Sophie Hale

@sophiehale.bsky.social

Principal Economist leading on trade and intergenerational fairness at the Resolution Foundation.

As shown below, the UK has ended up with relatively low tariffs - our starting point was ok (we don't run a big goods deficit with the US) and the UK-US deal took off some of the sector-specific sharp edges. Only Canada faces lower tariffs by October.

November 6, 2025 at 11:54 AM

As shown below, the UK has ended up with relatively low tariffs - our starting point was ok (we don't run a big goods deficit with the US) and the UK-US deal took off some of the sector-specific sharp edges. Only Canada faces lower tariffs by October.

Research from Yale Budget Lab looks at the impact of US tariffs. As expected, it finds the UK does relatively well. But it goes further suggesting the UK economy will be about 0.1% larger in the long run.

budgetlab.yale.edu/research/sta...

budgetlab.yale.edu/research/sta...

November 6, 2025 at 11:54 AM

Research from Yale Budget Lab looks at the impact of US tariffs. As expected, it finds the UK does relatively well. But it goes further suggesting the UK economy will be about 0.1% larger in the long run.

budgetlab.yale.edu/research/sta...

budgetlab.yale.edu/research/sta...

In 2018-20, median wealth among Britons in their 60s was 55 per cent higher in real terms than among those of the same age in 2006-08, whereas median wealth for those in their 30s was a third (34 per cent) lower.

November 4, 2025 at 8:45 PM

In 2018-20, median wealth among Britons in their 60s was 55 per cent higher in real terms than among those of the same age in 2006-08, whereas median wealth for those in their 30s was a third (34 per cent) lower.

By comparison, services exports growth has been much stronger since the start of 2024. However, 3m on 3m growth has also been tailing off since June, with growth in 2025 looking set to significantly underperform 2024.

October 16, 2025 at 11:41 AM

By comparison, services exports growth has been much stronger since the start of 2024. However, 3m on 3m growth has also been tailing off since June, with growth in 2025 looking set to significantly underperform 2024.

3m on 3m goods export growth has dried up in recent months after a strong start to the year - related to US tariff policy and rising global trade tensions. But it is clear goods exports growth has been generally weak across the last couple of year.

October 16, 2025 at 11:41 AM

3m on 3m goods export growth has dried up in recent months after a strong start to the year - related to US tariff policy and rising global trade tensions. But it is clear goods exports growth has been generally weak across the last couple of year.

The value of goods exports fell by 3.3% in August, driven by a substantial monthly fall in EU goods exports (down 5.3%). The value of imports was flat, with growth in EU imports matched by the fall in non-EU imports. But services trade, both exports and imports, grew in August.

October 16, 2025 at 11:41 AM

The value of goods exports fell by 3.3% in August, driven by a substantial monthly fall in EU goods exports (down 5.3%). The value of imports was flat, with growth in EU imports matched by the fall in non-EU imports. But services trade, both exports and imports, grew in August.

