Macroeconomics, Environmental, International Trade

Alumn from @sciencespo, and @sorbonne_univ

Website: http://thomasbourany.github.io/

From France 🥖🧀🍷🥐🇫🇷

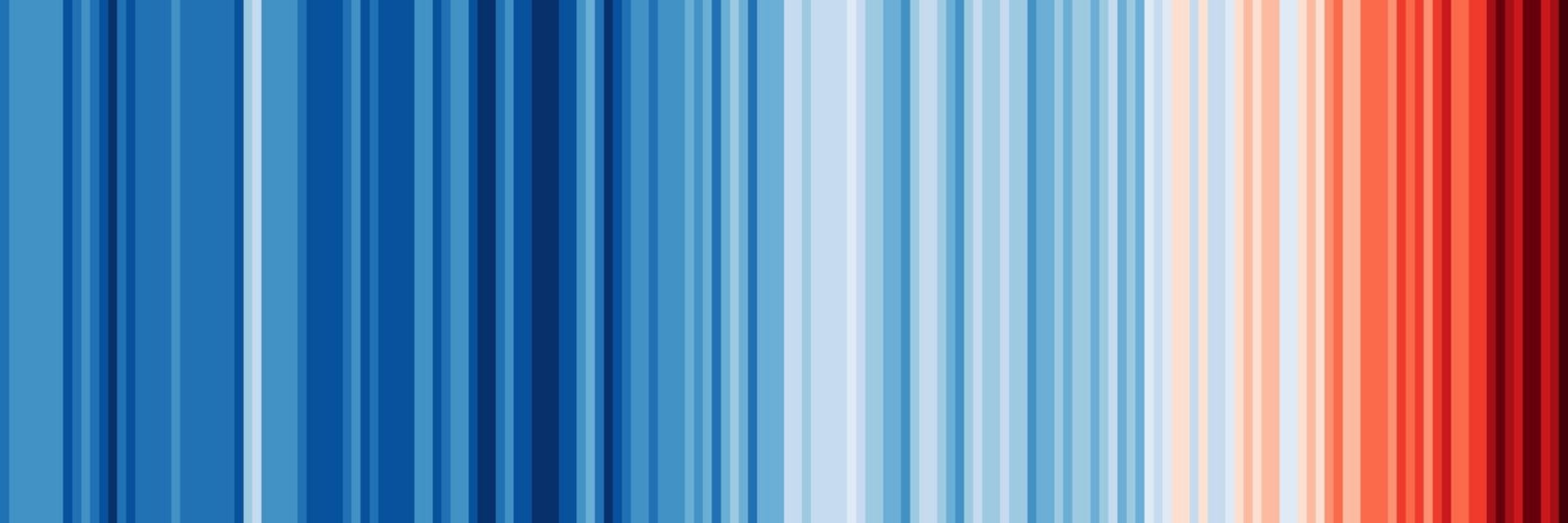

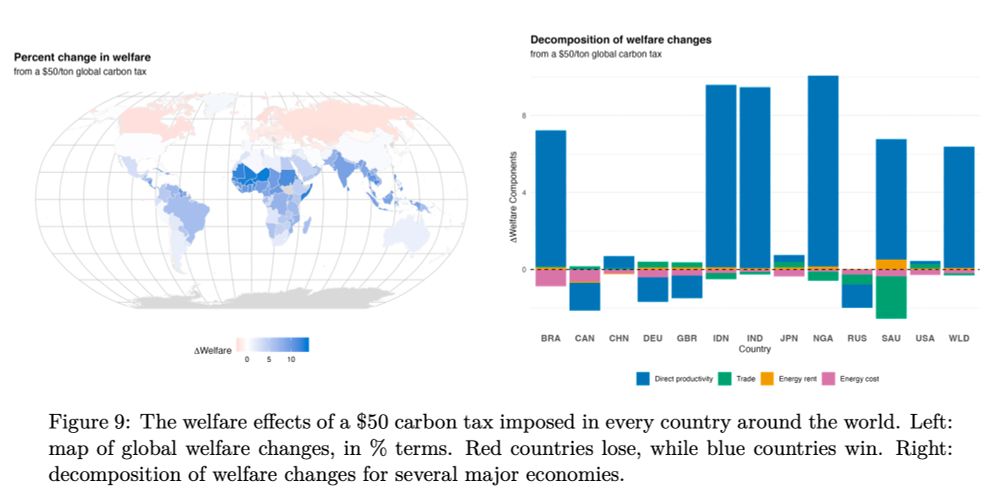

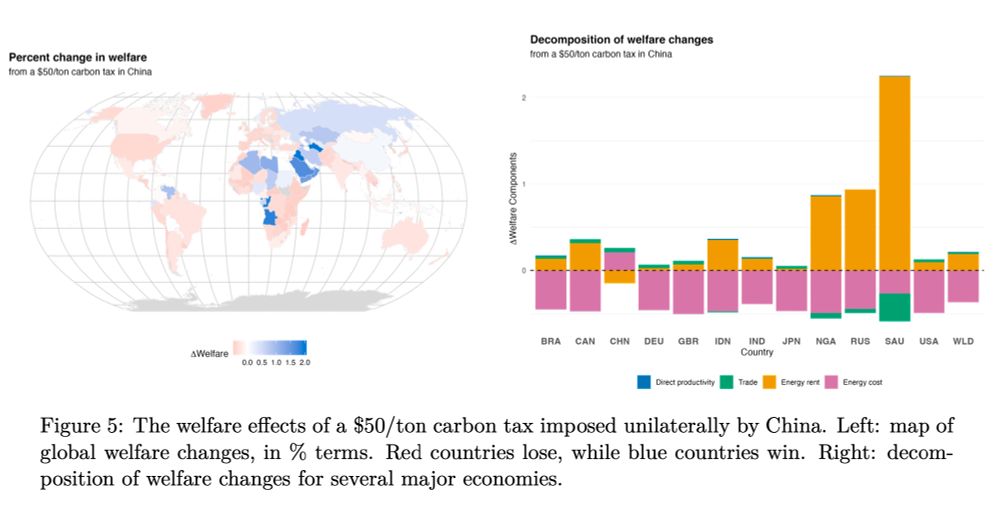

