@pedroserodio.com

Britain has world-class universities, strong labour markets, leading industrial clusters, and a sophisticated financial market. We need to focus on structural constraints that stop these advantages turning into attractive investments.

June 19, 2025 at 7:54 AM

Britain has world-class universities, strong labour markets, leading industrial clusters, and a sophisticated financial market. We need to focus on structural constraints that stop these advantages turning into attractive investments.

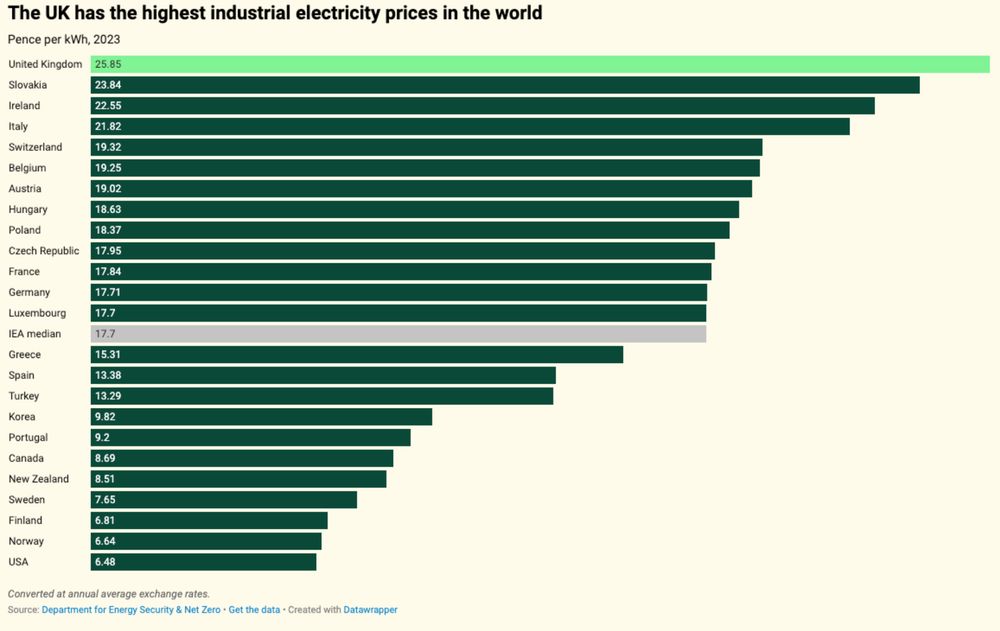

The most important is to fix the sources of the UK’s cost disadvantages relative to other countries (planning, energy, infrastructure), but we must also improve financial markets by removing frictions - not forcing artificial allocations.

June 19, 2025 at 7:54 AM

The most important is to fix the sources of the UK’s cost disadvantages relative to other countries (planning, energy, infrastructure), but we must also improve financial markets by removing frictions - not forcing artificial allocations.

Trying to revive financial flows without addressing fundamental barriers to economic activity is like treating the symptoms and ignoring the disease. To achieve both, we propose two necessary conditions:

June 19, 2025 at 7:54 AM

Trying to revive financial flows without addressing fundamental barriers to economic activity is like treating the symptoms and ignoring the disease. To achieve both, we propose two necessary conditions:

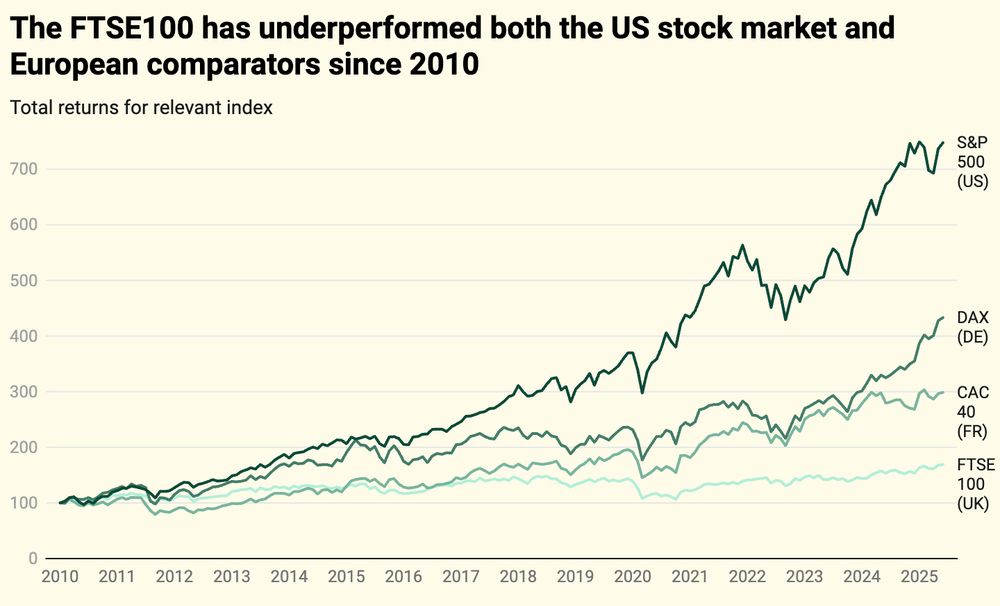

Overall, these effects are second-order. The fundamental issues of high input costs and availability: energy, industrial locations, and limited housing availability in key clusters create systematic disadvantages that no amount of capital can overcome.

