Mark Zandi

@markzandi.bsky.social

Chief Economist of Moody’s Analytics. Host of the Inside Economics podcast. Co-founder of Economy.com. Views expressed here are my own.

Reposted by Mark Zandi

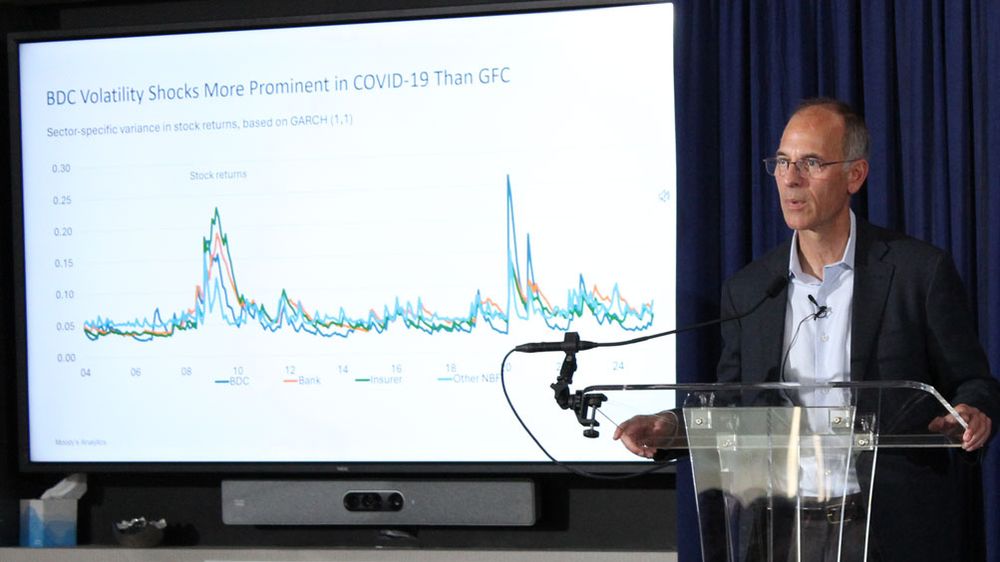

"The shape of the financial system has shifted from where it was in the Great Financial Crisis, from a bank-centric hub-and-spoke system with the banks in the middle and everyone else around the periphery to more of a web, with private credit more central in that web." - @markzandi.bsky.social

September 19, 2025 at 5:36 PM

"The shape of the financial system has shifted from where it was in the Great Financial Crisis, from a bank-centric hub-and-spoke system with the banks in the middle and everyone else around the periphery to more of a web, with private credit more central in that web." - @markzandi.bsky.social

Reposted by Mark Zandi

What have we learned from these first few months of talks?

@scottlincicome.bsky.social of @cato.org, Ramesh Ponnuru, @natasharsarin.bsky.social, @michaelrstrain.bsky.social, @justinwolfers.bsky.social and @markzandi.bsky.social weigh in:

@scottlincicome.bsky.social of @cato.org, Ramesh Ponnuru, @natasharsarin.bsky.social, @michaelrstrain.bsky.social, @justinwolfers.bsky.social and @markzandi.bsky.social weigh in:

Opinion | Trump’s tariff deadline: Six experts weigh in

Donald Trump’s deadline for countries to strike a trade deal with the U.S. or face hefty tariffs has arrived.

wapo.st

August 1, 2025 at 11:02 PM

What have we learned from these first few months of talks?

@scottlincicome.bsky.social of @cato.org, Ramesh Ponnuru, @natasharsarin.bsky.social, @michaelrstrain.bsky.social, @justinwolfers.bsky.social and @markzandi.bsky.social weigh in:

@scottlincicome.bsky.social of @cato.org, Ramesh Ponnuru, @natasharsarin.bsky.social, @michaelrstrain.bsky.social, @justinwolfers.bsky.social and @markzandi.bsky.social weigh in:

Reposted by Mark Zandi

Mark Zandi: “The housing downturn to date has been mostly about the depressed existing home sales. New home sales, housing completions, and house prices have held up well—that’s about to change.” http://f-st.co/M6nFvD7

Housing market ‘red flare’: Moody’s chief economist sees home price declines spreading

Mark Zandi: 'The housing downturn to date has been mostly about the depressed existing home sales. New home sales, housing completions, and house prices have held up well—that’s about to change.”

f-st.co

July 19, 2025 at 10:22 AM

Mark Zandi: “The housing downturn to date has been mostly about the depressed existing home sales. New home sales, housing completions, and house prices have held up well—that’s about to change.” http://f-st.co/M6nFvD7

I sent off a yellow flare on the housing market in a post a couple of weeks ago, but I now think a red flare is more appropriate. Home sales, homebuilding, and even house prices are set to slump unless mortgage rates decline materially from their current near 7% soon. That, however, seems unlikely.

