Neal Hudson

@resi-analyst.bsky.social

UK housing market analyst. Personal account.

Analysis and commentary at https://builtplace.com/

Visiting Fellow at Henley Business School.

Columnist for FT Weekend’s Money.

Analysis and commentary at https://builtplace.com/

Visiting Fellow at Henley Business School.

Columnist for FT Weekend’s Money.

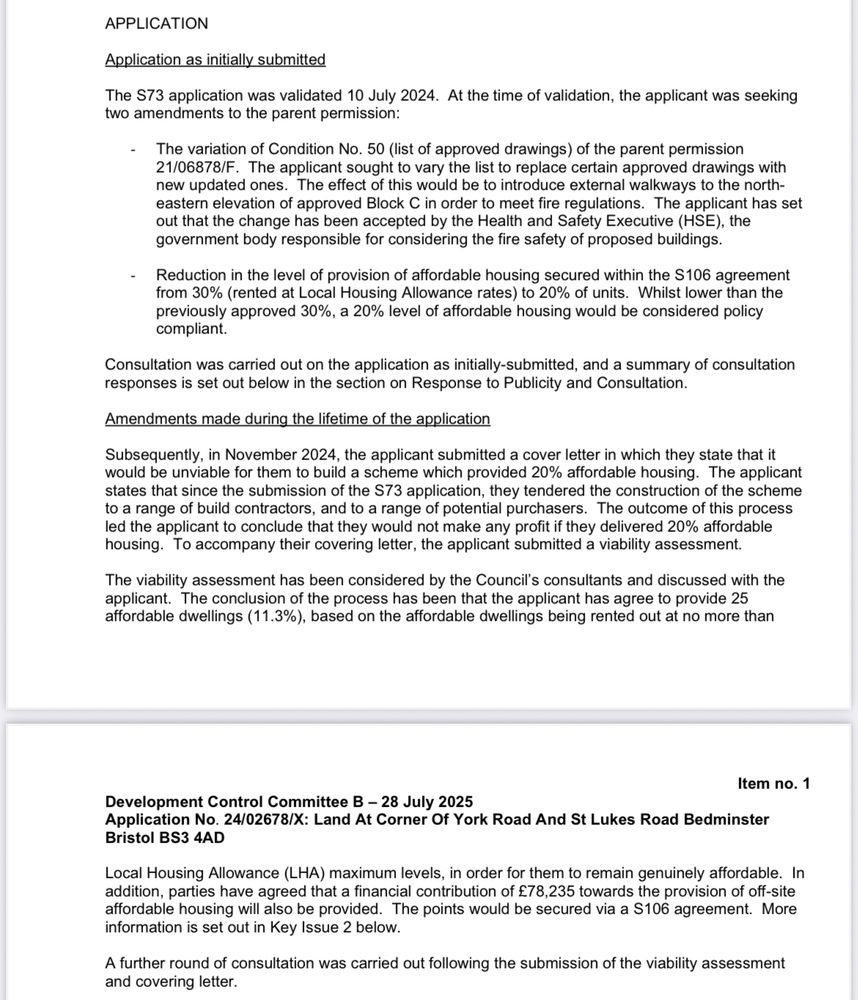

Not my area of expertise but I’ve seen a few s73 apps over last year where there have been updates to the plans due to fire safety etc but the developer has also used it as an opportunity to renegotiate the s106. Eg this one in Bristol

October 24, 2025 at 7:39 AM

Not my area of expertise but I’ve seen a few s73 apps over last year where there have been updates to the plans due to fire safety etc but the developer has also used it as an opportunity to renegotiate the s106. Eg this one in Bristol

Yes, and the developers that have still been active in London in recent years will be much more optimistic than most. Many of the larger UK based ones exited the London market about a decade ago.

October 20, 2025 at 11:20 AM

Yes, and the developers that have still been active in London in recent years will be much more optimistic than most. Many of the larger UK based ones exited the London market about a decade ago.

As I wrote back in Feb:

October 17, 2025 at 6:26 AM

As I wrote back in Feb:

Even the affordable homes funding programme doesn't match their aspirations.

October 14, 2025 at 3:18 PM

Even the affordable homes funding programme doesn't match their aspirations.

