Macroeconomics, Environmental, International Trade

Alumn from @sciencespo, and @sorbonne_univ

Website: http://thomasbourany.github.io/

From France 🥖🧀🍷🥐🇫🇷

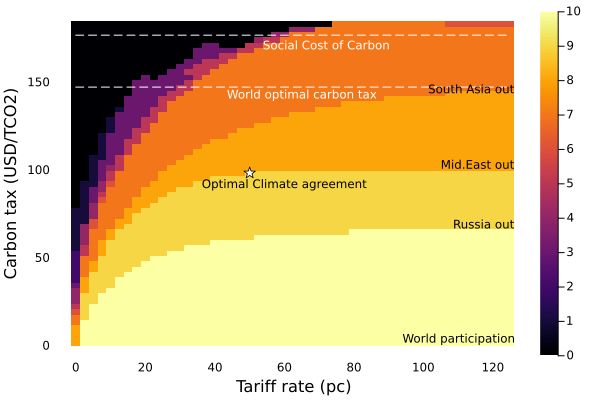

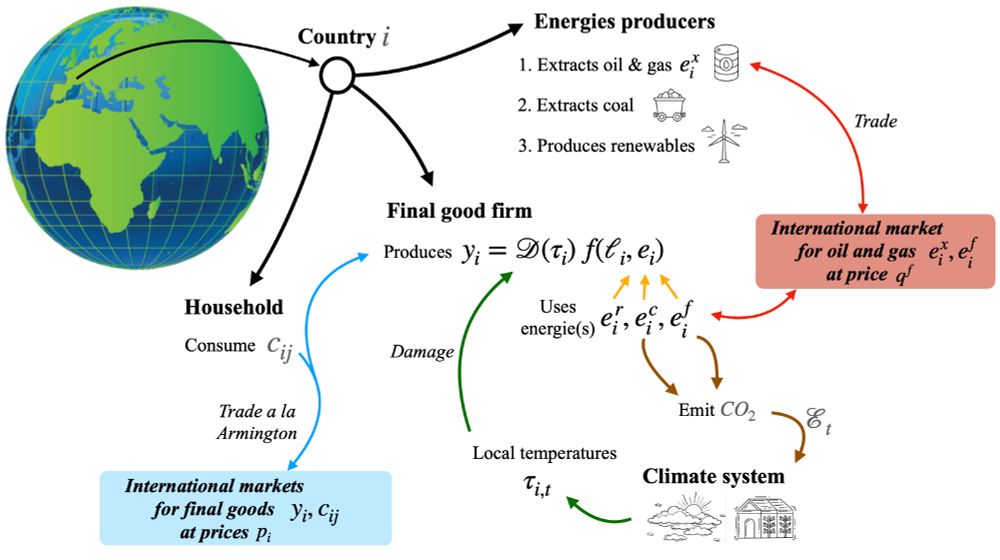

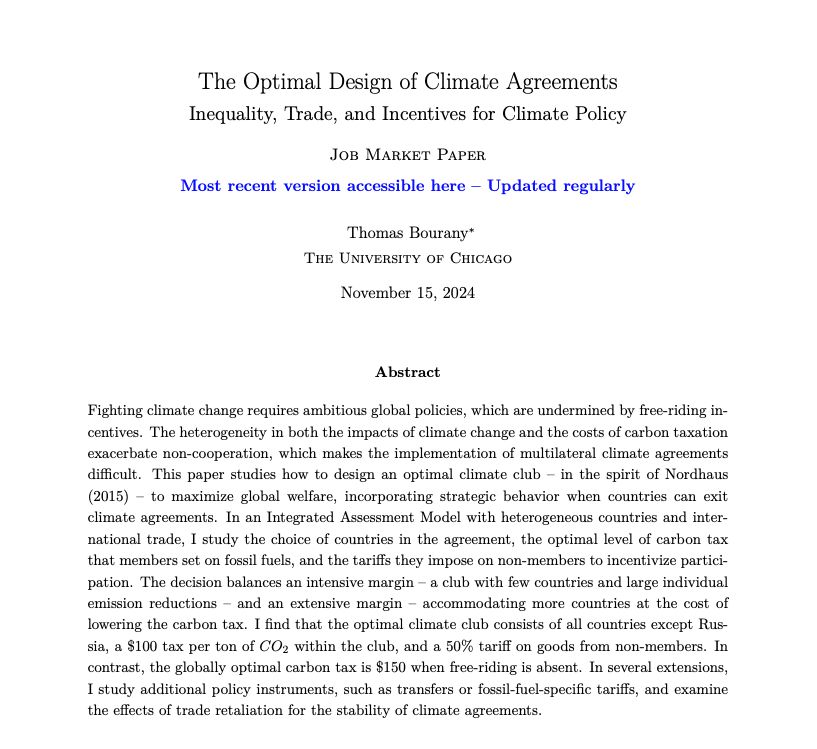

thomasbourany.github.io/files/Bouran...

thomasbourany.github.io/files/Bouran...

@jordanrk.bsky.social 's research focuses on estimating climate costs, studies model uncertainty, and explores the role of cities in adapting to global warming. Check out his work!

@jordanrk.bsky.social 's research focuses on estimating climate costs, studies model uncertainty, and explores the role of cities in adapting to global warming. Check out his work!

The job market paper and my research can be found here: thomasbourany.github.io/research/

#EconJMP #EconSky

The job market paper and my research can be found here: thomasbourany.github.io/research/

#EconJMP #EconSky

@UChicago economics: Mike Golosov, Esteban Rossi-Hansberg, Lars Hansen, and Michael Greenstone (not yet converted to #EconSky)

11/10

@UChicago economics: Mike Golosov, Esteban Rossi-Hansberg, Lars Hansen, and Michael Greenstone (not yet converted to #EconSky)

11/10