- Small Cap Value

- European Investor 🇪🇺

- Nordic Stocks 🇩🇰🇳🇴🇸🇪🇫🇮🇮🇸🇫🇴🇬🇱

Because... that company is literally here.

$ADBE #ADBE 🎨💻🔥

Because... that company is literally here.

$ADBE #ADBE 🎨💻🔥

• forward EPS ~24 USD

• ROIC ~28%

• gross margin ~89%

• operating margin ~36%

• recurring revenue ~90% 🔁

• 10y revenue CAGR ~15% 📊

• FCF margin ~40% 💵

• R&D spend ~18% of revenue 🧪

Asking for a friend called $ADBE (share price ~320 USD) 📈🔥

• forward EPS ~24 USD

• ROIC ~28%

• gross margin ~89%

• operating margin ~36%

• recurring revenue ~90% 🔁

• 10y revenue CAGR ~15% 📊

• FCF margin ~40% 💵

• R&D spend ~18% of revenue 🧪

Asking for a friend called $ADBE (share price ~320 USD) 📈🔥

• ROIC: 43% 🔥

• Silver: ~32 USD/oz 🪙🚀

• Gold: ~2,900–4,000 USD/oz 📈

• US LFL: +6% 🇺🇸

• Europe LFL: -1% 🇪🇺

• RoP LFL: +6% 🌏

• Australia LFL: +4% 🇦🇺

• Net store openings (12m): +65 CS, +85 SiS 🏬

• China stores: -33 QoQ, -60 YoY 🇨🇳

#PNDORA #PNDORA.CO #Pandora #2025Q3

• ROIC: 43% 🔥

• Silver: ~32 USD/oz 🪙🚀

• Gold: ~2,900–4,000 USD/oz 📈

• US LFL: +6% 🇺🇸

• Europe LFL: -1% 🇪🇺

• RoP LFL: +6% 🌏

• Australia LFL: +4% 🇦🇺

• Net store openings (12m): +65 CS, +85 SiS 🏬

• China stores: -33 QoQ, -60 YoY 🇨🇳

#PNDORA #PNDORA.CO #Pandora #2025Q3

• EBIT hit: ~380bp from silver, gold, FX, tariffs 🪙📉

• Gross margin drag: ~280bp 🧊

• Structural lifts: pricing +, mix +, network + 🧩

• EBIT margin: 14.0% (vs 16.1%) ⚙️

• 2025 EBIT guidance: ~24% 🎯

#PNDORA #PNDORA.CO #Pandora #2025Q3

• EBIT hit: ~380bp from silver, gold, FX, tariffs 🪙📉

• Gross margin drag: ~280bp 🧊

• Structural lifts: pricing +, mix +, network + 🧩

• EBIT margin: 14.0% (vs 16.1%) ⚙️

• 2025 EBIT guidance: ~24% 🎯

#PNDORA #PNDORA.CO #Pandora #2025Q3

• Organic growth: +6% 🚀

• LFL: +2% 📈

• Revenue: DKK 6.27B 💎

• Gross margin: 79.3% (-80bp) 📉

• EBIT margin: 14.0% (-210bp) ⚙️

• EPS: 6.3 DKK (-14%, +5% FX-adjusted) 🌐

• US LFL: +6% 🇺🇸

• Europe LFL: -1% 🇪🇺

• RoP LFL: +6% 🌍

#PNDORA #PNDORA.CO #Pandora #2025Q3

• Organic growth: +6% 🚀

• LFL: +2% 📈

• Revenue: DKK 6.27B 💎

• Gross margin: 79.3% (-80bp) 📉

• EBIT margin: 14.0% (-210bp) ⚙️

• EPS: 6.3 DKK (-14%, +5% FX-adjusted) 🌐

• US LFL: +6% 🇺🇸

• Europe LFL: -1% 🇪🇺

• RoP LFL: +6% 🌍

#PNDORA #PNDORA.CO #Pandora #2025Q3

Higher gold and silver prices may pressure margins, but network expansion and strong US demand support the long-term thesis.

