Simon Schairer

@simonschairer.bsky.social

PhD-Candidate/Doctoral Research Fellow SuFi Project @UniWH SuFi Project | IPE, global finance, shadow banking, sustainable finance, monetary policy, theories of money & credit.

(Please don't take the banner serious - it's ironic :)

(Please don't take the banner serious - it's ironic :)

Pinned

Simon Schairer

@simonschairer.bsky.social

· Jun 30

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

www.uni-wh.de

How can political decision-makers strengthen sustainable and climate-friendly investments - and at the same time effectively prevent climate-damaging financial flows? The latest [tra:ce] Policy Report takes a closer look at this question.

Further information:

www.uni-wh.de/en/your-camp...

Further information:

www.uni-wh.de/en/your-camp...

Reposted by Simon Schairer

🚨New article🚨 Why has the promise of universal ownership been broken, as @benbraun.bsky.social has suggested?

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

September 24, 2025 at 12:29 PM

🚨New article🚨 Why has the promise of universal ownership been broken, as @benbraun.bsky.social has suggested?

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

Our argument: because the Big Three are hardly universal. They mainly invest in those that can insulate themselves from environmental harm - big tech & financials in the Global North.

🧵

As the revision of the #SFDR comes to an end, I am joining @reclaimfinance.org and +120 experts in calling on the @ec.europa.eu exclude companies developing new fossil fuel projects a minimum criterion across all #SFDR product categories.

There's no room for new fossil fuels in sustainable funds!

There's no room for new fossil fuels in sustainable funds!

September 30, 2025 at 1:50 PM

As the revision of the #SFDR comes to an end, I am joining @reclaimfinance.org and +120 experts in calling on the @ec.europa.eu exclude companies developing new fossil fuel projects a minimum criterion across all #SFDR product categories.

There's no room for new fossil fuels in sustainable funds!

There's no room for new fossil fuels in sustainable funds!

Reposted by Simon Schairer

📣 Avec plus de 120 organisations, experts, chercheurs et entreprises, nous appelons la Commission européenne à garantir l'exclusion des entreprises développant de nouveaux projets d'énergies fossiles des futures catégories du SFDR afin de lutter efficacement contre le greenwashing.

Lire la lettre ⤵️

Lire la lettre ⤵️

There is no room for fossil fuel developers in any sustainable finance categories - Reclaim Finance

The review of the SFDR is coming to an end with the publication of the proposal for a revised regulation by the European Commission announced for Q4 2025.

reclaimfinance.org

September 30, 2025 at 8:48 AM

📣 Avec plus de 120 organisations, experts, chercheurs et entreprises, nous appelons la Commission européenne à garantir l'exclusion des entreprises développant de nouveaux projets d'énergies fossiles des futures catégories du SFDR afin de lutter efficacement contre le greenwashing.

Lire la lettre ⤵️

Lire la lettre ⤵️

Once again a cery interesting, thought provoking and inspiring Finance and Society conference @finandsoc.bsky.social - looking forward to next year (whereever it's going to be)!

Thanks to numerous colleagues for intense discussions and critical questions!

Thanks to numerous colleagues for intense discussions and critical questions!

September 12, 2025 at 2:02 PM

Once again a cery interesting, thought provoking and inspiring Finance and Society conference @finandsoc.bsky.social - looking forward to next year (whereever it's going to be)!

Thanks to numerous colleagues for intense discussions and critical questions!

Thanks to numerous colleagues for intense discussions and critical questions!

Reposted by Simon Schairer

On September 11, 1973, Chile’s socialist president Salvador Allende was overthrown in a CIA-backed coup.

In this 1971 interview, published in English for the first time in Jacobin, Allende expressed his fears of destabilization and US interference.

In this 1971 interview, published in English for the first time in Jacobin, Allende expressed his fears of destabilization and US interference.

