Remarkably every one of those losses has been 30% or worse

2000: -36.1%

2001: -33.3%

2002: -37.4%

2008: -41.7%

2022: -32.4%

awealthofcommonsense.com/2025/12/the-...

Remarkably every one of those losses has been 30% or worse

2000: -36.1%

2001: -33.3%

2002: -37.4%

2008: -41.7%

2022: -32.4%

awealthofcommonsense.com/2025/12/the-...

US stocks +18%

International stocks +30%

US bonds +7%

Simple 3-fund 60/40 portfolio +16%

Boring investing still works:

awealthofcommonsense.com/2025/12/bori...

US stocks +18%

International stocks +30%

US bonds +7%

Simple 3-fund 60/40 portfolio +16%

Boring investing still works:

awealthofcommonsense.com/2025/12/bori...

Housing prices have fallen 2x in the past 11 recessions

Is it finally going to happen in 2026?

awealthofcommonsense.com/2025/12/will...

Housing prices have fallen 2x in the past 11 recessions

Is it finally going to happen in 2026?

awealthofcommonsense.com/2025/12/will...

One of my readers retired at the peak of the dot-com bubble followed by two crashes & a lost decade

Here's the story about how he managed his investment plan through some seriously bad luck on retirement timing:

awealthofcommonsense.com/2025/11/the-...

One of my readers retired at the peak of the dot-com bubble followed by two crashes & a lost decade

Here's the story about how he managed his investment plan through some seriously bad luck on retirement timing:

awealthofcommonsense.com/2025/11/the-...

1. It was a massive infrastructure buildout

2. It was full of grifters

But the grifters back then were on another level

Here's the story:

awealthofcommonsense.com/2025/11/the-...

1. It was a massive infrastructure buildout

2. It was full of grifters

But the grifters back then were on another level

Here's the story:

awealthofcommonsense.com/2025/11/the-...

The good news is housing is much more affordable in the US than many other developed countries

The bad news is unless we do something about it things could get even worse

awealthofcommonsense.com/2025/12/the-...

The good news is housing is much more affordable in the US than many other developed countries

The bad news is unless we do something about it things could get even worse

awealthofcommonsense.com/2025/12/the-...

The average down year in the stock market is -13%

How much will the stock market fall in 2026?

awealthofcommonsense.com/2025/11/how-...

The average down year in the stock market is -13%

How much will the stock market fall in 2026?

awealthofcommonsense.com/2025/11/how-...

thecollegeinvestor.com/17145/would-...

thecollegeinvestor.com/17145/would-...

#studentloans

thecollegeinvestor.com/22725/studen...

#studentloans

thecollegeinvestor.com/22725/studen...

Visual Capitalist provides a glance at the insightful data: https://www.voronoiapp.com/category/Americans-Average-Net-Worth-by-Age-7233

Visual Capitalist provides a glance at the insightful data: https://www.voronoiapp.com/category/Americans-Average-Net-Worth-by-Age-7233

Ehsan Soltani breaks it down and explores the data at: https://www.voronoiapp.com/category/-Four-AI-Giants-Drove-Half-of-the-2025-US-Stock-Market-Rally-7214

Ehsan Soltani breaks it down and explores the data at: https://www.voronoiapp.com/category/-Four-AI-Giants-Drove-Half-of-the-2025-US-Stock-Market-Rally-7214

Are investors prepared for a recessionary bear market that lasts more than a few months?

Do we need one to wash out the excesses?

Which generation of investors would feel the most pain?

awealthofcommonsense.com/2025/11/do-w...

Are investors prepared for a recessionary bear market that lasts more than a few months?

Do we need one to wash out the excesses?

Which generation of investors would feel the most pain?

awealthofcommonsense.com/2025/11/do-w...

He used margin to make the purchase

The money was to be used to buy a home

Can you save an investor like this?

awealthofcommonsense.com/2025/11/goin...

He used margin to make the purchase

The money was to be used to buy a home

Can you save an investor like this?

awealthofcommonsense.com/2025/11/goin...

Investors always talk about what stocks to buy, biggest risks, economic data, etc

That stuff is far less important than simply maxing out your 401k every year

Saving more money is your best hedge

awealthofcommonsense.com/2025/11/max-...

Investors always talk about what stocks to buy, biggest risks, economic data, etc

That stuff is far less important than simply maxing out your 401k every year

Saving more money is your best hedge

awealthofcommonsense.com/2025/11/max-...

