https://psfl.princeton.edu

-Blame predecessors for high debt burden (hidden debt revelations make this effective).

-Avoid IMF program & conditions.

-Hold out for an improvement in debt servicing capacity, perhaps through resource revenues or taxation.

on.ft.com/3JERoii

-Blame predecessors for high debt burden (hidden debt revelations make this effective).

-Avoid IMF program & conditions.

-Hold out for an improvement in debt servicing capacity, perhaps through resource revenues or taxation.

on.ft.com/3JERoii

This summary describes the measure and how it is predicted (sometimes) by the electoral cycle, among other things.

psfl.princeton.edu/document/491

@peterrosendorff.bsky.social

@laynamosley.bsky.social

This summary describes the measure and how it is predicted (sometimes) by the electoral cycle, among other things.

psfl.princeton.edu/document/491

@peterrosendorff.bsky.social

@laynamosley.bsky.social

web.cvent.com/event/005168...

web.cvent.com/event/005168...

With Professor Layna Mosley @laynamosley.bsky.social

psfl.princeton.edu/events/2025/...

With Professor Layna Mosley @laynamosley.bsky.social

psfl.princeton.edu/events/2025/...

wp.nyu.edu/sfrn/nyu-pes...

wp.nyu.edu/sfrn/nyu-pes...

wp.nyu.edu/sfrn/nyu-pes...

wp.nyu.edu/sfrn/nyu-pes...

@princetonsovfinlab.bsky.social

@princetonsovfinlab.bsky.social

psfl.princeton.edu/events/2025/...

psfl.princeton.edu/events/2025/...

psfl.princeton.edu/document/311

psfl.princeton.edu/document/311

psfl.princeton.edu/document/306

psfl.princeton.edu/document/306

www.law.georgetown.edu/iiel/initiat...

(Policy panel proposals accepted through April 30)

@laynamosley.bsky.social

www.law.georgetown.edu/iiel/initiat...

(Policy panel proposals accepted through April 30)

@laynamosley.bsky.social

www.law.georgetown.edu/iiel/initiat...

goodauthority.org/news/good-to...

goodauthority.org/news/good-to...

@princetonsovfinlab.bsky.social

@princetonsovfinlab.bsky.social

on.ft.com/4gIQ2hR

[An old story about investors' concern with overall deficit and debt levels: www.cambridge.org/core/journal...

@princetonsovfinlab.bsky.social

on.ft.com/4gIQ2hR

[An old story about investors' concern with overall deficit and debt levels: www.cambridge.org/core/journal...

@princetonsovfinlab.bsky.social

www.economist.com/finance-and-...

www.economist.com/finance-and-...

"Long-term, “real-money” investors in double A-rated government bonds .... want boring, predictable returns."

www.ft.com/content/9d49...

"Long-term, “real-money” investors in double A-rated government bonds .... want boring, predictable returns."

www.ft.com/content/9d49...

www.economist.com/finance-and-...

www.economist.com/finance-and-...

Ballard-Rosa, Mosley & Wellhausen 2021: the "democratic advantage" in sovereign borrowing only exists when rates are high in mature markets. [

www.cambridge.org/core/journal...

Ballard-Rosa, Mosley & Wellhausen 2021: the "democratic advantage" in sovereign borrowing only exists when rates are high in mature markets. [

www.cambridge.org/core/journal...

psfl.princeton.edu

psfl.princeton.edu

go.bsky.app/Cw8ufrd

go.bsky.app/Cw8ufrd

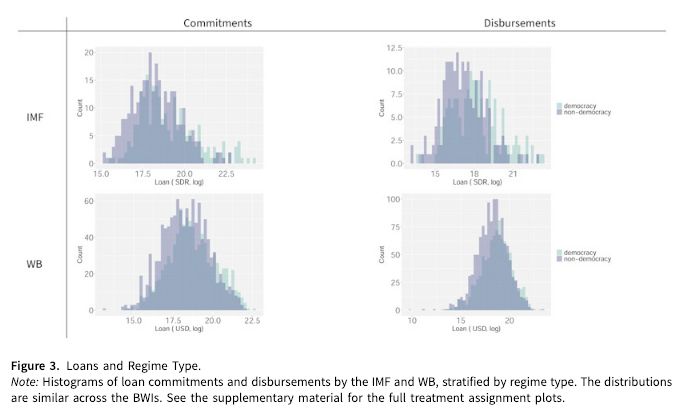

➡️J. Hollyer X. Pang @peterrosendorff.bsky.social J. Vreeland show that loan disbursements from the IMF and the WB are positively associated with economic transparency, especially in democracies www.cambridge.org/core/journal... #FirstView

➡️J. Hollyer X. Pang @peterrosendorff.bsky.social J. Vreeland show that loan disbursements from the IMF and the WB are positively associated with economic transparency, especially in democracies www.cambridge.org/core/journal... #FirstView