Still one of the best-run Nordic consumer brands with solid ROIC and pricing power.

#Pandora #PNDORA #OMXN40 #NordicStocks

Higher gold and silver prices may pressure margins, but network expansion and strong US demand support the long-term thesis.

Still one of the best-run Nordic consumer brands with solid ROIC and pricing power.

#Pandora #PNDORA #OMXN40 #NordicStocks

COGS 52.8% -70bp

R&D 8.7% -80bp

SG&A 6.9% -20bp

COGS 52.8% -70bp

R&D 8.7% -80bp

SG&A 6.9% -20bp

🌎 Americas 44,192 +6%

🌍 Europe 28,703 +15%

🌏 Greater China 14,493 -4%

Total 102,466 +8%

🌎 Americas 44,192 +6%

🌍 Europe 28,703 +15%

🌏 Greater China 14,493 -4%

Total 102,466 +8%

Q2 organic revenue growth and profit margin change:

👜📉 Fashion & Leather Goods -9% -4% ⚠️

💄📈 Selective Retailing +4% +1%

💍📉 Watches & Jewelry 0% -2%

🥃📉 Wines & Spirits -4% -8%

🧴📈 Perfumes & Cosmetics +1% -1%

#LVMH #MC.PA #$MC.PA #LuxuryGoods #CAC40 #FranceStocks #Fundamentals

Q2 organic revenue growth and profit margin change:

👜📉 Fashion & Leather Goods -9% -4% ⚠️

💄📈 Selective Retailing +4% +1%

💍📉 Watches & Jewelry 0% -2%

🥃📉 Wines & Spirits -4% -8%

🧴📈 Perfumes & Cosmetics +1% -1%

#LVMH #MC.PA #$MC.PA #LuxuryGoods #CAC40 #FranceStocks #Fundamentals

📊⬇️ 5‑yr median ROIC vs fwd rev growth

🔍 Closer look?

🇩🇰 Novo Nordisk 💉

⚠️ Semaglutide cliff early 2030s 📉

🇩🇰 Pandora 💍

⚠️ 1/3 US sales 🇺🇸

⚠️ Thailand tariffs 🇹🇭

🇳🇱 ASML

⚠️ Export curbs 🛂

⚠️ China slump 🇨🇳

#NOVO-B.CO #PNDORA.CO #ASML.AS

📊⬇️ 5‑yr median ROIC vs fwd rev growth

🔍 Closer look?

