@energyinnovation.bsky.social. Working to help deploy clean energy technologies, drive down costs , and cut greenhouse gas emissions through smart and innovative policy. Posts are my own.

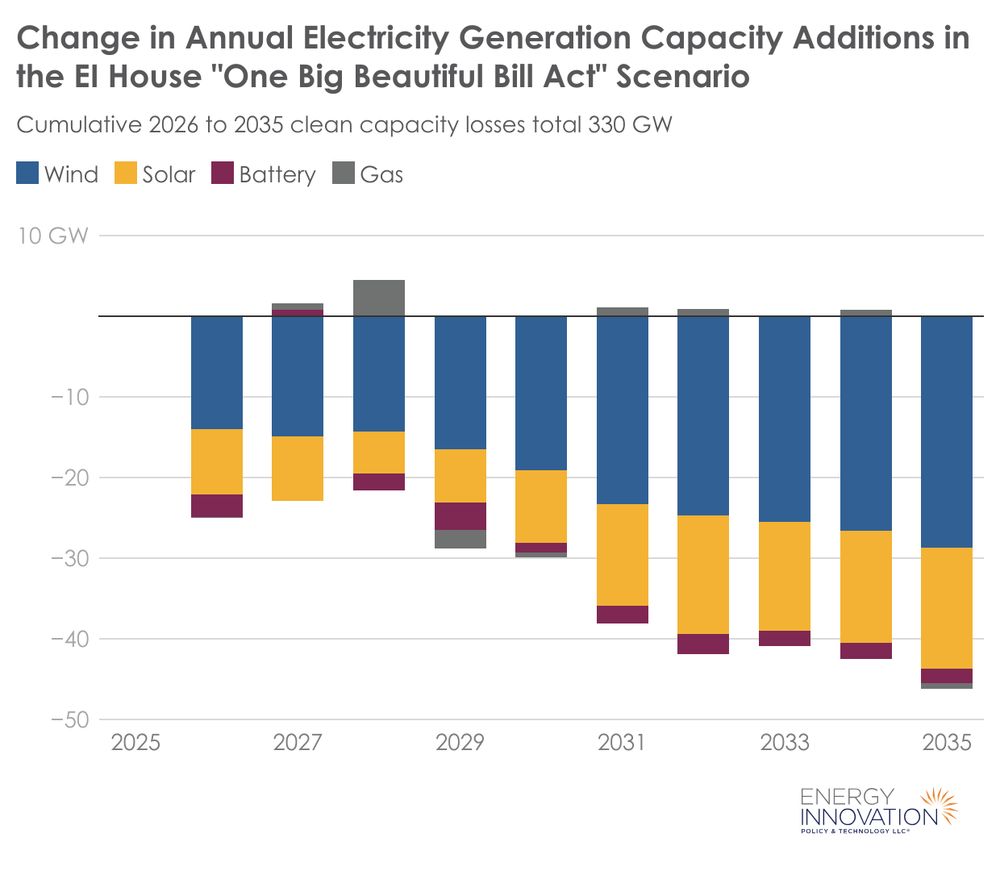

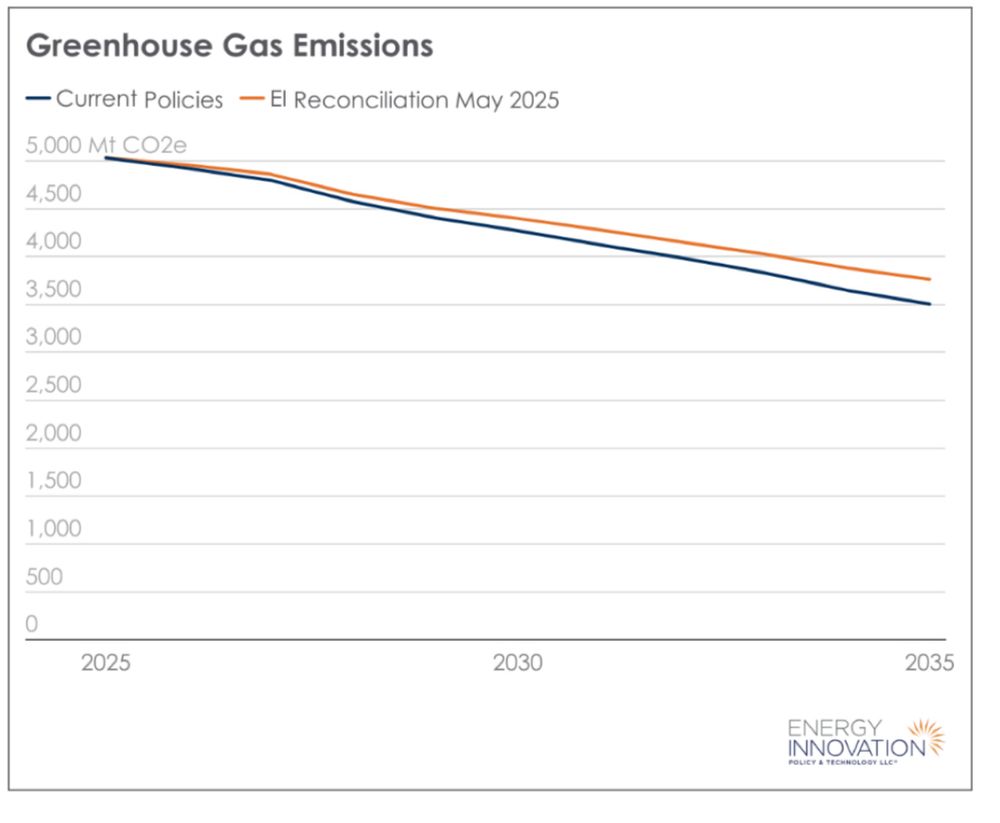

