James Bland

@jamesbland.bsky.social

Economist at UToledo. 🇦🇺 Bayesian Econometrics for economic experiments and Behavioral Economics

Free online book on this stuff here: https://jamesblandecon.github.io/StructuralBayesianTechniques/section.html

https://sites.google.com/site/jamesbland/

He/his

Free online book on this stuff here: https://jamesblandecon.github.io/StructuralBayesianTechniques/section.html

https://sites.google.com/site/jamesbland/

He/his

Getting ready to present my work at Purdue

Also looking forward to catching up with a whole lot of friends and colleagues from my PhD program!

link to paper here: papers.ssrn.com/sol3/papers....

Also looking forward to catching up with a whole lot of friends and colleagues from my PhD program!

link to paper here: papers.ssrn.com/sol3/papers....

November 6, 2025 at 11:15 AM

Getting ready to present my work at Purdue

Also looking forward to catching up with a whole lot of friends and colleagues from my PhD program!

link to paper here: papers.ssrn.com/sol3/papers....

Also looking forward to catching up with a whole lot of friends and colleagues from my PhD program!

link to paper here: papers.ssrn.com/sol3/papers....

Or you could estimate a hierarchical model that assumes your participants' parameters are drawn from a population distribution.

November 4, 2025 at 4:42 PM

Or you could estimate a hierarchical model that assumes your participants' parameters are drawn from a population distribution.

Or you could assume a finite mixture of preference types

I really don't like this one, especially for this application. It really looks more like a continuous distribution.

I really don't like this one, especially for this application. It really looks more like a continuous distribution.

November 4, 2025 at 4:42 PM

Or you could assume a finite mixture of preference types

I really don't like this one, especially for this application. It really looks more like a continuous distribution.

I really don't like this one, especially for this application. It really looks more like a continuous distribution.

Now come some "in between" choices.

If you have participant demographics, you can make your parameters a function of these

If you have participant demographics, you can make your parameters a function of these

November 4, 2025 at 4:42 PM

Now come some "in between" choices.

If you have participant demographics, you can make your parameters a function of these

If you have participant demographics, you can make your parameters a function of these

At the other end of things, you can estimate your model once for every participant. This is really flexible, but your estimates will likely be imprecise.

November 4, 2025 at 4:42 PM

At the other end of things, you can estimate your model once for every participant. This is really flexible, but your estimates will likely be imprecise.

First (not advisable) you can ignore the heterogeneity and assume everyone is the same.

Simple, easy, probably very wrong.

Simple, easy, probably very wrong.

November 4, 2025 at 4:42 PM

First (not advisable) you can ignore the heterogeneity and assume everyone is the same.

Simple, easy, probably very wrong.

Simple, easy, probably very wrong.

New working paper!

"Adding parameter heterogeneity to structural models: some guidance for the practitioner"

papers.ssrn.com/sol3/papers....

a thread ...

#TeachBE #EconSky

"Adding parameter heterogeneity to structural models: some guidance for the practitioner"

papers.ssrn.com/sol3/papers....

a thread ...

#TeachBE #EconSky

November 4, 2025 at 4:42 PM

New working paper!

"Adding parameter heterogeneity to structural models: some guidance for the practitioner"

papers.ssrn.com/sol3/papers....

a thread ...

#TeachBE #EconSky

"Adding parameter heterogeneity to structural models: some guidance for the practitioner"

papers.ssrn.com/sol3/papers....

a thread ...

#TeachBE #EconSky

November 3, 2025 at 4:35 PM

Getting ready to present this at @pittecon.bsky.social

Link to paper here: papers.ssrn.com/sol3/papers....

Link to paper here: papers.ssrn.com/sol3/papers....

October 31, 2025 at 12:21 PM

Getting ready to present this at @pittecon.bsky.social

Link to paper here: papers.ssrn.com/sol3/papers....

Link to paper here: papers.ssrn.com/sol3/papers....

