Optimise Accountants specializes in international tax advisory services for American and British expats who move to or invest in the UK, US, or Spain

📖 Free UK Property Tax eBook: zurl.co/o02yN

#UKTax #FIC #InheritanceTax

📖 Free UK Property Tax eBook: zurl.co/o02yN

#UKTax #FIC #InheritanceTax

📖 Free eBook: zurl.co/3IDDq

#UKLandlords #PropertyTax

📖 Free eBook: zurl.co/3IDDq

#UKLandlords #PropertyTax

Generic accountants & DIY returns cost landlords £££ in missed reliefs.

Stop losing money—get specialist advice now!

#UKLandlordTax #BuyToLet

Generic accountants & DIY returns cost landlords £££ in missed reliefs.

Stop losing money—get specialist advice now!

#UKLandlordTax #BuyToLet

✅ Keep control & pass shares to heirs

✅ Cut IHT—gifting early may save 40% tax

✅ Shield wealth from divorce

📩 Get expert advice!

📘 Free guide: zurl.co/NIm8U

✅ Keep control & pass shares to heirs

✅ Cut IHT—gifting early may save 40% tax

✅ Shield wealth from divorce

📩 Get expert advice!

📘 Free guide: zurl.co/NIm8U

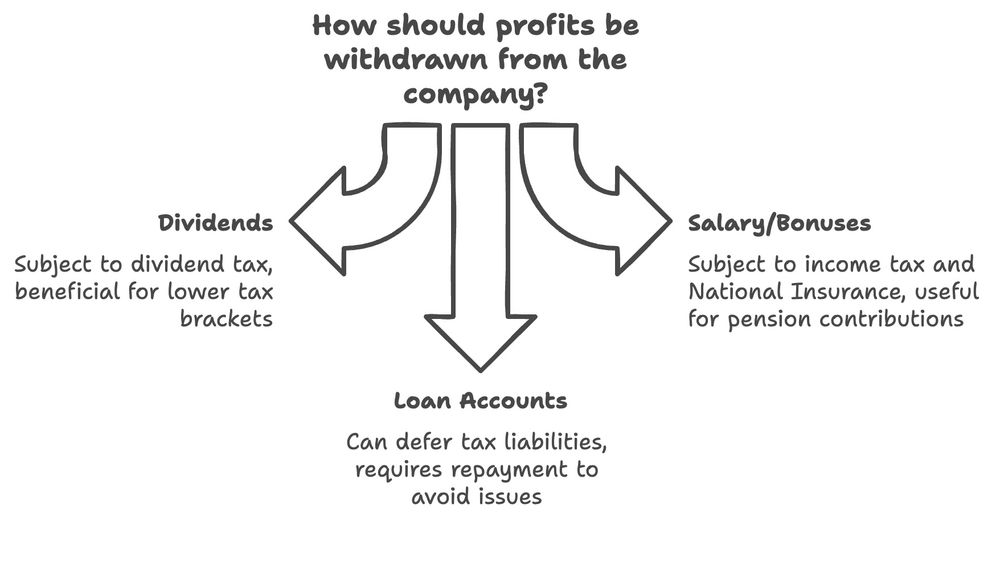

✅ Dividends: 8.75%-39.35% tax

✅ Salary & Bonuses: Income Tax & NICs

✅ Director’s Loan: 33.75% if unpaid

Get our FREE UK Property Tax eBook 👉 zurl.co/RnjmO

✅ Dividends: 8.75%-39.35% tax

✅ Salary & Bonuses: Income Tax & NICs

✅ Director’s Loan: 33.75% if unpaid

Get our FREE UK Property Tax eBook 👉 zurl.co/RnjmO

Sick of handing too much over to HMRC? 😩

Learn how to legally pay less tax, claim more expenses, and keep more 💷 in your pocket!

🎓 Free Property Tax Training Course

👉 zurl.co/k4rAz

#LandlordLife #BuyToLet #UKProperty

Sick of handing too much over to HMRC? 😩

Learn how to legally pay less tax, claim more expenses, and keep more 💷 in your pocket!

🎓 Free Property Tax Training Course

👉 zurl.co/k4rAz

#LandlordLife #BuyToLet #UKProperty

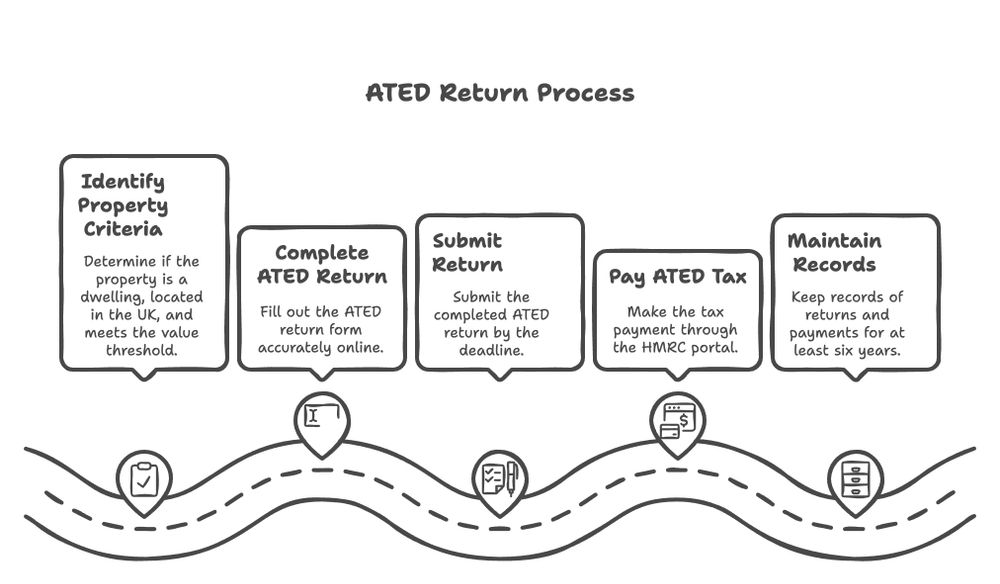

If your company owns UK residential property over £500K, you may owe tax! Some exemptions apply.

