Website: sentimentrader.com

X: x.com/sentimentrader

LinkedIn: linkedin.com/company/sentimentrader

YouTube: youtube.com/SentimenTrader

A retiring legend and record cash balance during a momentum market are deadly for returns.

A retiring legend and record cash balance during a momentum market are deadly for returns.

For the first time in several months, the NFIB survey popped above 100. For the small-cap Russell 2000 index, a reading above 100 is not necessarily a great sign.

For the first time in several months, the NFIB survey popped above 100. For the small-cap Russell 2000 index, a reading above 100 is not necessarily a great sign.

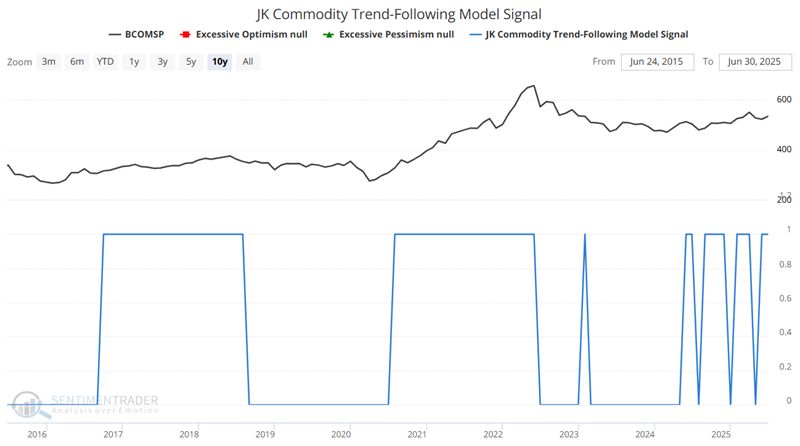

A simple Triple 40 system invests when bitcoin is above its 40-day average, at least 40% of traders are bullish, and 40% of cryptocurrencies are in uptrends.

A simple Triple 40 system invests when bitcoin is above its 40-day average, at least 40% of traders are bullish, and 40% of cryptocurrencies are in uptrends.

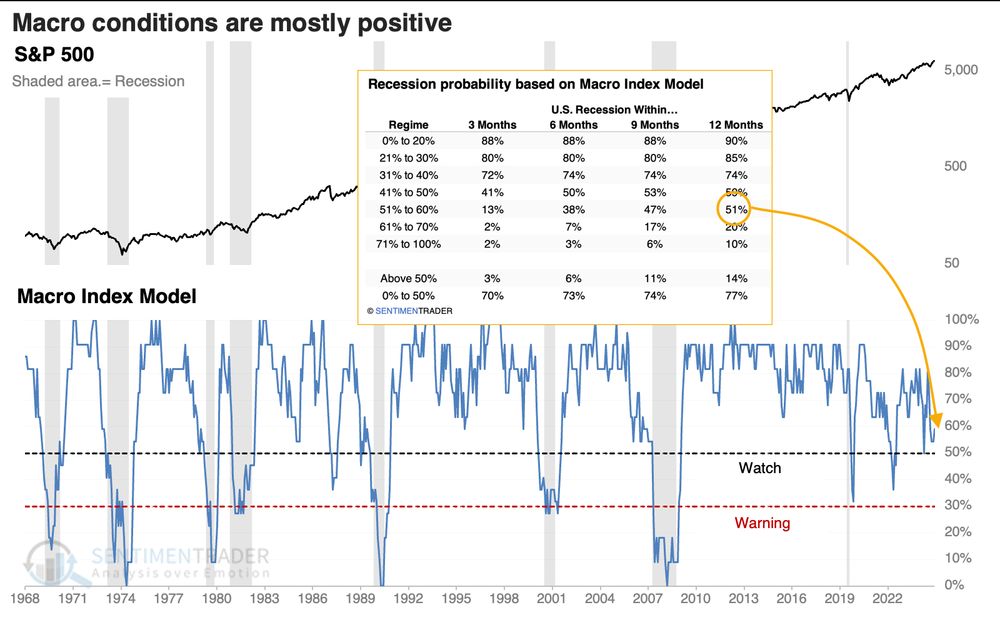

Our Macro Index Model's latest reading has a better-than-even historical record of preceding a recession within one year. It won't take much for the model to fall further, and that would significantly raise investors' risks.

Our Macro Index Model's latest reading has a better-than-even historical record of preceding a recession within one year. It won't take much for the model to fall further, and that would significantly raise investors' risks.

