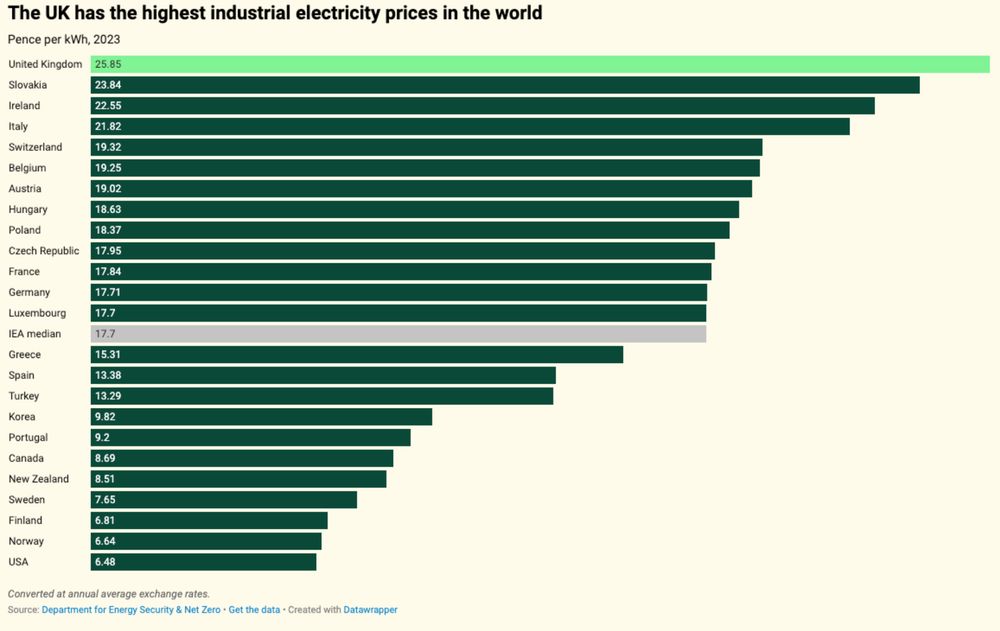

Manufacturing firms or those dependent on access to infrastructure struggle. Same financial system, very different outcomes.

Manufacturing firms or those dependent on access to infrastructure struggle. Same financial system, very different outcomes.

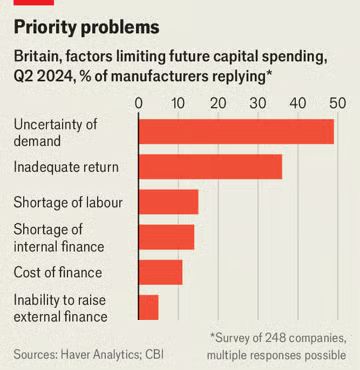

It also ignores what companies are telling us. UK manufacturers cite 'uncertainty of demand' and 'inadequate returns' as their main investment barriers, not the 'cost of finance'.

It also ignores what companies are telling us. UK manufacturers cite 'uncertainty of demand' and 'inadequate returns' as their main investment barriers, not the 'cost of finance'.

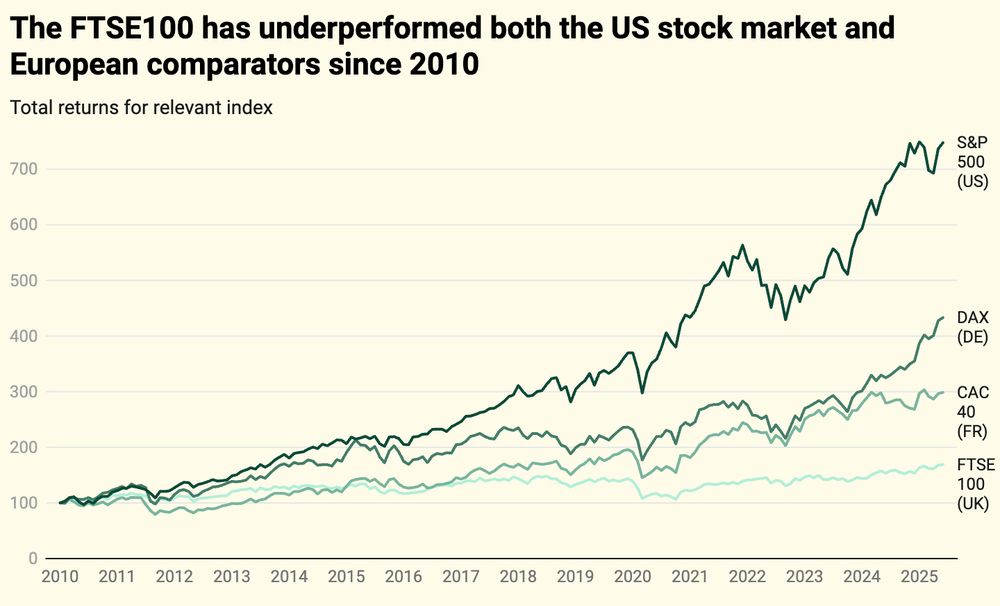

Politicians keep threatening to direct British savings & pensions to UK equities. But this won’t fix the underlying reasons for Britain’s low investment & productivity – and could deliver worse returns. 🧵

Politicians keep threatening to direct British savings & pensions to UK equities. But this won’t fix the underlying reasons for Britain’s low investment & productivity – and could deliver worse returns. 🧵

Empirical evidence produced at the research frontier becomes less useful for forecasts - forcing the OBR to rely more on other sources, like Government produced figures.

Empirical evidence produced at the research frontier becomes less useful for forecasts - forcing the OBR to rely more on other sources, like Government produced figures.

These affect long-term productivity growth, which the OBR’s toolkit is not designed to forecast.

These affect long-term productivity growth, which the OBR’s toolkit is not designed to forecast.

The 2022 mini-budget fallout is the starkest example of the OBR’s impact.

A 🧵on the pressure this puts on the OBR to get things right 👇

The 2022 mini-budget fallout is the starkest example of the OBR’s impact.

A 🧵on the pressure this puts on the OBR to get things right 👇