Instead, big tax cuts and spending hikes pushed projected deficits towards $3T-$4T within a decade. Ignore the spin, watch the data.

Instead, big tax cuts and spending hikes pushed projected deficits towards $3T-$4T within a decade. Ignore the spin, watch the data.

Haha, you're funny. The only evidence of DOGE savings is a $12 billion reduction in State Dept & foreign aid funding. And the IRS layoffs will cost more money than that in tax evasion and fewer audits.

Haha, you're funny. The only evidence of DOGE savings is a $12 billion reduction in State Dept & foreign aid funding. And the IRS layoffs will cost more money than that in tax evasion and fewer audits.

He credits Trump's aggressive savings policies.

He credits Trump's aggressive savings policies.

Politicians need to stop looking for easy, fake solutions and make the tough decisions on deficits. (/F)

Politicians need to stop looking for easy, fake solutions and make the tough decisions on deficits. (/F)

Thus, I estimate even a *full-point* cut in the Fed funds rate would save maybe $44 billion next year. White House OMB data shows even less savings. That's out of a $7T budget.

Thus, I estimate even a *full-point* cut in the Fed funds rate would save maybe $44 billion next year. White House OMB data shows even less savings. That's out of a $7T budget.

Also, the market determines the interest rate paid by the Treasury on its debt, and the Fed Funds rate has limited impact there.

Also, the market determines the interest rate paid by the Treasury on its debt, and the Fed Funds rate has limited impact there.

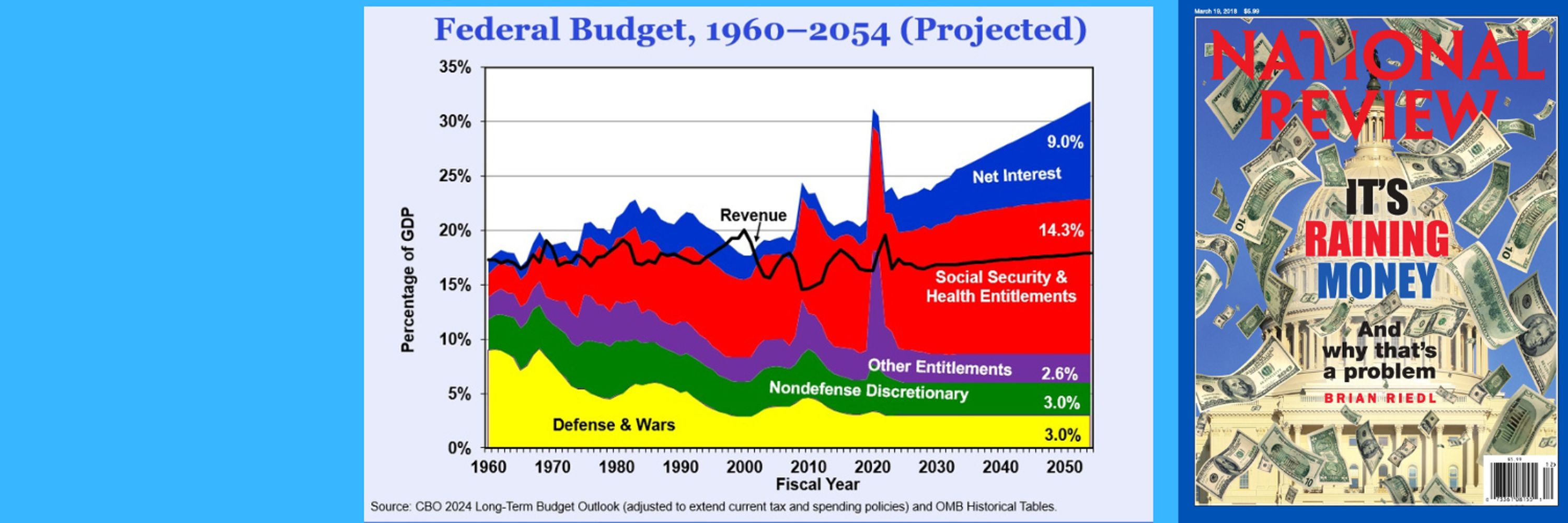

2021 - $352 billion

2025 - $1 trillion (approx)

2035 - $2 trillion (projected)

Interest has soared past Medicaid, defense, and Medicare to become the second-biggest item in the federal budget.

2021 - $352 billion

2025 - $1 trillion (approx)

2035 - $2 trillion (projected)

Interest has soared past Medicaid, defense, and Medicare to become the second-biggest item in the federal budget.

bsky.app/profile/jess...

www.youtube.com/watch?v=o0x1...

bsky.app/profile/jess...

Instead, interest costs have tripled to $1 trillion and are the 2nd largest budget item after Social Security - and may double again within a decade. So even more debt.

Instead, interest costs have tripled to $1 trillion and are the 2nd largest budget item after Social Security - and may double again within a decade. So even more debt.

It means all growth must come from labor productivity, which itself is not great.

It means all growth must come from labor productivity, which itself is not great.

First, the demographic challenge is raising senior benefit costs while limiting taxpaying workers.

First, the demographic challenge is raising senior benefit costs while limiting taxpaying workers.