This could be a transformational tool for attracting private investment into affordable housing.

And will be key for delivering 1.5 million homes this Parliament.

This could be a transformational tool for attracting private investment into affordable housing.

And will be key for delivering 1.5 million homes this Parliament.

This will be vital for attracting investment into affordable housing

And means the new £39bn Affordable Homes Programme can focus more on social rent homes to maximise affordability

This will be vital for attracting investment into affordable housing

And means the new £39bn Affordable Homes Programme can focus more on social rent homes to maximise affordability

💡The opportunity now is for the govt to scale this up to a national approach to ramp up housebuilding (11/12)

💡The opportunity now is for the govt to scale this up to a national approach to ramp up housebuilding (11/12)

With funding to invest in affordable housing funds if they can demonstrate they will deliver certain levels of affordable homes and can leverage wider private investment into projects (8/12)

With funding to invest in affordable housing funds if they can demonstrate they will deliver certain levels of affordable homes and can leverage wider private investment into projects (8/12)

Using low-interest loans can turn market-rate rental housing into affordable rent.

Equity investment can attract private investment, incl from pension funds (7/12)

Using low-interest loans can turn market-rate rental housing into affordable rent.

Equity investment can attract private investment, incl from pension funds (7/12)

Higher housing targets will increase local authority ambition and the grey belt reforms will bring more land into the system.

Yet, the government is still forecast to fall short of its 1.5 million homes target (4/12)

Higher housing targets will increase local authority ambition and the grey belt reforms will bring more land into the system.

Yet, the government is still forecast to fall short of its 1.5 million homes target (4/12)

40% fewer projects were started last year than the year before – with a similar number now as after the financial crisis (2/12)

40% fewer projects were started last year than the year before – with a similar number now as after the financial crisis (2/12)

Changes at regional level vs method consulted on are here.

Main point is that target is 9,000 higher in London and SE.

Changes at regional level vs method consulted on are here.

Main point is that target is 9,000 higher in London and SE.

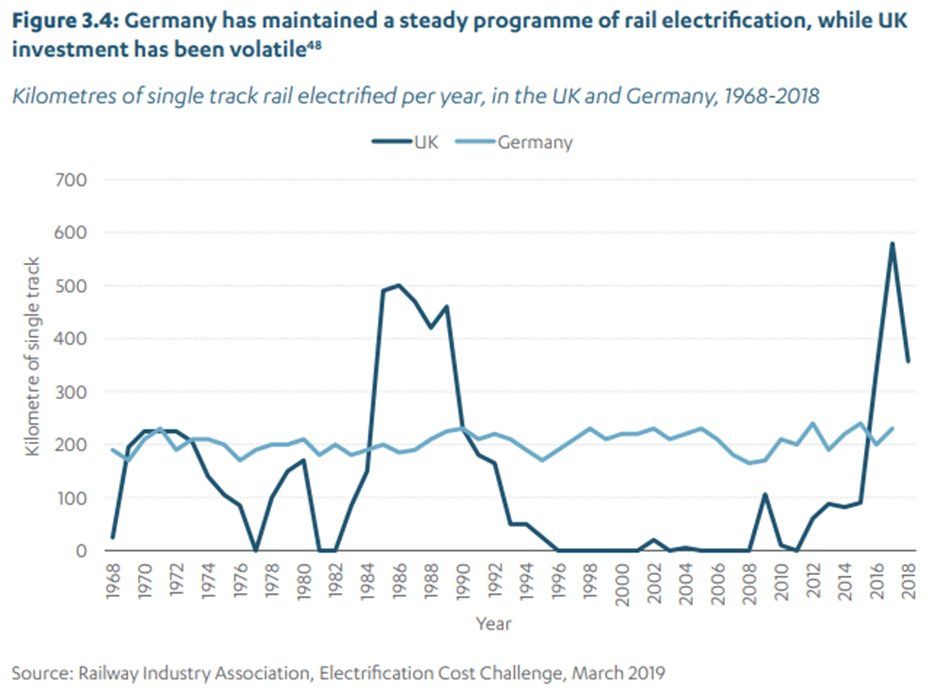

1. Key reason: a lack of strategic direction. They show the UK has the most volatile public investment levels across the G7 – which has reduced the supply chain’s confidence to invest.

1. Key reason: a lack of strategic direction. They show the UK has the most volatile public investment levels across the G7 – which has reduced the supply chain’s confidence to invest.

3. But looking at breakdowns. Those bearing highest costs of housing crisis are happier to live in new towns - young people (45%) and renters (40%) (2/3)

3. But looking at breakdowns. Those bearing highest costs of housing crisis are happier to live in new towns - young people (45%) and renters (40%) (2/3)

1. While most people think new towns would reduce pressure on existing towns and cities, only a 1/3 of people would want to live in or visit them. (1/3)

1. While most people think new towns would reduce pressure on existing towns and cities, only a 1/3 of people would want to live in or visit them. (1/3)