June 19, 2025 at 7:54 AM

Overall, these effects are second-order. The fundamental issues of high input costs and availability: energy, industrial locations, and limited housing availability in key clusters create systematic disadvantages that no amount of capital can overcome.

Plus, once implemented, beneficiary interest groups will fight future reversal, locking in costly mistakes. If directing UK savings to underperforming assets ends up hurting returns, we'll be paying for it long after the policy fails.

June 19, 2025 at 7:54 AM

Plus, once implemented, beneficiary interest groups will fight future reversal, locking in costly mistakes. If directing UK savings to underperforming assets ends up hurting returns, we'll be paying for it long after the policy fails.

But financial markets are not perfect. MiFID II reduced incentives for research coverage of smaller companies. Britain's 0.5% stamp duty is higher than most major markets. Pension fragmentation limits sophisticated investment.

June 19, 2025 at 7:54 AM

But financial markets are not perfect. MiFID II reduced incentives for research coverage of smaller companies. Britain's 0.5% stamp duty is higher than most major markets. Pension fragmentation limits sophisticated investment.

The difference? Fintech operates where Britain has advantages: a strong sectoral cluster, low physical footprint, deep talent pools. Manufacturing firms or data centres face high energy costs and planning complexity.

June 19, 2025 at 7:54 AM

The difference? Fintech operates where Britain has advantages: a strong sectoral cluster, low physical footprint, deep talent pools. Manufacturing firms or data centres face high energy costs and planning complexity.

We can see this in the divide between different types of companies: UK fintech (Revolut, Monzo) readily access capital.

Manufacturing firms or those dependent on access to infrastructure struggle. Same financial system, very different outcomes.

Manufacturing firms or those dependent on access to infrastructure struggle. Same financial system, very different outcomes.

June 19, 2025 at 7:54 AM

We can see this in the divide between different types of companies: UK fintech (Revolut, Monzo) readily access capital.

Manufacturing firms or those dependent on access to infrastructure struggle. Same financial system, very different outcomes.

Manufacturing firms or those dependent on access to infrastructure struggle. Same financial system, very different outcomes.

If companies are struggling to find attractive opportunities, and persuading investors to part with their funds, simply channeling more capital towards them won't solve anything. That misdiagnoses the problem.

June 19, 2025 at 7:54 AM

If companies are struggling to find attractive opportunities, and persuading investors to part with their funds, simply channeling more capital towards them won't solve anything. That misdiagnoses the problem.

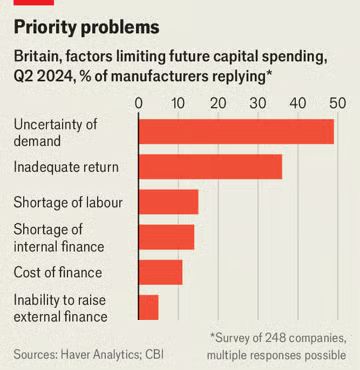

Forcing savers to invest in British companies addresses a symptom, but misses the underlying cause.

It also ignores what companies are telling us. UK manufacturers cite 'uncertainty of demand' and 'inadequate returns' as their main investment barriers, not the 'cost of finance'.

It also ignores what companies are telling us. UK manufacturers cite 'uncertainty of demand' and 'inadequate returns' as their main investment barriers, not the 'cost of finance'.

June 19, 2025 at 7:54 AM

Forcing savers to invest in British companies addresses a symptom, but misses the underlying cause.

It also ignores what companies are telling us. UK manufacturers cite 'uncertainty of demand' and 'inadequate returns' as their main investment barriers, not the 'cost of finance'.

It also ignores what companies are telling us. UK manufacturers cite 'uncertainty of demand' and 'inadequate returns' as their main investment barriers, not the 'cost of finance'.

Hoping that the more skilled half of the team can raise me up to their level.

April 3, 2025 at 12:34 PM

Hoping that the more skilled half of the team can raise me up to their level.

A big thank you to @jujulemons.bsky.social and

@davidlawrenceuk.bsky.social for the invitation - I am thrilled to be working with the very talented team of

@freddieposer.com, @ersatzben.bsky.social, @maxxturing.bsky.social , @droojb.bsky.social, and Tom Blake, as well as @lyan82.bsky.social.

