Pinned

“I don’t necessarily agree with everything I say.”

–Marshall McLuhan

–Marshall McLuhan

Comment: I sense that today’s politics have expanded gold sponsorship beyond its traditional libertarian borders. Guessing that left-leaning investors are now open to gold’s portfolio efficiency, which was generally not the case during my advisory career. H/t @RenMacLLC

November 10, 2025 at 3:19 PM

Comment: I sense that today’s politics have expanded gold sponsorship beyond its traditional libertarian borders. Guessing that left-leaning investors are now open to gold’s portfolio efficiency, which was generally not the case during my advisory career. H/t @RenMacLLC

GLD upper AVWAP was 375.5 at Friday's close, for those interested.

Honored to have contributed yesterday’s Chart of the Day. Don’t miss Patrick’s instructive clip regarding "AVWAP pinch.” www.thechartreport.com/cotd/11-06-25

Chart of the Day - Thursday, November 6, 2025

www.thechartreport.com

November 10, 2025 at 2:12 PM

GLD upper AVWAP was 375.5 at Friday's close, for those interested.

Confirmation on deck. Requires a close above Friday's high. A close above today's headline-driven open would further the case, in my view.

November 10, 2025 at 1:24 PM

Confirmation on deck. Requires a close above Friday's high. A close above today's headline-driven open would further the case, in my view.

1/ Heads up. 10-day average of NYSE new lows >4% has signaled cyclical tops in 11 of 20 cases since 1990. It would take an average of roughly 130 new lows over the next two sessions to hurdle 4%.

November 8, 2025 at 2:57 PM

1/ Heads up. 10-day average of NYSE new lows >4% has signaled cyclical tops in 11 of 20 cases since 1990. It would take an average of roughly 130 new lows over the next two sessions to hurdle 4%.

Wake me up when tech rolls over.

November 7, 2025 at 10:43 PM

Wake me up when tech rolls over.

Comment: Sharp correction followed by bull-market continuation commands the middle ground.

November 7, 2025 at 12:51 PM

Comment: Sharp correction followed by bull-market continuation commands the middle ground.

Honored to have contributed yesterday’s Chart of the Day. Don’t miss Patrick’s instructive clip regarding "AVWAP pinch.” www.thechartreport.com/cotd/11-06-25

Chart of the Day - Thursday, November 6, 2025

www.thechartreport.com

November 7, 2025 at 10:52 AM

Honored to have contributed yesterday’s Chart of the Day. Don’t miss Patrick’s instructive clip regarding "AVWAP pinch.” www.thechartreport.com/cotd/11-06-25

October job loss per Revelio Labs.

November 6, 2025 at 2:41 PM

October job loss per Revelio Labs.

Today's Challenger layoff report is boosting bond prices in early trading, but hasn't reversed yesterday's losses.

November 6, 2025 at 1:45 PM

Today's Challenger layoff report is boosting bond prices in early trading, but hasn't reversed yesterday's losses.

GLD anchored VWAP from last point of supply preceding 30% runup (blue), and frothy top preceding 11% drawdown (orange). Am I framing this correctly?

November 6, 2025 at 1:21 PM

GLD anchored VWAP from last point of supply preceding 30% runup (blue), and frothy top preceding 11% drawdown (orange). Am I framing this correctly?

Keeping a loose eye on housing.

November 5, 2025 at 2:56 PM

Keeping a loose eye on housing.

Is Palantir beyond repair?

November 5, 2025 at 12:04 PM

Is Palantir beyond repair?

Mid-week humor

November 5, 2025 at 11:27 AM

Mid-week humor

Why is it so hard to beat the S&P 500? Because cap-weighted indexes automatically promote winners and demote losers. As my old boss would say, “It’s not what you own that kills performance, it’s what you don’t.”

November 4, 2025 at 3:32 PM

Why is it so hard to beat the S&P 500? Because cap-weighted indexes automatically promote winners and demote losers. As my old boss would say, “It’s not what you own that kills performance, it’s what you don’t.”

If SPX continues to track post-1998 behavior (big if), expect fearful pullbacks toward 100dma, 200dma, or further. Comments: 1) All analogs eventually fail; 2) That today’s momentum regime is youthful by historic standards doesn’t preclude large drawdowns.

November 4, 2025 at 1:55 PM

If SPX continues to track post-1998 behavior (big if), expect fearful pullbacks toward 100dma, 200dma, or further. Comments: 1) All analogs eventually fail; 2) That today’s momentum regime is youthful by historic standards doesn’t preclude large drawdowns.

