Looking for management who under-promise and over-deliver.

DM to discuss shares. Family office

Was building a position below 5p before Harwood turned up. It's the order book I'm interested in for FY26 now

Was building a position below 5p before Harwood turned up. It's the order book I'm interested in for FY26 now

For those not on X I just posted:

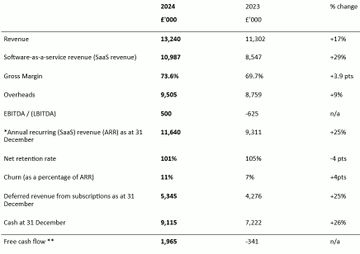

Phenomenal HY results from #ELIX today which IMO were well ahead of expectations (look at those margins):

Broker TP increased to 1240p (from 1100p)

For those not on X I just posted:

Phenomenal HY results from #ELIX today which IMO were well ahead of expectations (look at those margins):

Broker TP increased to 1240p (from 1100p)

I hold

I hold

Already a v sig position so this will be a short term trade for next month or so I think.

No, not gonna say what it is until I (if!) get filled

Already a v sig position so this will be a short term trade for next month or so I think.

No, not gonna say what it is until I (if!) get filled

• FY25 rev ~£224m +45.4%

▪︎ Adj EBITDA £41m +32.3%

Market cap of ~£300m. Won't be long before market works it out.

I hold. Did alert investors to potential 🙃

• FY25 rev ~£224m +45.4%

▪︎ Adj EBITDA £41m +32.3%

Market cap of ~£300m. Won't be long before market works it out.

I hold. Did alert investors to potential 🙃

#Elixirr #ELIX

Will be keeping a close eye on this in June:

www.britishcycling.org.uk/tourofbritai...

#Elixirr #ELIX

Will be keeping a close eye on this in June:

www.britishcycling.org.uk/tourofbritai...

>£8 for MoJ

and £2m for Dept of Culture, Media & Sports.

Momentum really building here now.

I hold #MTEC

>£8 for MoJ

and £2m for Dept of Culture, Media & Sports.

Momentum really building here now.

I hold #MTEC

Let's see if we agree on being clowns on the way down too 😆

The quote escapes me...market sentiment is majority of the move and stock picking is 10-20%? something like that?

Let's see if we agree on being clowns on the way down too 😆

The quote escapes me...market sentiment is majority of the move and stock picking is 10-20%? something like that?

Who's in charge of AIM now? Have they not noticed? At this rate we'll only have the loss making bio-tech & O, G & M's left.

Probably not a bad thing TBH

Who's in charge of AIM now? Have they not noticed? At this rate we'll only have the loss making bio-tech & O, G & M's left.

Probably not a bad thing TBH

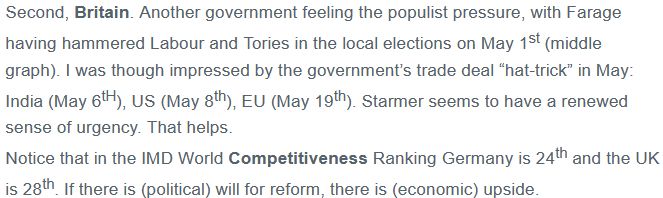

Despite the naysayers, nearly 3x in 5yrs, not too shabby. You only get a couple of really good opportunities every few years. Well I think I have another one & I've been buying:

Despite the naysayers, nearly 3x in 5yrs, not too shabby. You only get a couple of really good opportunities every few years. Well I think I have another one & I've been buying:

I sold #TRI during the tariff talk as I think it will struggle. Outlook mentions a pass through of costs

I sold #TRI during the tariff talk as I think it will struggle. Outlook mentions a pass through of costs

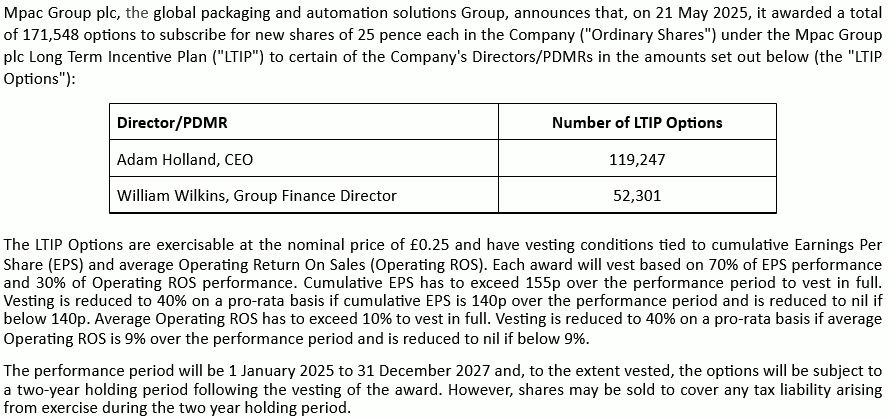

PBT £0.5m & diluted EPS 0.57p. We should start seeing operational gearing coming through.

Outlook: Solid start to year with ARR up 20% YoY to £12m.

Trading at 2.1x ARR/EV - UK companies usually sell at 3-5x

PBT £0.5m & diluted EPS 0.57p. We should start seeing operational gearing coming through.

Outlook: Solid start to year with ARR up 20% YoY to £12m.

Trading at 2.1x ARR/EV - UK companies usually sell at 3-5x

what have you been buying?

Me: #BOKU #MHA, #AOTI and my first venture outside of UK with #INPST (InPost). Will comment on all when I get a chance.

Let me know what you like in this sale

Can't help but think AI took a huge chunk from them.

I've never held. Think it will die a slow death BWDIK

Can't help but think AI took a huge chunk from them.

I've never held. Think it will die a slow death BWDIK

With ~3 months left they need both a rabbit & someone to lend em a hat.

The new TCP contract will take time to work through the financials #TRCS

With ~3 months left they need both a rabbit & someone to lend em a hat.

The new TCP contract will take time to work through the financials #TRCS

I don't currently hold having sold at a negligible loss earlier. Looking for a re-entry #AOM

I don't currently hold having sold at a negligible loss earlier. Looking for a re-entry #AOM

what have you been buying?

Me: #BOKU #MHA, #AOTI and my first venture outside of UK with #INPST (InPost). Will comment on all when I get a chance.

Let me know what you like in this sale

what have you been buying?

Me: #BOKU #MHA, #AOTI and my first venture outside of UK with #INPST (InPost). Will comment on all when I get a chance.

Let me know what you like in this sale

martinflitton1.wixsite.com/privatepunte...

martinflitton1.wixsite.com/privatepunte...

Overall happy to hold & add if we get a sig knock #CNC

Overall happy to hold & add if we get a sig knock #CNC

The US wants to sacrifice 70% margins on software so that they can have the privilege of making 5% margins on unmentionables?

Pls make it make sense!

Look at the exemptions 🤣

The US wants to sacrifice 70% margins on software so that they can have the privilege of making 5% margins on unmentionables?

Pls make it make sense!

Look at the exemptions 🤣