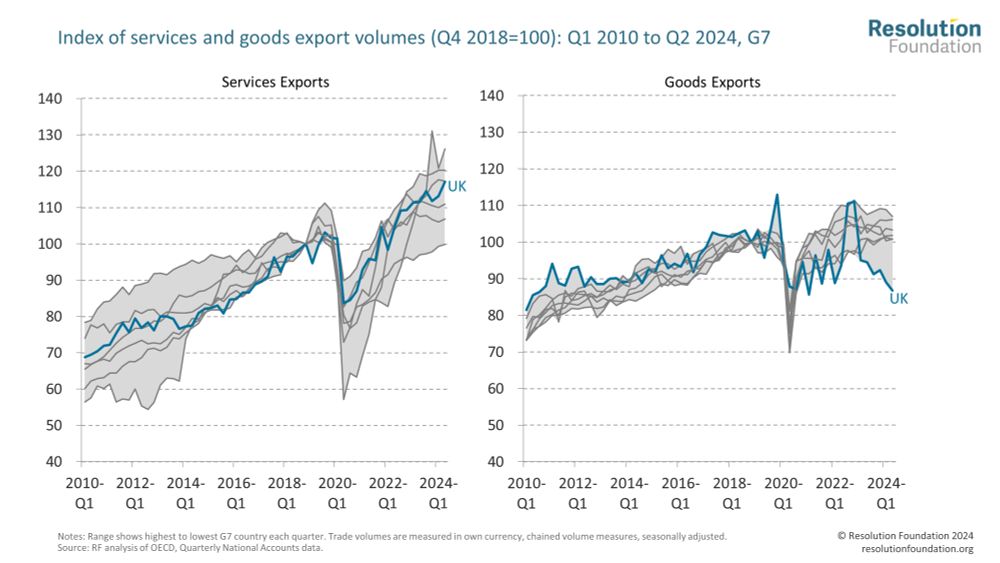

But what is more worrying is that the weak goods performance this year is nothing new. UK goods exports have continued to considerably underperform the rest of the G7. With the UKs overall export performance buoyed by a much stronger services performance.

September 12, 2025 at 7:39 AM

But what is more worrying is that the weak goods performance this year is nothing new. UK goods exports have continued to considerably underperform the rest of the G7. With the UKs overall export performance buoyed by a much stronger services performance.

But the impact of US tariffs seems to be materialising. UK exports to the US since April (when new tariffs were initially applied to UK goods) were 14% below their level over the same period last year (compared to just 4% lower with the world).

September 12, 2025 at 7:39 AM

But the impact of US tariffs seems to be materialising. UK exports to the US since April (when new tariffs were initially applied to UK goods) were 14% below their level over the same period last year (compared to just 4% lower with the world).

Global trade uncertainty has been unprecedently high, due to the tariff announcement coming from the US. And so a disruption to goods trade is unsurprising. Of course, for the UK, high trade uncertainty is nothing new, with years of high uncertainty following the EU referendum.

September 12, 2025 at 7:39 AM

Global trade uncertainty has been unprecedently high, due to the tariff announcement coming from the US. And so a disruption to goods trade is unsurprising. Of course, for the UK, high trade uncertainty is nothing new, with years of high uncertainty following the EU referendum.

But taking a step back to look at year to date where does this leave us? Despite the growth in July, goods export volumes are down 1% on last year. Meanwhile services export volumes have grown 5.5% and imports by 8.2%.

September 12, 2025 at 7:39 AM

But taking a step back to look at year to date where does this leave us? Despite the growth in July, goods export volumes are down 1% on last year. Meanwhile services export volumes have grown 5.5% and imports by 8.2%.

Starting with monthly trade volumes, total goods (excluding precious metals) exports grew by 5.2%, driven mainly by non-EU growth. Goods imports also grew by 4.1%. Services trade on the other hand was weak in July, with exports falling by 0.4% on the June.

September 12, 2025 at 7:39 AM

Starting with monthly trade volumes, total goods (excluding precious metals) exports grew by 5.2%, driven mainly by non-EU growth. Goods imports also grew by 4.1%. Services trade on the other hand was weak in July, with exports falling by 0.4% on the June.