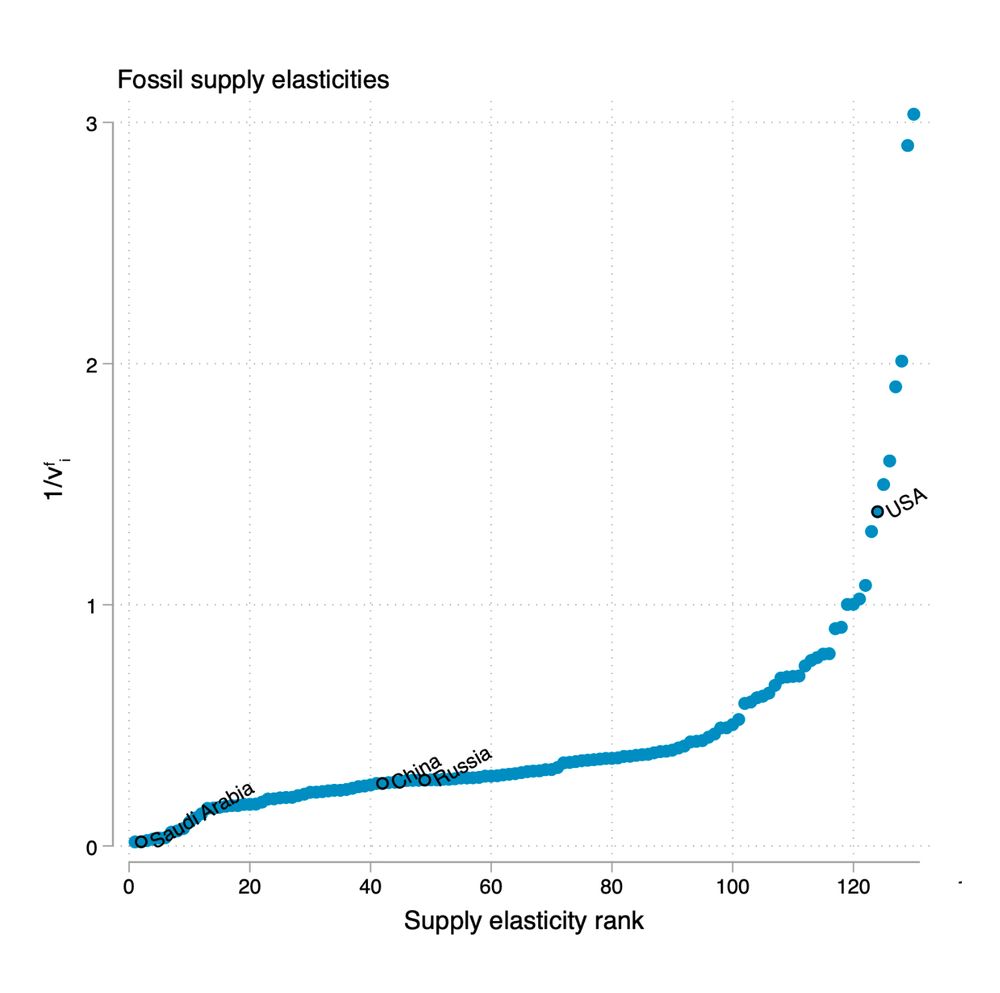

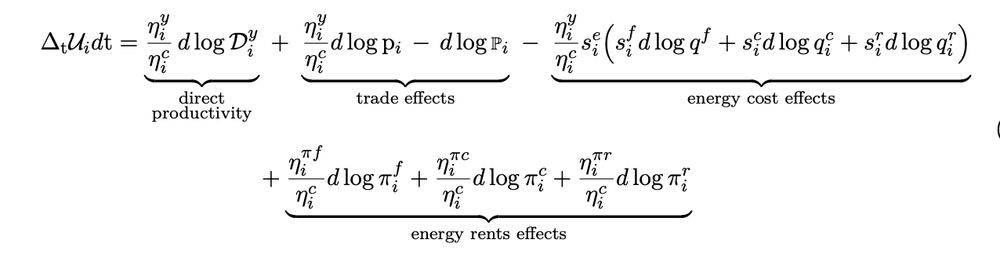

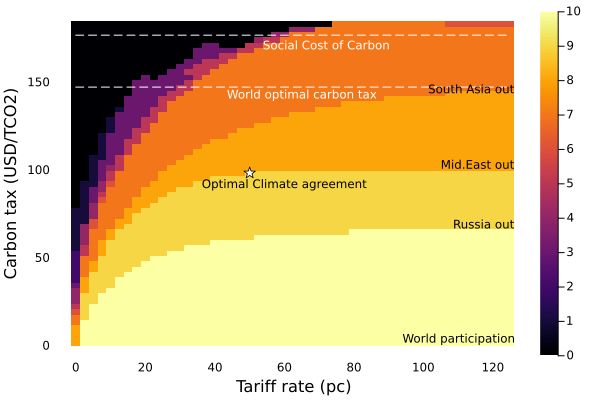

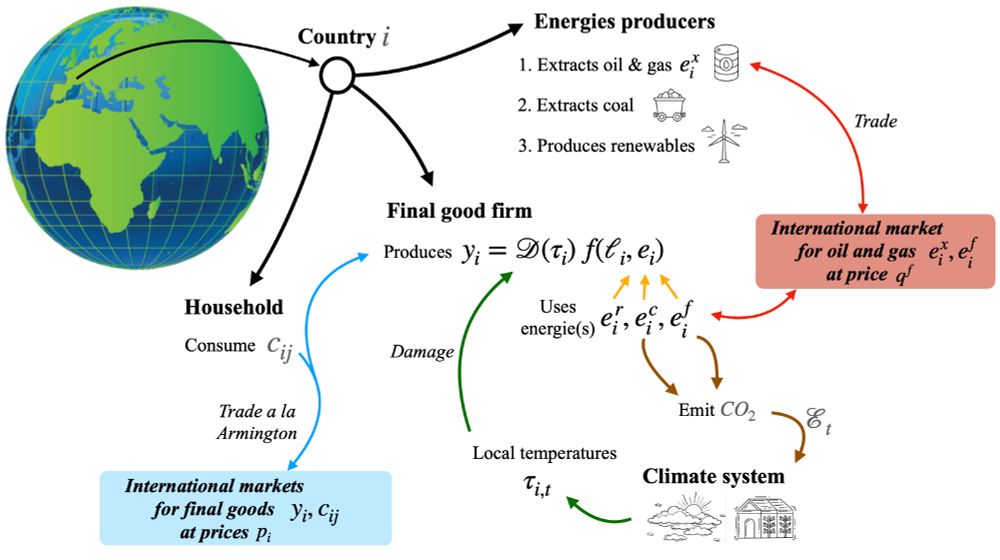

We study the spillovers of climate policies across countries through trade and energy markets #EconSky #ClimatePolicy #TradeLeakage #CBAM🧵1/10

We study the spillovers of climate policies across countries through trade and energy markets #EconSky #ClimatePolicy #TradeLeakage #CBAM🧵1/10

This is particularly related to the current discussions on trade policies and climate action