July 14, 2025 at 7:40 PM

I sent off a yellow flare on the housing market in a post a couple of weeks ago, but I now think a red flare is more appropriate. Home sales, homebuilding, and even house prices are set to slump unless mortgage rates decline materially from their current near 7% soon. That, however, seems unlikely.

Reposted by Mark Zandi

How do trade, spending cuts, and policy uncertainty affect growth? @markzandi.bsky.social of Moodys Analytics warns that while a recession isn't imminent, long-term U.S. growth could suffer.

Listen here: econofact.org/podcast/thro...

Listen here: econofact.org/podcast/thro...

Throttling Back: The Long and Short-run Economic Effects of Continued Uncertainty | Econofact Chats

A discussion with Mark Zandi on how continued uncertainty could affect the U.S. economy over the coming months, and over the longer term.

econofact.org

July 3, 2025 at 2:01 PM

How do trade, spending cuts, and policy uncertainty affect growth? @markzandi.bsky.social of Moodys Analytics warns that while a recession isn't imminent, long-term U.S. growth could suffer.

Listen here: econofact.org/podcast/thro...

Listen here: econofact.org/podcast/thro...

Another sign of a softer job market is rising unemployment insurance claims. Continuining claims are up, and signaling a slump in hiring. Initial claims are also up as of late. Anything north of their current near 250k per week would suggest layoffs are rising, and the job market is stalling.

June 12, 2025 at 7:40 PM

Another sign of a softer job market is rising unemployment insurance claims. Continuining claims are up, and signaling a slump in hiring. Initial claims are also up as of late. Anything north of their current near 250k per week would suggest layoffs are rising, and the job market is stalling.

The more I cogitate on the May jobs report, released last Friday by the BLS, the more uncomfortable I get about the economy’s prospects. There are a bunch of reasons why (listen to this week’s Inside Economics podcast), but high on the list is the sharp drop-off in labor force growth.

June 9, 2025 at 4:54 PM

The more I cogitate on the May jobs report, released last Friday by the BLS, the more uncomfortable I get about the economy’s prospects. There are a bunch of reasons why (listen to this week’s Inside Economics podcast), but high on the list is the sharp drop-off in labor force growth.

The job market is steadily but surely throttling back. Monthly job gains are moderating, and most telling, the gains are being consistently revised lower, and not by a little bit. Indeed, after revision, monthly job gains appear to be closing in on 100k.

June 6, 2025 at 1:49 PM

The job market is steadily but surely throttling back. Monthly job gains are moderating, and most telling, the gains are being consistently revised lower, and not by a little bit. Indeed, after revision, monthly job gains appear to be closing in on 100k.

Fannie Mae & Freddie Mac’s fate is back under debate, 15 years after entering conservatorship. Their stock prices are up, but what’s next for the GSEs? Here’s a breakdown of the most likely scenarios over the next few years, their probabilities, and their impact on mortgage rates:

June 2, 2025 at 2:48 PM

Fannie Mae & Freddie Mac’s fate is back under debate, 15 years after entering conservatorship. Their stock prices are up, but what’s next for the GSEs? Here’s a breakdown of the most likely scenarios over the next few years, their probabilities, and their impact on mortgage rates:

I’m perplexed by the narrative that while the so-called soft economic data are in the dumper, the hard economic data are just fine. Really? No argument regarding the soft data. Consumer, business, and investor sentiment is about as dark as it gets, but the hard data have also taken on a shadowy hue.

May 11, 2025 at 4:41 PM

I’m perplexed by the narrative that while the so-called soft economic data are in the dumper, the hard economic data are just fine. Really? No argument regarding the soft data. Consumer, business, and investor sentiment is about as dark as it gets, but the hard data have also taken on a shadowy hue.

A high and rising number of American households are under mounting financial stress. That’s the message in the April delinquency rate data we calculate based on all the credit files in the country from the credit bureau Equifax.

May 9, 2025 at 3:48 PM

A high and rising number of American households are under mounting financial stress. That’s the message in the April delinquency rate data we calculate based on all the credit files in the country from the credit bureau Equifax.

