Layna Mosley

@laynamosley.bsky.social

Political economy of finance; supply chains & worker rights; Princeton Sovereign Finance Lab. @princetonpolitics.bsky.social

Co-editor of International Organization. Recovering trail runner, very amateur rower. https://laynamosley.scholar.princeton.edu/

Co-editor of International Organization. Recovering trail runner, very amateur rower. https://laynamosley.scholar.princeton.edu/

Manels are so last century.

(Then again....)

(Then again....)

October 26, 2025 at 10:46 PM

Manels are so last century.

(Then again....)

(Then again....)

Still not too old to not take stationery from IOs.

October 22, 2025 at 2:07 PM

Still not too old to not take stationery from IOs.

Maybe it's less impressive to issue debt at just over US rates, given that the US has become (or should become?) a riskier place?

on.ft.com/3VCzxuE

on.ft.com/3VCzxuE

September 26, 2025 at 4:25 PM

Maybe it's less impressive to issue debt at just over US rates, given that the US has become (or should become?) a riskier place?

on.ft.com/3VCzxuE

on.ft.com/3VCzxuE

Next: president attempts to fire the head of the S&P for not providing better numbers.

August 1, 2025 at 8:57 PM

Next: president attempts to fire the head of the S&P for not providing better numbers.

Federal debt has been increasing for decades. Global reserve currency status (and default risk perceived to be zero) means the US has been able to borrow cheaply, even as debt/GDP ratio has grown.

fiscaldata.treasury.gov/americas-fin...

fiscaldata.treasury.gov/americas-fin...

May 25, 2025 at 7:51 PM

Federal debt has been increasing for decades. Global reserve currency status (and default risk perceived to be zero) means the US has been able to borrow cheaply, even as debt/GDP ratio has grown.

fiscaldata.treasury.gov/americas-fin...

fiscaldata.treasury.gov/americas-fin...

Good that some emerging market countries are still able to access credit via bond markets....but less clear whether the worst has passed....

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

May 4, 2025 at 6:19 PM

Good that some emerging market countries are still able to access credit via bond markets....but less clear whether the worst has passed....

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

Interested in sovereign debt transparency? The Sovereign Debt Forum is running this event on May 14, in conjunction with the IMF Legal Department. Details on registration for the virtual event are here:

@princetonsovfinlab.bsky.social

@princetonsovfinlab.bsky.social

May 4, 2025 at 6:15 PM

Interested in sovereign debt transparency? The Sovereign Debt Forum is running this event on May 14, in conjunction with the IMF Legal Department. Details on registration for the virtual event are here:

@princetonsovfinlab.bsky.social

@princetonsovfinlab.bsky.social

Thrilled to spend a couple days talking all things sovereign debt at our annual @princetonsovfinlab.bsky.social DC conference.

psfl.princeton.edu/events/2025/...

psfl.princeton.edu/events/2025/...

April 23, 2025 at 6:15 PM

Thrilled to spend a couple days talking all things sovereign debt at our annual @princetonsovfinlab.bsky.social DC conference.

psfl.princeton.edu/events/2025/...

psfl.princeton.edu/events/2025/...

Harvard reminding everyone that they are the patriots.

April 18, 2025 at 1:29 PM

Harvard reminding everyone that they are the patriots.

The Trump administration has created (more) long-term reputational risks for the US -- as an investment location as well as a sovereign borrower -- and these are unlikely to disappear anytime soon.

on.ft.com/42mekbf

on.ft.com/42mekbf

April 11, 2025 at 3:00 PM

The Trump administration has created (more) long-term reputational risks for the US -- as an investment location as well as a sovereign borrower -- and these are unlikely to disappear anytime soon.

on.ft.com/42mekbf

on.ft.com/42mekbf

Sure, but Liz Truss resigned after the mini-budget (and the tariff policy is so much worse...)

on.ft.com/4loDui8

on.ft.com/4loDui8

April 9, 2025 at 12:07 PM

Sure, but Liz Truss resigned after the mini-budget (and the tariff policy is so much worse...)

