Patrick Honohan

@phonohan.bsky.social

Former Governor, Central Bank of Ireland. @PIIE.com; @TCDeconomics; @CEPR.org

Nice review from @omfif.bsky.social of my @piie.com book on crisis management. www.omfif.org/2025/08/cent...

Central banking manual for fighting crises: the need for split personalities - OMFIF

Patrick Honohan, governor of the Central Bank of Ireland from 2009 to 2015 – the seminal period of euro area sovereign debt upsets – is a central banker who almost literally grew up with economic and ...

www.omfif.org

August 27, 2025 at 3:49 PM

Nice review from @omfif.bsky.social of my @piie.com book on crisis management. www.omfif.org/2025/08/cent...

Mackerel sky, Dublin tonight.

August 9, 2025 at 9:53 PM

Mackerel sky, Dublin tonight.

How much capital do central banks really have? My new

@piie.com paper provides the calculation for twenty countries. There are some surprises.

@piie.com paper provides the calculation for twenty countries. There are some surprises.

Central banks are incurring losses, @phonohan.bsky.social writes, because of impact of rising interest rates on their maturity mismatched portfolios & losses on foreign exchange reserves accumulated attempting to avoid currency overvaluation. But comparing experiences is not straightforward.

How much capital do central banks really have?

Twenty or more of the world’s most significant central banks have seen their equity position (or capital and reserves) go negative in the last few years. This novel situation does not fundamentally ch...

www.piie.com

July 7, 2025 at 5:48 PM

How much capital do central banks really have? My new

@piie.com paper provides the calculation for twenty countries. There are some surprises.

@piie.com paper provides the calculation for twenty countries. There are some surprises.

Central bank accounting is not standardised, making their financial condition hard to compare. www.piie.com/blogs/realti...

How much money have central banks really lost?

Central banks experienced widespread financial losses over the last three years. The problem has been most severe at banks whose balance sheets were bloated in the years of low interest rates and quan...

www.piie.com

July 1, 2025 at 7:10 PM

Central bank accounting is not standardised, making their financial condition hard to compare. www.piie.com/blogs/realti...

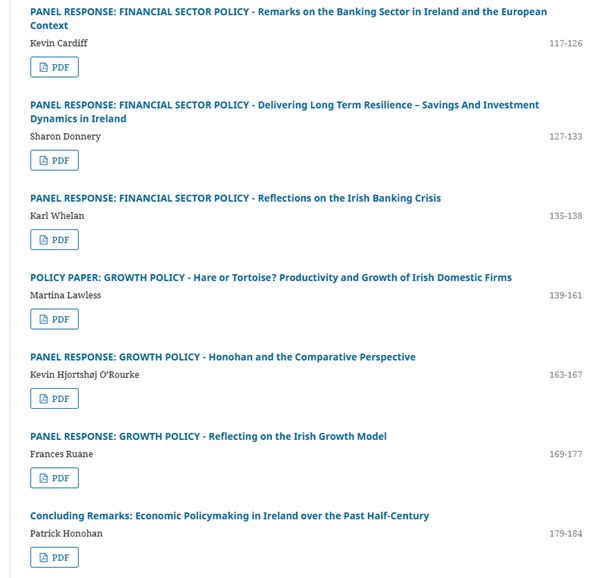

Studying the macroeconomic policy questions of Ireland over the past fifty years (with many colleagues) has been fascinating. The black hole of MNC profit repatriation, stabilizing the fiscal accounts, migration and unemployment, wealth inequality and financial crisis: there’s no better laboratory.

The Spring edition of the ESR is now available. This issue is based upon a special conference in honour of @phonohan.bsky.social. It features 3 papers relating to fiscal, growth and financial sector policy as well as articles in response from a panel of experts and...

www.esr.ie/index.php/es...

www.esr.ie/index.php/es...

April 17, 2025 at 2:34 PM

Studying the macroeconomic policy questions of Ireland over the past fifty years (with many colleagues) has been fascinating. The black hole of MNC profit repatriation, stabilizing the fiscal accounts, migration and unemployment, wealth inequality and financial crisis: there’s no better laboratory.

Given the (strange) way yesterday's new US tariffs were calculated, Ireland escapes a much higher tariff (42%) by being included in the EU (20%).

April 3, 2025 at 1:25 PM

Given the (strange) way yesterday's new US tariffs were calculated, Ireland escapes a much higher tariff (42%) by being included in the EU (20%).

Interesting combination and seasonal timing for this podcast from @bruegel.bsky.social

Happy #StPatricksDay! ☘️

Today, we dive into Ireland’s journey from crisis to confidence.

@rebeccawire.bsky.social speaks with Eamon Gilmore, former Foreign Minister, and @phonohan.bsky.social on Ireland’s recovery, housing crisis, and global role.

