Simon Schairer

@simonschairer.bsky.social

PhD-Candidate/Doctoral Research Fellow SuFi Project @UniWH SuFi Project | IPE, global finance, shadow banking, sustainable finance, monetary policy, theories of money & credit.

(Please don't take the banner serious - it's ironic :)

(Please don't take the banner serious - it's ironic :)

As the revision of the #SFDR comes to an end, I am joining @reclaimfinance.org and +120 experts in calling on the @ec.europa.eu exclude companies developing new fossil fuel projects a minimum criterion across all #SFDR product categories.

There's no room for new fossil fuels in sustainable funds!

There's no room for new fossil fuels in sustainable funds!

September 30, 2025 at 1:50 PM

As the revision of the #SFDR comes to an end, I am joining @reclaimfinance.org and +120 experts in calling on the @ec.europa.eu exclude companies developing new fossil fuel projects a minimum criterion across all #SFDR product categories.

There's no room for new fossil fuels in sustainable funds!

There's no room for new fossil fuels in sustainable funds!

Once again a cery interesting, thought provoking and inspiring Finance and Society conference @finandsoc.bsky.social - looking forward to next year (whereever it's going to be)!

Thanks to numerous colleagues for intense discussions and critical questions!

Thanks to numerous colleagues for intense discussions and critical questions!

September 12, 2025 at 2:02 PM

Once again a cery interesting, thought provoking and inspiring Finance and Society conference @finandsoc.bsky.social - looking forward to next year (whereever it's going to be)!

Thanks to numerous colleagues for intense discussions and critical questions!

Thanks to numerous colleagues for intense discussions and critical questions!

We are thrilled to announce the public launch of our policy paper: "Financing the green transition: Increasing bankability, phasing out carbon investments and funding 'never bankable' activities" Monday 30.06.2025, 11:00 (CET) via Zoom.

Please register here:

www.uni-wh.de/die-finanzie...

Please register here:

www.uni-wh.de/die-finanzie...

June 12, 2025 at 11:04 AM

We are thrilled to announce the public launch of our policy paper: "Financing the green transition: Increasing bankability, phasing out carbon investments and funding 'never bankable' activities" Monday 30.06.2025, 11:00 (CET) via Zoom.

Please register here:

www.uni-wh.de/die-finanzie...

Please register here:

www.uni-wh.de/die-finanzie...

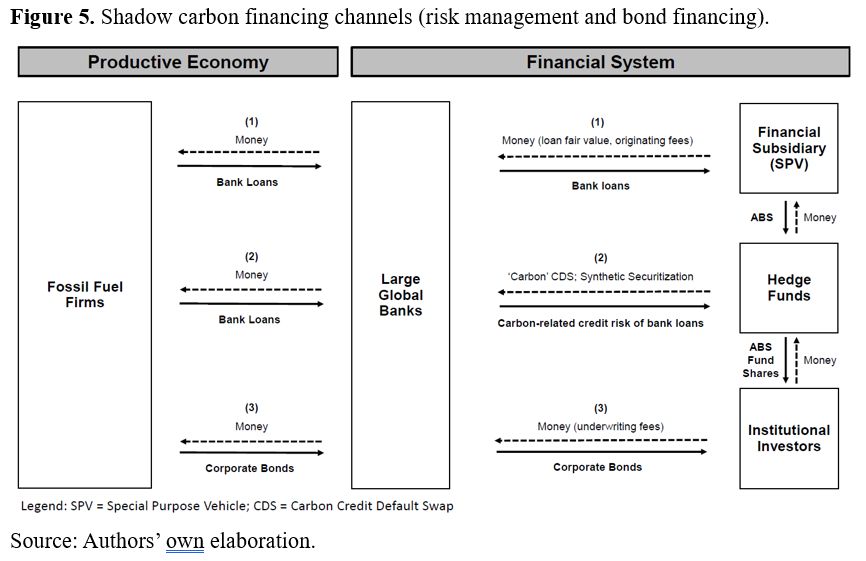

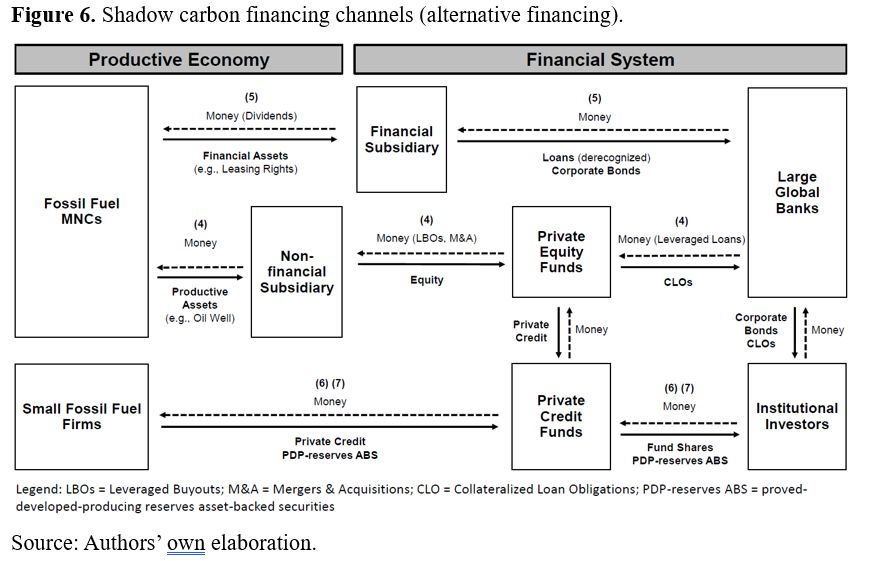

We argue that shadow carbon financing may increase climate-related systemic risks in various ways (see Figures). Consequently, financial regulation must address shadow carbon financing to avoid a "climate Minsky moment"