What Salvador Allende Feared

On September 11, 1973, Chile’s socialist president Salvador Allende was overthrown in a CIA-backed military coup. In this 1971 interview, published in English for the first time, Allende expressed his fears of internal destabilization and US interference.

jacobin.com

September 11, 2025 at 11:59 AM

On September 11, 1973, Chile’s socialist president Salvador Allende was overthrown in a CIA-backed coup.

In this 1971 interview, published in English for the first time in Jacobin, Allende expressed his fears of destabilization and US interference.

In this 1971 interview, published in English for the first time in Jacobin, Allende expressed his fears of destabilization and US interference.

Reposted by Simon Schairer

13/ “Beijing is offering cheap, clean power, employment, trade and a route to prosperity. Washington is offering tariffs, policy chaos, White nationalist memes and South Korean workers in shackles after a raid on an EV battery factory.” ht

@davidfickling.bsky.social

bloomberg.com/opinion/arti...

@davidfickling.bsky.social

bloomberg.com/opinion/arti...

September 12, 2025 at 4:23 AM

13/ “Beijing is offering cheap, clean power, employment, trade and a route to prosperity. Washington is offering tariffs, policy chaos, White nationalist memes and South Korean workers in shackles after a raid on an EV battery factory.” ht

@davidfickling.bsky.social

bloomberg.com/opinion/arti...

@davidfickling.bsky.social

bloomberg.com/opinion/arti...

Happy to share our new open-access article from the SuFi project at Witten/Herdecke University, just published in the @jeppjournal.bsky.social!

www.tandfonline.com/doi/full/10....

www.tandfonline.com/doi/full/10....

Playing the capital market? Sustainable finance and the discursive construction of the Capital Markets Union as a common good

The Capital Markets Union (CMU) project aims to create more integrated capital markets in Europe. However, the project faces resistance, and despite ongoing efforts EU capital markets remain fragme...

www.tandfonline.com

July 22, 2025 at 10:49 AM

Happy to share our new open-access article from the SuFi project at Witten/Herdecke University, just published in the @jeppjournal.bsky.social!

www.tandfonline.com/doi/full/10....

www.tandfonline.com/doi/full/10....

Reposted by Simon Schairer

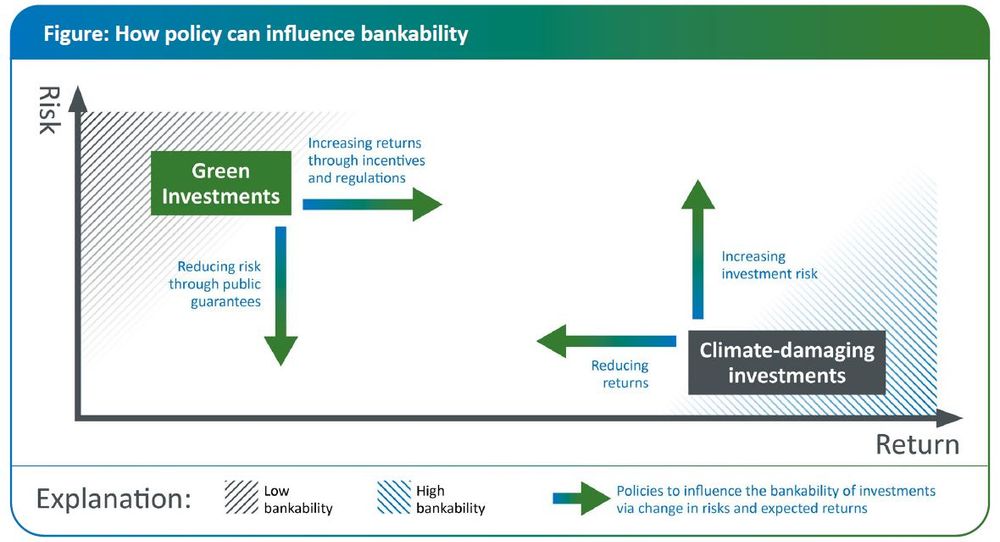

Our #policy #paper has just been published: "Financing the #green #transition: Increasing #bankability, phasing out carbon investments and funding 'never bankable' activities". We ask: Why does a large green financing gap persist? What policies do we need to change it: www.uni-wh.de/en/your-camp...

