Max Franks

@maxfranks.bsky.social

Senior scientist @PIK_Climate and formerly @TUBerlin. #carbonpricing, #CDR, #SDGs, #economics, #inequality, -- this is my private account

8/ 🌍 Curious about the details? Read the full study here: authors.elsevier.com/sd/article/S... Let’s talk about effective policies for sustainable diets! #ClimateAction #FoodPolicy

ScienceDirect.com | Science, health and medical journals, full text articles and books.

authors.elsevier.com

January 10, 2025 at 9:32 AM

8/ 🌍 Curious about the details? Read the full study here: authors.elsevier.com/sd/article/S... Let’s talk about effective policies for sustainable diets! #ClimateAction #FoodPolicy

7/ 🤔 Note: We couldn’t include meat substitutes like soy or seitan in our analysis due to data limitations.

January 10, 2025 at 9:32 AM

7/ 🤔 Note: We couldn’t include meat substitutes like soy or seitan in our analysis due to data limitations.

6/ Cf. @s-stantcheva.bsky.social post shorturl.at/Zw127: Public acceptance is possible if there's clear communication that 1) the approach is effective in reducing emissions, 2) poorest households are overcompensated on avg & 3) all revenue is returned, strongly limiting costs to each individual.

Stefanie Stantcheva (@s-stantcheva.bsky.social)

🚨🔢 New data alert! If you are curious about people's attitudes towards climate change and related policies, check out this large-scale survey data from 20 countries from our paper. Publicly available ...

shorturl.at

January 10, 2025 at 9:32 AM

6/ Cf. @s-stantcheva.bsky.social post shorturl.at/Zw127: Public acceptance is possible if there's clear communication that 1) the approach is effective in reducing emissions, 2) poorest households are overcompensated on avg & 3) all revenue is returned, strongly limiting costs to each individual.

5/ 🛒 Price effects at €200/tCO2:

• Yoghurt & milk: +€0.25/kg

• Beef, sheep & goat meat: +€4/kg

• Yoghurt & milk: +€0.25/kg

• Beef, sheep & goat meat: +€4/kg

January 10, 2025 at 9:29 AM

5/ 🛒 Price effects at €200/tCO2:

• Yoghurt & milk: +€0.25/kg

• Beef, sheep & goat meat: +€4/kg

• Yoghurt & milk: +€0.25/kg

• Beef, sheep & goat meat: +€4/kg

4/ 📉 Emission reduction potential:

• At €30/tCO2, annual emissions fall by just 2 MtCO2eq.

• At the social cost of carbon (€200/tCO2), emissions drop by a significant 15 MtCO2eq.

• At €30/tCO2, annual emissions fall by just 2 MtCO2eq.

• At the social cost of carbon (€200/tCO2), emissions drop by a significant 15 MtCO2eq.

January 10, 2025 at 9:29 AM

4/ 📉 Emission reduction potential:

• At €30/tCO2, annual emissions fall by just 2 MtCO2eq.

• At the social cost of carbon (€200/tCO2), emissions drop by a significant 15 MtCO2eq.

• At €30/tCO2, annual emissions fall by just 2 MtCO2eq.

• At the social cost of carbon (€200/tCO2), emissions drop by a significant 15 MtCO2eq.

3/ 💶 What is the effect of returning the public revenue as climate dividend? The poorest 20% of households are relieved by 0.14% of their income, i.e., on average they’d be overcompensated, while the better-off face an 0.02% reduction of their income

January 10, 2025 at 9:29 AM

3/ 💶 What is the effect of returning the public revenue as climate dividend? The poorest 20% of households are relieved by 0.14% of their income, i.e., on average they’d be overcompensated, while the better-off face an 0.02% reduction of their income

2/ 🍽️ We study how a climate fee on food combined with a #climatedividend could help achieve this target in a socially balanced way by encouraging households to choose less CO2-intensive foods—e.g., less red meat and dairy, more vegetables.

January 10, 2025 at 9:28 AM

2/ 🍽️ We study how a climate fee on food combined with a #climatedividend could help achieve this target in a socially balanced way by encouraging households to choose less CO2-intensive foods—e.g., less red meat and dairy, more vegetables.