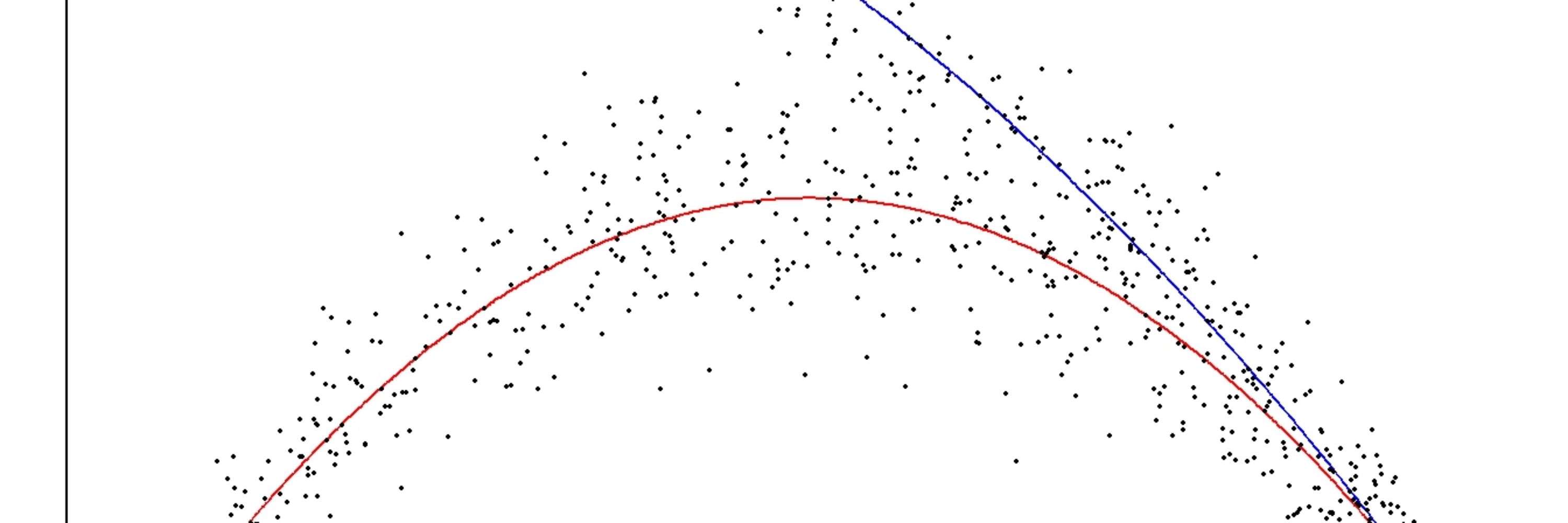

In a common experiment design, I show that RDU preferences can be nonconvex. This can be a problem for estimation, as there can be multiple optima.

October 27, 2025 at 6:31 PM

In a common experiment design, I show that RDU preferences can be nonconvex. This can be a problem for estimation, as there can be multiple optima.

Getting ready for my Workshop for Ukraine. Coming up in a bit under two hours!

October 16, 2025 at 2:16 PM

Getting ready for my Workshop for Ukraine. Coming up in a bit under two hours!

And about 75% of participants actually make themselves better off on average.

But that leaves about 25% of participants who made themselves *worse* off by revising their choices.

But that leaves about 25% of participants who made themselves *worse* off by revising their choices.

October 14, 2025 at 4:05 PM

And about 75% of participants actually make themselves better off on average.

But that leaves about 25% of participants who made themselves *worse* off by revising their choices.

But that leaves about 25% of participants who made themselves *worse* off by revising their choices.

I then use this estimated utility function to calculate the certainty equivalent of initial and revised choices.

For almost all participants, the revised choice is much more likely to be a utility improvement than not.

For almost all participants, the revised choice is much more likely to be a utility improvement than not.

October 14, 2025 at 4:05 PM

I then use this estimated utility function to calculate the certainty equivalent of initial and revised choices.

