I write http://TheCrunch.co for 10,700 readers

Not a financial/tax advice

At the time, these shares were valued at ~$6.5 million.

He paid a small gift tax on the transfer.

At the time, these shares were valued at ~$6.5 million.

He paid a small gift tax on the transfer.

But it’s nothing to celebrate.

You gave the IRS a 0% interest loan for $15,258 throughout the year.

That’s $680 you could’ve earned with a 4.5% HYSA instead in a year. Adjust your W-4.

But it’s nothing to celebrate.

You gave the IRS a 0% interest loan for $15,258 throughout the year.

That’s $680 you could’ve earned with a 4.5% HYSA instead in a year. Adjust your W-4.

Not investing within the account.

It happens more often than you might think:

Not investing within the account.

It happens more often than you might think:

One of their ambitious Plan B proposals was to establish a progressive income-consumption tax with three different rates (15%, 25%, 30%).

One of their ambitious Plan B proposals was to establish a progressive income-consumption tax with three different rates (15%, 25%, 30%).

> $50,000 to $100,000 pay an average tax rate of 7.1% (tax/AGI)

> $100,000 to $200,000 pay an average tax rate of 11%.

> $50,000 to $100,000 pay an average tax rate of 7.1% (tax/AGI)

> $100,000 to $200,000 pay an average tax rate of 11%.

Based on my understanding, the Buckeye Institute (not a party in the case) submitted a brief supporting the plaintiffs.

This means that they agree with the nationwide injunction.

Based on my understanding, the Buckeye Institute (not a party in the case) submitted a brief supporting the plaintiffs.

This means that they agree with the nationwide injunction.

They concluded with: "The district court’s order should be stayed pending appeal. In the alternative, the injunction should be narrowed to the companies specifically identified in the lawsuit"

They concluded with: "The district court’s order should be stayed pending appeal. In the alternative, the injunction should be narrowed to the companies specifically identified in the lawsuit"

The appeal essentially said, "We appeal the decision to grant the plaintiffs’ motion for a preliminary injunction."

The appeal essentially said, "We appeal the decision to grant the plaintiffs’ motion for a preliminary injunction."

You don’t have to max it out. Just put as much as you can.

Your future self will thank you.

You don’t have to max it out. Just put as much as you can.

Your future self will thank you.

In reality, it’s up 27% YTD.

Don’t pay attention to clickbait, just continue to invest for the long term.

In reality, it’s up 27% YTD.

Don’t pay attention to clickbait, just continue to invest for the long term.

The interest rate on a Series I savings bond changes every 6 months, based on inflation.

The interest is received when you cash in the bond.

You can buy it directly from TreasuryDirect. Taxes are deferred until cashed.

The interest rate on a Series I savings bond changes every 6 months, based on inflation.

The interest is received when you cash in the bond.

You can buy it directly from TreasuryDirect. Taxes are deferred until cashed.

USFR is a Treasury ETF holding floating rate notes (FRN).

It holds a group of 2 year FRNs and pays out a monthly yield.

State and local tax exempt.

USFR is a Treasury ETF holding floating rate notes (FRN).

It holds a group of 2 year FRNs and pays out a monthly yield.

State and local tax exempt.

A CD is a savings account where you agree to keep your money in the account for a set period of time.

It is FDIC insured

Example:

• First Bank of The Lake 7 month CD - 5%

A CD is a savings account where you agree to keep your money in the account for a set period of time.

It is FDIC insured

Example:

• First Bank of The Lake 7 month CD - 5%

If you don't want to buy T-bills directly, the iShares 0-3 Month Treasury Bond ETF can be a good choice.

It's state and local tax exempt.

You can also buy the Treasury MMF at Vanguard ($VUSXX), Fidelity or Schwab.

If you don't want to buy T-bills directly, the iShares 0-3 Month Treasury Bond ETF can be a good choice.

It's state and local tax exempt.

You can also buy the Treasury MMF at Vanguard ($VUSXX), Fidelity or Schwab.

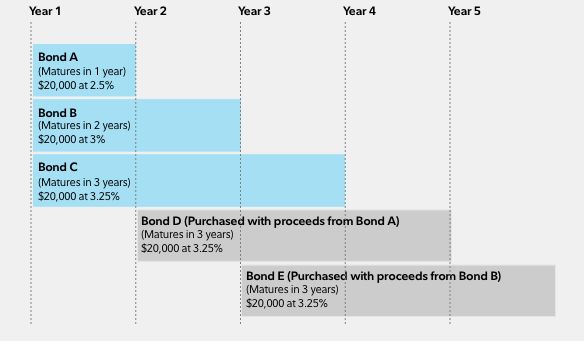

If you want to buy T-Bills directly and avoid expense ratios of ETFs, T-bill ladder is a great choice.

It's a strategy to spread your money across several T-bills with different maturity dates to improve liquidity.

If you want to buy T-Bills directly and avoid expense ratios of ETFs, T-bill ladder is a great choice.

It's a strategy to spread your money across several T-bills with different maturity dates to improve liquidity.

2,044 IRS employees have balances due totaling more than $12 million for one or more tax periods that are not on any installment agreement.

Why does the IRS employ people who can't even pay their own taxes?

2,044 IRS employees have balances due totaling more than $12 million for one or more tax periods that are not on any installment agreement.

Why does the IRS employ people who can't even pay their own taxes?

I personally would be hesitant to invest in something with an expense ratio of 0.25% or higher.

I personally would be hesitant to invest in something with an expense ratio of 0.25% or higher.

So, what's the main benefit of GRATs, and how is he avoiding estate taxes?

So, what's the main benefit of GRATs, and how is he avoiding estate taxes?

According to SEC filings, he further diversified his gift and estate tax strategy by establishing a Grantor Retained Annuity Trust (GRAT) and transferring 3,078,820 shares into it.

According to SEC filings, he further diversified his gift and estate tax strategy by establishing a Grantor Retained Annuity Trust (GRAT) and transferring 3,078,820 shares into it.

Today, after accounting for stock splits, those shares are worth an estimated $3.3 billion.

Today, after accounting for stock splits, those shares are worth an estimated $3.3 billion.