Max Franks

@maxfranks.bsky.social

Senior scientist @PIK_Climate and formerly @TUBerlin. #carbonpricing, #CDR, #SDGs, #economics, #inequality, -- this is my private account

3/ 💶 What is the effect of returning the public revenue as climate dividend? The poorest 20% of households are relieved by 0.14% of their income, i.e., on average they’d be overcompensated, while the better-off face an 0.02% reduction of their income

January 10, 2025 at 9:29 AM

3/ 💶 What is the effect of returning the public revenue as climate dividend? The poorest 20% of households are relieved by 0.14% of their income, i.e., on average they’d be overcompensated, while the better-off face an 0.02% reduction of their income

(8/n) Higher GDP due to land taxes can be desirable, but this depends on the normative standpoint. Hence, we compare different welfare functions and show that already a very moderate level of inequality aversion is enough to make land rent taxes the best policy option.

November 14, 2023 at 9:49 AM

(8/n) Higher GDP due to land taxes can be desirable, but this depends on the normative standpoint. Hence, we compare different welfare functions and show that already a very moderate level of inequality aversion is enough to make land rent taxes the best policy option.

(7/n) Our results suggest that land rent taxes reduce inequality, increase GDP and social welfare. Capital taxes are much less desirable and a tax on both types of wealth lies somewhere in the middle.

November 14, 2023 at 9:49 AM

(7/n) Our results suggest that land rent taxes reduce inequality, increase GDP and social welfare. Capital taxes are much less desirable and a tax on both types of wealth lies somewhere in the middle.

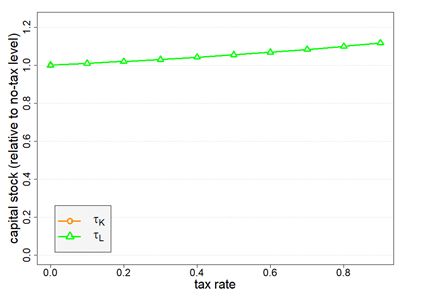

(5/n) With capital taxes, by contrast, investors shift finance away from capital investments and instead demand for land increases, driving up land prices, but not land supply. The capital stock decreases and GDP falls.

November 14, 2023 at 9:49 AM

(5/n) With capital taxes, by contrast, investors shift finance away from capital investments and instead demand for land increases, driving up land prices, but not land supply. The capital stock decreases and GDP falls.

(4/n) Under land rent taxes, investors redirect financial flows from land to capital investments. Importantly, while land supply is fixed, the capital stock grows, and output = GDP increases.

November 14, 2023 at 9:49 AM

(4/n) Under land rent taxes, investors redirect financial flows from land to capital investments. Importantly, while land supply is fixed, the capital stock grows, and output = GDP increases.