April 1, 2025 at 10:57 AM

We argue that shadow carbon financing may increase climate-related systemic risks in various ways (see Figures). Consequently, financial regulation must address shadow carbon financing to avoid a "climate Minsky moment"

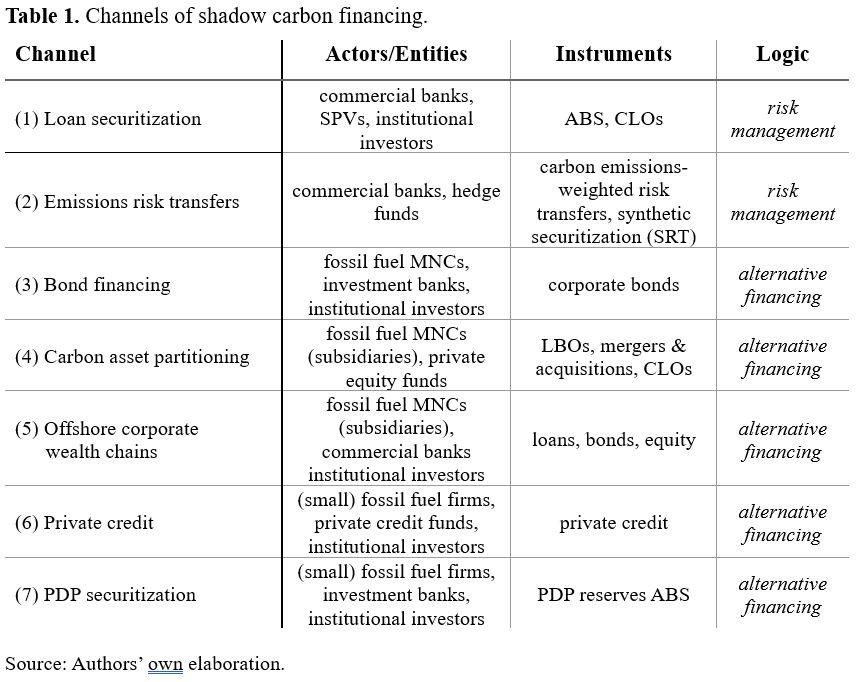

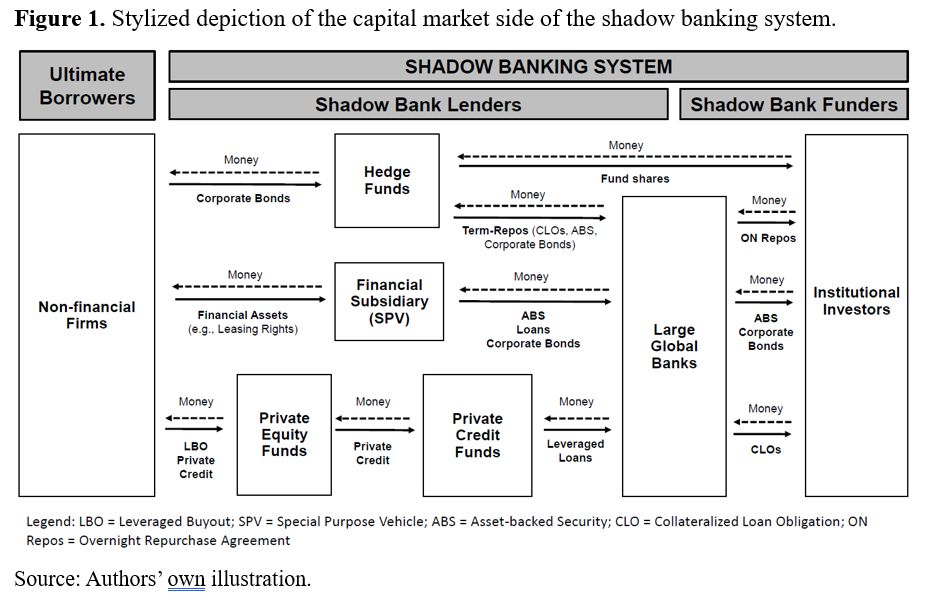

Drawing on qualitative expert interviews and financial market data, the paper explains how the offshore-shadow-banking nexus hampers the green transition by introducing the concept of ‘shadow carbon financing’, which can operate through the following seven channels:

April 1, 2025 at 10:55 AM

Drawing on qualitative expert interviews and financial market data, the paper explains how the offshore-shadow-banking nexus hampers the green transition by introducing the concept of ‘shadow carbon financing’, which can operate through the following seven channels:

Recent years saw regulatory efforts to steer the financial system towards financing the transition to a net-zero economy and phase out carbon financing. However, EU regulation has left the nexus of offshore finance and the shadow banking system untouched.

April 1, 2025 at 10:55 AM

Recent years saw regulatory efforts to steer the financial system towards financing the transition to a net-zero economy and phase out carbon financing. However, EU regulation has left the nexus of offshore finance and the shadow banking system untouched.