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

www.uni-wh.de

July 3, 2025 at 6:01 AM

Our #policy #paper has just been published: "Financing the #green #transition: Increasing #bankability, phasing out carbon investments and funding 'never bankable' activities". We ask: Why does a large green financing gap persist? What policies do we need to change it: www.uni-wh.de/en/your-camp...

Reposted by Simon Schairer

🚨 Do check out this very timely Policy Report on "Financing the green transition" 👇

How can political decision-makers strengthen sustainable and climate-friendly investments - and at the same time effectively prevent climate-damaging financial flows? The latest [tra:ce] Policy Report takes a closer look at this question.

Further information:

www.uni-wh.de/en/your-camp...

Further information:

www.uni-wh.de/en/your-camp...

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

www.uni-wh.de

June 30, 2025 at 1:22 PM

🚨 Do check out this very timely Policy Report on "Financing the green transition" 👇

Reposted by Simon Schairer

Figure from our #policy #report: 1. The main barrier to #financing the necessary activities for the sustainable transition is their lack of #bankability

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

July 11, 2025 at 1:10 PM

Figure from our #policy #report: 1. The main barrier to #financing the necessary activities for the sustainable transition is their lack of #bankability

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

2. High GHG-emitting activities remain #bankable and thus continue to attract financing from banks and shadow banks

www.uni-wh.de/en/your-camp...

How can political decision-makers strengthen sustainable and climate-friendly investments - and at the same time effectively prevent climate-damaging financial flows? The latest [tra:ce] Policy Report takes a closer look at this question.

Further information:

www.uni-wh.de/en/your-camp...

Further information:

www.uni-wh.de/en/your-camp...

[tra:ce] Policy Report

Financing the green transition: Increasing bankability, phasing out carbon investments and funding ‘never bankable’ activities

www.uni-wh.de

June 30, 2025 at 12:08 PM

How can political decision-makers strengthen sustainable and climate-friendly investments - and at the same time effectively prevent climate-damaging financial flows? The latest [tra:ce] Policy Report takes a closer look at this question.

Further information:

www.uni-wh.de/en/your-camp...

Further information:

www.uni-wh.de/en/your-camp...

We are thrilled to announce the public launch of our policy paper: "Financing the green transition: Increasing bankability, phasing out carbon investments and funding 'never bankable' activities" Monday 30.06.2025, 11:00 (CET) via Zoom.

Please register here:

www.uni-wh.de/die-finanzie...

Please register here:

www.uni-wh.de/die-finanzie...

June 12, 2025 at 11:04 AM

We are thrilled to announce the public launch of our policy paper: "Financing the green transition: Increasing bankability, phasing out carbon investments and funding 'never bankable' activities" Monday 30.06.2025, 11:00 (CET) via Zoom.

Please register here:

www.uni-wh.de/die-finanzie...

Please register here:

www.uni-wh.de/die-finanzie...

Ratschläge aus der Zukunft gesucht!

Wir suchen inspirierende, innovative & kreative Antworten auf die Frage „Was rät die Zukunft dem Heute?”

Stell dir vor: Es ist das Jahr 2070 und du lebst in einer nachhaltigen und gerechten Welt.

Spread the word! :)

www.uni-wh.de/euer-campus/...

Wir suchen inspirierende, innovative & kreative Antworten auf die Frage „Was rät die Zukunft dem Heute?”

Stell dir vor: Es ist das Jahr 2070 und du lebst in einer nachhaltigen und gerechten Welt.

Spread the word! :)

www.uni-wh.de/euer-campus/...

