Joel Jacobs

@joeljacobs.bsky.social

Data reporter @propublica.org. Former software engineer.

.

.

Reposted by Joel Jacobs

Trump says he loves vets. He's promised to "put veterans first."

He's also planning to cut the agency that cares for more than nine million of them.

If you're a vet who gets care at VA -- or you work there -- *we want to hear from you.*

www.propublica.org/getinvolved/...

He's also planning to cut the agency that cares for more than nine million of them.

If you're a vet who gets care at VA -- or you work there -- *we want to hear from you.*

www.propublica.org/getinvolved/...

Have You Been Affected by Changes at the Department of Veterans Affairs? Tell Us About It.

Have you experienced setbacks in your care or benefits amid the changes at the Department of Veterans Affairs? ProPublica wants to hear from you.

www.propublica.org

May 6, 2025 at 10:59 AM

Trump says he loves vets. He's promised to "put veterans first."

He's also planning to cut the agency that cares for more than nine million of them.

If you're a vet who gets care at VA -- or you work there -- *we want to hear from you.*

www.propublica.org/getinvolved/...

He's also planning to cut the agency that cares for more than nine million of them.

If you're a vet who gets care at VA -- or you work there -- *we want to hear from you.*

www.propublica.org/getinvolved/...

Reposted by Joel Jacobs

Strategically parked around the corner …

February 27, 2025 at 2:57 PM

Strategically parked around the corner …

For more, see our full tribal lending series here: www.propublica.org/series/despe...

Or check out my thread on our previous reporting 👇

Or check out my thread on our previous reporting 👇

ICYMI: Last week @megomatz.bsky.social and I reported on how the tribal lending industry has survived and thrived offering exorbitant online loans to millions of borrowers — with APRs that can exceed 600%.

www.propublica.org/article/trib...

We’ve been investigating this opaque industry for months:🧵

www.propublica.org/article/trib...

We’ve been investigating this opaque industry for months:🧵

The Tribal Lending Industry Offers Quick Cash Online at Outrageous Interest Rates. Here’s How It’s Survived.

Despite lawsuits, prosecutions and federal crackdown attempts, the tribal lending industry has adapted for over a decade, providing exorbitant loans to millions of financially vulnerable consumers.

www.propublica.org

January 15, 2025 at 4:20 PM

For more, see our full tribal lending series here: www.propublica.org/series/despe...

Or check out my thread on our previous reporting 👇

Or check out my thread on our previous reporting 👇

11/ Read more: www.propublica.org/article/trib...

January 3, 2025 at 12:20 AM

11/ Read more: www.propublica.org/article/trib...

10/ Despite lawsuits, prosecutions and federal crackdown attempts, how has the industry managed to persist? With help from powerful lobbying groups that have spent millions.

“This is a very entrenched industry with a lot of dollars at stake,” said UNM law professor Nathalie Martin.

“This is a very entrenched industry with a lot of dollars at stake,” said UNM law professor Nathalie Martin.

January 3, 2025 at 12:20 AM

10/ Despite lawsuits, prosecutions and federal crackdown attempts, how has the industry managed to persist? With help from powerful lobbying groups that have spent millions.

“This is a very entrenched industry with a lot of dollars at stake,” said UNM law professor Nathalie Martin.

“This is a very entrenched industry with a lot of dollars at stake,” said UNM law professor Nathalie Martin.

9/ In a statement to ProPublica last year, John Johnson Sr., LDF’s president, described the tribe’s lending business as “a narrative of empowerment, ethical business practice, and commitment to community enrichment.”

January 3, 2025 at 12:20 AM

9/ In a statement to ProPublica last year, John Johnson Sr., LDF’s president, described the tribe’s lending business as “a narrative of empowerment, ethical business practice, and commitment to community enrichment.”

8/ The tribe has since faced state legal action – in November, it agreed to stop lending in Minnesota and forgive debt to MN residents as part of an agreement with the state’s AG: www.propublica.org/article/minn...

A Tribal Lender Charging 800% APR Has Agreed to Stop Operating in Minnesota

The Lac du Flambeau tribe of Wisconsin settled a civil suit filed by Minnesota’s attorney general that alleged its triple-digit interest rates violated state caps. The tribe is under increasing legal ...

www.propublica.org

January 3, 2025 at 12:20 AM

8/ The tribe has since faced state legal action – in November, it agreed to stop lending in Minnesota and forgive debt to MN residents as part of an agreement with the state’s AG: www.propublica.org/article/minn...

