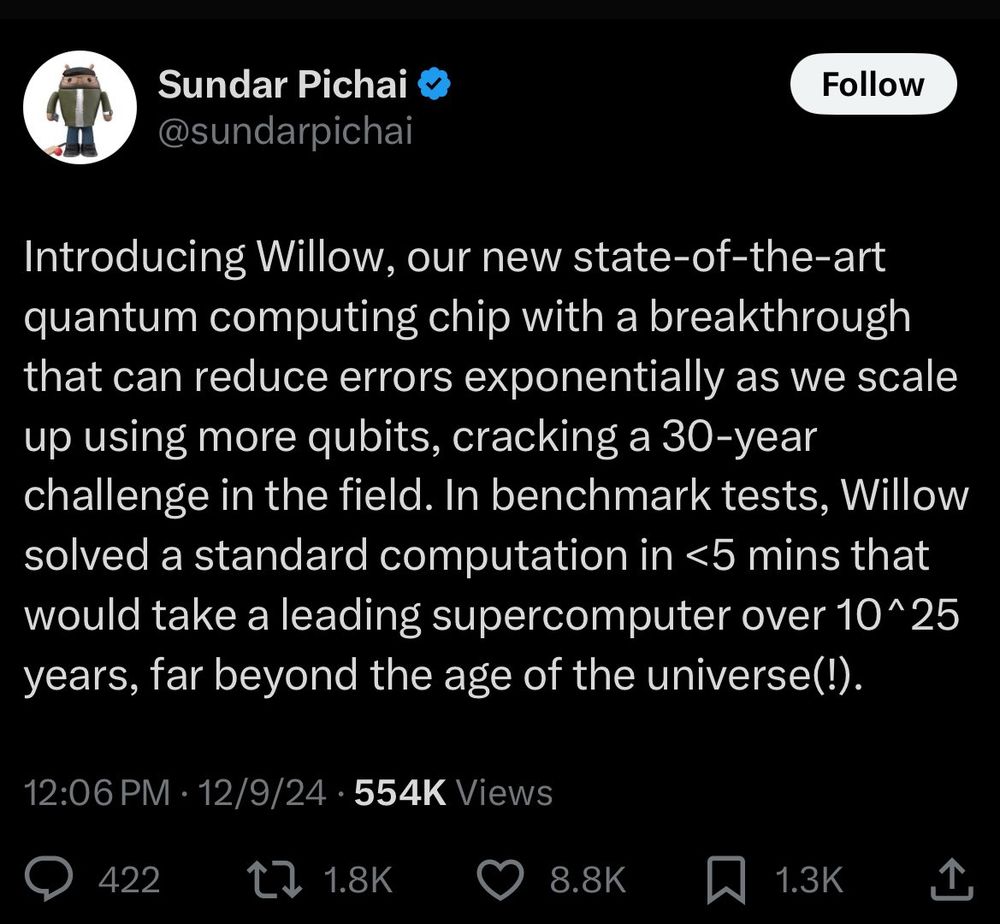

$GOOG just commercialized the most advanced quantum chip.

It’s not competing with $NVDA or others, it simply leapfrogged them.

This is the technology that will enable new breakthroughs in AI, drug discovery, biotech etc…

You must own $GOOG.

$GOOG just commercialized the most advanced quantum chip.

It’s not competing with $NVDA or others, it simply leapfrogged them.

This is the technology that will enable new breakthroughs in AI, drug discovery, biotech etc…

You must own $GOOG.

It has the largest AI computing capacity among cloud providers.

What’s even better is that 70% of its capacity comes from its own TPU chips.

$MSFT and $AMZN are completely dependent on Nvidia.

I can’t imagine being bearish $GOOG.

It has the largest AI computing capacity among cloud providers.

What’s even better is that 70% of its capacity comes from its own TPU chips.

$MSFT and $AMZN are completely dependent on Nvidia.

I can’t imagine being bearish $GOOG.

Big tech makes up 42% of S&P 500.

In tech, investments are intangible, not capitalized but deducted from earnings.

That doesn’t effect cash flow but drives PE up.

This is why the gap is big.

Big tech makes up 42% of S&P 500.

In tech, investments are intangible, not capitalized but deducted from earnings.

That doesn’t effect cash flow but drives PE up.

This is why the gap is big.

It’s natural that the US market has always traded at a premium over the international markets.

However, international market discount looks way overdone at this point.

It’s a good time to start diversifying away from the US.

It’s natural that the US market has always traded at a premium over the international markets.

However, international market discount looks way overdone at this point.

It’s a good time to start diversifying away from the US.

Invest if the President is a Democrat.

Invest is the inflation is high.

Invest if the inflation is low.

Invest if you have much.

Invest if you have little.

Invest and just spend more time in the market.

Invest if the President is a Democrat.

Invest is the inflation is high.

Invest if the inflation is low.

Invest if you have much.

Invest if you have little.

Invest and just spend more time in the market.