Gopi Shah Goda

@gsgoda.bsky.social

Senior Fellow and Director, Retirement Security Project @Brookings. Previously: Research Associate @NBER, Senior Fellow @SIEPR, Biden-Harris Council of Economic Advisers. Passionate about connecting research to policy.

https://www.gopishahgoda.org

https://www.gopishahgoda.org

Reposted by Gopi Shah Goda

The new Trump administration is now making an unprecedented effort to PREVENT science from informing policy.

For many years, these committees of outside, independent scientists advised federal statistical agencies on best methods.

Administration says we don't want that.

bsky.app/profile/eric...

For many years, these committees of outside, independent scientists advised federal statistical agencies on best methods.

Administration says we don't want that.

bsky.app/profile/eric...

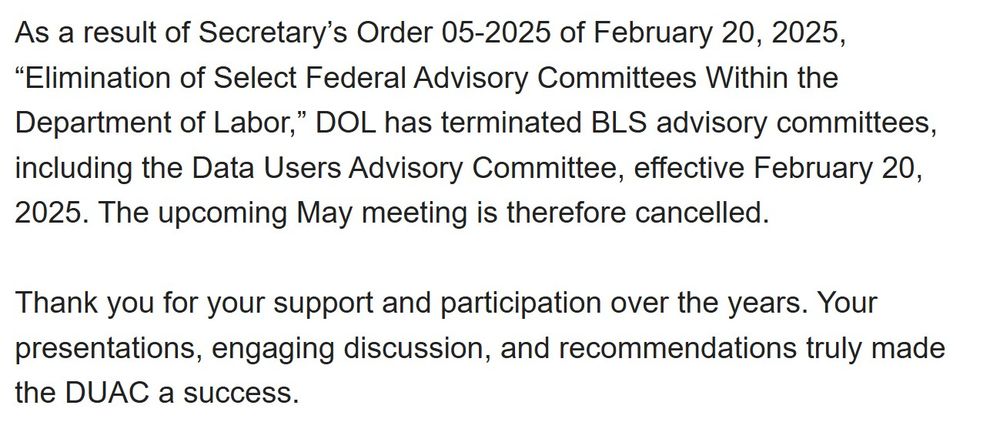

R.I.P. #DUAC & #BLSTAC. The Labor Sec. just terminated BLS’s 2 remaining advisory committees. Members got notice today (3/19/25). See attached text.

#FESAC, which served #BLS, BEA & Census jointly, was axed on 3/4/25.

@stevepierson123.bsky.social @aaronsojourner.org

#FESAC, which served #BLS, BEA & Census jointly, was axed on 3/4/25.

@stevepierson123.bsky.social @aaronsojourner.org

March 19, 2025 at 9:10 PM

The new Trump administration is now making an unprecedented effort to PREVENT science from informing policy.

For many years, these committees of outside, independent scientists advised federal statistical agencies on best methods.

Administration says we don't want that.

bsky.app/profile/eric...

For many years, these committees of outside, independent scientists advised federal statistical agencies on best methods.

Administration says we don't want that.

bsky.app/profile/eric...

Thanks to TIAA Institute for funding this work! This paper is dedicated to my dad, who was the inspiration for this research agenda.

December 2, 2024 at 4:08 PM

Thanks to TIAA Institute for funding this work! This paper is dedicated to my dad, who was the inspiration for this research agenda.

If you like this paper and want to learn about how the tax savings for IMDs are distributed, how it compares to the MID, and how it changed with the TCJA, check out my related paper with Ithai Lurie, Priyanka Parikh, and Chelsea Swete here!

www.nber.org/papers/w33157

11/ END

www.nber.org/papers/w33157

11/ END

The Distributional Implications of Itemized Medical Deductions

Founded in 1920, the NBER is a private, non-profit, non-partisan organization dedicated to conducting economic research and to disseminating research findings among academics, public policy makers, an...

www.nber.org

December 2, 2024 at 3:14 PM

If you like this paper and want to learn about how the tax savings for IMDs are distributed, how it compares to the MID, and how it changed with the TCJA, check out my related paper with Ithai Lurie, Priyanka Parikh, and Chelsea Swete here!

www.nber.org/papers/w33157

11/ END

www.nber.org/papers/w33157

11/ END

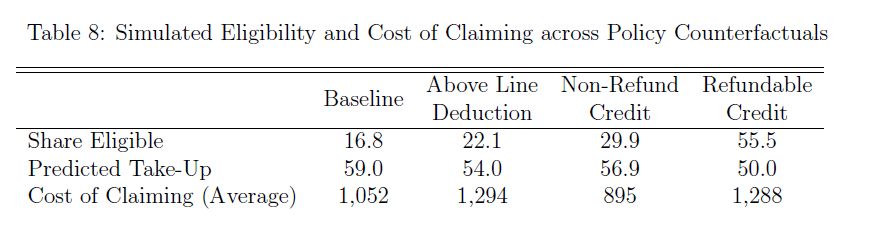

In conclusion, subsidizing medical expenses through the tax code imposes significant economic burdens, reducing the net subsidy available to taxpayers. 10/