I hope it goes well for you. Wider challenge with current model is that developers need a large % of off-plan sales years before completion to unlock funding. Since GFC, Asian middle classes could get finance locked up for those timeframes but domestic buyers couldn't.

October 14, 2025 at 3:12 PM

I hope it goes well for you. Wider challenge with current model is that developers need a large % of off-plan sales years before completion to unlock funding. Since GFC, Asian middle classes could get finance locked up for those timeframes but domestic buyers couldn't.

As a side point on the Molior slides, it's worth keeping this GLA chart in mind too.

Molior is useful for trends in the market but they appear to only capture about half of the London new build market. Hence, I'm always a bit cautious about their absolute numbers.

Molior is useful for trends in the market but they appear to only capture about half of the London new build market. Hence, I'm always a bit cautious about their absolute numbers.

October 14, 2025 at 2:38 PM

As a side point on the Molior slides, it's worth keeping this GLA chart in mind too.

Molior is useful for trends in the market but they appear to only capture about half of the London new build market. Hence, I'm always a bit cautious about their absolute numbers.

Molior is useful for trends in the market but they appear to only capture about half of the London new build market. Hence, I'm always a bit cautious about their absolute numbers.

No. Right now the bottleneck is a lack of demand at current prices.

October 14, 2025 at 2:30 PM

No. Right now the bottleneck is a lack of demand at current prices.

Saturday night at the Rec.

October 11, 2025 at 4:30 PM

Saturday night at the Rec.

Data isn’t perfect but I’ve got s106 (incl partial grant) holding up after the GFC at least until post 2010 so even that’s not totally cyclical. But my broader point is that previous downturns have seen funding for the HA sector to maintain delivery - that’s how they really started in the 1990s.

October 1, 2025 at 7:12 PM

Data isn’t perfect but I’ve got s106 (incl partial grant) holding up after the GFC at least until post 2010 so even that’s not totally cyclical. But my broader point is that previous downturns have seen funding for the HA sector to maintain delivery - that’s how they really started in the 1990s.

MHCLG SoS in his “build baby build” cap at conference

September 28, 2025 at 6:00 PM

MHCLG SoS in his “build baby build” cap at conference

Locations of proposed new towns

September 28, 2025 at 7:16 AM

Locations of proposed new towns

A point I made earlier in the year is that the government’s 1.5m target is stuck in a no-man’s land. It kinda looked achievable from where we were a couple of years ago but isn’t high enough to require a radical rethink about how we commission, fund and build new homes builtplace.com/still-search...

September 27, 2025 at 1:29 PM

A point I made earlier in the year is that the government’s 1.5m target is stuck in a no-man’s land. It kinda looked achievable from where we were a couple of years ago but isn’t high enough to require a radical rethink about how we commission, fund and build new homes builtplace.com/still-search...

They seem to think the problems are supply side and more planning reform will fix it but the most immediate problem is a lack of demand at current house prices and mortgage rates.

builtplace.com/market-comme...

builtplace.com/market-comme...

September 27, 2025 at 12:57 PM

They seem to think the problems are supply side and more planning reform will fix it but the most immediate problem is a lack of demand at current house prices and mortgage rates.

builtplace.com/market-comme...

builtplace.com/market-comme...

FYI there are bigger issues with the data than the lack of detailed breakdowns. I'm not convinced they should've published this data at this time given the issues.

builtplace.com/weekly-summa...

builtplace.com/weekly-summa...

September 26, 2025 at 11:46 AM

FYI there are bigger issues with the data than the lack of detailed breakdowns. I'm not convinced they should've published this data at this time given the issues.

builtplace.com/weekly-summa...

builtplace.com/weekly-summa...

As I wrote back in Feb, the government's focus on building homes with no apparent strategy beyond "planning reform" is dangerous and their ongoing failure to hit their stupid 1.5m target makes is more likely they'll be stuck with only the bad options to choose from.

builtplace.com/still-search...

builtplace.com/still-search...

September 19, 2025 at 9:12 AM

As I wrote back in Feb, the government's focus on building homes with no apparent strategy beyond "planning reform" is dangerous and their ongoing failure to hit their stupid 1.5m target makes is more likely they'll be stuck with only the bad options to choose from.

builtplace.com/still-search...

builtplace.com/still-search...