1/ 🐄🌾 Agriculture is responsible for 8% of Germany’s greenhouse gas emissions—about 62 MtCO2eq annually. The government aims to reduce this to 56 MtCO2eq by 2030.

January 10, 2025 at 9:27 AM

1/ 🐄🌾 Agriculture is responsible for 8% of Germany’s greenhouse gas emissions—about 62 MtCO2eq annually. The government aims to reduce this to 56 MtCO2eq by 2030.

(8/n) Higher GDP due to land taxes can be desirable, but this depends on the normative standpoint. Hence, we compare different welfare functions and show that already a very moderate level of inequality aversion is enough to make land rent taxes the best policy option.

November 14, 2023 at 9:49 AM

(8/n) Higher GDP due to land taxes can be desirable, but this depends on the normative standpoint. Hence, we compare different welfare functions and show that already a very moderate level of inequality aversion is enough to make land rent taxes the best policy option.

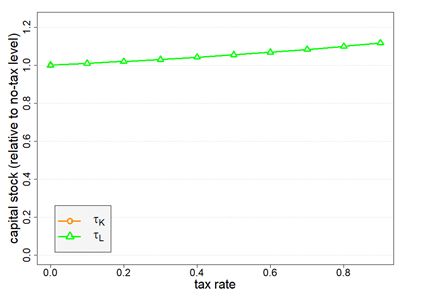

(7/n) Our results suggest that land rent taxes reduce inequality, increase GDP and social welfare. Capital taxes are much less desirable and a tax on both types of wealth lies somewhere in the middle.

November 14, 2023 at 9:49 AM

(7/n) Our results suggest that land rent taxes reduce inequality, increase GDP and social welfare. Capital taxes are much less desirable and a tax on both types of wealth lies somewhere in the middle.

(6/n) How can this reduce inequality? With less capital tax & more land tax, 3 effects reduce inequality:

1) Housing prices fall (at least grow slower)

2) Increased investments -> higher GDP -> higher wages

3) More tax income for redistribution

1) Housing prices fall (at least grow slower)

2) Increased investments -> higher GDP -> higher wages

3) More tax income for redistribution

November 14, 2023 at 9:49 AM

(6/n) How can this reduce inequality? With less capital tax & more land tax, 3 effects reduce inequality:

1) Housing prices fall (at least grow slower)

2) Increased investments -> higher GDP -> higher wages

3) More tax income for redistribution

1) Housing prices fall (at least grow slower)

2) Increased investments -> higher GDP -> higher wages

3) More tax income for redistribution

(5/n) With capital taxes, by contrast, investors shift finance away from capital investments and instead demand for land increases, driving up land prices, but not land supply. The capital stock decreases and GDP falls.

November 14, 2023 at 9:49 AM

(5/n) With capital taxes, by contrast, investors shift finance away from capital investments and instead demand for land increases, driving up land prices, but not land supply. The capital stock decreases and GDP falls.

(4/n) Under land rent taxes, investors redirect financial flows from land to capital investments. Importantly, while land supply is fixed, the capital stock grows, and output = GDP increases.

November 14, 2023 at 9:49 AM

(4/n) Under land rent taxes, investors redirect financial flows from land to capital investments. Importantly, while land supply is fixed, the capital stock grows, and output = GDP increases.

(3/n) Taxing land enhances investment in productive capital. This is the so-called (asset-)portfolio effect - a classic result by Martin Feldstein 1977. Now, we examine how governments can use this effect to reduce wealth inequality. So, how does the portfolio effect work?

November 14, 2023 at 9:48 AM

(3/n) Taxing land enhances investment in productive capital. This is the so-called (asset-)portfolio effect - a classic result by Martin Feldstein 1977. Now, we examine how governments can use this effect to reduce wealth inequality. So, how does the portfolio effect work?

(2/n) Importantly, wealth & capital aren’t equal. Often, it’s assumed that wealth consists of only one asset class: capital. In reality, there are more than that - and a very interesting one is land. So we analyze differences btw capital & land as tax base

November 14, 2023 at 9:48 AM

(2/n) Importantly, wealth & capital aren’t equal. Often, it’s assumed that wealth consists of only one asset class: capital. In reality, there are more than that - and a very interesting one is land. So we analyze differences btw capital & land as tax base