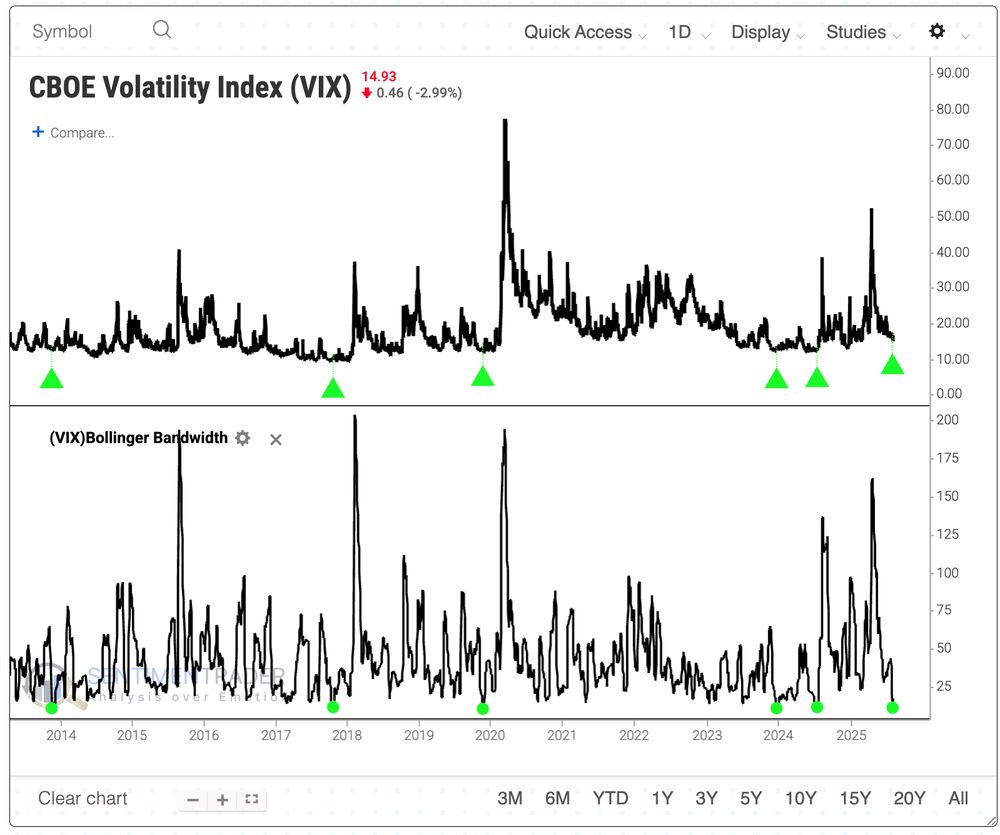

Watching how much the VIX moves lets us know how comfortable traders are with their beliefs.

Watching how much the VIX moves lets us know how comfortable traders are with their beliefs.

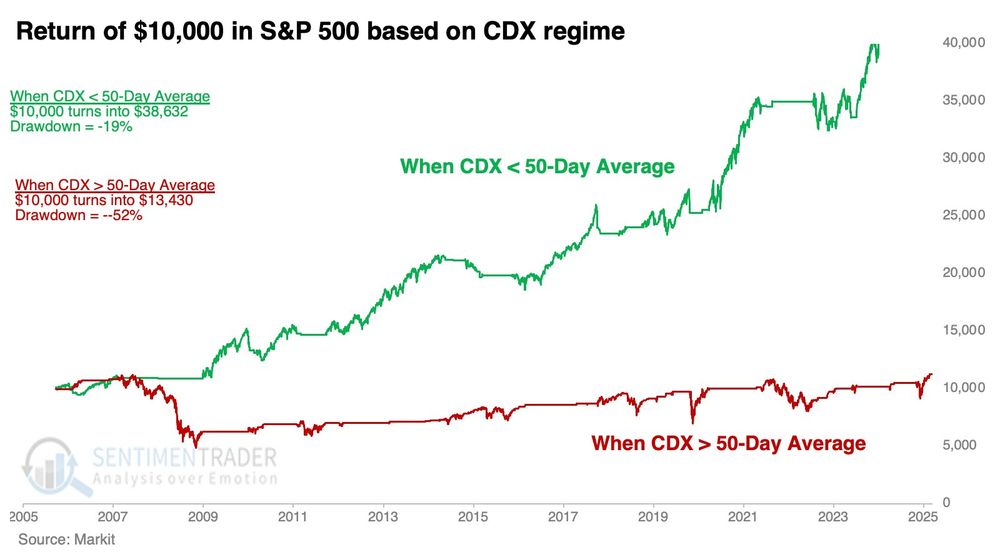

Regardless, bond traders are not worried about defaults. And that has been a very good thing for the S&P 500.

