Inspired by great investors who tout reading beyond the scope of investing, I'm going to be disciplined in reading classics. A great excuse to get this going is putting myself out there. Hope you'll join me!

🔗 in prof

Inspired by great investors who tout reading beyond the scope of investing, I'm going to be disciplined in reading classics. A great excuse to get this going is putting myself out there. Hope you'll join me!

🔗 in prof

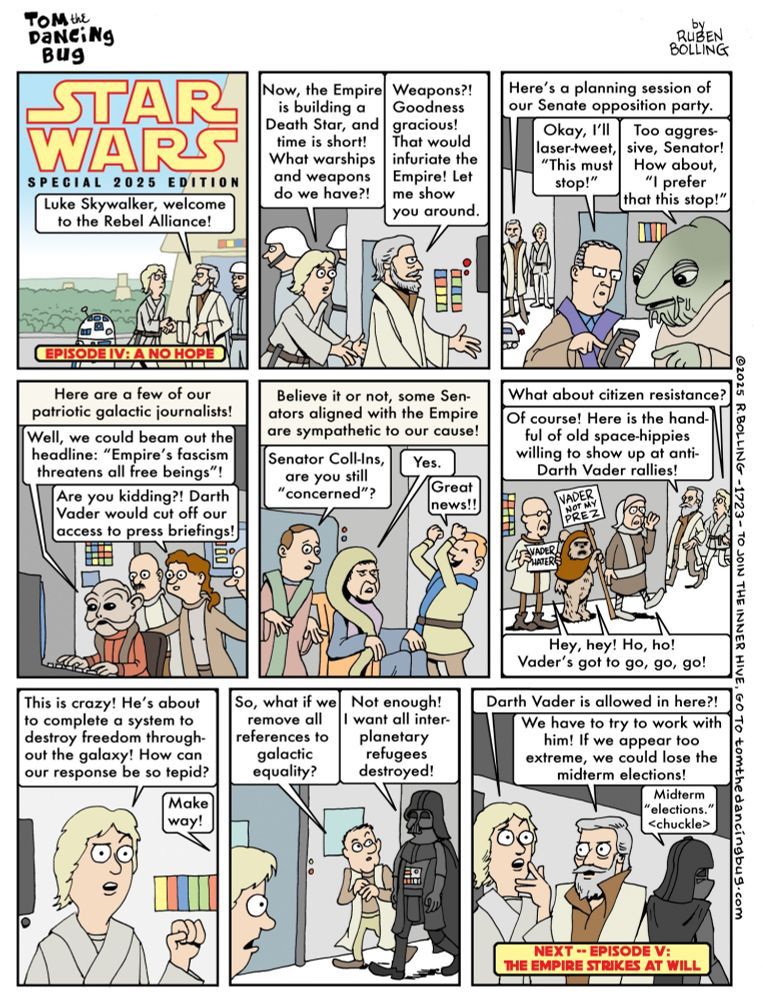

Trump is basically King Louis XII.

Lays the grounds for several strong adversaries to expand (🇷🇺, but mostly 🇨🇳)

Weakens allies due to fear of other strong powers

Aggrandisement of powers he idolises

Trump is basically King Louis XII.

Lays the grounds for several strong adversaries to expand (🇷🇺, but mostly 🇨🇳)