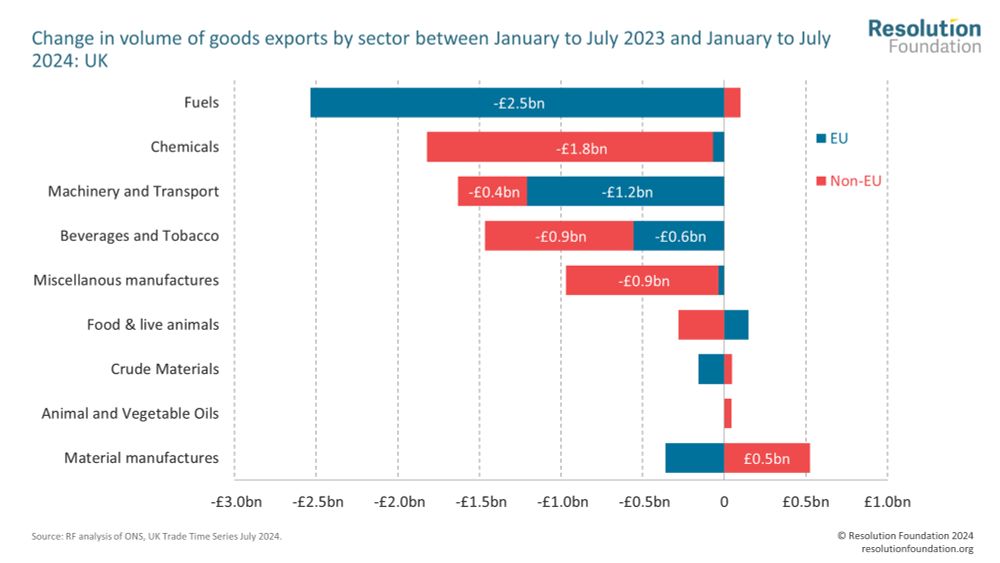

And worryingly this goods weakness continues to be pretty widespread across sectors – with both high value-added machinery and transport and chemicals sectors exports falling to both the EU and non-EU.

September 11, 2024 at 7:59 AM

And worryingly this goods weakness continues to be pretty widespread across sectors – with both high value-added machinery and transport and chemicals sectors exports falling to both the EU and non-EU.

Revisiting last month’s quarterly trade data though, the UK’s weak goods export performance continues to stand out: the gap between the UK and the rest of the G7 continues to widen, leaving the UK the only G7 country with goods export volumes still below Q4-2018 levels.

September 11, 2024 at 7:58 AM

Revisiting last month’s quarterly trade data though, the UK’s weak goods export performance continues to stand out: the gap between the UK and the rest of the G7 continues to widen, leaving the UK the only G7 country with goods export volumes still below Q4-2018 levels.

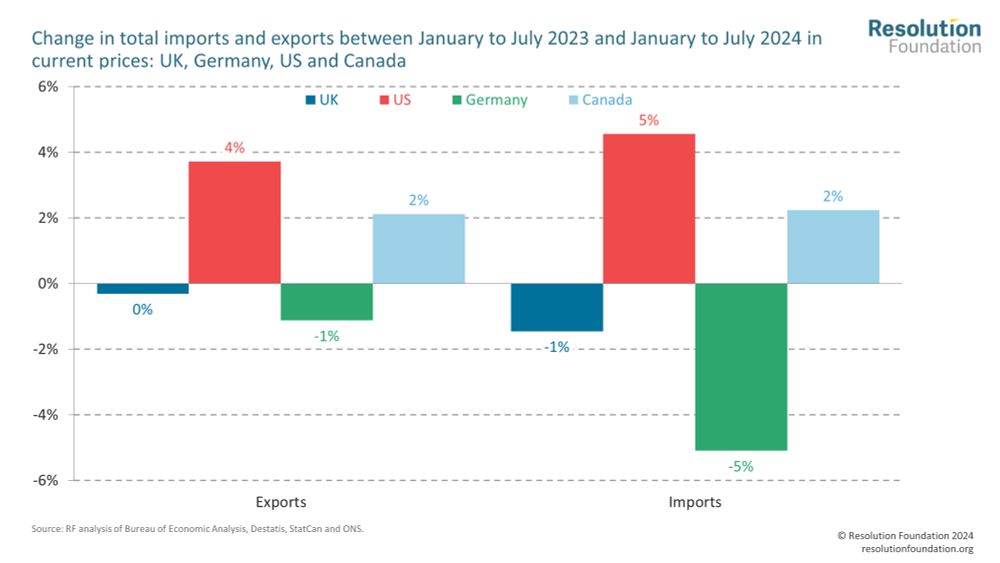

This year that leaves UK trade values looking substantially weaker than Canada and the US, but stronger than Germany which has also struggled to reinvigorate its goods exports.

September 11, 2024 at 7:58 AM

This year that leaves UK trade values looking substantially weaker than Canada and the US, but stronger than Germany which has also struggled to reinvigorate its goods exports.

