👉 Droughts in US, China, Latam, Mideast make it hard to cool thermal power stations and data centers, curb hydro output.

👉 36% power generation capacity may be located in high water-stress areas by 2030.

Clients can read on FFM <GO>.

👉 Droughts in US, China, Latam, Mideast make it hard to cool thermal power stations and data centers, curb hydro output.

👉 36% power generation capacity may be located in high water-stress areas by 2030.

Clients can read on FFM <GO>.

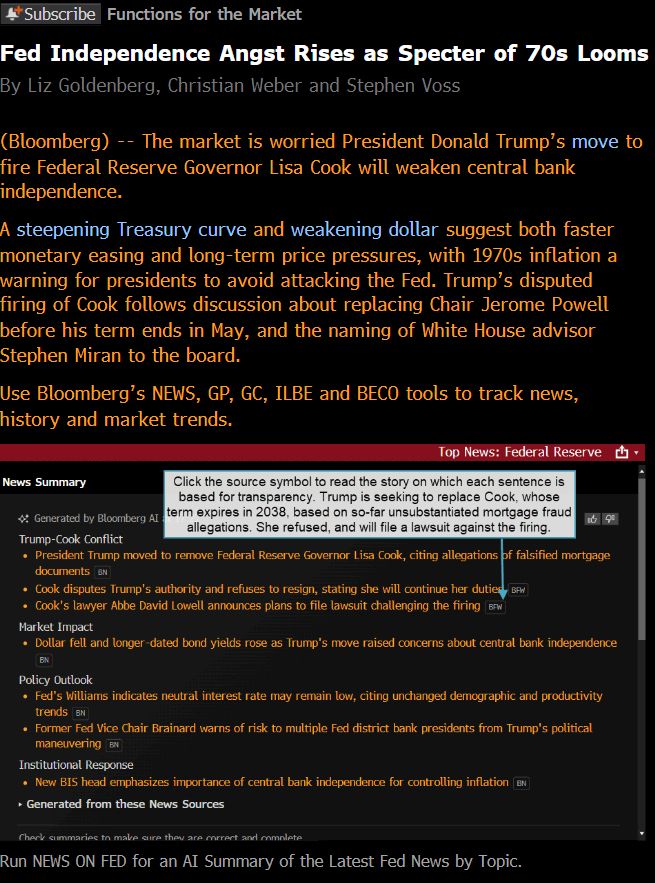

👉 A steepening Treasury curve and falling dollar raise specter of runaway inflation after Nixon pressured Burns in the 1970s.

Clients can read at FFM

👉 A steepening Treasury curve and falling dollar raise specter of runaway inflation after Nixon pressured Burns in the 1970s.

Clients can read at FFM

👉 The factor, which counts dividends, buybacks & debt repayment, beat dividend yield over 1Y & 8Y.

👉 This week was marked by factor rotation.

👉 Shareholder yield stars show higher profitability, growth.

On FFM <GO>.

👉 The factor, which counts dividends, buybacks & debt repayment, beat dividend yield over 1Y & 8Y.

👉 This week was marked by factor rotation.

👉 Shareholder yield stars show higher profitability, growth.

On FFM <GO>.

👉Bloomberg Intelligence says high-end brands are best positioned to raise prices in the face of tariffs.

👉LVMH opened a "boat" in Shanghai as Chinese tourism rebounds slowly.

Now on FFM <GO>.

👉Bloomberg Intelligence says high-end brands are best positioned to raise prices in the face of tariffs.

👉LVMH opened a "boat" in Shanghai as Chinese tourism rebounds slowly.

Now on FFM <GO>.

👉 12 tech giants account for 40% of S&P 500 weight.

👉 Nvidia, Microsoft, Meta drove half of gauge’s 2025 gain.

👉 Russell 2000, equal-weight S&P 500 ETFs saw 1M outflows.

👉 Ark Innovation, Nasdaq 100 ETFS saw 1M inflows.

Clients can read on FFM <GO>.

👉 12 tech giants account for 40% of S&P 500 weight.

👉 Nvidia, Microsoft, Meta drove half of gauge’s 2025 gain.

👉 Russell 2000, equal-weight S&P 500 ETFs saw 1M outflows.

👉 Ark Innovation, Nasdaq 100 ETFS saw 1M inflows.

Clients can read on FFM <GO>.

👉CPI lands Aug. 12 and inflation expectations Aug. 15.

👉Inflation may be nearer to 3% than Fed 2% target.

👉McDonald’s CEO saw "a lot of anxiety" on jobs and tariffs.

👉13% student loans and 7% credit cards 90 days+ overdue

Clients can read on FFM <GO>.

👉CPI lands Aug. 12 and inflation expectations Aug. 15.

👉Inflation may be nearer to 3% than Fed 2% target.

👉McDonald’s CEO saw "a lot of anxiety" on jobs and tariffs.

👉13% student loans and 7% credit cards 90 days+ overdue

Clients can read on FFM <GO>.

Clients can read on FFM <GO>.

Clients can read on FFM <GO>.