Weakens allies due to fear of other strong powers

Aggrandisement of powers he idolises

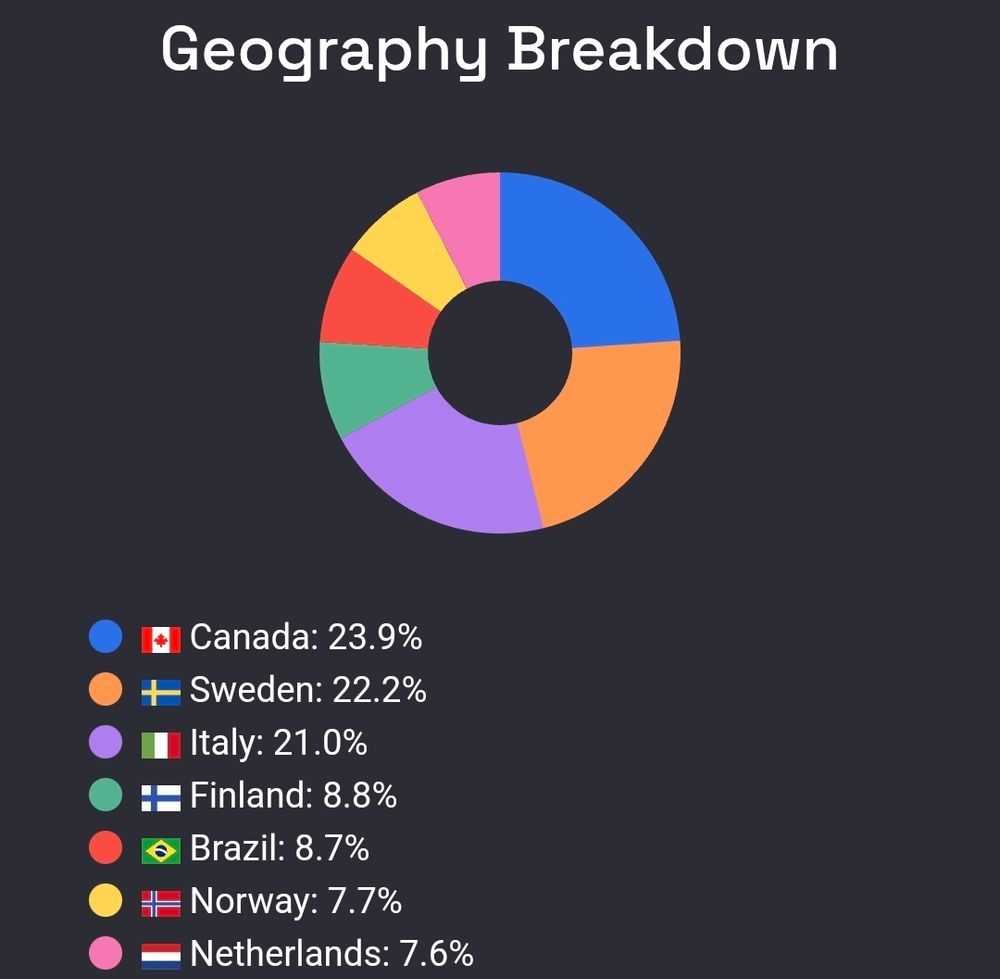

But not looking forward to the volatility of LATAM and credit exposure 🧙♂️

But not looking forward to the volatility of LATAM and credit exposure 🧙♂️

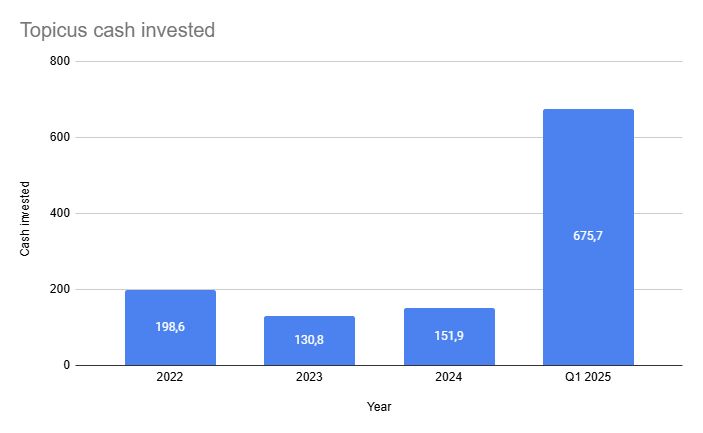

Avoma, industrial services acquisition, with SEK 56mln in turnover and 40 employees

Sulmu, industrial acquisition, with SEK 59.2mln in turnover and 29 employees

Good to see things ramp up, they typically pay between 5-7x EBITA and 1.3-1.7x revenue.

Avoma, industrial services acquisition, with SEK 56mln in turnover and 40 employees

Sulmu, industrial acquisition, with SEK 59.2mln in turnover and 29 employees

Good to see things ramp up, they typically pay between 5-7x EBITA and 1.3-1.7x revenue.

Could've said its due to concerns about the slide away from democracy, but it's due to valuations.

Still no value investor, but I want higher fwd IRRs than 4-7% which is what I "found" in my (former) US holdings.

Could've said its due to concerns about the slide away from democracy, but it's due to valuations.

Still no value investor, but I want higher fwd IRRs than 4-7% which is what I "found" in my (former) US holdings.

Also: A bunch of tips for podcasts, newsletters and more!

February post below 👇

open.substack.com/pub/growthby...

Also: A bunch of tips for podcasts, newsletters and more!

February post below 👇

open.substack.com/pub/growthby...

+32% net income (even absorbing a more than doubling in taxes in Q4)

FCFA2S +27%

EBITA margins: 28,5%

This is before the insane Q1 of cash deployment is added to the company. Despite the recent share price jump it's still an attractive opportunity.

+32% net income (even absorbing a more than doubling in taxes in Q4)

FCFA2S +27%

EBITA margins: 28,5%

This is before the insane Q1 of cash deployment is added to the company. Despite the recent share price jump it's still an attractive opportunity.

Evolution AB is looking better and better each day imo. Keep focused on the fundamentals and the business.

Evolution AB is looking better and better each day imo. Keep focused on the fundamentals and the business.

I'm currently looking into three great companies that I'm considering either adding to, or opening a position in:

1. $DPZ

2. $LIN

3. $DPLM

More about each company 👇

I'm currently looking into three great companies that I'm considering either adding to, or opening a position in:

1. $DPZ

2. $LIN

3. $DPLM

More about each company 👇

(Obviously not a big deal, but I'd love to be able to search a $ instead of #)

(Obviously not a big deal, but I'd love to be able to search a $ instead of #)

I write about my investing and learning journey at my Substack: growthbylearning.substack.com

I try to write deep dives on undercovered compounders, share what I learn in my investment process and about musings that come and go in relation to investing learnings.

I write about my investing and learning journey at my Substack: growthbylearning.substack.com

I try to write deep dives on undercovered compounders, share what I learn in my investment process and about musings that come and go in relation to investing learnings.