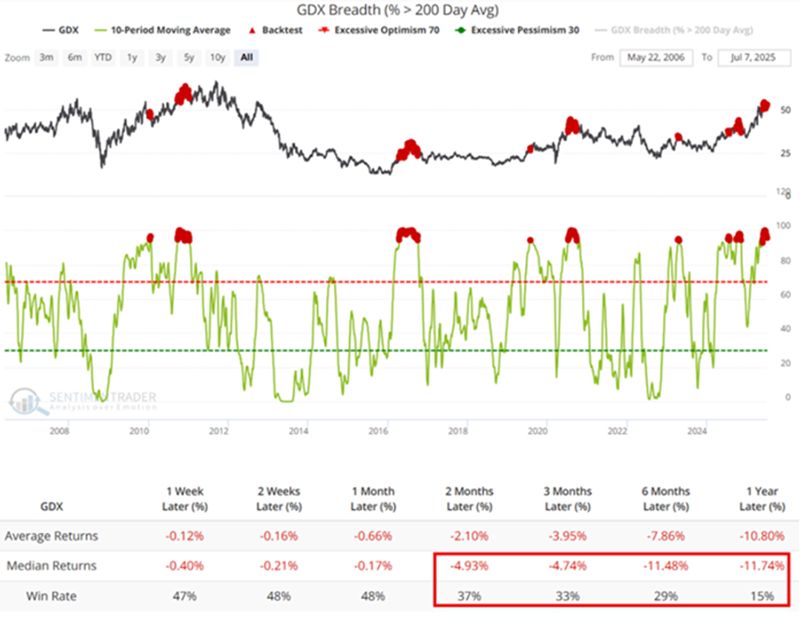

Watch out if the index climbs above its 50-day moving average.

Regardless, bond traders are not worried about defaults. And that has been a very good thing for the S&P 500.

Watch out if the index climbs above its 50-day moving average.

