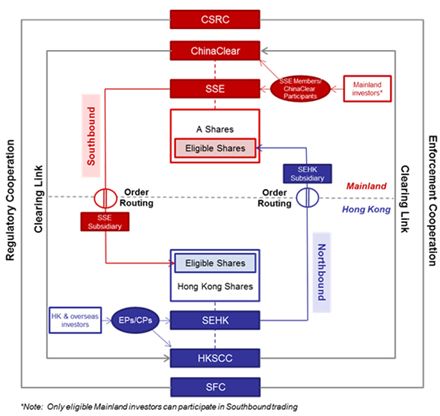

China is not building a dollar-style empire of sprawling markets and speculative finance but something leaner, more functional & tightly managed.

www.phenomenalworld.org/analysis/a-s...

China is not building a dollar-style empire of sprawling markets and speculative finance but something leaner, more functional & tightly managed.

www.phenomenalworld.org/analysis/a-s...

We bring the Frankfurt School into the Spotify age — and it was a fun one to write! 😎

'From Adorno to 50 Cent: Financialized platform capitalism, Spotify, and the culture industry in the twenty-first century' in @finandsoc.bsky.social

Check it out here:

doi.org/10.1017/fas....

We bring the Frankfurt School into the Spotify age — and it was a fun one to write! 😎

'From Adorno to 50 Cent: Financialized platform capitalism, Spotify, and the culture industry in the twenty-first century' in @finandsoc.bsky.social

Check it out here:

doi.org/10.1017/fas....

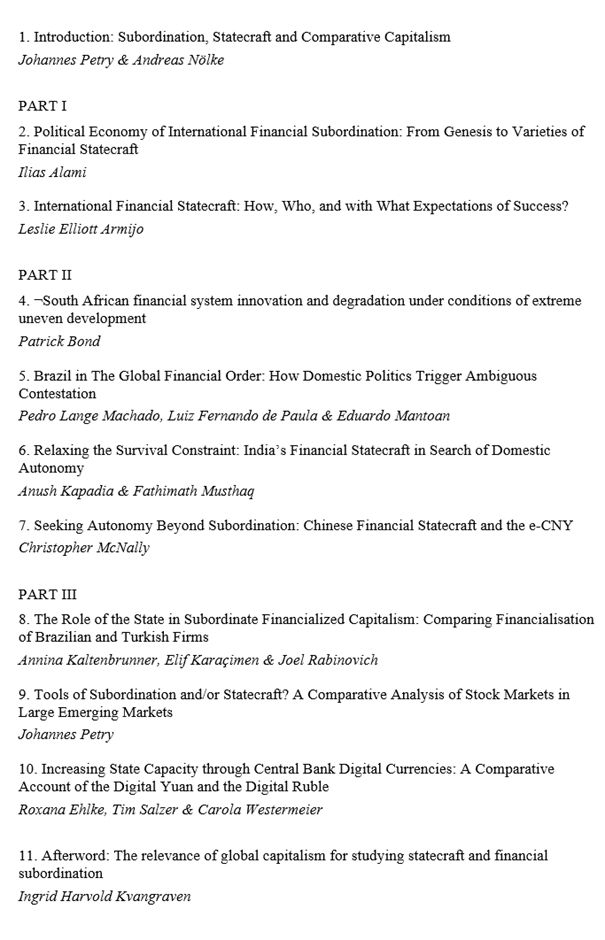

Check out the book here:

bristoluniversitypressdigital.com/edcollbook/b...

1/

Check out the book here:

bristoluniversitypressdigital.com/edcollbook/b...

1/

Very honoured to have contributed two chapters on exchanges and ESG (with Jan Fichtner & Robin Jaspert) to this volume 🙂

www.cambridge.org/core/books/c...

www.cambridge.org/core/books/c...

Very honoured to have contributed two chapters on exchanges and ESG (with Jan Fichtner & Robin Jaspert) to this volume 🙂

www.cambridge.org/core/books/c...

www.cambridge.org/core/books/c...

In 'China’s quest for pricing power' I analyse the connection between financial hierarchy, autonomy & commodity futures markets!

Forthcoming as part of our special issue on 'Asia in global finance' @iajournal.bsky.social

osf.io/preprints/so...

In 'China’s quest for pricing power' I analyse the connection between financial hierarchy, autonomy & commodity futures markets!

Forthcoming as part of our special issue on 'Asia in global finance' @iajournal.bsky.social

osf.io/preprints/so...

Check out p.25 in today’s print edition for the full interview

CKN report: www.chinakennisnetwerk.nl/publications...

Check out p.25 in today’s print edition for the full interview

CKN report: www.chinakennisnetwerk.nl/publications...

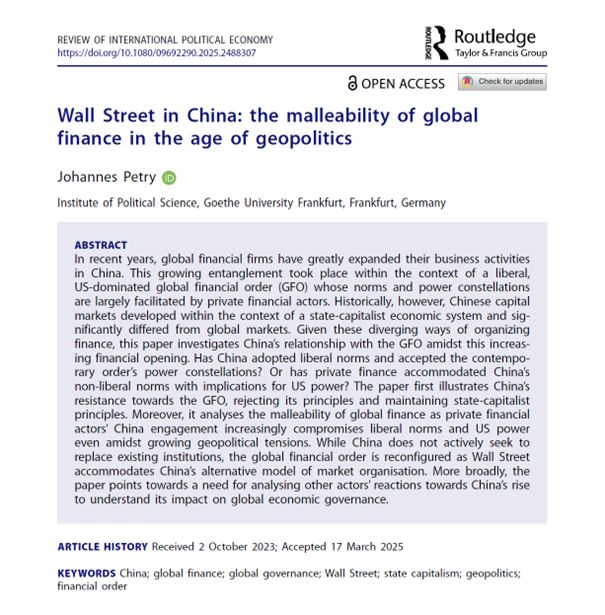

www.tandfonline.com/doi/full/10....

www.tandfonline.com/doi/full/10....

