Jordi Schröder Bosch

@jordischroeder.bsky.social

PhD Candidate at FU Berlin, EQUALFIN doctoral program “Finance and Inequality in Times of Polycrisis”

Researcher at Positive Money EU.

IMFS | Central Banking | Political Economy

Researcher at Positive Money EU.

IMFS | Central Banking | Political Economy

Line goes up!

ember-energy.org/latest-insig...

ember-energy.org/latest-insig...

November 6, 2025 at 3:07 PM

Line goes up!

ember-energy.org/latest-insig...

ember-energy.org/latest-insig...

This is absolutely nuts.

November 6, 2025 at 3:05 PM

This is absolutely nuts.

Finally, we have the first ECB “estimate” of future bank demand for excess reserves, ranging from €600 billion to €2.2 trillion, depending on banks’ HQLA holdings and LCR targets.

November 6, 2025 at 11:51 AM

Finally, we have the first ECB “estimate” of future bank demand for excess reserves, ranging from €600 billion to €2.2 trillion, depending on banks’ HQLA holdings and LCR targets.

Compared to other countries, excess reserves remain abundant in the euro area, with the spread of repo rates over policy rates currently slightly negative.

November 6, 2025 at 11:51 AM

Compared to other countries, excess reserves remain abundant in the euro area, with the spread of repo rates over policy rates currently slightly negative.

However, this increases duration risk in banks' balance sheets. An increase in government bond rates would have a significant impact on banks' LCRs. The role of reserves as HQLA is one of the main reasons why today’s normalisation does not entail a return to the pre-GFC framework.

November 6, 2025 at 11:51 AM

However, this increases duration risk in banks' balance sheets. An increase in government bond rates would have a significant impact on banks' LCRs. The role of reserves as HQLA is one of the main reasons why today’s normalisation does not entail a return to the pre-GFC framework.

As reserves have decreased, banks have absorbed the decline in HQLA assets by purchasing government bonds, keeping their LCRs relatively stable.

November 6, 2025 at 11:51 AM

As reserves have decreased, banks have absorbed the decline in HQLA assets by purchasing government bonds, keeping their LCRs relatively stable.

As for structural monetary policy operations, the ECB will first launch structural refinancing operations, followed later by a structural securities portfolio once legacy bond holdings have wound down sufficiently. Before implementation, MROs and 3m LTROs need to pick up considerably.

November 6, 2025 at 11:51 AM

As for structural monetary policy operations, the ECB will first launch structural refinancing operations, followed later by a structural securities portfolio once legacy bond holdings have wound down sufficiently. Before implementation, MROs and 3m LTROs need to pick up considerably.

While China's exports to the US have decreased, they have strongly increased for ASEAN countries.

(www.ecb.europa.eu//press/key/d...)

(www.ecb.europa.eu//press/key/d...)

November 6, 2025 at 9:03 AM

While China's exports to the US have decreased, they have strongly increased for ASEAN countries.

(www.ecb.europa.eu//press/key/d...)

(www.ecb.europa.eu//press/key/d...)

Interesting figures from Philip Lane. The constant downward revision to real exports is quite telling.

November 6, 2025 at 9:03 AM

Interesting figures from Philip Lane. The constant downward revision to real exports is quite telling.

In 2024, there was a significant decline in gas and coal power generation. The electricity sector in the EU is becoming increasingly decarbonised, and the integration of batteries will hopefully accelerate this positive trend.

Source: ember-energy.org/latest-insig...

Source: ember-energy.org/latest-insig...

October 5, 2025 at 11:32 AM

In 2024, there was a significant decline in gas and coal power generation. The electricity sector in the EU is becoming increasingly decarbonised, and the integration of batteries will hopefully accelerate this positive trend.

Source: ember-energy.org/latest-insig...

Source: ember-energy.org/latest-insig...

But solar (and wind) are replacing fossil fuels. Coal power generation in the EU has been declining for more than a decade, and gas power generation has been decreasing over the last 5 years.

October 5, 2025 at 11:27 AM

But solar (and wind) are replacing fossil fuels. Coal power generation in the EU has been declining for more than a decade, and gas power generation has been decreasing over the last 5 years.