Jugend-Kreativpreis Nachhaltigkeit 2025

www.uni-wh.de

May 26, 2025 at 4:09 PM

Ratschläge aus der Zukunft gesucht!

Wir suchen inspirierende, innovative & kreative Antworten auf die Frage „Was rät die Zukunft dem Heute?”

Stell dir vor: Es ist das Jahr 2070 und du lebst in einer nachhaltigen und gerechten Welt.

Spread the word! :)

www.uni-wh.de/euer-campus/...

Wir suchen inspirierende, innovative & kreative Antworten auf die Frage „Was rät die Zukunft dem Heute?”

Stell dir vor: Es ist das Jahr 2070 und du lebst in einer nachhaltigen und gerechten Welt.

Spread the word! :)

www.uni-wh.de/euer-campus/...

Check out our second [tra:ce] working paper!

This time, we zoom in on the role of banks in sustainable finance: "The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation". *Join our public paper launch on Monday, 26 May, 11h (CET)*!

This time, we zoom in on the role of banks in sustainable finance: "The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation". *Join our public paper launch on Monday, 26 May, 11h (CET)*!

Banks have been slow to increase green lending and continue to finance high-GHG-emitting activities. Why? Based on 88 interviews, in our new @trace working paper, we argue that there are three main reasons: bankability, business model, and regulations. papers.ssrn.com/sol3/papers....

The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation

Banks have been slow to increase green lending while they continue to finance high-GHG-emitting activities, a phenomenon we call the "green banking gap&quo

papers.ssrn.com

May 19, 2025 at 10:44 AM

Check out our second [tra:ce] working paper!

This time, we zoom in on the role of banks in sustainable finance: "The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation". *Join our public paper launch on Monday, 26 May, 11h (CET)*!

This time, we zoom in on the role of banks in sustainable finance: "The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation". *Join our public paper launch on Monday, 26 May, 11h (CET)*!

Reposted by Simon Schairer

Interesting read.

✨ New Essay! ✨

A powerful fiscal counter-strategy stands ready for deployment: a Blue state bond drive for democracy.

moneyontheleft.org/2025/05/09/b...

It's time for fearless invention. Blue bonds can save lives, motivate voters & model politics for the post-Trump era.

Please share widely! 🙌

A powerful fiscal counter-strategy stands ready for deployment: a Blue state bond drive for democracy.

moneyontheleft.org/2025/05/09/b...

It's time for fearless invention. Blue bonds can save lives, motivate voters & model politics for the post-Trump era.

Please share widely! 🙌

May 15, 2025 at 7:20 AM

Interesting read.

Reposted by Simon Schairer

📢 Job announcement – 1 PhD researcher in my "Global Sustainability Governance" research group

Please share this opportunity within your networks and encourage suitable candidates to apply (or consider applying yourself)! Happy to answer questions!

Deadline: 4 June 👇

www.uni-due.de/karriere/ste...

Please share this opportunity within your networks and encourage suitable candidates to apply (or consider applying yourself)! Happy to answer questions!

Deadline: 4 June 👇

www.uni-due.de/karriere/ste...

Stellenausschreibung

www.uni-due.de

May 17, 2025 at 7:59 AM

📢 Job announcement – 1 PhD researcher in my "Global Sustainability Governance" research group

Please share this opportunity within your networks and encourage suitable candidates to apply (or consider applying yourself)! Happy to answer questions!

Deadline: 4 June 👇

www.uni-due.de/karriere/ste...

Please share this opportunity within your networks and encourage suitable candidates to apply (or consider applying yourself)! Happy to answer questions!

Deadline: 4 June 👇

www.uni-due.de/karriere/ste...

🚨 New Working Paper published:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

Out of the light, into the dark: how 'shadow carbon financing' hampers the green transition and increases climate-related systemic risk

Recent years saw major regulatory efforts to steer the financial system towards financing the transition to a net-zero carbon economy and phase out carbon finan

papers.ssrn.com

April 1, 2025 at 10:44 AM

🚨 New Working Paper published:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

Out of the light, into the dark: how ‘shadow carbon financing’ hampers the green transition and increases climate-related systemic risk

🛢️💸🏝️

papers.ssrn.com/sol3/papers....