#studentloans #hr

#studentloans #hr

#studentloans

#studentloans

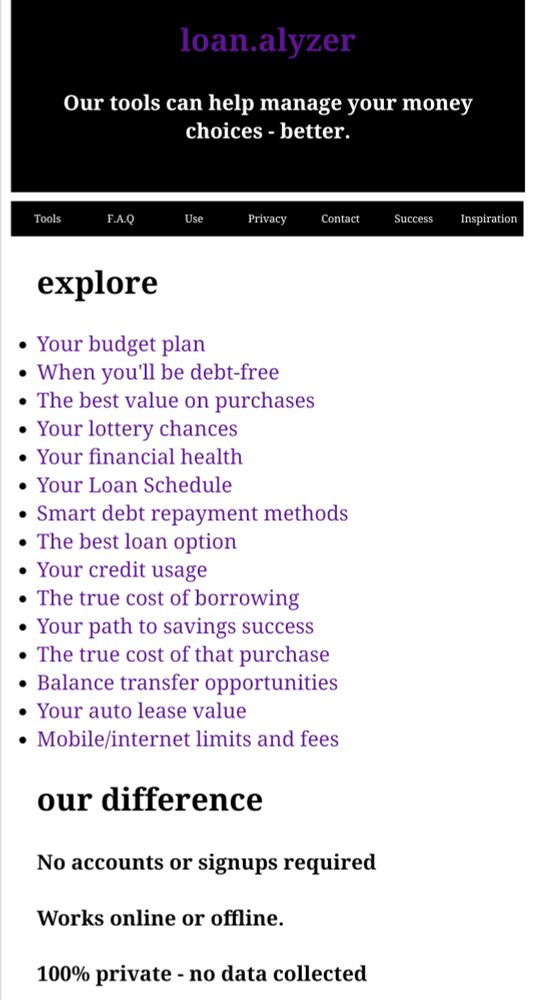

#personal #finance #loans #debt #credit #data #savings #shopping #lottery #networth #data #automobile #balance #transfer #lottery #lotto #budget #independence

loan.alyzer.com/instant-insp...

#ZigZiglarWisdom

#results #choice #action #change #journey #forward #growth #Quotes #Progress #experience #Life #Lessons #wisdom

#Monday #Timeless #Advice #quote #tshirt #inspiration #joy #lessons #MondayMotivation

It's a K-shaped economy

Young ppl are screwed

Only the rich are thriving

I get it but think we're taking this too far

What if things are better than they seem on social media?

Some facts, figures and thoughts on this:

awealthofcommonsense.com/2025/11/what...

It's a K-shaped economy

Young ppl are screwed

Only the rich are thriving

I get it but think we're taking this too far

What if things are better than they seem on social media?

Some facts, figures and thoughts on this:

awealthofcommonsense.com/2025/11/what...

1. 50 year mortgages (not that helpful)

2. One time 3% mortgage for anyone who missed out (not bad)

3. Build more housing (we're deregulating everything else but not this for some reason)

awealthofcommonsense.com/2025/11/the-...

1. 50 year mortgages (not that helpful)

2. One time 3% mortgage for anyone who missed out (not bad)

3. Build more housing (we're deregulating everything else but not this for some reason)

awealthofcommonsense.com/2025/11/the-...

1. There are more rules in place (no SEC, FDIC back then)

2. The stock market is way more important (1-2% of households owned stocks in 1929)

3. Policymakers have learned from past crises

awealthofcommonsense.com/2025/11/why-...

1. There are more rules in place (no SEC, FDIC back then)

2. The stock market is way more important (1-2% of households owned stocks in 1929)

3. Policymakers have learned from past crises

awealthofcommonsense.com/2025/11/why-...

#investing

#investing

thecollegeinvestor.com/32275/hsa-an...

thecollegeinvestor.com/32275/hsa-an...

After the crash from 1929-1932 the $2.5 million turned into just $375k

In his memoir Graham wrote about how hubris was the cause of his losses

Some thoughts on bull market brain:

awealthofcommonsense.com/2025/11/ben-...

After the crash from 1929-1932 the $2.5 million turned into just $375k

In his memoir Graham wrote about how hubris was the cause of his losses

Some thoughts on bull market brain:

awealthofcommonsense.com/2025/11/ben-...