👉 https://www.capitalist-letters.com

$TMDX is undervalued below $70.

$UNH is undervalued below $550.

$NU is undervalued below $13.

$GOOG is still a buy.

$AMZN is still a buy.

$META is still a buy.

Despite all time highs, there are plenty of opportunities in the market.

$TMDX is undervalued below $70.

$UNH is undervalued below $550.

$NU is undervalued below $13.

$GOOG is still a buy.

$AMZN is still a buy.

$META is still a buy.

Despite all time highs, there are plenty of opportunities in the market.

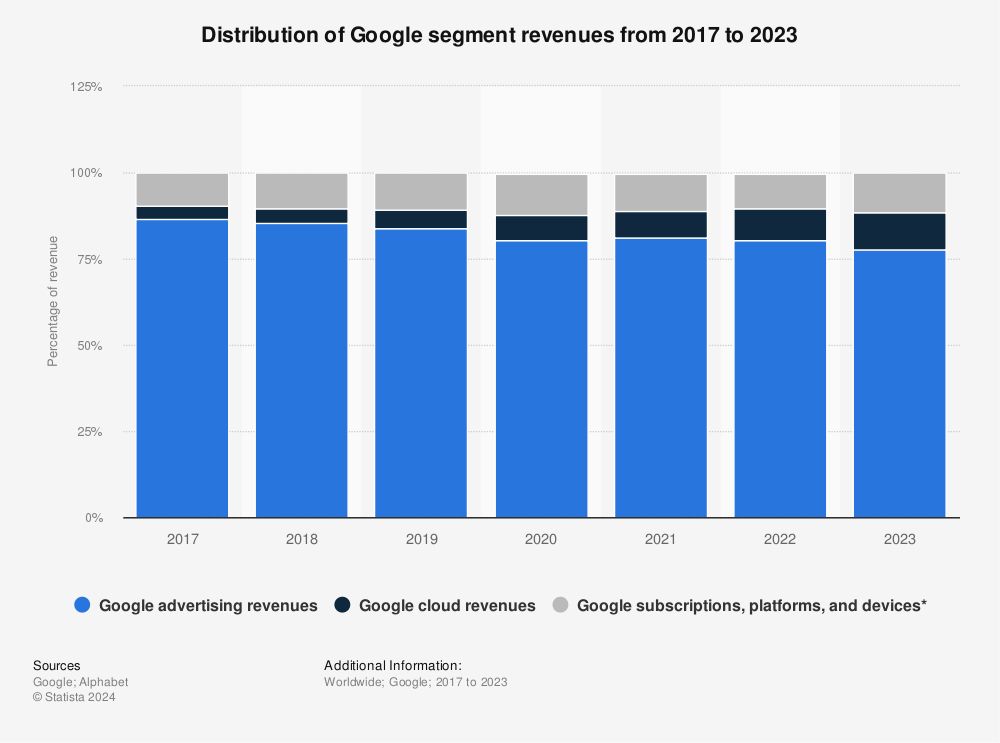

Search’s share of revenue has been consistently decreasing since 2017.

It has:

- Fastest growing cloud unit.

- Dominant streaming service.

- Leadership in quantum computing.

70% of its cloud powered by its own chips.

Long $GOOG!

Search’s share of revenue has been consistently decreasing since 2017.

It has:

- Fastest growing cloud unit.

- Dominant streaming service.

- Leadership in quantum computing.

70% of its cloud powered by its own chips.

Long $GOOG!

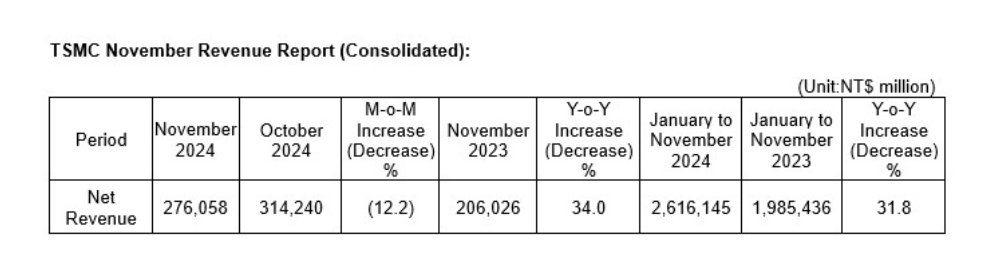

It announced 34% YoY sales growth for November.

