| political economy | social history of political theory | Kant |

Website: https://drqerqay.com/

X: https://x.com/drqerqay

Until then, check out my comprehensive examination on the conceptual framework of political capitalism:

textumdergi.net/siyasi-kapit...

Until then, check out my comprehensive examination on the conceptual framework of political capitalism:

textumdergi.net/siyasi-kapit...

Across every crisis the same recurs: profitability without production, power without growth.

The downturn is capitalism.

Across every crisis the same recurs: profitability without production, power without growth.

The downturn is capitalism.

📌Yet across the economy, profit now depends on state-backed credit.

📌A debt-saturated order where liquidity replaces accumulation.

📌Yet across the economy, profit now depends on state-backed credit.

📌A debt-saturated order where liquidity replaces accumulation.

📌States sustain the slowdown through bailouts, tax cuts, and credit expansion

📌Bubbleonomics becomes the onlygame.

📌Growth falters, profits survive

📌States sustain the slowdown through bailouts, tax cuts, and credit expansion

📌Bubbleonomics becomes the onlygame.

📌Growth falters, profits survive

📌Firms innovate to survive; innovation multiplies capacity and drives down prices.

📌Each cycle of recovery prepares the next contraction, everything turns circular, like an engine revving in neutral.

📌Firms innovate to survive; innovation multiplies capacity and drives down prices.

📌Each cycle of recovery prepares the next contraction, everything turns circular, like an engine revving in neutral.

📌To enter ownership, one must purchase cheaply — often on credit, indebted to the future.

📌To remain an owner, one must sell profitably in markets crowded with rivals.

📌Accumulation becomes a knife fight in a shrinking room.

📌To enter ownership, one must purchase cheaply — often on credit, indebted to the future.

📌To remain an owner, one must sell profitably in markets crowded with rivals.

📌Accumulation becomes a knife fight in a shrinking room.

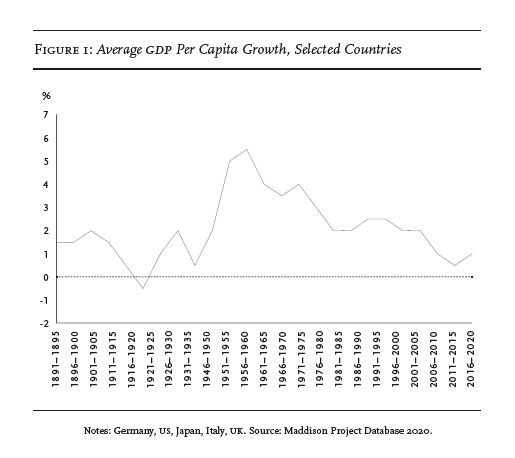

In both Hansen and Summers' accounts secular stagnation remained descriptive and related to exogenous factors.

www.youtube.com/watch?v=xvmh...

In both Hansen and Summers' accounts secular stagnation remained descriptive and related to exogenous factors.

www.youtube.com/watch?v=xvmh...