https://substack.com/@macromarketnotes

#JobsReport

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/june-payro...

#JobsReport

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/june-payro...

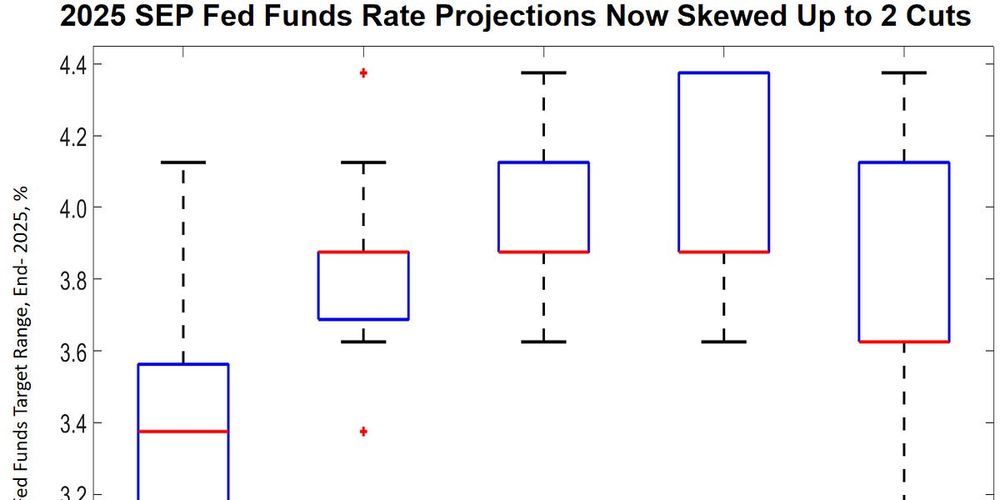

#FOMC #feddecision #Economy

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/june-2025-...

#FOMC #feddecision #Economy

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/june-2025-...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/may-cpi-an...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/may-cpi-an...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/may-payrol...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/may-payrol...

A 🧵but for more details go to Macro Market Notes: janjjgroen.substack.com/p/april-pers...

A 🧵but for more details go to Macro Market Notes: janjjgroen.substack.com/p/april-pers...

A 🧵but for more details go to Macro Market Notes: janjjgroen.substack.com/p/q1-2025-pr...

A 🧵but for more details go to Macro Market Notes: janjjgroen.substack.com/p/q1-2025-pr...

A 🧵but for more details go to Macro Market Notes: janjjgroen.substack.com/p/q1-2025-pr...

#FOMC #FederalReserve #inflation

A🧵but for more detail visit Macro Market Notes: janjjgroen.substack.com/p/may-2025-f...

#FOMC #FederalReserve #inflation

A🧵but for more detail visit Macro Market Notes: janjjgroen.substack.com/p/may-2025-f...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/april-payr...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/april-payr...

A 🧵but for more detail go to Macro Market Notes: janjjgroen.substack.com/p/march-pers...

A 🧵but for more detail go to Macro Market Notes: janjjgroen.substack.com/p/march-pers...

with [prev. Fed chair] Bill Martin there. He was always six months too late doing anything. I’m counting on you, Arthur, to keep us out of a recession.”' www.aeaweb.org/articles?id=...

with [prev. Fed chair] Bill Martin there. He was always six months too late doing anything. I’m counting on you, Arthur, to keep us out of a recession.”' www.aeaweb.org/articles?id=...

A 🧵but for more details go to Macro Market Notes: janjjgroen.substack.com/p/march-cpi-...

A 🧵but for more details go to Macro Market Notes: janjjgroen.substack.com/p/march-cpi-...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/march-payr...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/march-payr...

A 🧵but for more detail go to Macro Market Notes: janjjgroen.substack.com/p/feb-person...

A 🧵but for more detail go to Macro Market Notes: janjjgroen.substack.com/p/feb-person...

www.wsj.com/podcasts/the...

www.wsj.com/podcasts/the...

www.ft.com/content/1de4...

www.ft.com/content/1de4...

#FOMC #FederalReserve #inflation #economy

A🧵but for more detail visit Macro Market Notes: janjjgroen.substack.com/p/march-2025...

#FOMC #FederalReserve #inflation #economy

A🧵but for more detail visit Macro Market Notes: janjjgroen.substack.com/p/march-2025...

A 🧵with some thoughts ahead of tomorrow's March FOMC rate decision. #FederalReserve #FOMC #economy

Let's go but for more details (incl. my view on Feb. #retailsales) go to Macro Market Notes: janjjgroen.substack.com/p/feb-retail...

A 🧵with some thoughts ahead of tomorrow's March FOMC rate decision. #FederalReserve #FOMC #economy

Let's go but for more details (incl. my view on Feb. #retailsales) go to Macro Market Notes: janjjgroen.substack.com/p/feb-retail...

A 🧵but for more details go to Macro Market Notes: janjjgroen.substack.com/p/feb-cpi-in...

A 🧵but for more details go to Macro Market Notes: janjjgroen.substack.com/p/feb-cpi-in...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/feb-payrol...

A 🧵but for more details visit Macro Market Notes: janjjgroen.substack.com/p/feb-payrol...

A 🧵but for detail visit Macro Market Notes: janjjgroen.substack.com/p/jan-person...

A 🧵but for detail visit Macro Market Notes: janjjgroen.substack.com/p/jan-person...

A 🧵but for detail visit Macro Market Notes: janjjgroen.substack.com/p/jan-person...