🇩🇰 Novo Nordisk 💉

⚠️ Semaglutide cliff early 2030s 📉

🇩🇰 Pandora 💍

⚠️ 1/3 US sales 🇺🇸

⚠️ Thailand tariffs 🇹🇭

🇳🇱 ASML

⚠️ Export curbs 🛂

⚠️ China slump 🇨🇳

#NOVO-B.CO #PNDORA.CO #ASML.AS

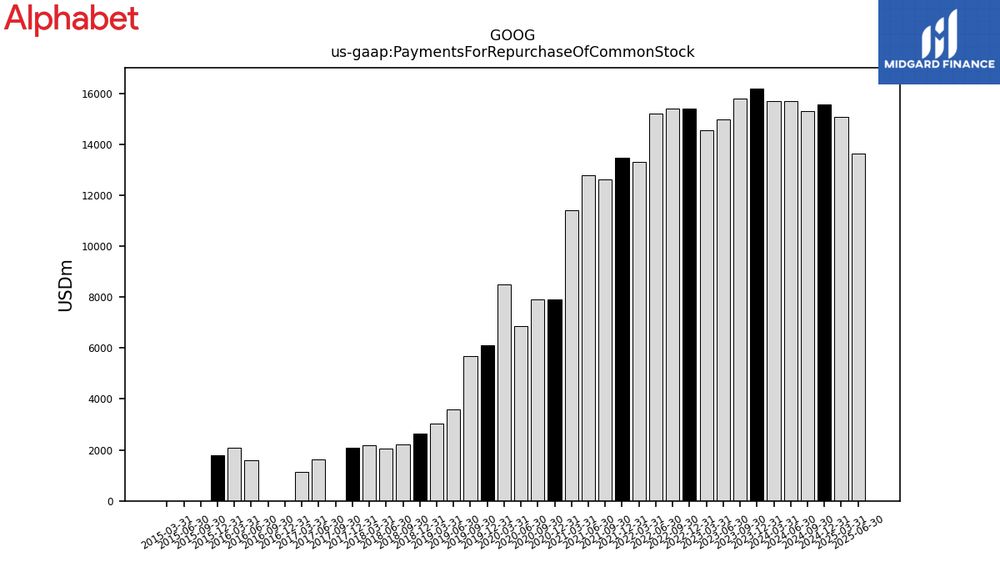

💸 CapEx (PPE) $22.4B (+70% YoY) - AI data centers 📈

🔁 Buybacks $13.6B (‑13% YoY)

🪙 Dividends $2.54B (+3.1% YoY)

🧪 R&D $13.8B (+16% YoY)

Charts ⬇️

#$GOOG #AI #AIInfra #CapEx #Buybacks #Dividends #TechStocks

💸 CapEx (PPE) $22.4B (+70% YoY) - AI data centers 📈

🔁 Buybacks $13.6B (‑13% YoY)

🪙 Dividends $2.54B (+3.1% YoY)

🧪 R&D $13.8B (+16% YoY)

Charts ⬇️

#$GOOG #AI #AIInfra #CapEx #Buybacks #Dividends #TechStocks

💰 Rev $96.4B (+14% YoY)

🔎 Search ~$54.2B (+12%)

▶️ YouTube ads ~$9.8B (+13%)

☁️ Cloud $13.6B (+32%)

Charts ⬇️

#$GOOG #AlphabetEarnings #AI #GoogleCloud #Search #YouTube

💰 Rev $96.4B (+14% YoY)

🔎 Search ~$54.2B (+12%)

▶️ YouTube ads ~$9.8B (+13%)

☁️ Cloud $13.6B (+32%)

Charts ⬇️

#$GOOG #AlphabetEarnings #AI #GoogleCloud #Search #YouTube

- Net rev €524.3 m (+3%) 📈

- EBITDA margin 65.9%

- Live casino flexed +3.6% 📈

- New studios just dropped in 🇵🇭 & 🇧🇷

- EU rev -5% on 🇬🇧 ring-fencing 📉

- 110+ fresh games queued for 2025

- Margin guide 66-68% still locked

- €500 m buyback & €2.80 div teased 💸

#EVO #EVO.ST

−15.7% mean weight loss vs −3.1% placebo at 68 weeks

💪

Combo still delivers, even with insulin resistance on board.

#CagriSema #T2D #Obesity #GLP1 #NEJM #NovoNordisk #ADA2025 #Diabetes

−15.7% mean weight loss vs −3.1% placebo at 68 weeks

💪

Combo still delivers, even with insulin resistance on board.

#CagriSema #T2D #Obesity #GLP1 #NEJM #NovoNordisk #ADA2025 #Diabetes

−22.7% mean weight loss at 68 weeks vs −2.3% placebo.

Best-in-class? Combo GLP-1 + amylin is setting new records 🚀

#CagriSema #Obesity #NEJM #NovoNordisk #ADA2025 #NVO

−22.7% mean weight loss at 68 weeks vs −2.3% placebo.

Best-in-class? Combo GLP-1 + amylin is setting new records 🚀

#CagriSema #Obesity #NEJM #NovoNordisk #ADA2025 #NVO

In just 12 wks, −13% weight (2×50 mg), −10% (50 mg), placebo −1%. No plateau. Mild GI side-effects. Dual-agonist combo could reshape obesity treatment. 🌊

#NovoNordisk #Amycretin #ADA2025

In just 12 wks, −13% weight (2×50 mg), −10% (50 mg), placebo −1%. No plateau. Mild GI side-effects. Dual-agonist combo could reshape obesity treatment. 🌊

#NovoNordisk #Amycretin #ADA2025