#EconSky

Today, we dive into Ireland’s journey from crisis to confidence.

@rebeccawire.bsky.social speaks with Eamon Gilmore, former Foreign Minister, and @phonohan.bsky.social on Ireland’s recovery, housing crisis, and global role.

#EconSky

Ireland’s journey from crisis to confidence

A conversation on Ireland’s economic recovery, housing crisis, and international role

buff.ly

March 17, 2025 at 2:44 PM

Interesting combination and seasonal timing for this podcast from @bruegel.bsky.social

Reposted by Patrick Honohan

Ireland collects much of the corporate tax revenue a more coherent US tax code would channel back across the Atlantic. Ireland could also be in the firing line as a major & growing contributor to the US trade deficit—now 4th in the world. By @phonohan.bsky.social: www.irishtimes.com/opinion/2025...

Patrick Honohan: Ireland is more exposed to Trump’s tariff war than any other European country

Without turning away from the United States, it is vital for Ireland to remain unambiguously and progressively engaged in collective action in support of Europe

www.irishtimes.com

February 10, 2025 at 6:46 PM

Ireland collects much of the corporate tax revenue a more coherent US tax code would channel back across the Atlantic. Ireland could also be in the firing line as a major & growing contributor to the US trade deficit—now 4th in the world. By @phonohan.bsky.social: www.irishtimes.com/opinion/2025...

Through Waterford-born Nobel prize-winning Physicist Ernest Walton (1903-95), Ireland has a better claim than the United States to having been the first (along with New Zealander Ernest Rutherford and Englishman John Cockroft), to have "split the atom". www.atomicarchive.com/history/manh...

The Atomic Solar System

The Manhattan Project: Making the Atomic Bomb.

www.atomicarchive.com

January 21, 2025 at 12:52 PM

Through Waterford-born Nobel prize-winning Physicist Ernest Walton (1903-95), Ireland has a better claim than the United States to having been the first (along with New Zealander Ernest Rutherford and Englishman John Cockroft), to have "split the atom". www.atomicarchive.com/history/manh...

Disappointing indeed. International regulatory collaboration is needed to help prevent climate damage from the financial sector.

While California burns & Florida drowns @federalreserve.bsky.social is exiting NGFS. While it did not have much enthusiasm to start with, it is a sign that US is not willing to work with rest of the world on climate ⛔️ grim start to 4-year misery to begin today

www.federalreserve.gov/newsevents/p...

www.federalreserve.gov/newsevents/p...

Federal Reserve Board announces it has withdrawn from the Network of Central Banks and Supervisors for Greening the Financial System (NGFS)

The Federal Reserve Board on Friday announced it has withdrawn from the Network of Central Banks and Supervisors for Greening the Financial System (NGFS). Whi

www.federalreserve.gov

January 21, 2025 at 12:01 PM

Disappointing indeed. International regulatory collaboration is needed to help prevent climate damage from the financial sector.

Here is ECB Chief Economist Philip Lane recommending my new @piie.com book The Central Bank as Crisis Manager in today’s ECB Podcast (Minute 15:30). soundcloud.com/europeancent...

Tariffs, tensions and tackling inflation: the road ahead

What impact do global events have on our economy? And how has the ECB’s monetary policy shifted?

As 2024 comes to an end, our host Paul Gordon discusses these questions and more with Chief Economist

soundcloud.com

December 20, 2024 at 9:37 PM

Here is ECB Chief Economist Philip Lane recommending my new @piie.com book The Central Bank as Crisis Manager in today’s ECB Podcast (Minute 15:30). soundcloud.com/europeancent...

Online at 6 pm Wednesday (Dublin time)

DECEMBER 11: The launch of @phonohan.bsky.social's new book "The Central Bank as Crisis Manager," drawing lessons from recent crises across four continents & calling on central banks to prepare for crisis management. #EconSky

Info & register: www.piie.com/events/2024/...

Info & register: www.piie.com/events/2024/...

December 10, 2024 at 2:30 AM

Online at 6 pm Wednesday (Dublin time)

And one sector provides an interesting exception to the lackluster 2019-2024 sectoral real earnings growth in Ireland. It's the Information and Communication sector (shown below as IT), already with relatively high weekly earnings and still racing ahead as it has for many years.

November 29, 2024 at 6:29 PM

And one sector provides an interesting exception to the lackluster 2019-2024 sectoral real earnings growth in Ireland. It's the Information and Communication sector (shown below as IT), already with relatively high weekly earnings and still racing ahead as it has for many years.

If it's economics that drives voting in general elections, the question for Ireland today is whether it's microeconomics or macro. (See the NYT piece by @fotoole). These graphs quantify the contrast between rocketing aggregate employment growth and below peak average real earnings.

