Partner at ExoPeak.

Based in Paris.

With costs continuing to drop, BESS will likely scale faster than renewables did, as their rollout is less constrained by grid stability concerns.

With costs continuing to drop, BESS will likely scale faster than renewables did, as their rollout is less constrained by grid stability concerns.

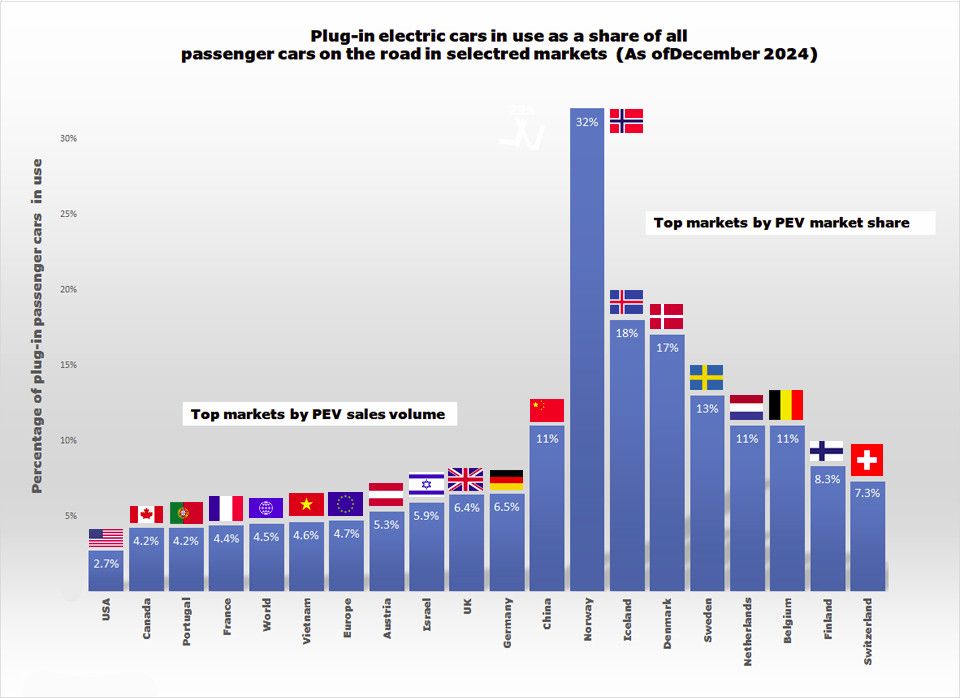

It's also very ironic to see the AAI state that "EV sales mandates were never achievable" in the US when you look at where most other developed countries stand...

It's also very ironic to see the AAI state that "EV sales mandates were never achievable" in the US when you look at where most other developed countries stand...

It's also very ironic to see the AAI state that "EV sales mandates were never achievable" in the US when you look at where most other developed countries stand...

It's also very ironic to see the AAI state that "EV sales mandates were never achievable" in the US when you look at where most other developed countries stand...

As a side note, this has to be one of the worst charts I've seen in a while.

As a side note, this has to be one of the worst charts I've seen in a while.

Battery and waste recycling and new extraction methods attract virtually all investments.

I hope we’ll see plenty of exciting innovations in the coming months/ years.

Battery and waste recycling and new extraction methods attract virtually all investments.

I hope we’ll see plenty of exciting innovations in the coming months/ years.

Yet its market presence remains limited (cf. previous chart), and China also dominates the downstream production stages.

Yet its market presence remains limited (cf. previous chart), and China also dominates the downstream production stages.

Bypassing China’s dominance was a major driver of battery tech R&D and investment, but in the case of LFP, China’s control is even stronger.

Bypassing China’s dominance was a major driver of battery tech R&D and investment, but in the case of LFP, China’s control is even stronger.

See below the impact that recent export restrictions had on prices.

See below the impact that recent export restrictions had on prices.

To name a few: control over extraction, strong gov subsidies that allowed rapid supply expansion and growing vertical integration of Chinese energy technology companies.