December 2, 2024 at 3:14 PM

In conclusion, subsidizing medical expenses through the tax code imposes significant economic burdens, reducing the net subsidy available to taxpayers. 10/

The implied costs for alternative subsidy structures simulated using the model estimates are slightly lower but still substantial relative to the overall tax savings, as tracking out-of-pocket medical spending likely accounts for a large part of the hassle.

9/

9/

December 2, 2024 at 3:14 PM

The implied costs for alternative subsidy structures simulated using the model estimates are slightly lower but still substantial relative to the overall tax savings, as tracking out-of-pocket medical spending likely accounts for a large part of the hassle.

9/

9/

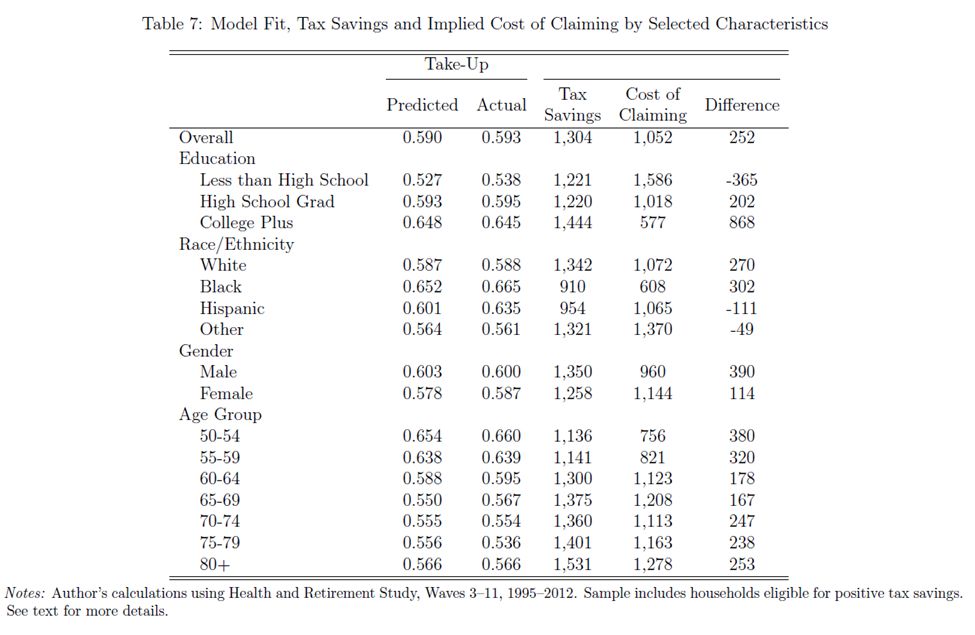

Finally, I estimate a simple model that makes use of differences in the value of the subsidy across states. The model generates an implied cost of claiming the subsidy ~80% as large as the tax savings, on average. For some groups, the implied cost exceeds the tax savings. 8/

December 2, 2024 at 3:14 PM

Finally, I estimate a simple model that makes use of differences in the value of the subsidy across states. The model generates an implied cost of claiming the subsidy ~80% as large as the tax savings, on average. For some groups, the implied cost exceeds the tax savings. 8/

I explore potential mechanisms behind incomplete take-up and find evidence that lack of awareness plays a role – as households are eligible more years, they are more and more likely to take advantage of the deduction. 7/

December 2, 2024 at 3:14 PM

I explore potential mechanisms behind incomplete take-up and find evidence that lack of awareness plays a role – as households are eligible more years, they are more and more likely to take advantage of the deduction. 7/