After digging deep into the economic data released last week, from GDP to jobs, and all the releases in between, here’s why I’m even more concerned about the economy’s prospects:

May 4, 2025 at 1:53 PM

After digging deep into the economic data released last week, from GDP to jobs, and all the releases in between, here’s why I’m even more concerned about the economy’s prospects:

The April jobs report shows the economy is not in recession, despite the Q1 decline in GDP. Employment increased 177,000 in the month, suggesting the job market remain a firewall between continued growth and a downturn.

May 2, 2025 at 1:49 PM

The April jobs report shows the economy is not in recession, despite the Q1 decline in GDP. Employment increased 177,000 in the month, suggesting the job market remain a firewall between continued growth and a downturn.

Reposted by Mark Zandi

OPINION TODAY featured podcast —

Chuck Todd is joined by @markzandi.bsky.social, chief economist at Moody’s Analytics, to discuss the damaging effects of President Donald Trump’s tariffs and trade war on the U.S. economy.

opiniontoday.substack.com/i/162029400/...

Chuck Todd is joined by @markzandi.bsky.social, chief economist at Moody’s Analytics, to discuss the damaging effects of President Donald Trump’s tariffs and trade war on the U.S. economy.

opiniontoday.substack.com/i/162029400/...

April 25, 2025 at 12:25 AM

OPINION TODAY featured podcast —

Chuck Todd is joined by @markzandi.bsky.social, chief economist at Moody’s Analytics, to discuss the damaging effects of President Donald Trump’s tariffs and trade war on the U.S. economy.

opiniontoday.substack.com/i/162029400/...

Chuck Todd is joined by @markzandi.bsky.social, chief economist at Moody’s Analytics, to discuss the damaging effects of President Donald Trump’s tariffs and trade war on the U.S. economy.

opiniontoday.substack.com/i/162029400/...

The Trump administration’s policies are set to severely diminish the economy, not only for the next few months but for years. The administration’s trade war is undermining the global safe-haven status of the U.S., which has provided incalculable benefits, including our economy’s exceptionalism. 🧵

April 21, 2025 at 6:49 PM

The Trump administration’s policies are set to severely diminish the economy, not only for the next few months but for years. The administration’s trade war is undermining the global safe-haven status of the U.S., which has provided incalculable benefits, including our economy’s exceptionalism. 🧵

Reposted by Mark Zandi

Another great discussion with @markzandi.bsky.social trying to explain what the Trump admin is trying to do with tariffs. It’s the most complete explanation I have heard though I disagree they are competent or honest actors in their plan.

#tariffs #econsky

podcasts.apple.com/us/podcast/m...

#tariffs #econsky

podcasts.apple.com/us/podcast/m...

Channeling Trump

Podcast Episode · Moody's Talks - Inside Economics · 04/09/2025 · Bonus · 1h 16m

podcasts.apple.com

April 12, 2025 at 8:56 PM

Another great discussion with @markzandi.bsky.social trying to explain what the Trump admin is trying to do with tariffs. It’s the most complete explanation I have heard though I disagree they are competent or honest actors in their plan.

#tariffs #econsky

podcasts.apple.com/us/podcast/m...

#tariffs #econsky

podcasts.apple.com/us/podcast/m...

The U.S.’s global safe haven status is severely damaged by the U.S. tariffs and resulting global trade war. Global investors rightly question whether the U.S. is money good – the global economy’s Aaa credit. Thus, the spike in the long-term Treasury yields and the weaker U.S. dollar in recent days.

April 13, 2025 at 8:47 PM

The U.S.’s global safe haven status is severely damaged by the U.S. tariffs and resulting global trade war. Global investors rightly question whether the U.S. is money good – the global economy’s Aaa credit. Thus, the spike in the long-term Treasury yields and the weaker U.S. dollar in recent days.

Reposted by Mark Zandi

In the latest episode of The Delegates Lounge podcast, we're joined by Moody's Chief Economist @markzandi.bsky.social. Three guesses which classic movie reminds him of the present moment. Listen apple.co/4ejt5jE or wherever you get your podcasts.

April 2, 2025 at 5:16 PM

In the latest episode of The Delegates Lounge podcast, we're joined by Moody's Chief Economist @markzandi.bsky.social. Three guesses which classic movie reminds him of the present moment. Listen apple.co/4ejt5jE or wherever you get your podcasts.