@davidlawrenceuk.bsky.social for the invitation - I am thrilled to be working with the very talented team of

@freddieposer.com, @ersatzben.bsky.social, @maxxturing.bsky.social , @droojb.bsky.social, and Tom Blake, as well as @lyan82.bsky.social.

April 3, 2025 at 12:34 PM

A big thank you to @jujulemons.bsky.social and

@davidlawrenceuk.bsky.social for the invitation - I am thrilled to be working with the very talented team of

@freddieposer.com, @ersatzben.bsky.social, @maxxturing.bsky.social , @droojb.bsky.social, and Tom Blake, as well as @lyan82.bsky.social.

@davidlawrenceuk.bsky.social for the invitation - I am thrilled to be working with the very talented team of

@freddieposer.com, @ersatzben.bsky.social, @maxxturing.bsky.social , @droojb.bsky.social, and Tom Blake, as well as @lyan82.bsky.social.

The OBR’s role in ensuring fiscal accountability is too important to risk in disputes over its political nature - 2022 proved that.

But it needs tools to help it respond to the needs of governments who want to focus on long-term growth.

Full piece here:

ukdayone.org/briefings/ho...

But it needs tools to help it respond to the needs of governments who want to focus on long-term growth.

Full piece here:

ukdayone.org/briefings/ho...

How Can We Strengthen the OBR’s Forecasting? - UK Day One

ukdayone.org

March 27, 2025 at 1:22 PM

The OBR’s role in ensuring fiscal accountability is too important to risk in disputes over its political nature - 2022 proved that.

But it needs tools to help it respond to the needs of governments who want to focus on long-term growth.

Full piece here:

ukdayone.org/briefings/ho...

But it needs tools to help it respond to the needs of governments who want to focus on long-term growth.

Full piece here:

ukdayone.org/briefings/ho...

When HMG policy is shaped by OBR forecasts, and Govt is pushing on reforms that the OBR toolkit wasn’t built for (like reg. reform), it creates a pressure to reshape the OBR's role and question whether it has become a political institution.

March 27, 2025 at 1:22 PM

When HMG policy is shaped by OBR forecasts, and Govt is pushing on reforms that the OBR toolkit wasn’t built for (like reg. reform), it creates a pressure to reshape the OBR's role and question whether it has become a political institution.

The result is a difficult feedback loop that my new piece with macroeconomist Rohan Shah for

@ukdayone.bsky.social examines:

ukdayone.org/briefings/ho...

@ukdayone.bsky.social examines:

ukdayone.org/briefings/ho...

How Can We Strengthen the OBR’s Forecasting? - UK Day One

ukdayone.org

March 27, 2025 at 1:22 PM

The result is a difficult feedback loop that my new piece with macroeconomist Rohan Shah for

@ukdayone.bsky.social examines:

ukdayone.org/briefings/ho...

@ukdayone.bsky.social examines:

ukdayone.org/briefings/ho...

This elevates the role of OBR "judgement" for key forecast inputs (eg, productivity trends).

Some judgement is unavoidable, but relying on judgement calls for binding forecasts invites intense scrutiny and questions about the basis for those constraints.

bsky.app/profile/gemm...

Some judgement is unavoidable, but relying on judgement calls for binding forecasts invites intense scrutiny and questions about the basis for those constraints.

bsky.app/profile/gemm...

OBR forecast revisions knocked a hole in Rachel Reeves' fiscal plans. She responded by announcing measures to restore *exactly* the same margin against her rules as she had in October - still very small given average size of forecast revisions

March 27, 2025 at 1:22 PM

This elevates the role of OBR "judgement" for key forecast inputs (eg, productivity trends).

Some judgement is unavoidable, but relying on judgement calls for binding forecasts invites intense scrutiny and questions about the basis for those constraints.

bsky.app/profile/gemm...

Some judgement is unavoidable, but relying on judgement calls for binding forecasts invites intense scrutiny and questions about the basis for those constraints.

bsky.app/profile/gemm...

The approach underlying all OBR forecasting is now very far from the state of the art in macroeconomics.

Empirical evidence produced at the research frontier becomes less useful for forecasts - forcing the OBR to rely more on other sources, like Government produced figures.

Empirical evidence produced at the research frontier becomes less useful for forecasts - forcing the OBR to rely more on other sources, like Government produced figures.

March 27, 2025 at 1:22 PM

The approach underlying all OBR forecasting is now very far from the state of the art in macroeconomics.

Empirical evidence produced at the research frontier becomes less useful for forecasts - forcing the OBR to rely more on other sources, like Government produced figures.

Empirical evidence produced at the research frontier becomes less useful for forecasts - forcing the OBR to rely more on other sources, like Government produced figures.