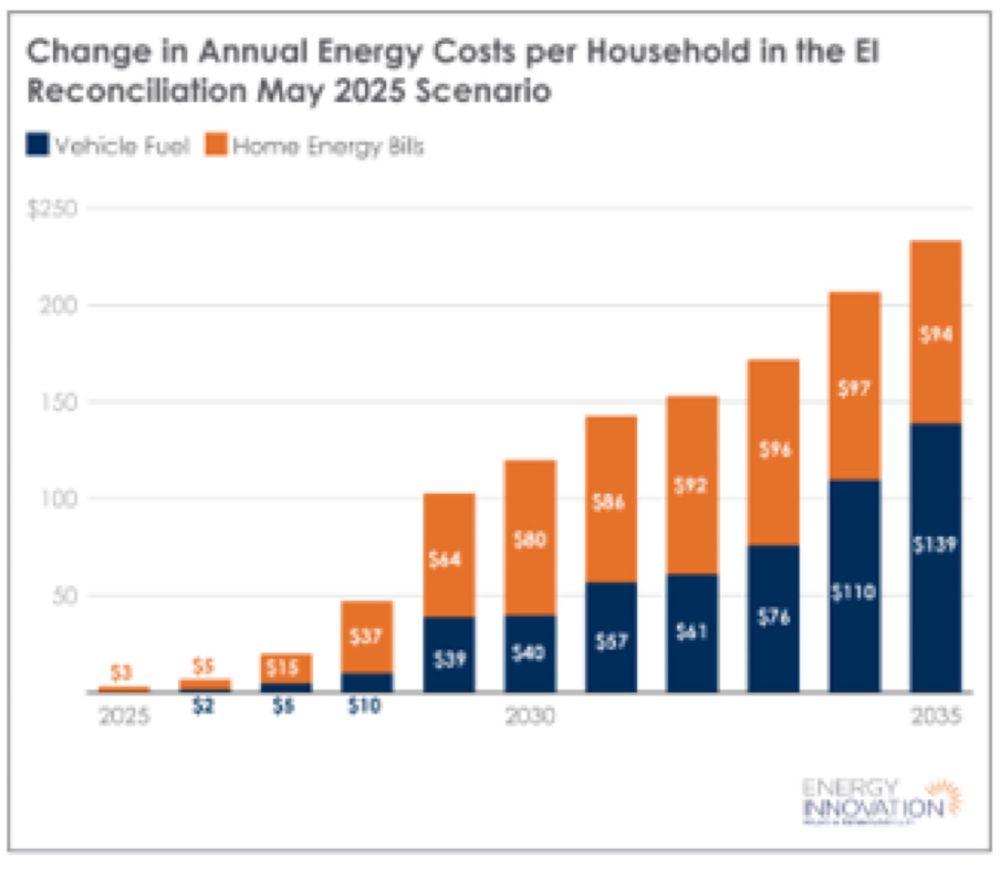

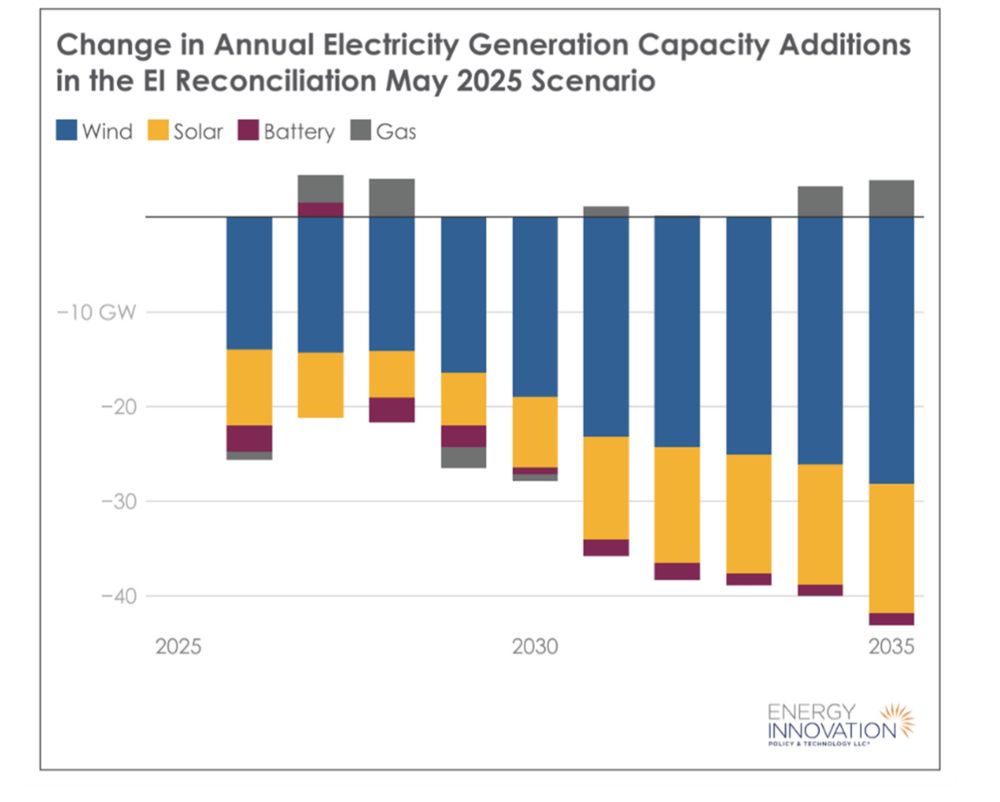

Two main reasons: 1) the loss of clean electricity tax credits makes electricity much more expensive, significantly raising rates in some states and...

Two main reasons: 1) the loss of clean electricity tax credits makes electricity much more expensive, significantly raising rates in some states and...

One was caused entirely by the president’s actions. The other was due to a global pandemic and war. JFC.

One was caused entirely by the president’s actions. The other was due to a global pandemic and war. JFC.