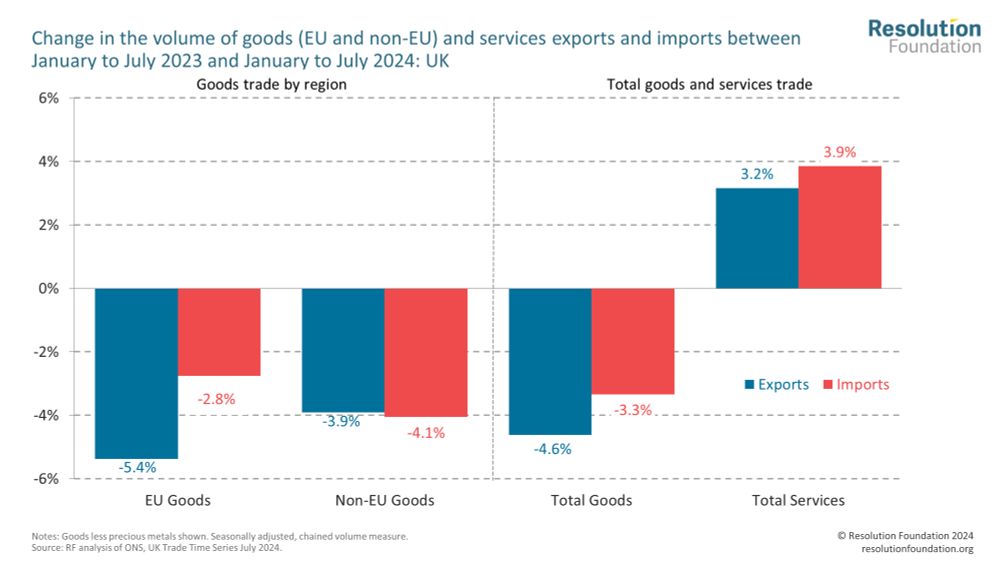

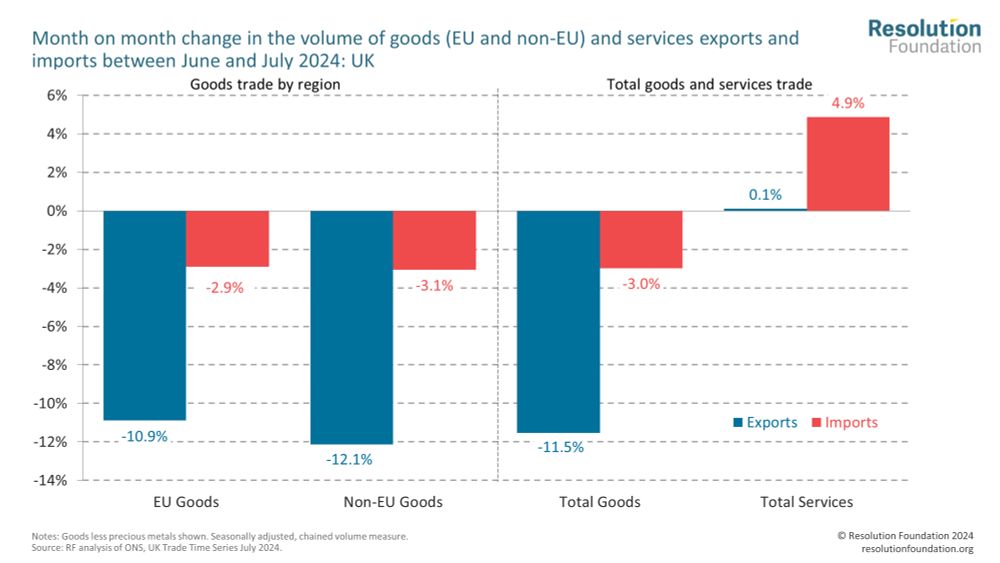

Comparing the year to date with last year we see goods trade volumes remain down, led by weaker goods exports to the EU (which fell 5.4%). Meanwhile, services trade volumes continue to show reasonable growth on last year.

September 11, 2024 at 7:57 AM

Comparing the year to date with last year we see goods trade volumes remain down, led by weaker goods exports to the EU (which fell 5.4%). Meanwhile, services trade volumes continue to show reasonable growth on last year.