#EconSky #COP29 #Climate 🧵1/10

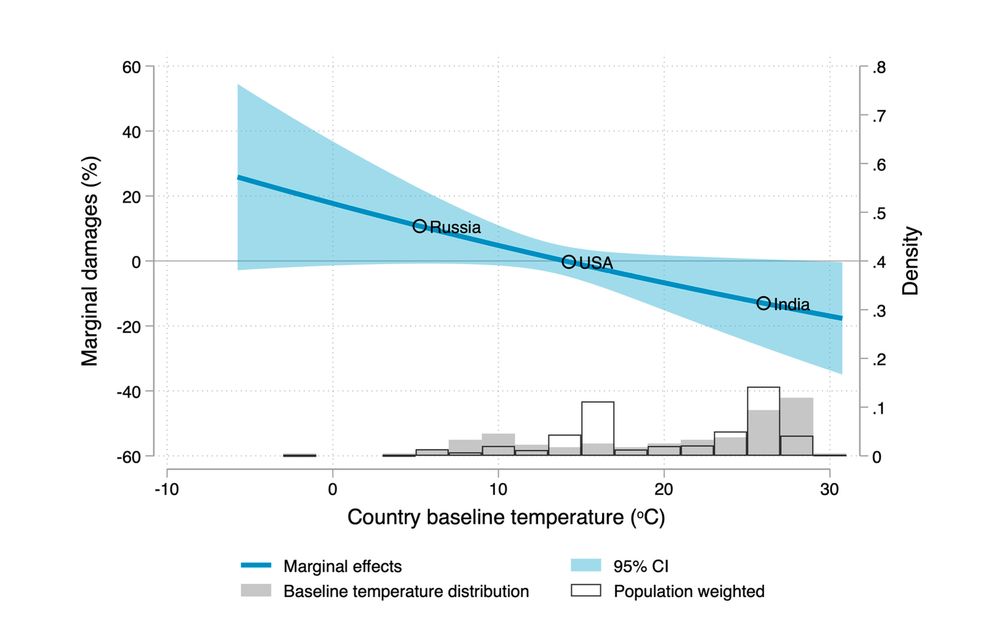

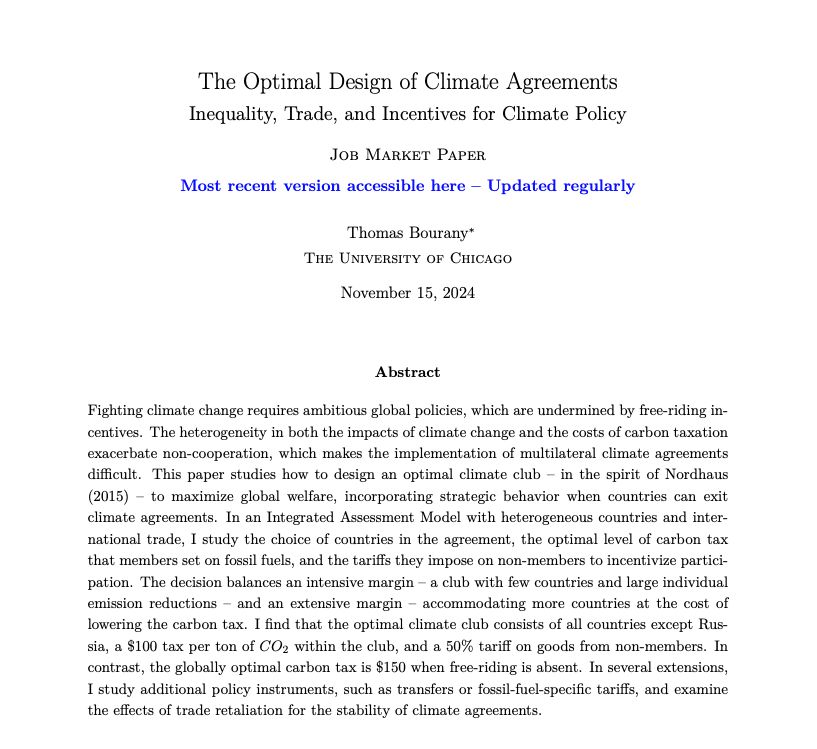

In my JMP, I study how to design optimal climate agreements and carbon policy in the presence of free-riding and inequality.

#EconJMP #EconSky #climate

website: thomasbourany.github.io

In my JMP, I study how to design optimal climate agreements and carbon policy in the presence of free-riding and inequality.

#EconJMP #EconSky #climate

website: thomasbourany.github.io