nodeepdives.substack.com

His system? Bet small when losing, big when winning.

Cool story.

It's also just that. A story

nodeepdives.substack.com/p/ackchyuall...

His system? Bet small when losing, big when winning.

Cool story.

It's also just that. A story

nodeepdives.substack.com/p/ackchyuall...

I got you.

open.substack.com/pub/nodeepdi...

I got you.

open.substack.com/pub/nodeepdi...

-0.13% vs -8.69% for S&P 500 (EUR)

nodeepdives.substack.com/p/q1-2025-po...

-0.13% vs -8.69% for S&P 500 (EUR)

nodeepdives.substack.com/p/q1-2025-po...

"Jeld-Wen forecast revenues would drop 4-9%"

"AO Smith forecast flat to modest sales growth"

"Home Depot forecast 1% rise"

"Trump’s eagerness to deport undocumented workers poses a particular threat" to construction

$JELD $AOS $HD

"Jeld-Wen forecast revenues would drop 4-9%"

"AO Smith forecast flat to modest sales growth"

"Home Depot forecast 1% rise"

"Trump’s eagerness to deport undocumented workers poses a particular threat" to construction

$JELD $AOS $HD

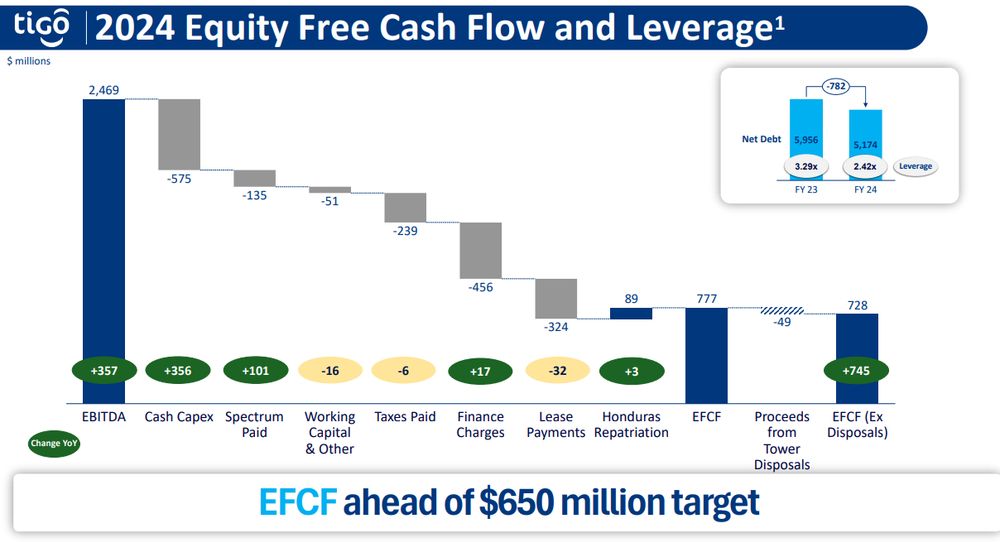

'24 FCF: $725m (vs estimates of $675m)

'25 FCF guidance: $750m (vs $703m est)

At $28, that's about 15.3% LTM FCF yield, 15.8% fwd

Reconfirming a quartertly $0.75 dividend to be sustained or grown

(That's $3 per year or 10.7% dividend yield)

'24 FCF: $725m (vs estimates of $675m)

'25 FCF guidance: $750m (vs $703m est)

At $28, that's about 15.3% LTM FCF yield, 15.8% fwd

Reconfirming a quartertly $0.75 dividend to be sustained or grown

(That's $3 per year or 10.7% dividend yield)

• Majority owner of Exmar holds > 88%, leaving a free float of just ~11.5%

• He tenders at €11.50/share

• To squeeze out, he must reach 95% of shares AND > 90% of the free float needs to tender

= a minority of 1.2% can block the deal

• Majority owner of Exmar holds > 88%, leaving a free float of just ~11.5%

• He tenders at €11.50/share

• To squeeze out, he must reach 95% of shares AND > 90% of the free float needs to tender