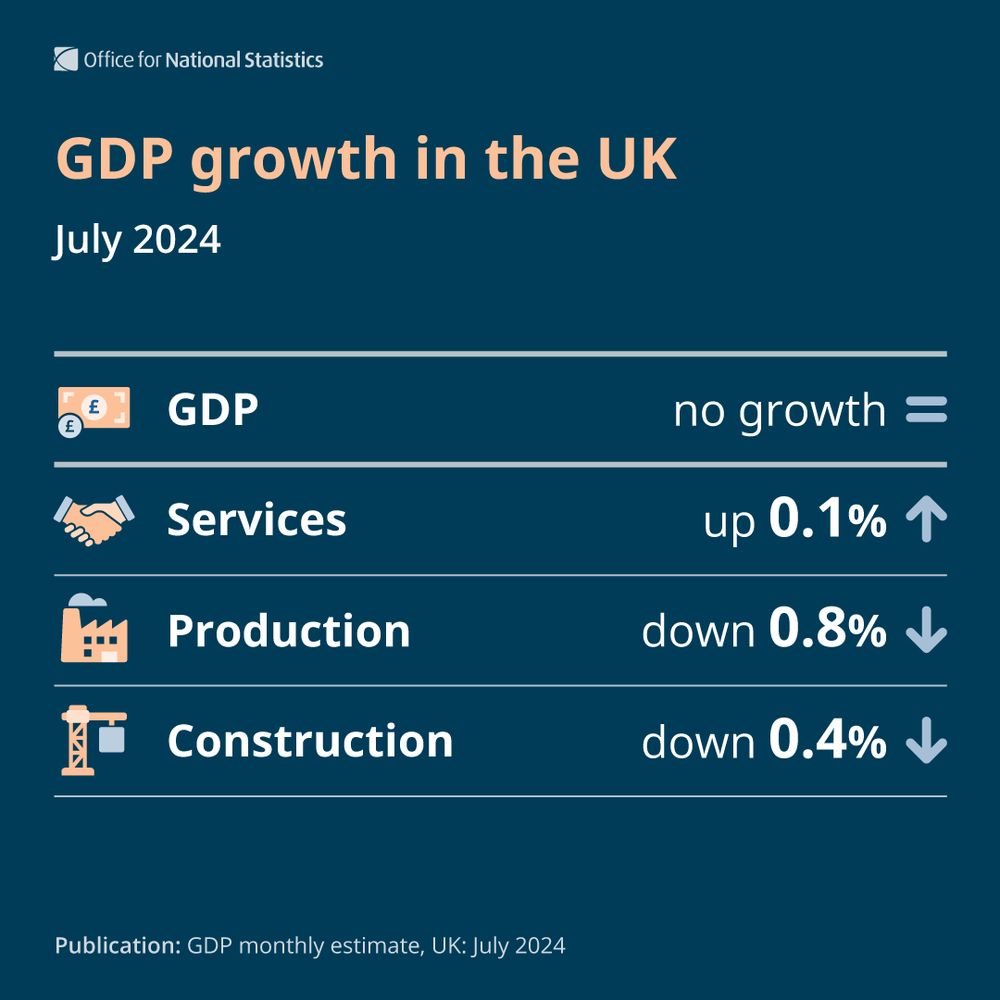

This aligns with what we are seeing in monthly GDP, with services sectors growth outweighing larger falls in production output.

September 11, 2024 at 7:56 AM

This aligns with what we are seeing in monthly GDP, with services sectors growth outweighing larger falls in production output.

Monthly trade dominated by very weak goods export volumes in July, to both EU and non-EU partners. Goods exports down 11.5% in July, reversing substantial growth seen last month (+11% in June). Services trade continues to grow, partially offsetting weaker goods trade.

September 11, 2024 at 7:54 AM

Monthly trade dominated by very weak goods export volumes in July, to both EU and non-EU partners. Goods exports down 11.5% in July, reversing substantial growth seen last month (+11% in June). Services trade continues to grow, partially offsetting weaker goods trade.