This is just INSANE…

It manufactures all chips for $NVDA and $AAPL. It also manufactures $AMD MI300 accelerators.

It captures 95% of the whole demand for AI chips.

Long $TSM.

It announced 34% YoY sales growth for November.

This is just INSANE…

It manufactures all chips for $NVDA and $AAPL. It also manufactures $AMD MI300 accelerators.

It captures 95% of the whole demand for AI chips.

Long $TSM.

- Only cloud not dependent on $NVDA.

- Dominant streaming platform.

- Leader in quantum computing.

It also casually owns search market, dominant web browser and only operational robo-taxi business…

$GOOG is a MUST own for the next decade.

- Only cloud not dependent on $NVDA.

- Dominant streaming platform.

- Leader in quantum computing.

It also casually owns search market, dominant web browser and only operational robo-taxi business…

$GOOG is a MUST own for the next decade.

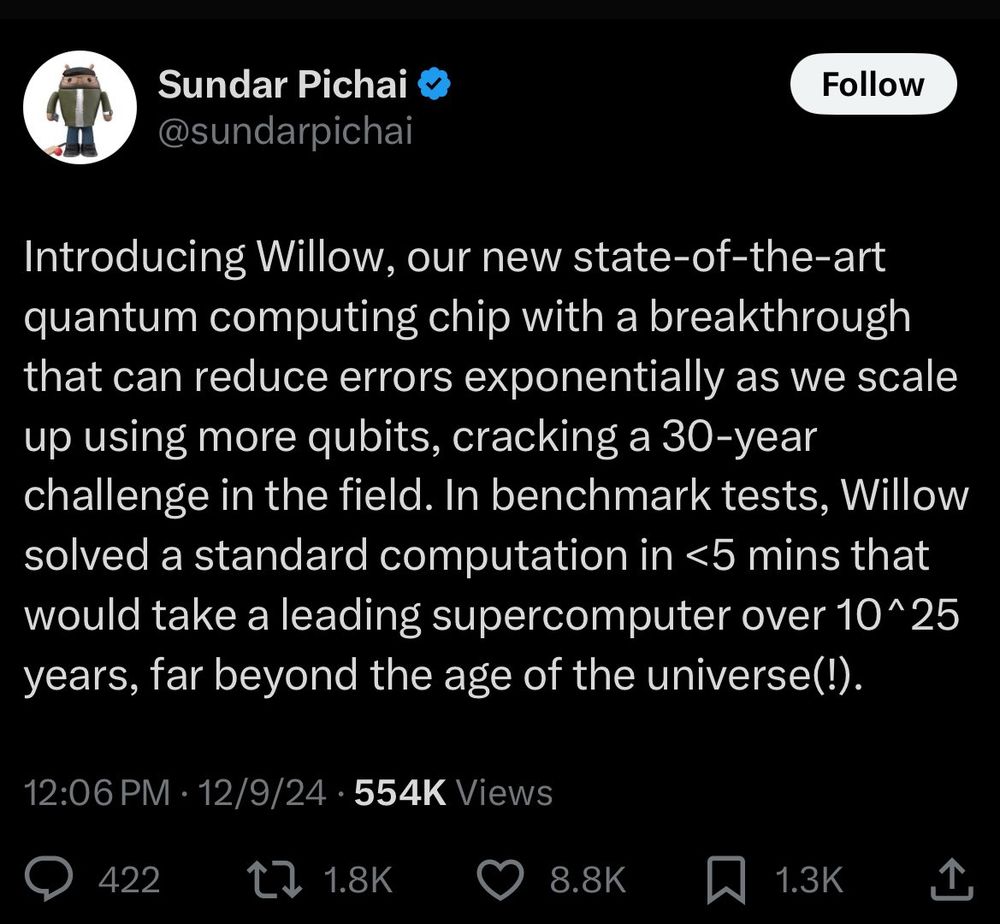

$GOOG just commercialized the most advanced quantum chip.