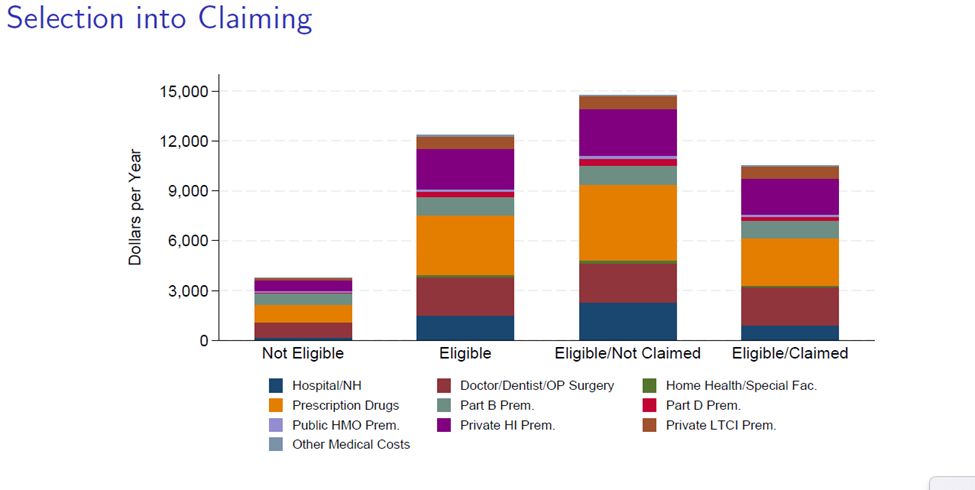

What’s more – those who are eligible but don’t claim the subsidy actually have *higher* levels of medical spending than those who are eligible and do claim. They also have lower income, lower levels of education and worse measures of health. 6/

December 2, 2024 at 3:14 PM

What’s more – those who are eligible but don’t claim the subsidy actually have *higher* levels of medical spending than those who are eligible and do claim. They also have lower income, lower levels of education and worse measures of health. 6/