A 🧵 with our main arguments:

This cause is close to my heart - please sign: weact.campact.de/petitions/ve...

Verfassungsschutz-Gutachten über die AfD vor der Bundestagswahl am 23.2. vorlegen!

Die AfD hat beim Bundesparteitag nochmal mehr ihr wahres Gesicht gezeigt. “Remigration” steht jetzt offiziell im Wahlprogramm der Partei.

Die Landesverbände in Thüringen, Sachsen und Sachsen-Anhalt h...

weact.campact.de

February 8, 2025 at 7:15 PM

This cause is close to my heart - please sign: weact.campact.de/petitions/ve...

Reposted by Simon Schairer

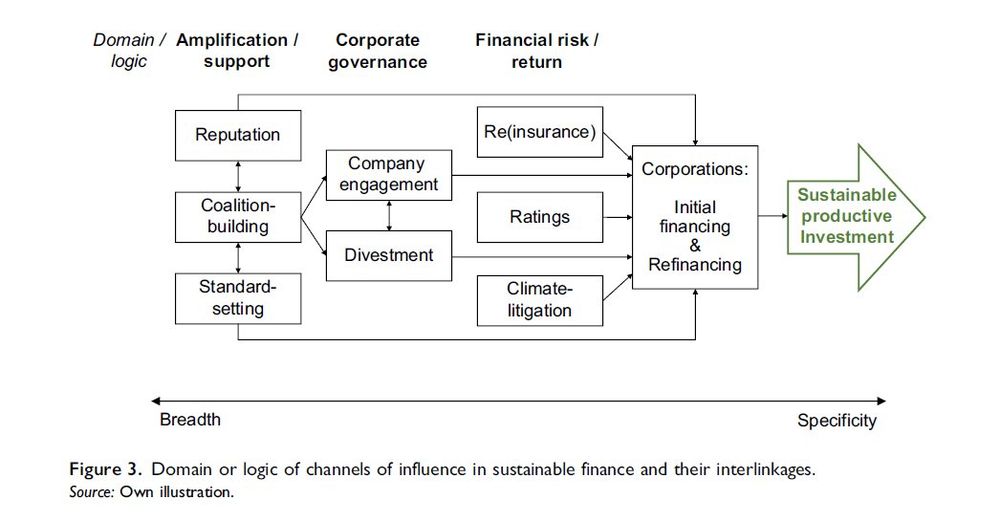

We argue that in the dominant "derisiking" green macrofinancial regime (@danielagabor.bsky.social

& @benbraun.bsky.social) utilizing all available channels of influence in sustainable finance is a necessary – albeit insufficient – condition to advance the green transition.

🧵 END.

& @benbraun.bsky.social) utilizing all available channels of influence in sustainable finance is a necessary – albeit insufficient – condition to advance the green transition.

🧵 END.

January 30, 2025 at 10:07 AM

We argue that in the dominant "derisiking" green macrofinancial regime (@danielagabor.bsky.social

& @benbraun.bsky.social) utilizing all available channels of influence in sustainable finance is a necessary – albeit insufficient – condition to advance the green transition.

🧵 END.

& @benbraun.bsky.social) utilizing all available channels of influence in sustainable finance is a necessary – albeit insufficient – condition to advance the green transition.

🧵 END.