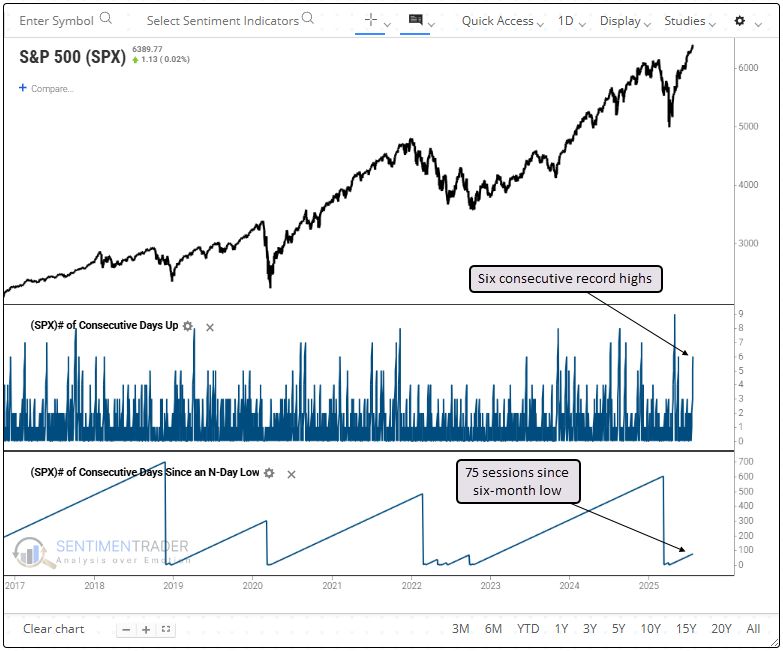

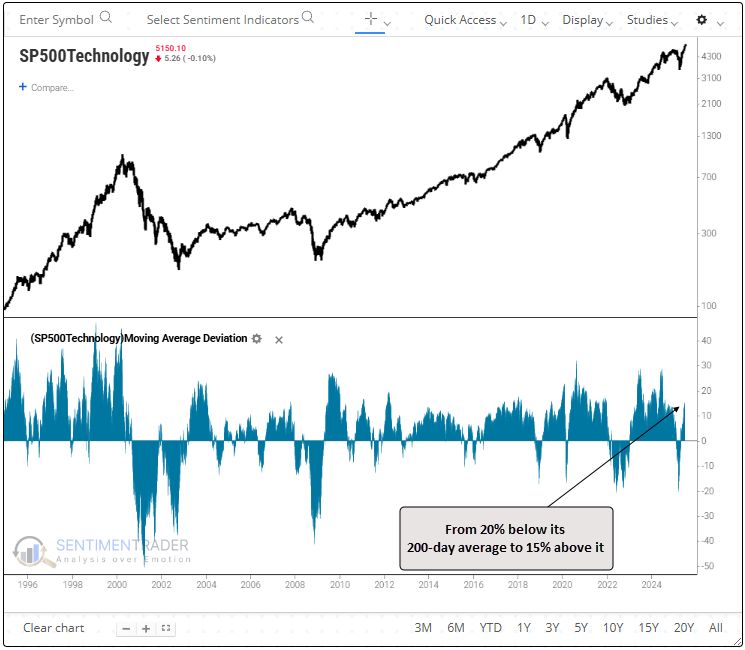

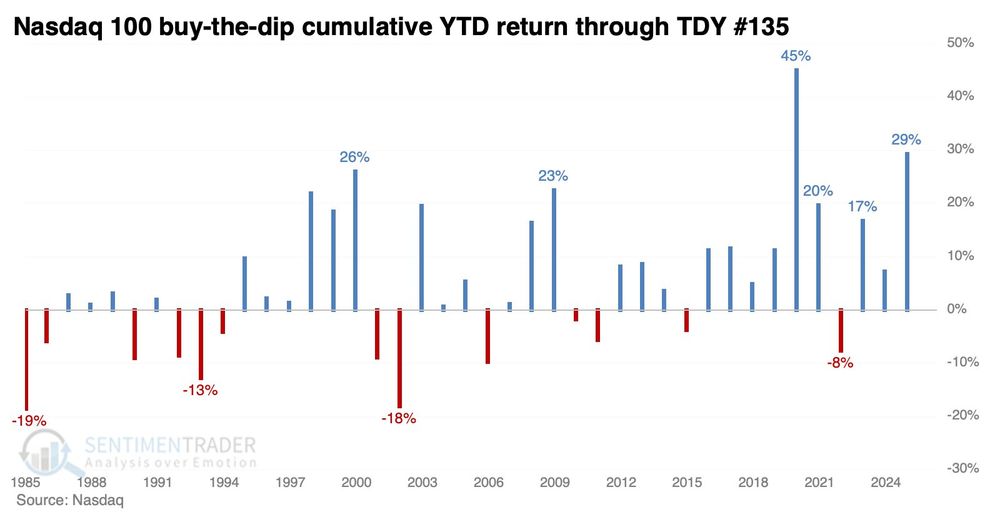

That's second only to 2020 and ahead of the year 2000.

The S&P 500's cumulative +18% return is tied for the 4th-highest since 1928.

That's second only to 2020 and ahead of the year 2000.

The S&P 500's cumulative +18% return is tied for the 4th-highest since 1928.

🔗Read our Senior Analyst Dean Christians's Jul 18 "Alternative asset managers regain leadership status”: users.sentimentrader.com/users/modele...

🔗Read our Senior Analyst Dean Christians's Jul 18 "Alternative asset managers regain leadership status”: users.sentimentrader.com/users/modele...