My view is it helped to increase new build market completions as a percentage of total market turnover from around 10% to around 15%

builtplace.com/digging-deep...

builtplace.com/digging-deep...

September 19, 2025 at 8:43 AM

My view is it helped to increase new build market completions as a percentage of total market turnover from around 10% to around 15%

builtplace.com/digging-deep...

builtplace.com/digging-deep...

MHCLG estimating that "196,500 net additional homes have been delivered in England between 1 April 2024 and 31 March 2025".

The numbers are heading in the wrong direction for the government to get anywhere near their 1.5m target and they'll be lucky to hit 1m at this rate.

The numbers are heading in the wrong direction for the government to get anywhere near their 1.5m target and they'll be lucky to hit 1m at this rate.

September 19, 2025 at 8:34 AM

MHCLG estimating that "196,500 net additional homes have been delivered in England between 1 April 2024 and 31 March 2025".

The numbers are heading in the wrong direction for the government to get anywhere near their 1.5m target and they'll be lucky to hit 1m at this rate.

The numbers are heading in the wrong direction for the government to get anywhere near their 1.5m target and they'll be lucky to hit 1m at this rate.

However, the Rightmove index appears to be more heavily weighted to the upper end of the housing market than the overall housing stock. My simple adjustments for this suggest asking prices were still up over the last year, though only by 0.3%.

September 15, 2025 at 6:46 AM

However, the Rightmove index appears to be more heavily weighted to the upper end of the housing market than the overall housing stock. My simple adjustments for this suggest asking prices were still up over the last year, though only by 0.3%.

Annual % change in Rightmove asking prices turns negative with -0.1% fall in August/September.

September 15, 2025 at 6:44 AM

Annual % change in Rightmove asking prices turns negative with -0.1% fall in August/September.

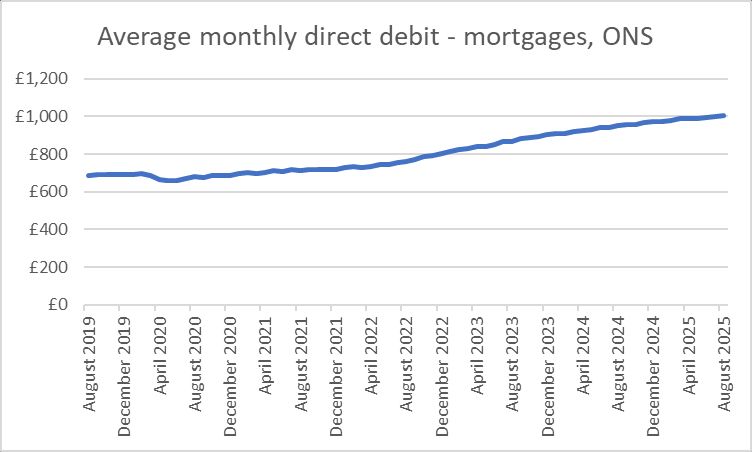

Average monthly direct debit for mortgages was over £1,000 for the first time in August (£1,002.27)

www.ons.gov.uk/economy/econ...

www.ons.gov.uk/economy/econ...

September 12, 2025 at 9:43 AM

Average monthly direct debit for mortgages was over £1,000 for the first time in August (£1,002.27)

www.ons.gov.uk/economy/econ...

www.ons.gov.uk/economy/econ...

Actually speaking later today at FT Weekend festival and this will be the first chart up: Cagr over twenty years for UK nominal/real house prices.

(& as you say, London is worse)

(& as you say, London is worse)

September 6, 2025 at 10:13 AM

Actually speaking later today at FT Weekend festival and this will be the first chart up: Cagr over twenty years for UK nominal/real house prices.

(& as you say, London is worse)

(& as you say, London is worse)

Labour's new build policies have been focussed on planning reform (important over the longer-term) but the more immediate problem is a crisis in demand. You can plan as many homes as you like but they won't get built if no one can buy them.

My latest market commentary

builtplace.com/market-comme...

My latest market commentary

builtplace.com/market-comme...

September 4, 2025 at 11:31 AM

Labour's new build policies have been focussed on planning reform (important over the longer-term) but the more immediate problem is a crisis in demand. You can plan as many homes as you like but they won't get built if no one can buy them.

My latest market commentary

builtplace.com/market-comme...

My latest market commentary

builtplace.com/market-comme...