Reposted by Simon Schairer

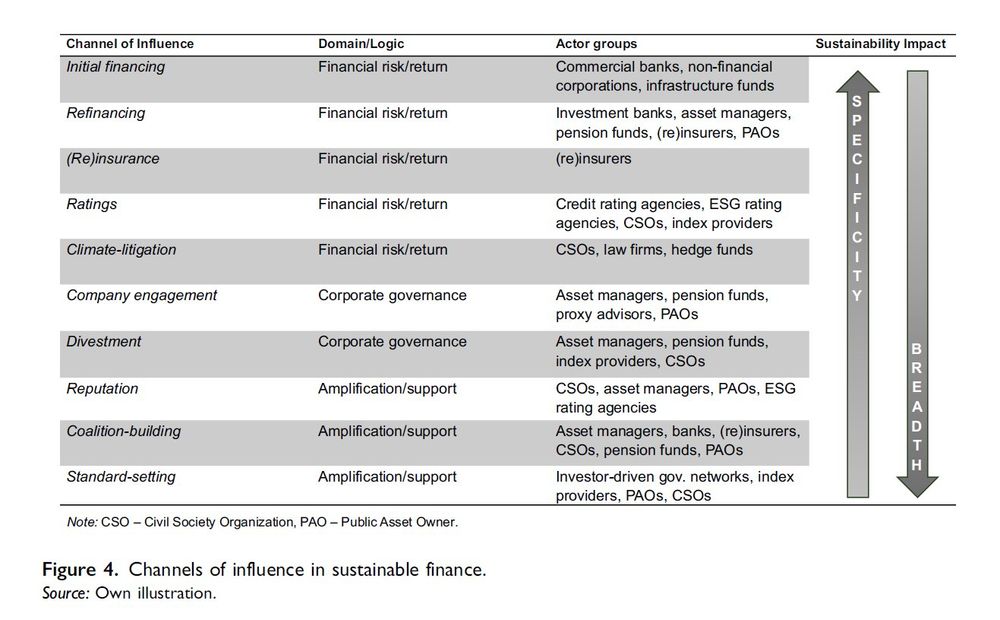

We provide a conceptualization of each channel of influence according to its domain or logic (financial risk–return, corporate governance, and amplification/support) and order them acc. to specificity versus breadth of their sustainability impact.

January 30, 2025 at 10:07 AM

We provide a conceptualization of each channel of influence according to its domain or logic (financial risk–return, corporate governance, and amplification/support) and order them acc. to specificity versus breadth of their sustainability impact.

Reposted by Simon Schairer

We identify ten channels of influence concerning sustainable finance: (1) initial financing; (2) refinancing; (3) (re)insurance; (4) ratings; (5) climate-litigation; (6) company engagement; (7) divestment; (8) reputation; (9) coalition-building; and (10) standard-setting.

January 30, 2025 at 10:07 AM

We identify ten channels of influence concerning sustainable finance: (1) initial financing; (2) refinancing; (3) (re)insurance; (4) ratings; (5) climate-litigation; (6) company engagement; (7) divestment; (8) reputation; (9) coalition-building; and (10) standard-setting.

