Looking for management who under-promise and over-deliver.

DM to discuss shares. Family office

Was building a position below 5p before Harwood turned up. It's the order book I'm interested in for FY26 now

Was building a position below 5p before Harwood turned up. It's the order book I'm interested in for FY26 now

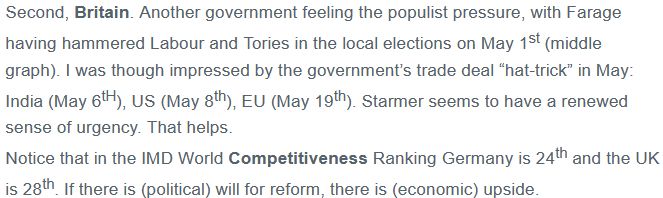

For those not on X I just posted:

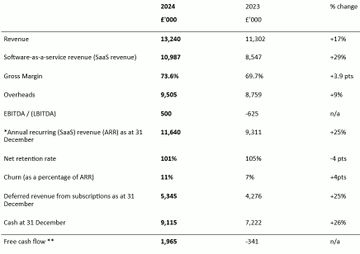

Phenomenal HY results from #ELIX today which IMO were well ahead of expectations (look at those margins):

Broker TP increased to 1240p (from 1100p)

For those not on X I just posted:

Phenomenal HY results from #ELIX today which IMO were well ahead of expectations (look at those margins):

Broker TP increased to 1240p (from 1100p)

I hold

I hold

#Elixirr #ELIX

Will be keeping a close eye on this in June:

www.britishcycling.org.uk/tourofbritai...

#Elixirr #ELIX

Will be keeping a close eye on this in June:

www.britishcycling.org.uk/tourofbritai...

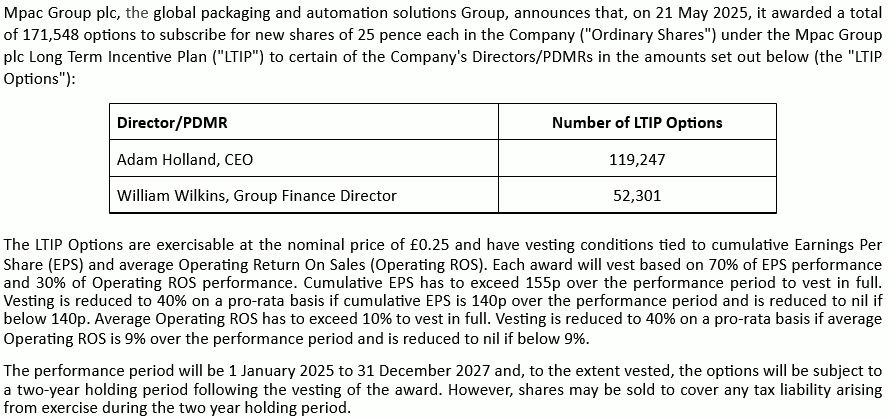

PBT £0.5m & diluted EPS 0.57p. We should start seeing operational gearing coming through.

Outlook: Solid start to year with ARR up 20% YoY to £12m.

Trading at 2.1x ARR/EV - UK companies usually sell at 3-5x

PBT £0.5m & diluted EPS 0.57p. We should start seeing operational gearing coming through.

Outlook: Solid start to year with ARR up 20% YoY to £12m.

Trading at 2.1x ARR/EV - UK companies usually sell at 3-5x

One of my go-to areas. Better than watching the markets at times like this!

One of my go-to areas. Better than watching the markets at times like this!

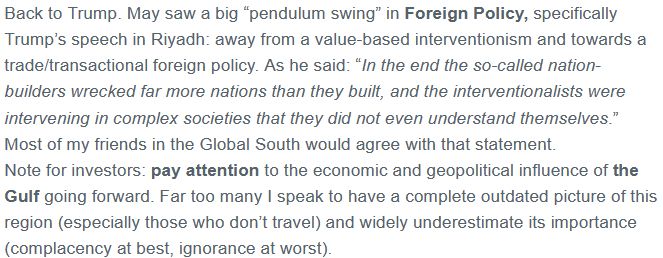

The forecasts are very solid for this year:

#TRI I hold

The forecasts are very solid for this year:

#TRI I hold

• Further margin benefits

• H2 inventory reduction historically better than H1

• Further reduction in net debt

Brokers leave FCs unchanged & they are ambitious. Note FY25 FCF yield 11.2% & FY26 21.9%! I hold

• Further margin benefits

• H2 inventory reduction historically better than H1

• Further reduction in net debt

Brokers leave FCs unchanged & they are ambitious. Note FY25 FCF yield 11.2% & FY26 21.9%! I hold

Some well known names in there too:

Some well known names in there too: