Inspired by great investors who tout reading beyond the scope of investing, I'm going to be disciplined in reading classics. A great excuse to get this going is putting myself out there. Hope you'll join me!

🔗 in prof

Inspired by great investors who tout reading beyond the scope of investing, I'm going to be disciplined in reading classics. A great excuse to get this going is putting myself out there. Hope you'll join me!

🔗 in prof

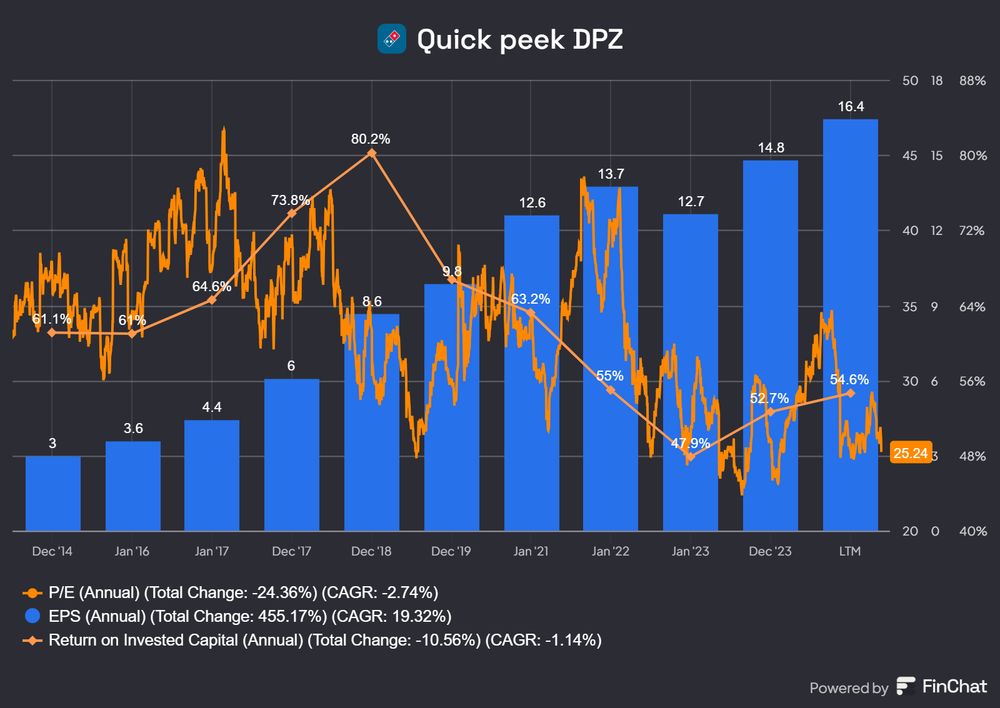

Could've said its due to concerns about the slide away from democracy, but it's due to valuations.

Still no value investor, but I want higher fwd IRRs than 4-7% which is what I "found" in my (former) US holdings.

Could've said its due to concerns about the slide away from democracy, but it's due to valuations.

Still no value investor, but I want higher fwd IRRs than 4-7% which is what I "found" in my (former) US holdings.

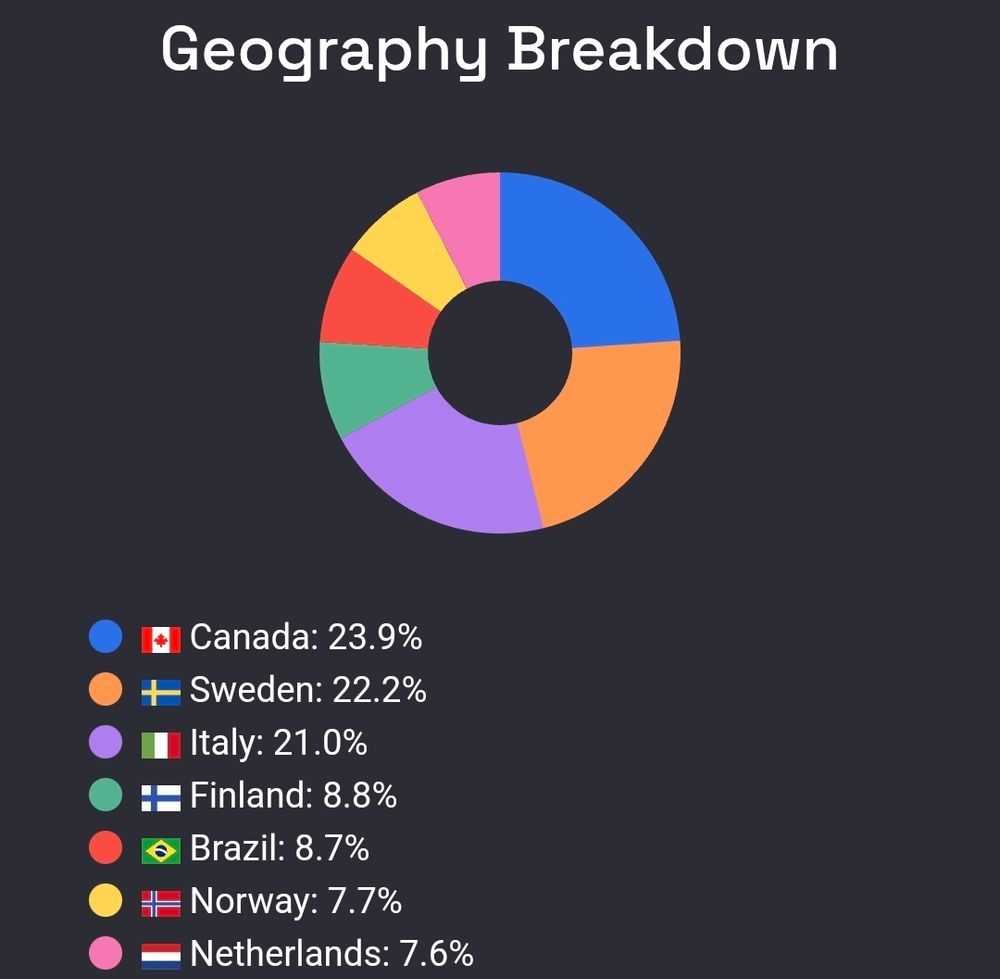

+32% net income (even absorbing a more than doubling in taxes in Q4)

FCFA2S +27%

EBITA margins: 28,5%

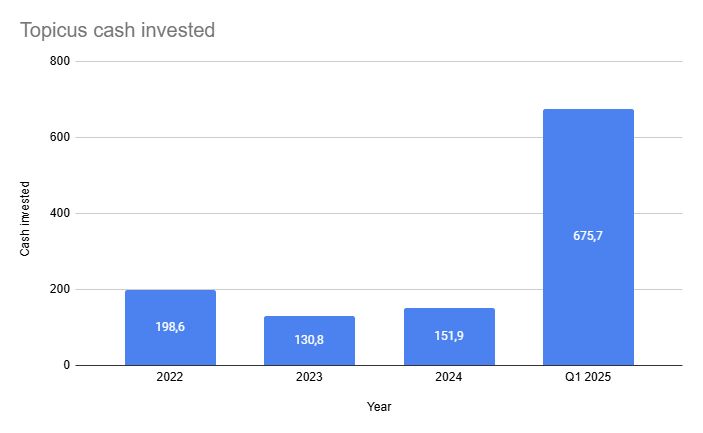

This is before the insane Q1 of cash deployment is added to the company. Despite the recent share price jump it's still an attractive opportunity.

+32% net income (even absorbing a more than doubling in taxes in Q4)

FCFA2S +27%

EBITA margins: 28,5%

This is before the insane Q1 of cash deployment is added to the company. Despite the recent share price jump it's still an attractive opportunity.

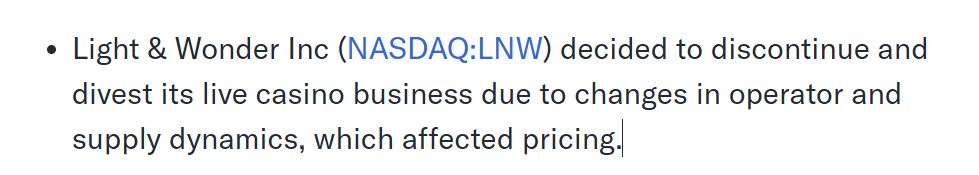

Evolution AB is looking better and better each day imo. Keep focused on the fundamentals and the business.

Evolution AB is looking better and better each day imo. Keep focused on the fundamentals and the business.

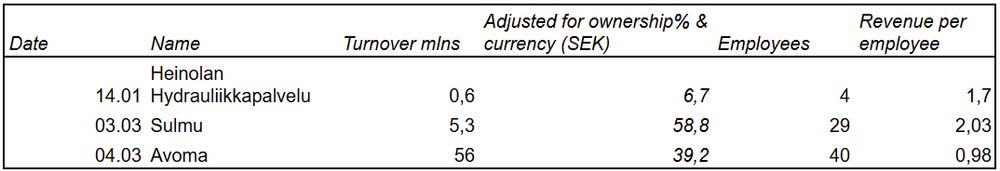

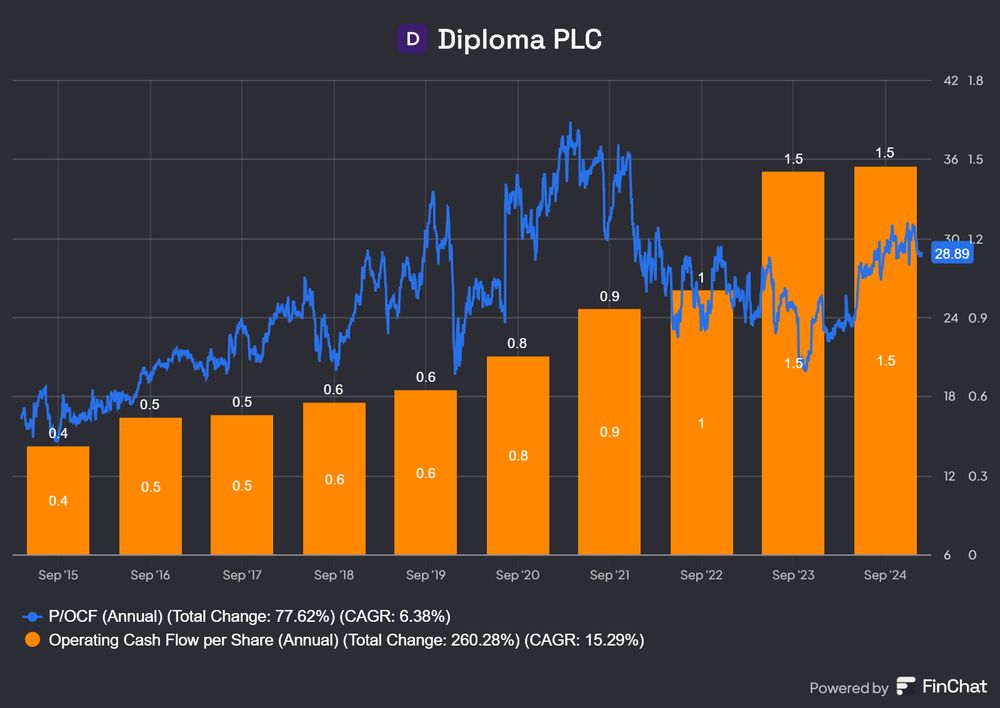

They operate within controls, seals and life sciences. $DPLM have a disciplined M&A approach that allows them to compound at a high rate alongside pretty good organic growth.

They operate within controls, seals and life sciences. $DPLM have a disciplined M&A approach that allows them to compound at a high rate alongside pretty good organic growth.

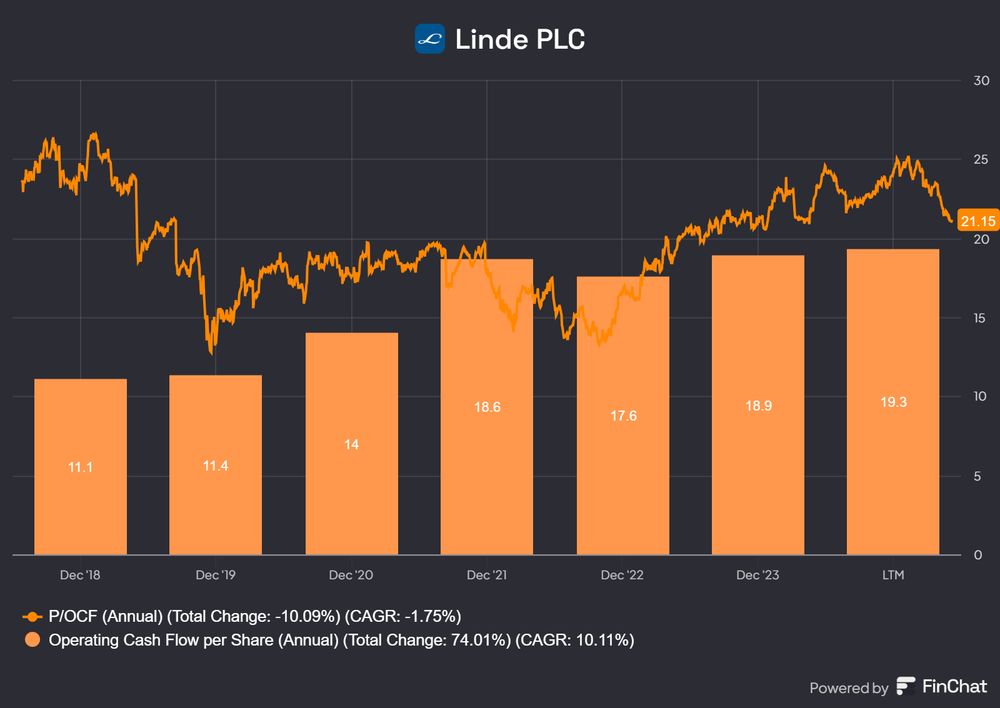

$LIN cater to every gas need their customers have. Their integrated distribution model, where they become an integral part of their customers production chain creates a very defensive business.

$LIN cater to every gas need their customers have. Their integrated distribution model, where they become an integral part of their customers production chain creates a very defensive business.