Anyway, free Palestine

September 27, 2025 at 5:40 PM

Anyway, free Palestine

Given Trump’s current attacks on the Fed, we should not fall back on defending the policy regime that is partly responsible for the current state of affairs. It is imperative to push our own progressive project. Worth reading @adamtooze.bsky.social here:

adamtooze.substack.com/p/chartbook-...

adamtooze.substack.com/p/chartbook-...

August 26, 2025 at 2:27 PM

Given Trump’s current attacks on the Fed, we should not fall back on defending the policy regime that is partly responsible for the current state of affairs. It is imperative to push our own progressive project. Worth reading @adamtooze.bsky.social here:

adamtooze.substack.com/p/chartbook-...

adamtooze.substack.com/p/chartbook-...

Este articulo parece escrito como si las dos últimas décadas no hubieran existido y pasa por alto la diferencia fundamental entre deuda en moneda propia y moneda extranjera.

Conviene recordar que el gasto público destinado al pago de intereses es bajo desde una perspectiva histórica.

Conviene recordar que el gasto público destinado al pago de intereses es bajo desde una perspectiva histórica.

August 25, 2025 at 11:20 AM

Este articulo parece escrito como si las dos últimas décadas no hubieran existido y pasa por alto la diferencia fundamental entre deuda en moneda propia y moneda extranjera.

Conviene recordar que el gasto público destinado al pago de intereses es bajo desde una perspectiva histórica.

Conviene recordar que el gasto público destinado al pago de intereses es bajo desde una perspectiva histórica.

El problema del títol d'"economista" és que un cap de suro amb un títol d'ADE, un màster en neuromarketing (lol) i una experiència laboral basada en prometre retorns del 15% sense risc (lol), se'l pot autoatorgar sense que ningú ho qüestioni.

August 22, 2025 at 9:31 AM

El problema del títol d'"economista" és que un cap de suro amb un títol d'ADE, un màster en neuromarketing (lol) i una experiència laboral basada en prometre retorns del 15% sense risc (lol), se'l pot autoatorgar sense que ningú ho qüestioni.

Y volviendo al principio, seguimos viendo diferencias marcadas en el ciclo. A mí lo que me parece sorprendente del período post-GFC es la disciplina de capital de las constructoras, garantizando que la vivienda sea un activo escaso. Para paliar esto, más que regulación, necesitas inversión pública.

August 9, 2025 at 12:53 PM

Y volviendo al principio, seguimos viendo diferencias marcadas en el ciclo. A mí lo que me parece sorprendente del período post-GFC es la disciplina de capital de las constructoras, garantizando que la vivienda sea un activo escaso. Para paliar esto, más que regulación, necesitas inversión pública.

This is the way

August 8, 2025 at 11:13 AM

This is the way

"today I'm a big believer" says the executive of a semiconductor company, after the line started to go up. Please interview this man again once the line starts going down.

August 8, 2025 at 11:03 AM

"today I'm a big believer" says the executive of a semiconductor company, after the line started to go up. Please interview this man again once the line starts going down.

This creates an extremely uneven playing field, where countries facing high WACC—mostly due to their country macroeconomic profile—will have much less competitive renewable electricity prices due to the much higher financing costs.

www.irena.org/Publications...

www.irena.org/Publications...

August 4, 2025 at 2:47 PM

This creates an extremely uneven playing field, where countries facing high WACC—mostly due to their country macroeconomic profile—will have much less competitive renewable electricity prices due to the much higher financing costs.

www.irena.org/Publications...

www.irena.org/Publications...

Great graph from the last @irena-official.bsky.social report, which illustrates the centrality of financing costs in renewable electricity LCOE, especially in Africa. Bringing down financing costs for renewable projects is central to boosting the green transition worldwide.

August 4, 2025 at 2:47 PM

Great graph from the last @irena-official.bsky.social report, which illustrates the centrality of financing costs in renewable electricity LCOE, especially in Africa. Bringing down financing costs for renewable projects is central to boosting the green transition worldwide.