📥 Free UK Property Tax eBook: zurl.co/mLzsq

#UKPropertyTax #ATED #TaxPlanning

If your company owns UK residential property over £500K, you may owe tax! Some exemptions apply.

📥 Free UK Property Tax eBook: zurl.co/mLzsq

#UKPropertyTax #ATED #TaxPlanning

Check out our channel zurl.co/Fl8qq

Check out our channel zurl.co/Fl8qq

Sick of handing too much over to HMRC? 😩

Learn how to legally pay less tax, claim more expenses, and keep more 💷 in your pocket!

🎓 Free Property Tax Training Course

👉 zurl.co/H7YGh

#LandlordLife #BuyToLet #UKProperty

Sick of handing too much over to HMRC? 😩

Learn how to legally pay less tax, claim more expenses, and keep more 💷 in your pocket!

🎓 Free Property Tax Training Course

👉 zurl.co/H7YGh

#LandlordLife #BuyToLet #UKProperty

✅ Repairs & maintenance – Deductible.

🚫 Improvements – Not deductible but may reduce CGT.

Need expert tax advice? DM us!

📖 Free UK Property Tax eBook: zurl.co/KO9E1

#BuyToLet #LandlordTax #UKTaxes

✅ Repairs & maintenance – Deductible.

🚫 Improvements – Not deductible but may reduce CGT.

Need expert tax advice? DM us!

📖 Free UK Property Tax eBook: zurl.co/KO9E1

#BuyToLet #LandlordTax #UKTaxes

Check out our channel zurl.co/Fl8qq

Check out our channel zurl.co/Fl8qq

Use our FREE 🧮 Stamp Duty Calculator now and save £££! Quick, easy, and online! 🚀

👉 zurl.co/iZBTw

#BuyToLet #StampDuty #UKProperty #LandlordTips #TaxCalculator 🏡💷

Use our FREE 🧮 Stamp Duty Calculator now and save £££! Quick, easy, and online! 🚀

👉 zurl.co/iZBTw

#BuyToLet #StampDuty #UKProperty #LandlordTips #TaxCalculator 🏡💷

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

📖 Free UK Property Tax eBook: zurl.co/oZhci #BuyToLet

📖 Free UK Property Tax eBook: zurl.co/oZhci #BuyToLet

📥 Free Expat Tax eBook: zurl.co/mn4S5

#InheritanceTax #UKTax #Expats

📥 Free Expat Tax eBook: zurl.co/mn4S5

#InheritanceTax #UKTax #Expats

Sick of handing too much over to HMRC? 😩

Learn how to legally pay less tax, claim more expenses, and keep more 💷 in your pocket!

🎓 Free Property Tax Training Course

👉 zurl.co/2oQOx

#LandlordLife #BuyToLet #UKProperty

Sick of handing too much over to HMRC? 😩

Learn how to legally pay less tax, claim more expenses, and keep more 💷 in your pocket!

🎓 Free Property Tax Training Course

👉 zurl.co/2oQOx

#LandlordLife #BuyToLet #UKProperty

📩 Free UK Property Tax eBook: zurl.co/EIDDm

#InheritanceTax #PensionPlanning #UKTax

📩 Free UK Property Tax eBook: zurl.co/EIDDm

#InheritanceTax #PensionPlanning #UKTax

Sale price - (Purchase price + Costs) = Capital Gain

CGT: 18% or 24% after £3,000 allowance.

📖 Get our FREE UK Property Tax eBook: zurl.co/FAUEl

#UKProperty #BuyToLet #CapitalGainsTax

Sale price - (Purchase price + Costs) = Capital Gain

CGT: 18% or 24% after £3,000 allowance.

📖 Get our FREE UK Property Tax eBook: zurl.co/FAUEl

#UKProperty #BuyToLet #CapitalGainsTax

✅ Protect assets from divorce & creditors

✅ Separates ownership from control

✅ Limits liability

📥 Free UK Property Tax eBook: zurl.co/YUFc3

#WealthProtection #UKTax #FIC #FamilyWealth

✅ Protect assets from divorce & creditors

✅ Separates ownership from control

✅ Limits liability

📥 Free UK Property Tax eBook: zurl.co/YUFc3

#WealthProtection #UKTax #FIC #FamilyWealth

💷 £500K pension = £200K lost to tax! Act now to protect your legacy.

Calculate here: zurl.co/Y89S0

#InheritanceTax #Pension #IHT #UKTax #TaxPlanning

💷 £500K pension = £200K lost to tax! Act now to protect your legacy.

Calculate here: zurl.co/Y89S0

#InheritanceTax #Pension #IHT #UKTax #TaxPlanning

Free Expat Tax eBook: zurl.co/ZqN4b

Free Property Tax eBook: zurl.co/hpuVp

Free Expat Tax eBook: zurl.co/ZqN4b

Free Property Tax eBook: zurl.co/hpuVp

✅ 0%-12% banded rates

✅ 5% surcharge applies

✅ £500K+ may face 15% flat rate

📥 Free UK Property Tax eBook: zurl.co/11aea

#SDLT #BuyToLet #UKTax

✅ 0%-12% banded rates

✅ 5% surcharge applies

✅ £500K+ may face 15% flat rate

📥 Free UK Property Tax eBook: zurl.co/11aea

#SDLT #BuyToLet #UKTax