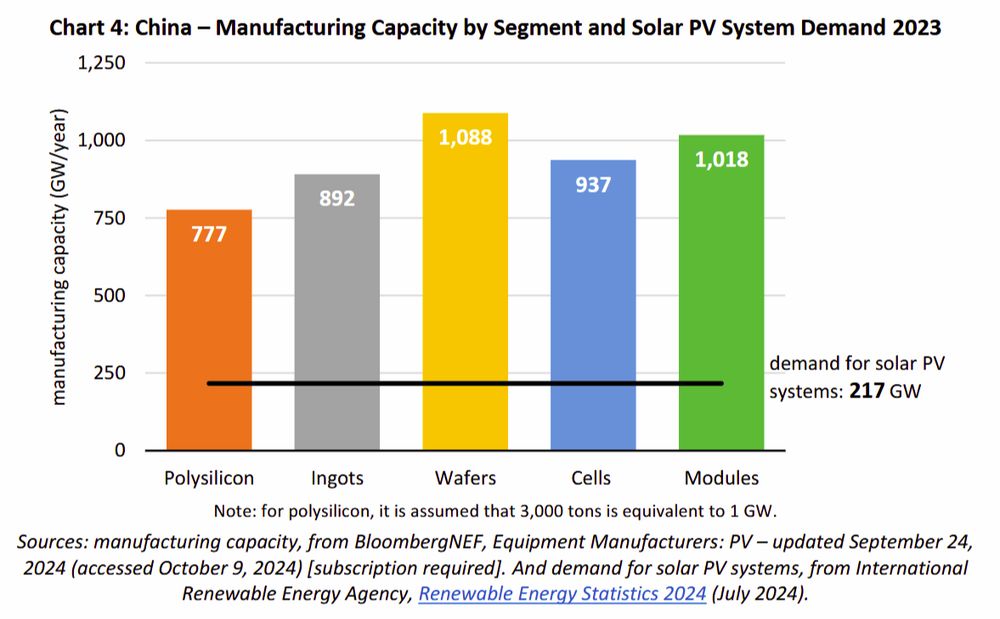

The chart below can serve as a partial illustration of that last point.

To name a few: control over extraction, strong gov subsidies that allowed rapid supply expansion and growing vertical integration of Chinese energy technology companies.

The chart below can serve as a partial illustration of that last point.

Not new, but always worth re-stating.

Not new, but always worth re-stating.

Global lithium demand surged nearly 30% in 2024 - three times the 2010s average - but supply grew even faster, rising by 40% and outpacing demand.

Global lithium demand surged nearly 30% in 2024 - three times the 2010s average - but supply grew even faster, rising by 40% and outpacing demand.

Interestingly, the exact opposite is happening for base metals.

Interestingly, the exact opposite is happening for base metals.

Yet, these concerns may lessen if steep tariffs are placed on Chinese PVs, and generous subsidies are given to Western thin-film PV manufacturers.

Yet, these concerns may lessen if steep tariffs are placed on Chinese PVs, and generous subsidies are given to Western thin-film PV manufacturers.

These can be produced with less reliance on China. Their main ingredient is iodine, of which Japan is the world's second-largest producer, after Chile.

These can be produced with less reliance on China. Their main ingredient is iodine, of which Japan is the world's second-largest producer, after Chile.

This is one of the drivers behind LONGi's recent earnings slip for instance.

This is one of the drivers behind LONGi's recent earnings slip for instance.

State-sponsored subsidies have twisted the sector's economics, to the point where China's total PV manufacturing capacity now largely exceeds current global demand.

State-sponsored subsidies have twisted the sector's economics, to the point where China's total PV manufacturing capacity now largely exceeds current global demand.

Again, this allowed for greater competitiveness vs. other countries.

Again, this allowed for greater competitiveness vs. other countries.

Both have allowed Chinese players to consistently undercut competitors, while still making healthy profits and ramping up volume that allowed for greater economies of scale.

Both have allowed Chinese players to consistently undercut competitors, while still making healthy profits and ramping up volume that allowed for greater economies of scale.

They produce >80% of the polysilicon in the world, which is a key component for crystalline PV production.

They produce >80% of the polysilicon in the world, which is a key component for crystalline PV production.

Despite this growth, the outlook seems gloomy for Chinese players.

A few thoughts on what sparked this growth, what's happening now and how the West is pushing back amid rising tensions.

Despite this growth, the outlook seems gloomy for Chinese players.

A few thoughts on what sparked this growth, what's happening now and how the West is pushing back amid rising tensions.

The EU Battery Regulation for instance sets mandatory targets for the share of recycled lithium, nickel and cobalt.

The EU Battery Regulation for instance sets mandatory targets for the share of recycled lithium, nickel and cobalt.

Growing constraints on energy and water supply could drive recycling rates up, as recycling has a >50% lower environmental impact than conventional mining.

Growing constraints on energy and water supply could drive recycling rates up, as recycling has a >50% lower environmental impact than conventional mining.