In our latest @bundesbank.de report, we present the proxy monetary policy rate, which combines information from the risk-free yield curve and risk assets. 1\ #EconSky @plieberk.bsky.social

In our latest @bundesbank.de report, we present the proxy monetary policy rate, which combines information from the risk-free yield curve and risk assets. 1\ #EconSky @plieberk.bsky.social

Typically, tight monetary policy transmits also by increasing risk premia on financial markets. Without it, transmission is notably weaker.

During the recent hiking cycle, we did not observe this feature.

bsky.app/profile/flxg...

Typically, tight monetary policy transmits also by increasing risk premia on financial markets. Without it, transmission is notably weaker.

During the recent hiking cycle, we did not observe this feature.

bsky.app/profile/flxg...

Read more here www.ecb.europa.eu/press/econom...

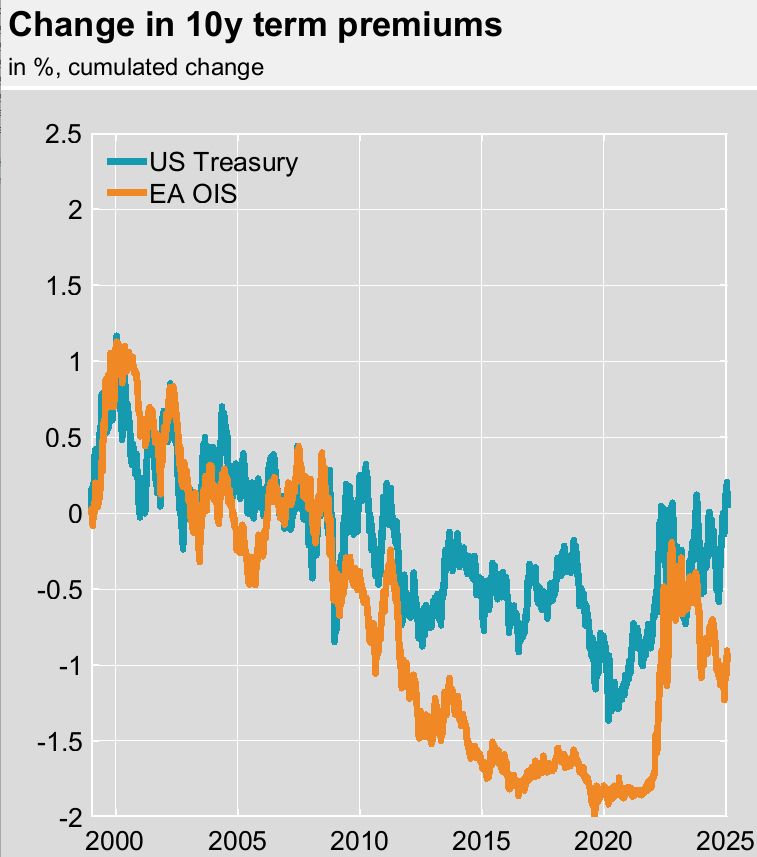

➡️99-12: strong co-movement

➡️12-20: EA term premium collapses relative to US

➡️22-24: de-compression more pronounced in EA

➡️since mid-24: degree of US term premium rise is only partly matched by EA

#EconSky

➡️99-12: strong co-movement

➡️12-20: EA term premium collapses relative to US

➡️22-24: de-compression more pronounced in EA

➡️since mid-24: degree of US term premium rise is only partly matched by EA

#EconSky

As bond holdings can be unwound only gradually, asset prices remain distorted for a long time. During the most recent tightening cycle, term and risk premia remained compressed, potentially distorting risk-taking behaviour. 1/3

As bond holdings can be unwound only gradually, asset prices remain distorted for a long time. During the most recent tightening cycle, term and risk premia remained compressed, potentially distorting risk-taking behaviour. 1/3