Reposted by Mark Zandi

“The thing that worries me is that our economies are now quickly moving apart. They already have decoupled and they're disengaging. And it's becoming self-reinforcing.”

@markzandi.bsky.social on the #Tariffs impact on US-China relations.

podcasts.apple.com/us/podcast/t...

@markzandi.bsky.social on the #Tariffs impact on US-China relations.

podcasts.apple.com/us/podcast/t...

OTTD: Tariffs

Podcast Episode · The Middle with Jeremy Hobson · 03/10/2025 · 30m

podcasts.apple.com

April 9, 2025 at 8:20 PM

“The thing that worries me is that our economies are now quickly moving apart. They already have decoupled and they're disengaging. And it's becoming self-reinforcing.”

@markzandi.bsky.social on the #Tariffs impact on US-China relations.

podcasts.apple.com/us/podcast/t...

@markzandi.bsky.social on the #Tariffs impact on US-China relations.

podcasts.apple.com/us/podcast/t...

It was encouraging to see the President reverse himself on the so-called “reciprocal” tariffs yesterday, but I wouldn’t take much solace in it as the global trade war continues to rage. I still put the odds of a recession this year at 60%.

April 10, 2025 at 12:17 PM

It was encouraging to see the President reverse himself on the so-called “reciprocal” tariffs yesterday, but I wouldn’t take much solace in it as the global trade war continues to rage. I still put the odds of a recession this year at 60%.

Global businesses are now signaling recession. This is according to Moody’s weekly survey of businesses we’ve conducted for over 20 years. President Trump’s shocking hike in U.S. tariffs and China's tit-for-tat response crushed global business sentiment last week. 🧵

April 9, 2025 at 3:26 PM

Global businesses are now signaling recession. This is according to Moody’s weekly survey of businesses we’ve conducted for over 20 years. President Trump’s shocking hike in U.S. tariffs and China's tit-for-tat response crushed global business sentiment last week. 🧵

Reposted by Mark Zandi

Are we headed to a slower economy and faster rising prices? @markzandi.bsky.social of Moody's Analytics discusses the impacts of the Administration's policies, and policy uncertainty, in this new @econofact.bsky.social Chats episode. econofact.org/podcast/look...

Looking Ahead to the 2025 Economy | Econofact Chats

A discussion with Mark Zandi on factors shaping U.S. economic growth over the coming quarters.

econofact.org

March 31, 2025 at 7:08 PM

Are we headed to a slower economy and faster rising prices? @markzandi.bsky.social of Moody's Analytics discusses the impacts of the Administration's policies, and policy uncertainty, in this new @econofact.bsky.social Chats episode. econofact.org/podcast/look...

Reposted by Mark Zandi

As President Trump's self-proclaimed "Liberation Day" approaches on April 2nd, bringing with it a wave of new tariffs, @thedelegateslounge.bsky.social chats with Moody's Chief Economist @markzandi.bsky.social. Hear more of our conversation on Apple Podcasts apple.co/4ejt5jE or wherever you listen.

March 30, 2025 at 6:58 PM

As President Trump's self-proclaimed "Liberation Day" approaches on April 2nd, bringing with it a wave of new tariffs, @thedelegateslounge.bsky.social chats with Moody's Chief Economist @markzandi.bsky.social. Hear more of our conversation on Apple Podcasts apple.co/4ejt5jE or wherever you listen.

I’m raising my odds that a recession will begin at some point this year to 40%, up from 15% at the start of the year. Last week’s economic data were disconcerting, including the slide in consumer confidence, punk consumer spending, and persistently high inflation.

March 30, 2025 at 2:47 PM

I’m raising my odds that a recession will begin at some point this year to 40%, up from 15% at the start of the year. Last week’s economic data were disconcerting, including the slide in consumer confidence, punk consumer spending, and persistently high inflation.

Leading Indicator #2 -the FHA mortgage delinquency rate. This isn’t common on leading economic indicator lists but it may be a proverbial canary in the coal mine in the current context. FHA borrowers have low to moderate incomes, with a median income of 75k a year, and most are 1st time homebuyers.

March 24, 2025 at 5:45 PM

Leading Indicator #2 -the FHA mortgage delinquency rate. This isn’t common on leading economic indicator lists but it may be a proverbial canary in the coal mine in the current context. FHA borrowers have low to moderate incomes, with a median income of 75k a year, and most are 1st time homebuyers.