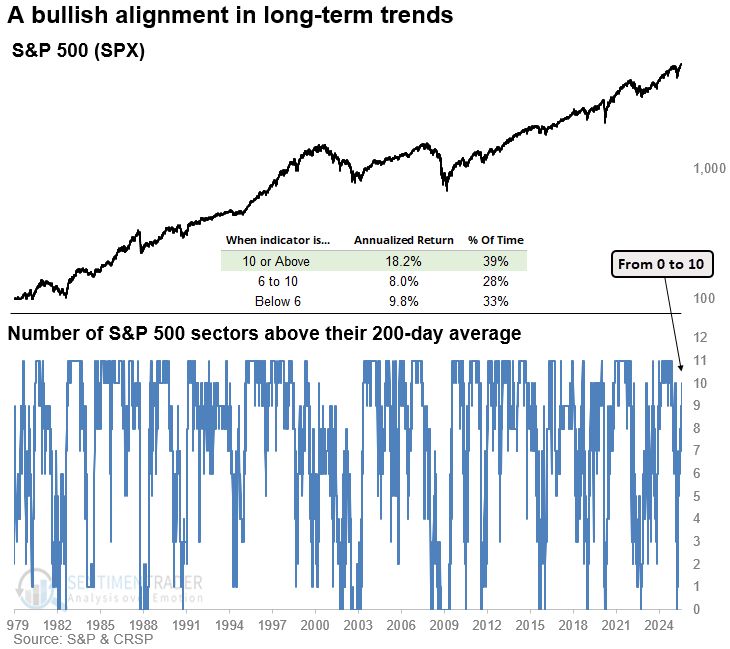

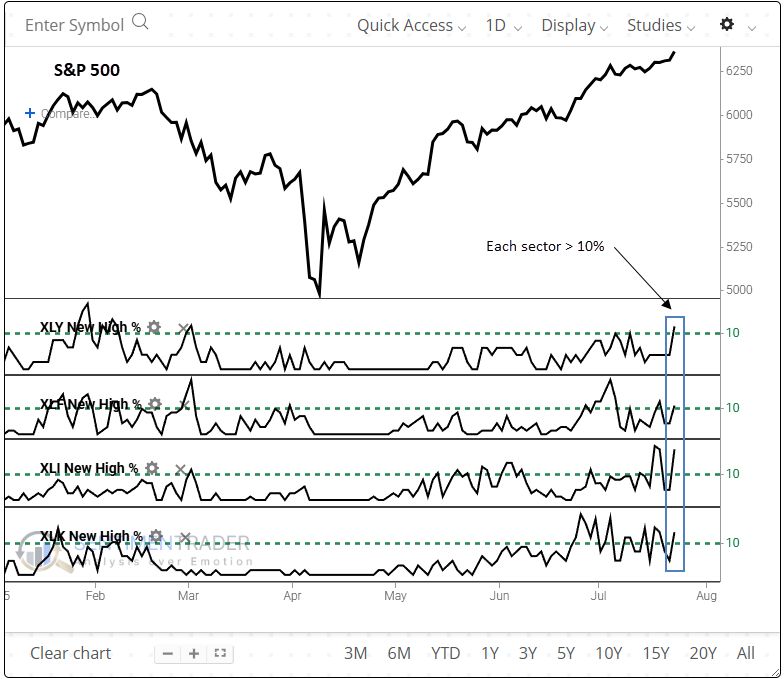

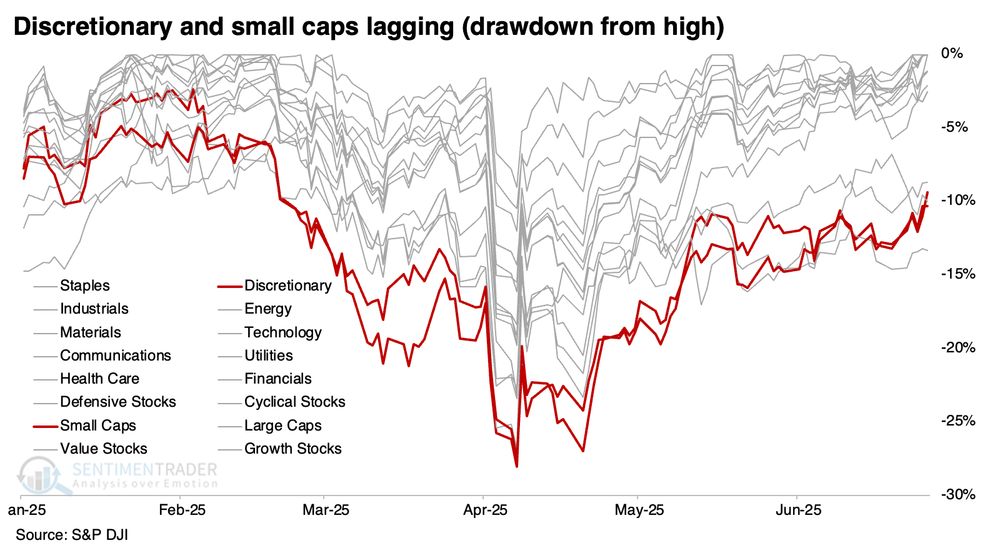

According to financial media, the rally isn't being led by what it should be because discretionary and small-cap stocks are lagging badly.

After similar conditions since 1926, only one instance (in 1990) preceded a meaningful downturn in stocks.

According to financial media, the rally isn't being led by what it should be because discretionary and small-cap stocks are lagging badly.

After similar conditions since 1926, only one instance (in 1990) preceded a meaningful downturn in stocks.