UK macro, retail and #costofliving 📈👨🏽💻🇬🇧

Opinions my own etc

Formerly Experian

Leicestershire, United Kingdom 🦊

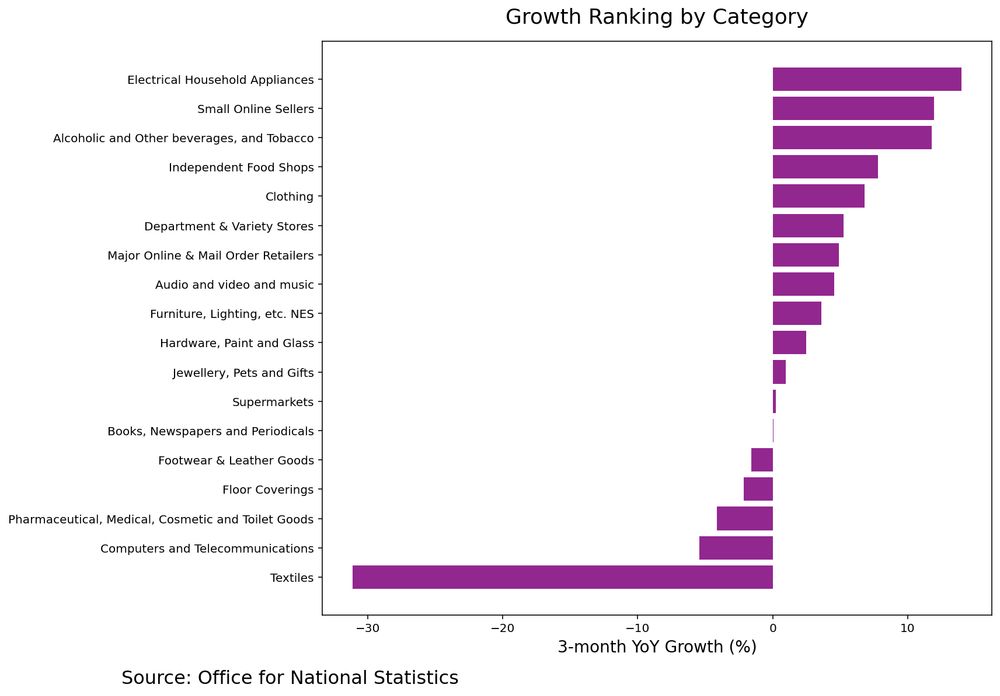

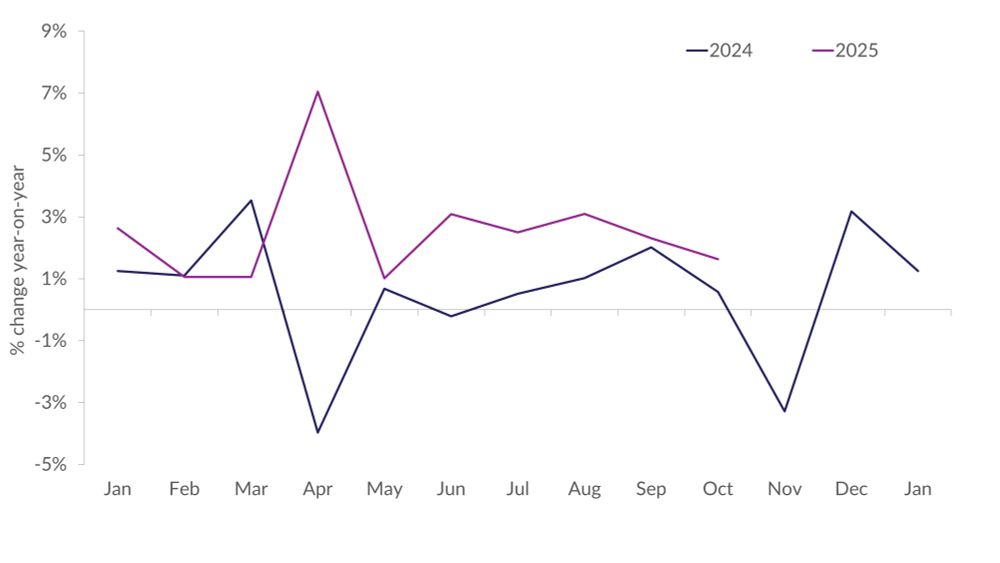

The @britishretail.bsky.social - @kpmguk.bsky.social retail sales measure rose 1.6% YoY in October, the slowest growth since May. Many shoppers delayed purchases, waiting for Black Friday deals and cooler weather before buying toys, electronics & clothing. 📊