= a minority of 1.2% can block the deal

- Economically sensitive business mode

- Limited ability to raise capital

- Always trades at a discount to NAV because NAV is not an appropriate benchmark

- Limited strategic options on a standalone basis

- Limited interest from potential acquirors

- Economically sensitive business mode

- Limited ability to raise capital

- Always trades at a discount to NAV because NAV is not an appropriate benchmark

- Limited strategic options on a standalone basis

- Limited interest from potential acquirors

"High-end brands incl. Diageo’s Casamigos and Bacardi’s Patrón have been lowering prices for more than a year"

Diageo "now positioning Casamigos at a lower price point than its Don Julio brand"

$DGE $DEO $BF.B

"High-end brands incl. Diageo’s Casamigos and Bacardi’s Patrón have been lowering prices for more than a year"

Diageo "now positioning Casamigos at a lower price point than its Don Julio brand"

$DGE $DEO $BF.B

$3 regular yearly dividend paid in quarterly increments, to be sustained or grown

On a $25 share price, this is a yield of 12%!

How is this possible?

Because the stock is cheap AF and has a FCF yield of 16%+

$3 regular yearly dividend paid in quarterly increments, to be sustained or grown

On a $25 share price, this is a yield of 12%!

How is this possible?

Because the stock is cheap AF and has a FCF yield of 16%+

nodeepdives.substack.com/p/model-port...

nodeepdives.substack.com/p/model-port...

Mentions a 300bp drag to the economy & high APRs ;)

@keubiko.bsky.social

Mentions a 300bp drag to the economy & high APRs ;)

@keubiko.bsky.social

- $150m buyback in 6 months (3.5%, or >7% annualized)

- special dividend of $1 in January (4% yield at $25), with the

intention of restarting a recurring dividend, to be approved at next AGM

- $150m buyback in 6 months (3.5%, or >7% annualized)

- special dividend of $1 in January (4% yield at $25), with the

intention of restarting a recurring dividend, to be approved at next AGM

Volex #VLX will make an offer on it's smaller peer TT Electronics #TTG

I wrote about it, but haven't pulled the trigger myself yet.

Curious to hear other opinions on the situation

nodeepdives.substack.com/p/tt-electro...

Volex #VLX will make an offer on it's smaller peer TT Electronics #TTG

I wrote about it, but haven't pulled the trigger myself yet.

Curious to hear other opinions on the situation

nodeepdives.substack.com/p/tt-electro...

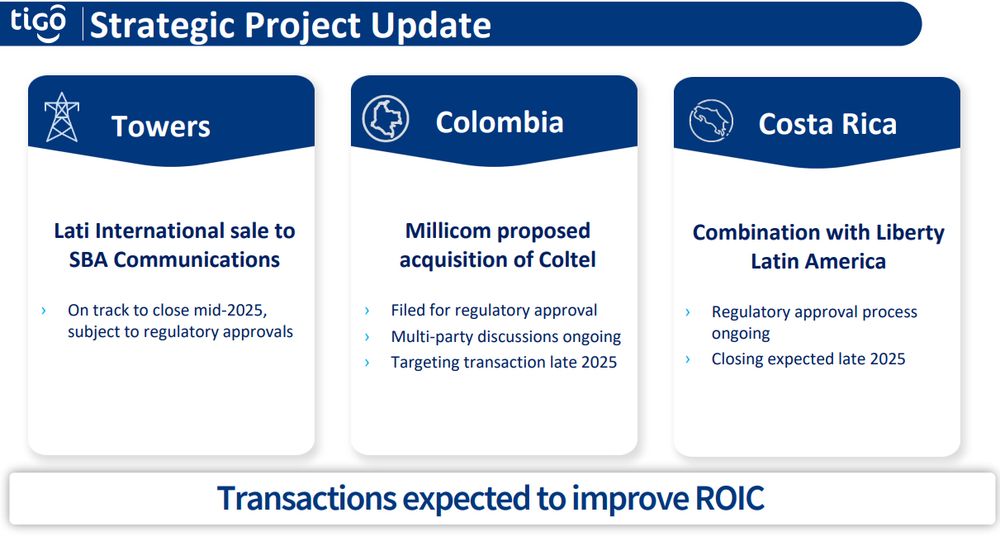

nodeepdives.substack.com/p/digesting-...

(Are cashtags a thing here? $TIGO $SBAC)

nodeepdives.substack.com/p/digesting-...

(Are cashtags a thing here? $TIGO $SBAC)