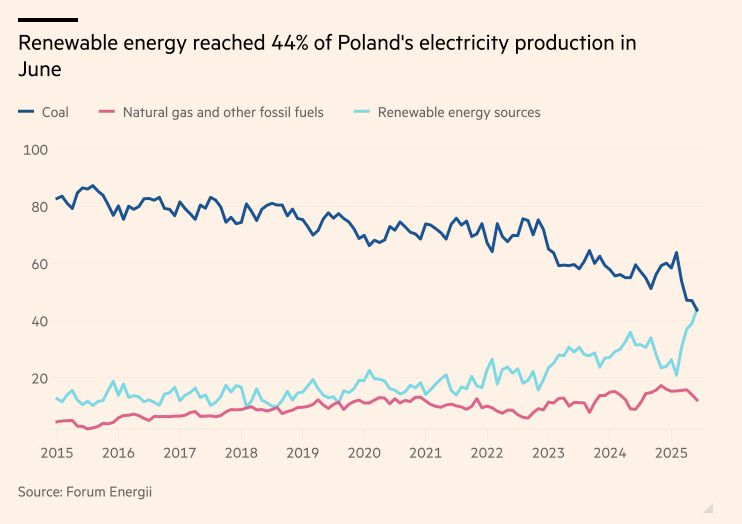

Huge: renewable energy overtakes coal for the first time in Poland.

"The country now boasts 23 gigawatts of installed solar capacity — more than three times the 2030 target set in 2021 — largely thanks to a solar energy push from the former PiS government."

"The country now boasts 23 gigawatts of installed solar capacity — more than three times the 2030 target set in 2021 — largely thanks to a solar energy push from the former PiS government."

July 3, 2025 at 8:08 AM

Huge: renewable energy overtakes coal for the first time in Poland.

"The country now boasts 23 gigawatts of installed solar capacity — more than three times the 2030 target set in 2021 — largely thanks to a solar energy push from the former PiS government."

"The country now boasts 23 gigawatts of installed solar capacity — more than three times the 2030 target set in 2021 — largely thanks to a solar energy push from the former PiS government."

Race, what race?

July 1, 2025 at 12:28 PM

Race, what race?

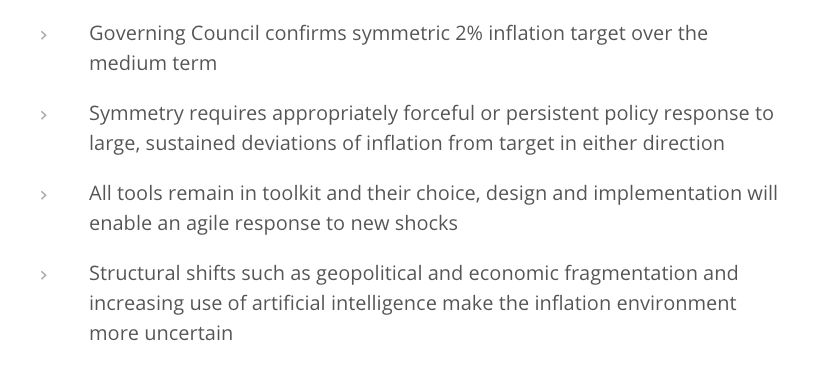

The ECB present the results of its strategy assessment. Whereas the 2021 strategy review focused on flexibility when responding to shocks, the ECB now argues that a more forceful response is needed. This can have important distributive consequences going forward.

www.ecb.europa.eu/press/pr/dat...

www.ecb.europa.eu/press/pr/dat...

June 30, 2025 at 9:46 AM

The ECB present the results of its strategy assessment. Whereas the 2021 strategy review focused on flexibility when responding to shocks, the ECB now argues that a more forceful response is needed. This can have important distributive consequences going forward.

www.ecb.europa.eu/press/pr/dat...

www.ecb.europa.eu/press/pr/dat...

Hi @isabelschnabel.bsky.social, there's a point that puzzles me from your recent speech. Back in 2022, you argued that a flat Philips Curve justified a forceful reaction by the ECB.

Yet in your latest speech, you suggest that a steep Phillips Curve also calls for a forceful reaction.

Yet in your latest speech, you suggest that a steep Phillips Curve also calls for a forceful reaction.

May 14, 2025 at 9:36 AM

Hi @isabelschnabel.bsky.social, there's a point that puzzles me from your recent speech. Back in 2022, you argued that a flat Philips Curve justified a forceful reaction by the ECB.

Yet in your latest speech, you suggest that a steep Phillips Curve also calls for a forceful reaction.

Yet in your latest speech, you suggest that a steep Phillips Curve also calls for a forceful reaction.