on.ft.com/4loDui8

on.ft.com/4loDui8

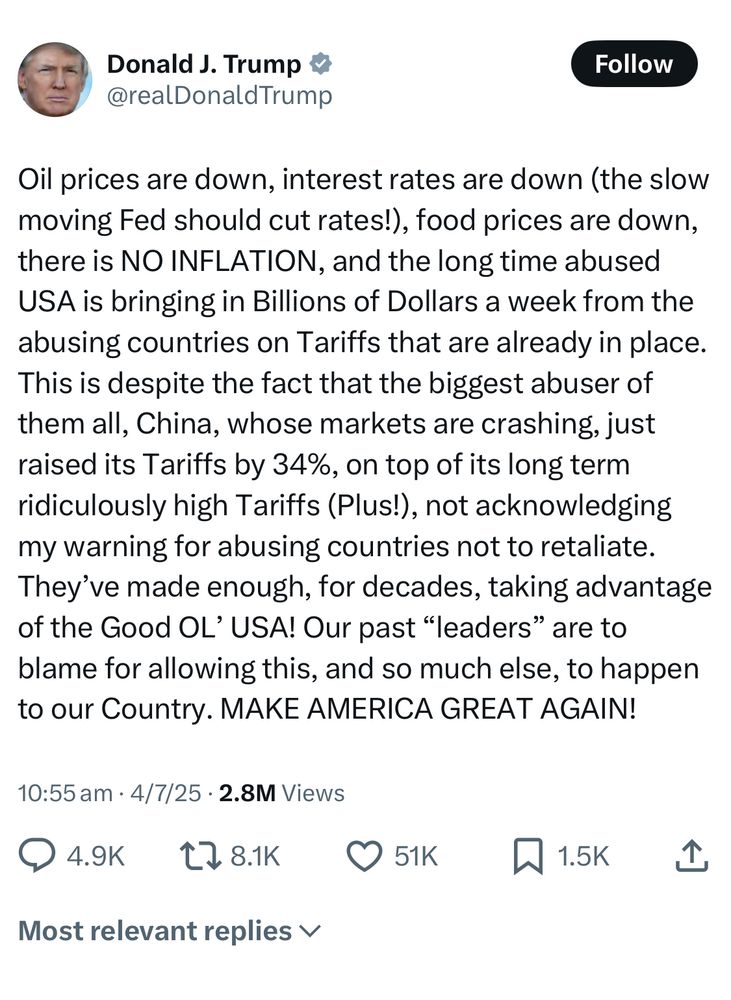

It’s bad enough that he doesn’t understand economics or trade policy.

But I don’t think he even understands how ignorant he is.

(Also can we raise the tariffs on randomly capitalized letters, even if they are domestically manufactured?)

But I don’t think he even understands how ignorant he is.

(Also can we raise the tariffs on randomly capitalized letters, even if they are domestically manufactured?)

April 7, 2025 at 3:30 PM

It’s bad enough that he doesn’t understand economics or trade policy.

But I don’t think he even understands how ignorant he is.

(Also can we raise the tariffs on randomly capitalized letters, even if they are domestically manufactured?)

But I don’t think he even understands how ignorant he is.

(Also can we raise the tariffs on randomly capitalized letters, even if they are domestically manufactured?)

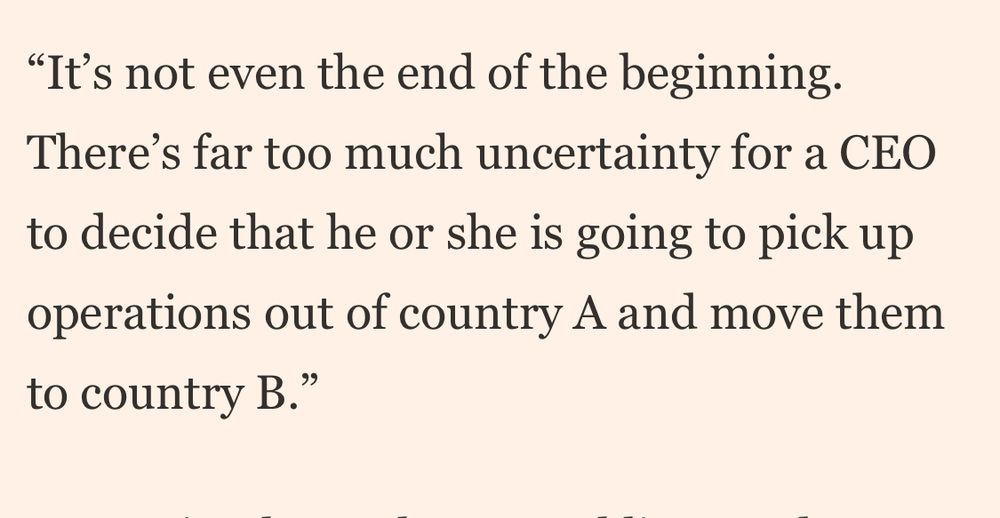

Corporate America fears wrath of Trump as it mulls tariffs response

And this should include, firms aren’t going to move production back the the US, in the face of eroding rule of law and heightened political risk…

And this should include, firms aren’t going to move production back the the US, in the face of eroding rule of law and heightened political risk…

April 5, 2025 at 7:06 PM

Corporate America fears wrath of Trump as it mulls tariffs response

And this should include, firms aren’t going to move production back the the US, in the face of eroding rule of law and heightened political risk…

And this should include, firms aren’t going to move production back the the US, in the face of eroding rule of law and heightened political risk…

Does @robinwigglesworth.ft.com know about #DebtCon?

@agelpern.bsky.social @upanizza.bsky.social

www.law.georgetown.edu/iiel/initiat...

@agelpern.bsky.social @upanizza.bsky.social

www.law.georgetown.edu/iiel/initiat...

February 9, 2025 at 11:05 PM

My fifth grader is learning that tariffs are taxes. That's something, I guess.

January 30, 2025 at 6:22 PM

My fifth grader is learning that tariffs are taxes. That's something, I guess.

Fun fact about the 1944 Bretton Woods conference (officially, the United Nations Monetary and Financial Conference): not enough space for everyone at the hotel, so some delegations had satellite housing -- including China, 22 miles away.

@princetonsovfinlab.bsky.social

@princetonsovfinlab.bsky.social

December 24, 2024 at 7:01 PM

Fun fact about the 1944 Bretton Woods conference (officially, the United Nations Monetary and Financial Conference): not enough space for everyone at the hotel, so some delegations had satellite housing -- including China, 22 miles away.

@princetonsovfinlab.bsky.social

@princetonsovfinlab.bsky.social

Avocado (consumption is) toast.

88% of US avocado imports came from Mexico (2019-2021).

88% of US avocado imports came from Mexico (2019-2021).

November 26, 2024 at 4:35 AM

Avocado (consumption is) toast.

88% of US avocado imports came from Mexico (2019-2021).

88% of US avocado imports came from Mexico (2019-2021).

When discussing sovereign default in class leads to a Ferris Bueller reference...

November 20, 2024 at 2:56 AM

When discussing sovereign default in class leads to a Ferris Bueller reference...