While striving for autonomy amid growing geopolitical pressures, China’s also creates new dependencies in global trade, finance, & technology:

Beyond Hegemony: China’s Quest for Domestic Autonomy, Creation of Global Dependencies?

check the CfP: tinyurl.com/5a4c949r

While striving for autonomy amid growing geopolitical pressures, China’s also creates new dependencies in global trade, finance, & technology:

Beyond Hegemony: China’s Quest for Domestic Autonomy, Creation of Global Dependencies?

check the CfP: tinyurl.com/5a4c949r

With a keynote by Dariusz Wojcik - author of the Atlas of Finance

For full details, check the CfP: tinyurl.com/3z2dy57b

@ineteconomics.bsky.social @goetheuni.bsky.social

With a keynote by Dariusz Wojcik - author of the Atlas of Finance

For full details, check the CfP: tinyurl.com/3z2dy57b

@ineteconomics.bsky.social @goetheuni.bsky.social

Let me know if you want to grab a coffee in London sometime! 🙂 @lseir.bsky.social

Let me know if you want to grab a coffee in London sometime! 🙂 @lseir.bsky.social

Looking forward to exploring Wall Street in China, financial ties with the Middle East, commodity pricing power & other topics as a visiting scholar at Fudan & Peking University in March/April! 🤓

Looking forward to exploring Wall Street in China, financial ties with the Middle East, commodity pricing power & other topics as a visiting scholar at Fudan & Peking University in March/April! 🤓

Great to see this online 🙂

www.youtube.com/watch?v=EUZx...

Great to see this online 🙂

www.youtube.com/watch?v=EUZx...

With fabulous contributions by @iliasalami.bsky.social, @ingridhk.bsky.social, @anninak.bsky.social, @c-westermeier.bsky.social & many others /1

With fabulous contributions by @iliasalami.bsky.social, @ingridhk.bsky.social, @anninak.bsky.social, @c-westermeier.bsky.social & many others /1

@financeandspace.bsky.social 🥳

on China's rise within the context of increasing geopolitical competition and its implications for the politics of global finance 🙂

www.tandfonline.com/doi/full/10....

@financeandspace.bsky.social 🥳

on China's rise within the context of increasing geopolitical competition and its implications for the politics of global finance 🙂

www.tandfonline.com/doi/full/10....

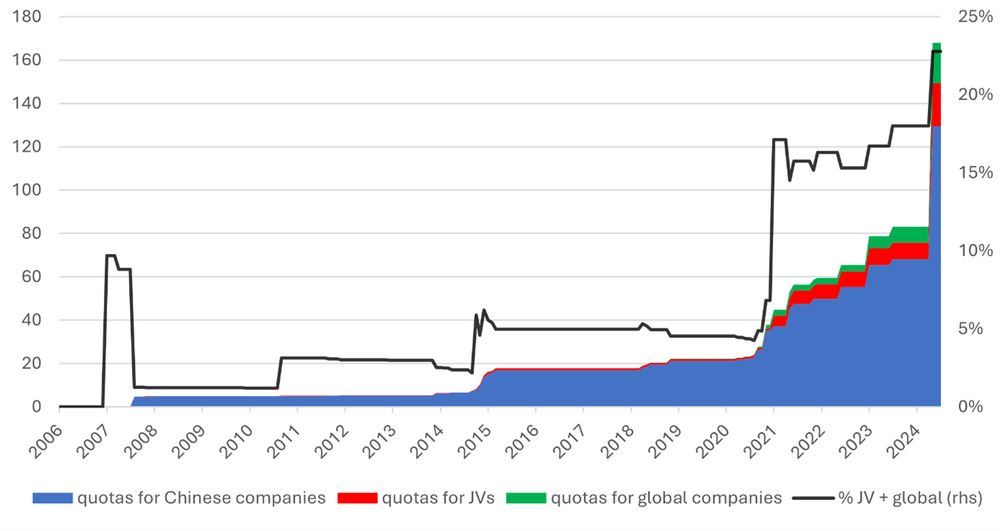

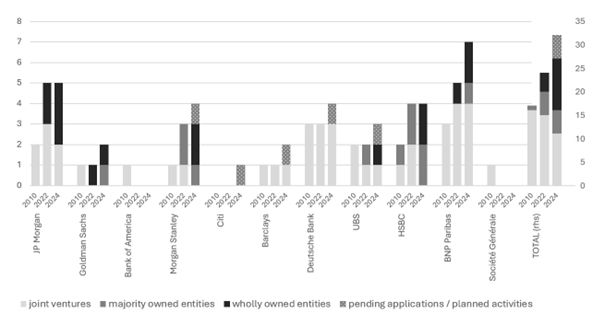

We're collecting ownership data of 4000+ companies to assess varieties of capital markets globally.

-> here a sneak peak of listed companies in the BRICS, US & UK 😎

We're collecting ownership data of 4000+ companies to assess varieties of capital markets globally.

-> here a sneak peak of listed companies in the BRICS, US & UK 😎