The @britishretail.bsky.social - @kpmguk.bsky.social retail sales measure rose 1.6% YoY in October, the slowest growth since May. Many shoppers delayed purchases, waiting for Black Friday deals and cooler weather before buying toys, electronics & clothing. 📊

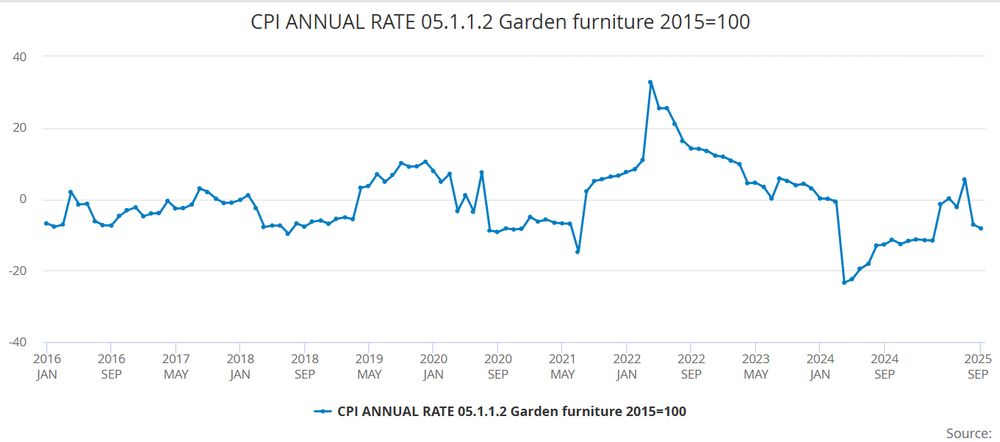

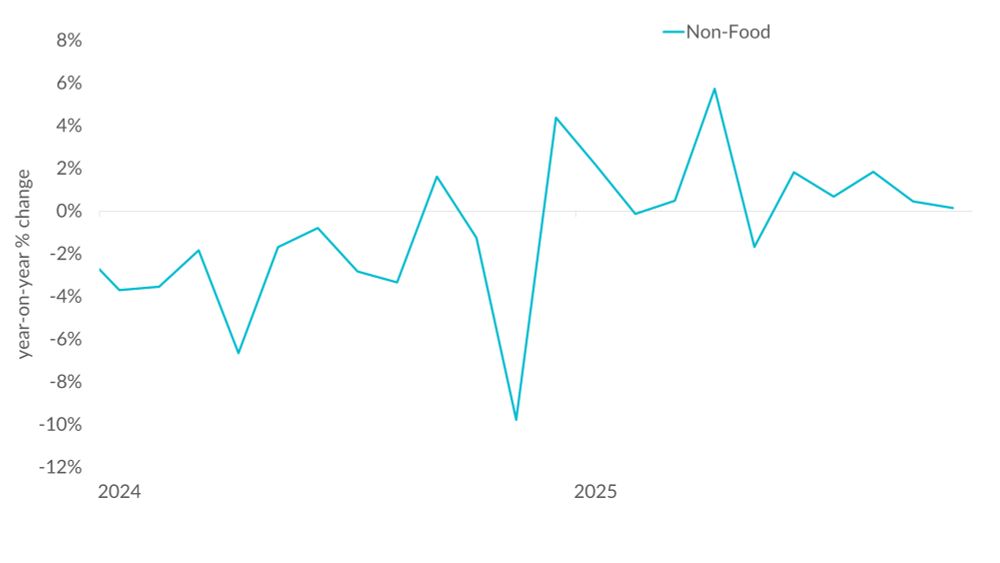

Today we published the latest @the_brc – @NielsenIQ Shop Price Monitor, covering October 2025.

Today we published the latest @the_brc – @NielsenIQ Shop Price Monitor, covering October 2025.