For almost all participants, the revised choice is much more likely to be a utility improvement than not.

For almost all participants, the revised choice is much more likely to be a utility improvement than not.

In this experiment, participants made 50 convex budget choices that determined a risky payoff. Then, participants were given an opportunity to revise 36 of these.

October 14, 2025 at 4:05 PM

In this experiment, participants made 50 convex budget choices that determined a risky payoff. Then, participants were given an opportunity to revise 36 of these.

I use structural techniques to estimate the utility gain (or loss) associated with these revisions in an existing economic experiment (Breig & Feldman, 2024).

October 14, 2025 at 4:05 PM

I use structural techniques to estimate the utility gain (or loss) associated with these revisions in an existing economic experiment (Breig & Feldman, 2024).

New working paper: The normative value of a revised choice: a

structural approach

papers.ssrn.com/sol3/papers....

#EconSky

A thread ...

structural approach

papers.ssrn.com/sol3/papers....

#EconSky

A thread ...

October 14, 2025 at 4:05 PM

New working paper: The normative value of a revised choice: a

structural approach

papers.ssrn.com/sol3/papers....

#EconSky

A thread ...

structural approach

papers.ssrn.com/sol3/papers....

#EconSky

A thread ...

The designs are really different to each other, and also look (to me at least) very different to existing designs by humans.

September 28, 2025 at 3:34 PM

The designs are really different to each other, and also look (to me at least) very different to existing designs by humans.

New version of a working paper:

"Optimizing experiment design for estimating parametric models in economic experiments"

github.com/JamesBlandEc...

#EconSky

A thread ...

"Optimizing experiment design for estimating parametric models in economic experiments"

github.com/JamesBlandEc...

#EconSky

A thread ...

September 28, 2025 at 3:34 PM

New version of a working paper:

"Optimizing experiment design for estimating parametric models in economic experiments"

github.com/JamesBlandEc...

#EconSky

A thread ...

"Optimizing experiment design for estimating parametric models in economic experiments"

github.com/JamesBlandEc...

#EconSky

A thread ...

In some non-econ news, I saw The Darkness in Detroit last night. Much fun was had!

September 18, 2025 at 11:52 AM

In some non-econ news, I saw The Darkness in Detroit last night. Much fun was had!

Getting my slide deck ready for an online workshop based on my book in October. Watch this space! 😀

Link to book here: jamesblandecon.github.io/StructuralBa...

#EconSky #TeachBE #RStats #Stan

Link to book here: jamesblandecon.github.io/StructuralBa...

#EconSky #TeachBE #RStats #Stan

September 9, 2025 at 3:33 PM

Getting my slide deck ready for an online workshop based on my book in October. Watch this space! 😀

Link to book here: jamesblandecon.github.io/StructuralBa...

#EconSky #TeachBE #RStats #Stan

Link to book here: jamesblandecon.github.io/StructuralBa...

#EconSky #TeachBE #RStats #Stan

Starting another chapter of my book.

This one will use data from:

Ellis, Andrew, and David J. Freeman. 2024. “Revealing Choice Bracketing.” American Economic Review 114 (9): 2668–2700

Link to book here: jamesblandecon.github.io/StructuralBa...

This one will use data from:

Ellis, Andrew, and David J. Freeman. 2024. “Revealing Choice Bracketing.” American Economic Review 114 (9): 2668–2700

Link to book here: jamesblandecon.github.io/StructuralBa...

September 5, 2025 at 7:29 PM

Starting another chapter of my book.

This one will use data from:

Ellis, Andrew, and David J. Freeman. 2024. “Revealing Choice Bracketing.” American Economic Review 114 (9): 2668–2700

Link to book here: jamesblandecon.github.io/StructuralBa...

This one will use data from:

Ellis, Andrew, and David J. Freeman. 2024. “Revealing Choice Bracketing.” American Economic Review 114 (9): 2668–2700

Link to book here: jamesblandecon.github.io/StructuralBa...

September 4, 2025 at 11:58 AM