Partner at ExoPeak.

Based in Paris.

Policy makers and investors hardly learn though, as geoengineering is set to enter the same hype-and-bust cycle as CCUS.

Policy makers and investors hardly learn though, as geoengineering is set to enter the same hype-and-bust cycle as CCUS.

100% with you on how sustainable solutions will only work if we keep investing to make them intrinsically better than alternatives.

100% with you on how sustainable solutions will only work if we keep investing to make them intrinsically better than alternatives.

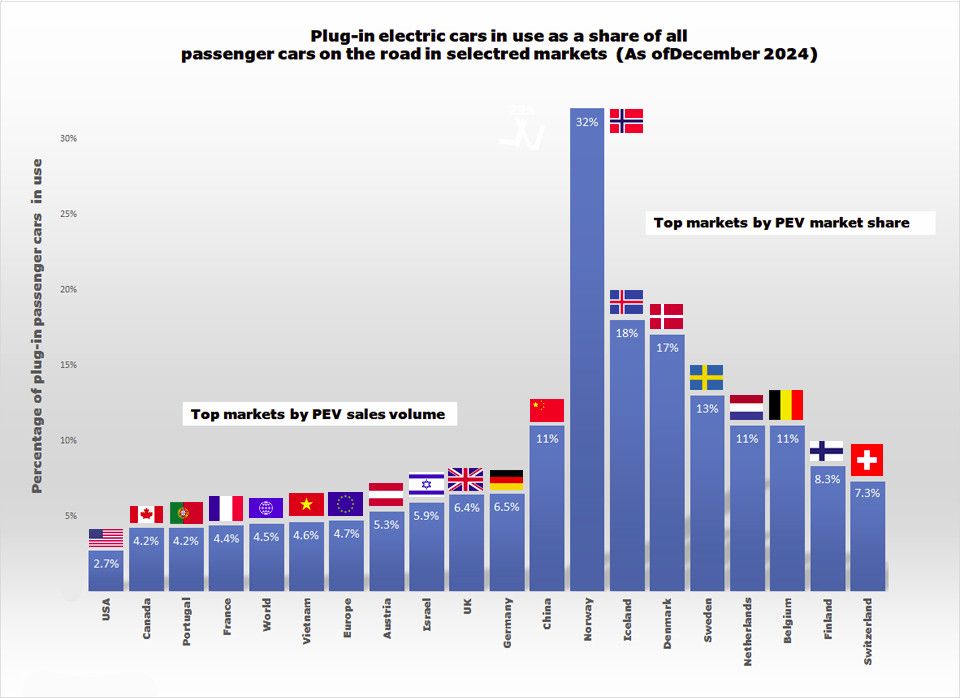

It's also very ironic to see the AAI state that "EV sales mandates were never achievable" in the US when you look at where most other developed countries stand...

It's also very ironic to see the AAI state that "EV sales mandates were never achievable" in the US when you look at where most other developed countries stand...

It's also very ironic to see the AAI state that "EV sales mandates were never achievable" in the US when you look at where most other developed countries stand...

It's also very ironic to see the AAI state that "EV sales mandates were never achievable" in the US when you look at where most other developed countries stand...

As a side note, this has to be one of the worst charts I've seen in a while.

As a side note, this has to be one of the worst charts I've seen in a while.

Battery and waste recycling and new extraction methods attract virtually all investments.

I hope we’ll see plenty of exciting innovations in the coming months/ years.

Battery and waste recycling and new extraction methods attract virtually all investments.

I hope we’ll see plenty of exciting innovations in the coming months/ years.

Yet its market presence remains limited (cf. previous chart), and China also dominates the downstream production stages.

Yet its market presence remains limited (cf. previous chart), and China also dominates the downstream production stages.

Bypassing China’s dominance was a major driver of battery tech R&D and investment, but in the case of LFP, China’s control is even stronger.

Bypassing China’s dominance was a major driver of battery tech R&D and investment, but in the case of LFP, China’s control is even stronger.

See below the impact that recent export restrictions had on prices.

See below the impact that recent export restrictions had on prices.

To name a few: control over extraction, strong gov subsidies that allowed rapid supply expansion and growing vertical integration of Chinese energy technology companies.

The chart below can serve as a partial illustration of that last point.

To name a few: control over extraction, strong gov subsidies that allowed rapid supply expansion and growing vertical integration of Chinese energy technology companies.

The chart below can serve as a partial illustration of that last point.