It’s not competing with $NVDA or others, it simply leapfrogged them.

This is the technology that will enable new breakthroughs in AI, drug discovery, biotech etc…

You must own $GOOG.

$GOOG just commercialized the most advanced quantum chip.

It’s not competing with $NVDA or others, it simply leapfrogged them.

This is the technology that will enable new breakthroughs in AI, drug discovery, biotech etc…

You must own $GOOG.

It has the largest AI computing capacity among cloud providers.

What’s even better is that 70% of its capacity comes from its own TPU chips.

$MSFT and $AMZN are completely dependent on Nvidia.

I can’t imagine being bearish $GOOG.

It has the largest AI computing capacity among cloud providers.

What’s even better is that 70% of its capacity comes from its own TPU chips.

$MSFT and $AMZN are completely dependent on Nvidia.

I can’t imagine being bearish $GOOG.

Big tech makes up 42% of S&P 500.

In tech, investments are intangible, not capitalized but deducted from earnings.

That doesn’t effect cash flow but drives PE up.

This is why the gap is big.

Big tech makes up 42% of S&P 500.

In tech, investments are intangible, not capitalized but deducted from earnings.

That doesn’t effect cash flow but drives PE up.

This is why the gap is big.

You need better stocks.

You need better stocks.

They lost a key ally and their path to the proxies in Lebanon.

It’s not hard to imagine a riot against cruel mollah regime in a few years.

It’ll surely happen.

The humiliation from losing these, if lost, will be the end of Putin's regime.

They lost a key ally and their path to the proxies in Lebanon.

It’s not hard to imagine a riot against cruel mollah regime in a few years.

It’ll surely happen.

People get irritated when their government sends generous aids to foreign countries while folks at home still struggle with deteriorating living standards.

People get irritated when their government sends generous aids to foreign countries while folks at home still struggle with deteriorating living standards.

- 12% annual revenue growth since 2019.

- Debt/Equity ratio of 0.34

- Trading at 11 PE.

Here is why I believe it can easily double in the next 5 years:

www.capitalist-letters.com/p/sanlorenzo...

- 12% annual revenue growth since 2019.

- Debt/Equity ratio of 0.34

- Trading at 11 PE.

Here is why I believe it can easily double in the next 5 years:

www.capitalist-letters.com/p/sanlorenzo...

It’s natural that the US market has always traded at a premium over the international markets.

However, international market discount looks way overdone at this point.

It’s a good time to start diversifying away from the US.

It’s natural that the US market has always traded at a premium over the international markets.

However, international market discount looks way overdone at this point.

It’s a good time to start diversifying away from the US.

Invest if the President is a Democrat.

Invest is the inflation is high.

Invest if the inflation is low.

Invest if you have much.

Invest if you have little.

Invest and just spend more time in the market.

Invest if the President is a Democrat.

Invest is the inflation is high.

Invest if the inflation is low.

Invest if you have much.

Invest if you have little.

Invest and just spend more time in the market.

$NU: Affected by short term headwinds.

$MELI: Mexico segment is exploding.

$SOFI: Lending is set to take off.

3 Growth stocks I would AVOID now:

$PLTR: Trading at 350 PE.

$AMD: GPU segment is slow.

$HOOD: Price is a bit elevated at 68 PE.

$NU: Affected by short term headwinds.

$MELI: Mexico segment is exploding.

$SOFI: Lending is set to take off.

3 Growth stocks I would AVOID now:

$PLTR: Trading at 350 PE.

$AMD: GPU segment is slow.

$HOOD: Price is a bit elevated at 68 PE.