Reposted by Simon Schairer

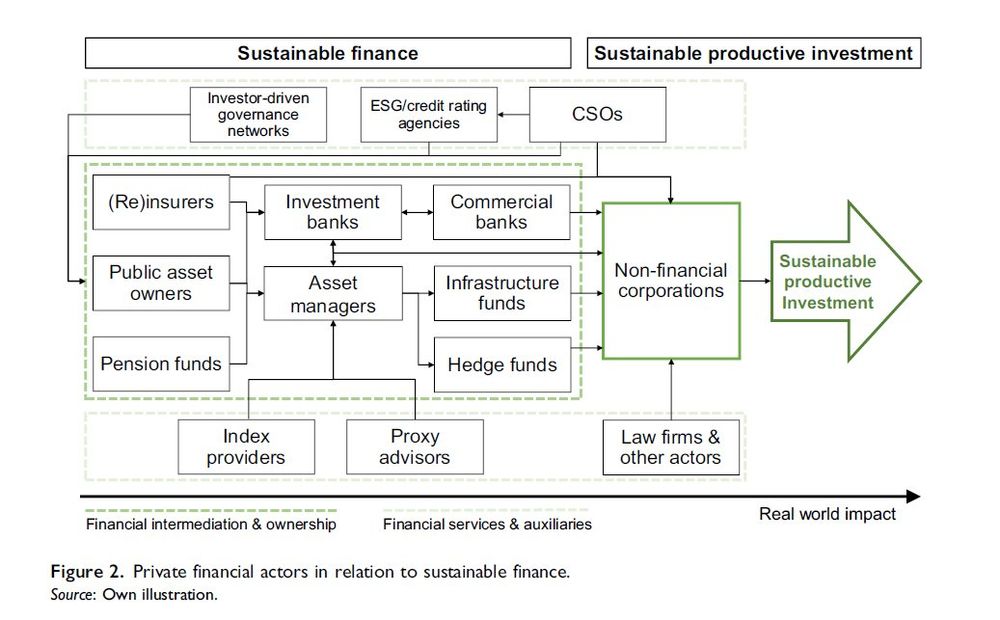

We introduce the conceptual framework of ‘channels of influence’, which are are different strategies and mechanisms used by private actors that influence the behavior of financial and non-financial corporations to increase financial flows to sustainable productive investments.

January 30, 2025 at 10:07 AM

We introduce the conceptual framework of ‘channels of influence’, which are are different strategies and mechanisms used by private actors that influence the behavior of financial and non-financial corporations to increase financial flows to sustainable productive investments.

Reposted by Simon Schairer

In fact, most sufi actors & instruments cannot directly advance sustainable productive investment.

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

January 30, 2025 at 10:07 AM

In fact, most sufi actors & instruments cannot directly advance sustainable productive investment.

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

We thus argue that sustainable finance is not exclusively about investing or providing finance, but crucially also about changing corporate practices toward greater sustainability.

Reposted by Simon Schairer

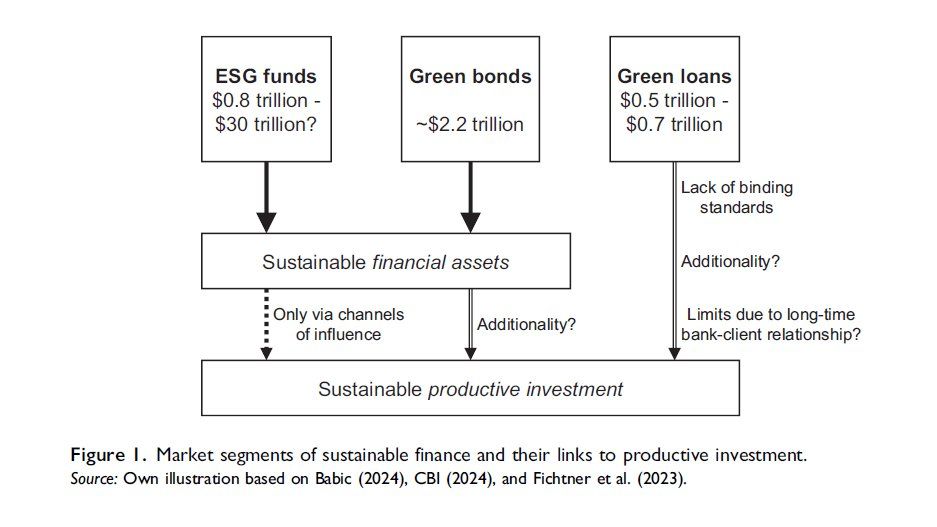

Since the Paris Agreement "sustainable finance" has grown rapidly. However, we don't see strong growth in real-world financial flows that mitigate climate change. Why?

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.

January 30, 2025 at 10:07 AM

Since the Paris Agreement "sustainable finance" has grown rapidly. However, we don't see strong growth in real-world financial flows that mitigate climate change. Why?

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.

Because most of sufi creates *financial assets* and not *productive investment* which drives decarbonization.