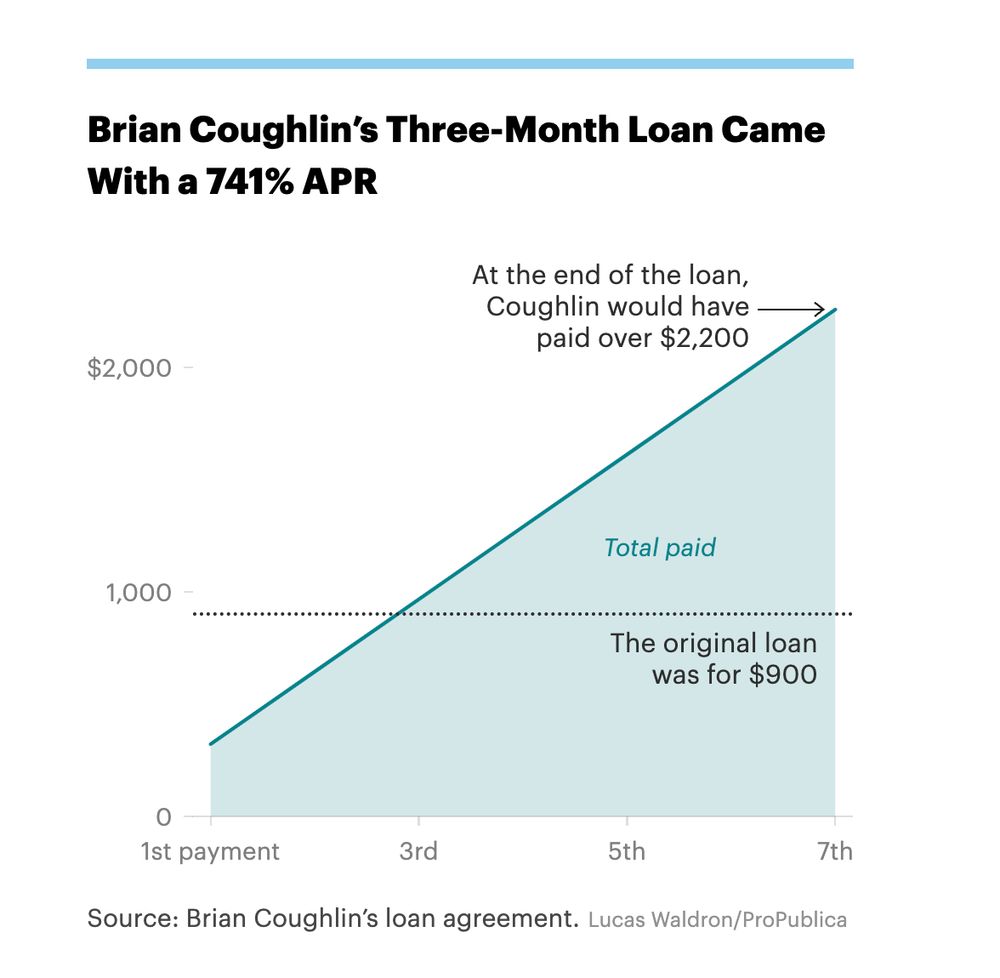

7/ In the Supreme Court case, a borrower with a 741% loan from LDF said that the incessant collection efforts by an LDF business partner — even after he declared bankruptcy — drove him to attempt suicide.

The business partner declined to comment.

The business partner declined to comment.

January 3, 2025 at 12:20 AM

7/ In the Supreme Court case, a borrower with a 741% loan from LDF said that the incessant collection efforts by an LDF business partner — even after he declared bankruptcy — drove him to attempt suicide.

The business partner declined to comment.

The business partner declined to comment.

6/ We found that the enterprise helped the Lac du Flambeau tribe avoid financial ruin, but it also led to costly lawsuits — including one that went up to the Supreme Court — and dubious partnerships with outside entities handling much of the daily operations: www.propublica.org/article/wisc...

Desperate Times Led Wisconsin Tribe to High-Interest Lending, Dubious Partnerships and Legal Jeopardy

Facing financial ruin, the Lac du Flambeau tribe began offering short-term loans online with annual rates often over 600%. But as the tribe rose in an industry derided for predatory practices, it put ...

www.propublica.org

January 3, 2025 at 12:20 AM

6/ We found that the enterprise helped the Lac du Flambeau tribe avoid financial ruin, but it also led to costly lawsuits — including one that went up to the Supreme Court — and dubious partnerships with outside entities handling much of the daily operations: www.propublica.org/article/wisc...