Does the dollar influence SPX leadership, or does SPX leadership influence the buck? Probably both. As a practical matter, it’s enough to know that each trend corroborates the other.

November 3, 2025 at 1:16 PM

Does the dollar influence SPX leadership, or does SPX leadership influence the buck? Probably both. As a practical matter, it’s enough to know that each trend corroborates the other.

Extreme regime. H/t @_rob_anderson

November 3, 2025 at 10:31 AM

Extreme regime. H/t @_rob_anderson

Comment: From a contrarian perspective, unusually high interest in my post-1998 analog suggests that the scenario is unlikely to play out. Wisdom of crowds or folly of crowds? 🤔

So far so good.

November 1, 2025 at 12:51 PM

Comment: From a contrarian perspective, unusually high interest in my post-1998 analog suggests that the scenario is unlikely to play out. Wisdom of crowds or folly of crowds? 🤔

H/t @FusionptCapital

October 31, 2025 at 11:36 AM

H/t @FusionptCapital

Reposted by Mark Ungewitter

Note to self: XLP/SPY is echoing post-LTCM behavior, suggesting a mature secular regime.

September 23, 2025 at 12:07 PM

Note to self: XLP/SPY is echoing post-LTCM behavior, suggesting a mature secular regime.

So far so good.

October 30, 2025 at 10:57 AM

So far so good.

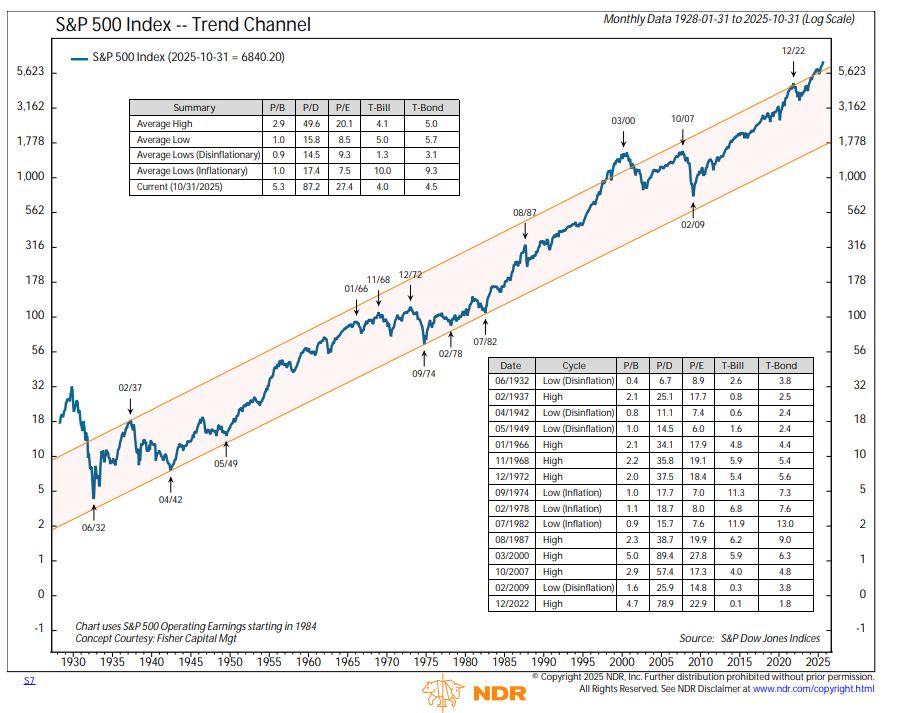

Channel time. H/t @TechCharts

October 30, 2025 at 10:38 AM

Channel time. H/t @TechCharts

Big tech on deck. META, MSFT, and GOOGL all report after today's bell. AMZN due tomorrow evening.

October 29, 2025 at 4:05 PM

Big tech on deck. META, MSFT, and GOOGL all report after today's bell. AMZN due tomorrow evening.

Q: Does anomalous price/breadth of yesterday's ilk flag important tops? A: Sometimes. Never a layup, is it?

October 29, 2025 at 12:00 PM

Q: Does anomalous price/breadth of yesterday's ilk flag important tops? A: Sometimes. Never a layup, is it?

Mid-week humor

October 29, 2025 at 10:39 AM

Mid-week humor