-Rapid-response (right of center) economic policy from a longtime DC policy veteran.

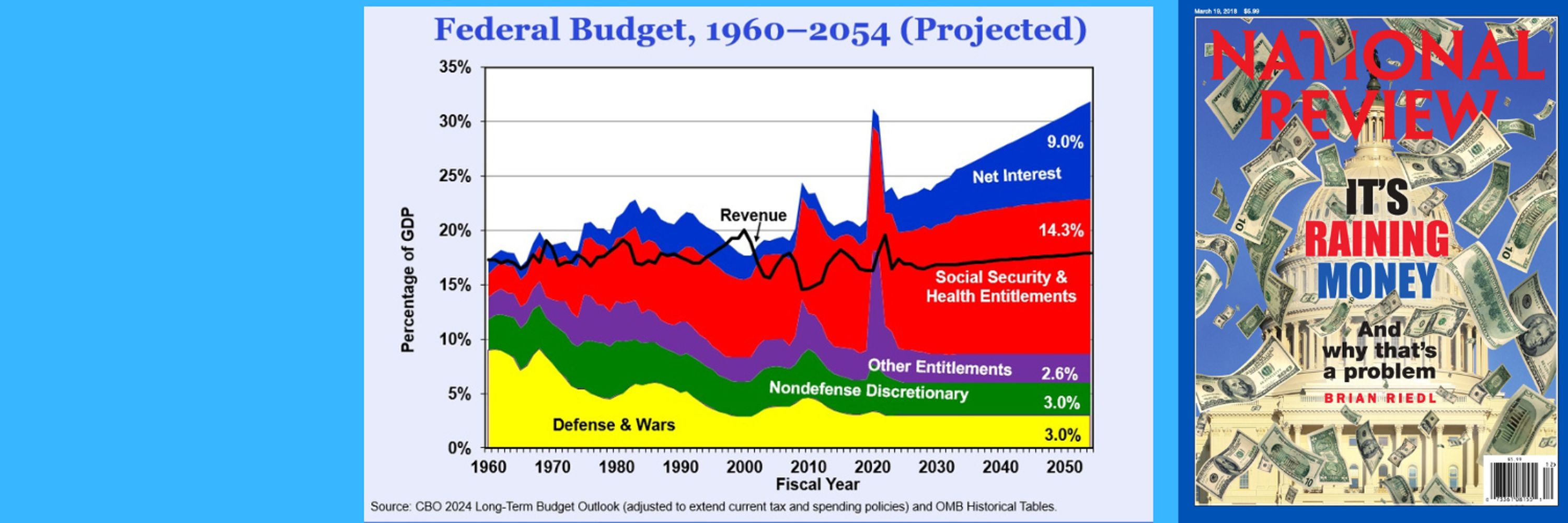

-So many charts – budget, spending, taxes, deficits.

-Contempt for both parties.

-Social libertarianism, tolerance, & civility.

-Wisconsin sports rants.

In reality, it would surely become yet another panderfest of tax cuts & spending hikes. 🧵

thedispatch.com/article/repu...

In reality, it would surely become yet another panderfest of tax cuts & spending hikes. 🧵

thedispatch.com/article/repu...

I explain why its failure to deeply slash spending was so predictable, and what that means for deficits. 🧵 thedispatch.com/article/why-...

I explain why its failure to deeply slash spending was so predictable, and what that means for deficits. 🧵 thedispatch.com/article/why-...

… I’m excited to join the Brookings Institution as a budget & tax fellow in its Tax Policy Center. New home, but same, center-right, fiscal hawk, free market economic analysis.

… I’m excited to join the Brookings Institution as a budget & tax fellow in its Tax Policy Center. New home, but same, center-right, fiscal hawk, free market economic analysis.

In return for saving $283 monthly, you will pay an extra $421,302 in interest over the life of the loan.

Or if you sell at 15 years, will have paid down just $29,000 in equity. Not good.

TRUMP: It's not even a big deal. You go from 40 to 50 years. All it means is you pay less per month

In return for saving $283 monthly, you will pay an extra $421,302 in interest over the life of the loan.

Or if you sell at 15 years, will have paid down just $29,000 in equity. Not good.

In @thedispatchmedia.bsky.social, I show that fiscal dominance would NOT reduce interest costs very much. 🧵

In @thedispatchmedia.bsky.social, I show that fiscal dominance would NOT reduce interest costs very much. 🧵

Sorry guys, you voted for this. Enjoy the consequences!

Sorry guys, you voted for this. Enjoy the consequences!

I examine the emerging debt crises that are destabilizing the British and French governments - and how America faces similar economic & fiscal challenges on an even deeper level. 🧵 www.washingtonpost.com/opinions/202...

I examine the emerging debt crises that are destabilizing the British and French governments - and how America faces similar economic & fiscal challenges on an even deeper level. 🧵 www.washingtonpost.com/opinions/202...

It is just dangerous ugliness from unhinged, fanatical bigots.

It is just dangerous ugliness from unhinged, fanatical bigots.

We desperately need de-escalators.

We desperately need de-escalators.

www.youtube.com/watch?v=o0x1...

www.youtube.com/watch?v=o0x1...

This is the power Trump seeks with impoundment. 🧵

thedispatch.com/article/trum...

This is the power Trump seeks with impoundment. 🧵

thedispatch.com/article/trum...

2) That stratospheric pre-2012 election GDP estimate showed... 2.0% growth.

3) Zero evidence of these estimates being rigged.

4) That DOD jump was driven by the looming sequester.

These conspiracy theories are absurd and sad.

2) That stratospheric pre-2012 election GDP estimate showed... 2.0% growth.

3) Zero evidence of these estimates being rigged.

4) That DOD jump was driven by the looming sequester.

These conspiracy theories are absurd and sad.

If a Democrat pulled these stunts, Republicans would be setting themselves on fire outside the White House.

If a Democrat pulled these stunts, Republicans would be setting themselves on fire outside the White House.

Tariffs may offset just 3% of ten-year deficits (or 1/6 of the new tax cuts) with lots of economic pain.🧵

www.washingtonpost.com/opinions/202...

Tariffs may offset just 3% of ten-year deficits (or 1/6 of the new tax cuts) with lots of economic pain.🧵

www.washingtonpost.com/opinions/202...

I address the new tax cuts, soaring debt, DOGE, Social Security, Medicare, tariffs, inflation, and firing Jerome Powell. www.youtube.com/watch?v=hHTN...

I address the new tax cuts, soaring debt, DOGE, Social Security, Medicare, tariffs, inflation, and firing Jerome Powell. www.youtube.com/watch?v=hHTN...

"Not a president turning the tariff dials every five minutes."

Follow on Apple: bit.ly/4lPez7n

"Not a president turning the tariff dials every five minutes."

Follow on Apple: bit.ly/4lPez7n

Conservative economist @jessicabriedl.bsky.social talks about how we got here--and how to fix it.

Don't miss our new interview airing on @pbs.org this weekend on Firing Line.

bit.ly/4feltkc

Conservative economist @jessicabriedl.bsky.social talks about how we got here--and how to fix it.

Don't miss our new interview airing on @pbs.org this weekend on Firing Line.

bit.ly/4feltkc