November 29, 2024 at 3:33 PM

If it's economics that drives voting in general elections, the question for Ireland today is whether it's microeconomics or macro. (See the NYT piece by @fotoole). These graphs quantify the contrast between rocketing aggregate employment growth and below peak average real earnings.

I think it’s spelled “Winsorizing”. en.m.wikipedia.org/wiki/Winsori...

November 27, 2024 at 11:35 AM

I think it’s spelled “Winsorizing”. en.m.wikipedia.org/wiki/Winsori...

Good points made by @luigaricano.

In addition, these restrictions that the ECB is proposing for its CBDC (maximum balance, interest rate) will prevent it anchoring a payments system independent of US jurisdiction…

In addition, these restrictions that the ECB is proposing for its CBDC (maximum balance, interest rate) will prevent it anchoring a payments system independent of US jurisdiction…

Very interesting analysis by @lugaricano.bsky.social on the poorly designed digital Euro project. One additional issue: the dual role of bank accounts as balances for payments ("money") and savings. ECB trying to do some of the first but none of the second. Not obvious to me.

The ECB is handicapping its digital euro project (strict holding limits, no interest payments, and mandatory bank account links) in order to protect the current broken, inefficient, subsidized banking system.

Do we need banks?

My post today

www.siliconcontinent.com/p/do-we-need...

🧵

1/10

Do we need banks?

My post today

www.siliconcontinent.com/p/do-we-need...

🧵

1/10

November 27, 2024 at 11:16 AM

Good points made by @luigaricano.

In addition, these restrictions that the ECB is proposing for its CBDC (maximum balance, interest rate) will prevent it anchoring a payments system independent of US jurisdiction…

In addition, these restrictions that the ECB is proposing for its CBDC (maximum balance, interest rate) will prevent it anchoring a payments system independent of US jurisdiction…

Reposted by Patrick Honohan

The global financial crisis had a huge impact on Ireland, with soaring unemployment & a big rise in public debt with the bank bailouts; but the economy has bounced back strongly since 2012, mainly due to globalisation & FDI

@econ-observatory.bsky.social

www.economicsobservatory.com/how-did-irel...

@econ-observatory.bsky.social

www.economicsobservatory.com/how-did-irel...

How did Ireland recover so strongly from the global financial crisis? - Economics Observatory

The global financial crisis of 2007-09 had a huge impact on Ireland, with soaring unemployment and a big rise in public debt as the government bailed out the country’s banks. But the Irish economy has...

www.economicsobservatory.com

November 25, 2024 at 10:45 AM

The global financial crisis had a huge impact on Ireland, with soaring unemployment & a big rise in public debt with the bank bailouts; but the economy has bounced back strongly since 2012, mainly due to globalisation & FDI

@econ-observatory.bsky.social

www.economicsobservatory.com/how-did-irel...

@econ-observatory.bsky.social

www.economicsobservatory.com/how-did-irel...

Economists working on Ireland. Great idea Rebecca, thanks!

I made a starter pack of Irish economists and economists interested in Ireland. It’s still sparse, but I’ll add to it as people join. Let me know if you would like to be added or have any suggestions.

go.bsky.app/UweG3ib

go.bsky.app/UweG3ib

November 21, 2024 at 4:52 PM

Economists working on Ireland. Great idea Rebecca, thanks!

Take a look at the jump in Irish employment. 100,000 in the past twelve months alone. Will the approaching de-globalization clouds be the peak of this roller-coaster?

November 21, 2024 at 1:01 PM

Take a look at the jump in Irish employment. 100,000 in the past twelve months alone. Will the approaching de-globalization clouds be the peak of this roller-coaster?

Congratulations David. Indeed, though I’ve read a lot of histories of money, you certainly have crafted a compelling narrative in yours.

Morning.

Fresh one in Dublin.

Lovely to wake up to this...@martinwolf_ of @FT @data.ft.com

has picked Money as one of his Best Economics Books of 2024.

Chuffed!

Cheers!

www.ft.com/content/d5fa...

Fresh one in Dublin.

Lovely to wake up to this...@martinwolf_ of @FT @data.ft.com

has picked Money as one of his Best Economics Books of 2024.

Chuffed!

Cheers!

www.ft.com/content/d5fa...

Best books of 2024: Economics

Martin Wolf selects his must-read titles

www.ft.com

November 20, 2024 at 5:18 PM

Congratulations David. Indeed, though I’ve read a lot of histories of money, you certainly have crafted a compelling narrative in yours.

Even though I know why, still neat to see it “going backwards”. Thanks.

Short timelapse of the Comet zooming through space in just 50 minutes!

#Comet #Space #astronomy #astrophotography 🧪🔭☄

#Comet #Space #astronomy #astrophotography 🧪🔭☄

October 30, 2024 at 4:21 PM

Even though I know why, still neat to see it “going backwards”. Thanks.