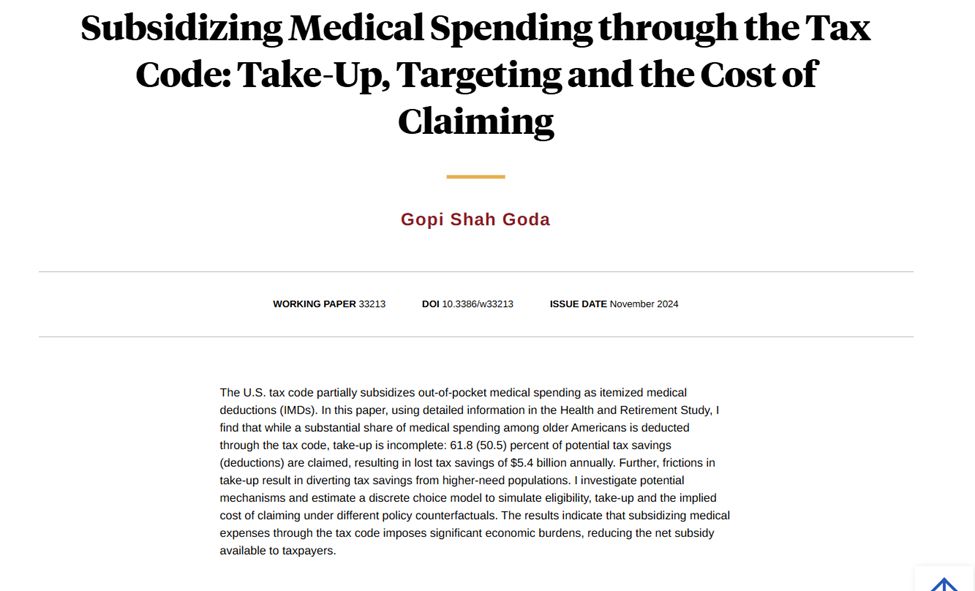

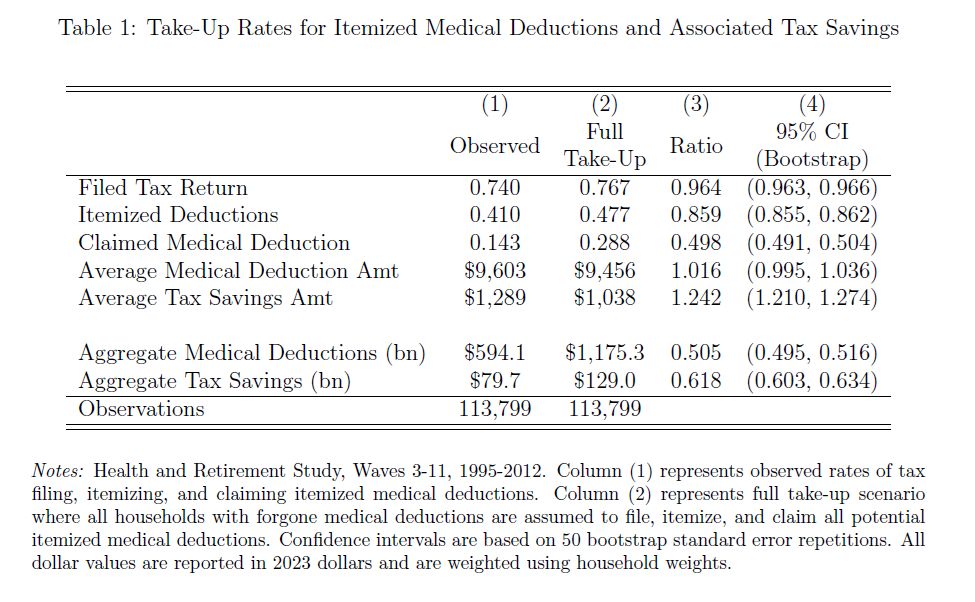

Using detailed data on income and out-of-pocket medical spending from the HRS, I estimate what people could deduct and compare them to what they actually do. I find about half of deductions are claimed, and incomplete take-up costs older households more than $5B annually in lost tax savings. 5/

December 2, 2024 at 3:14 PM

Using detailed data on income and out-of-pocket medical spending from the HRS, I estimate what people could deduct and compare them to what they actually do. I find about half of deductions are claimed, and incomplete take-up costs older households more than $5B annually in lost tax savings. 5/

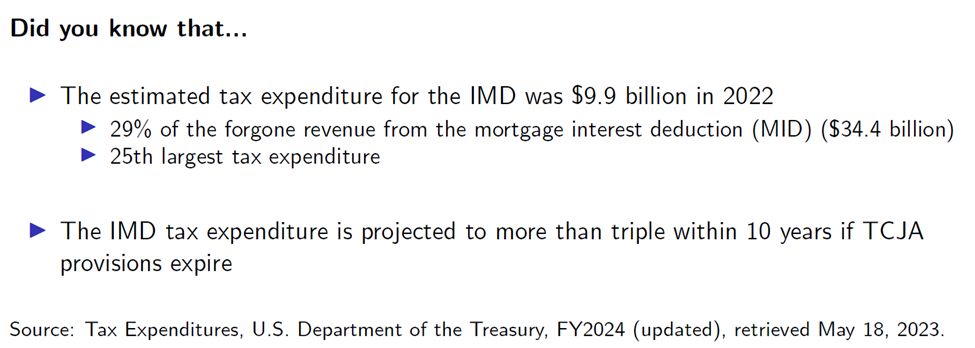

Does anyone actually spend that much on medical spending? Turns out over $75B in IMDs were deducted in 2021, about 2/3 by taxpayers over 65. The forgone revenue from this deduction is almost $10B annually – 29% of the forgone revenue from the mortgage interest deduction! 4/

December 2, 2024 at 3:14 PM

Does anyone actually spend that much on medical spending? Turns out over $75B in IMDs were deducted in 2021, about 2/3 by taxpayers over 65. The forgone revenue from this deduction is almost $10B annually – 29% of the forgone revenue from the mortgage interest deduction! 4/

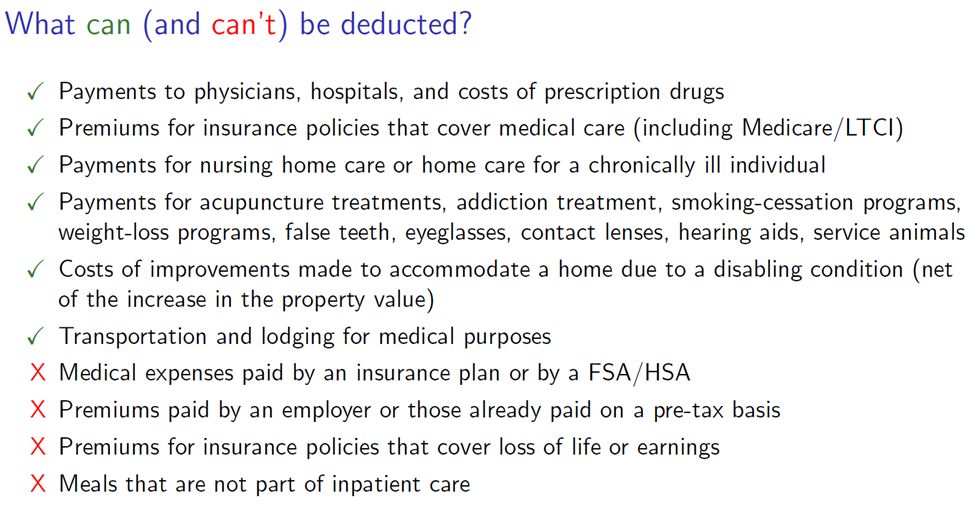

What you can deduct is quite expansive! (Caveat: I'm not an accountant and do not offer tax advice ☺️) 3/

December 2, 2024 at 3:14 PM

What you can deduct is quite expansive! (Caveat: I'm not an accountant and do not offer tax advice ☺️) 3/

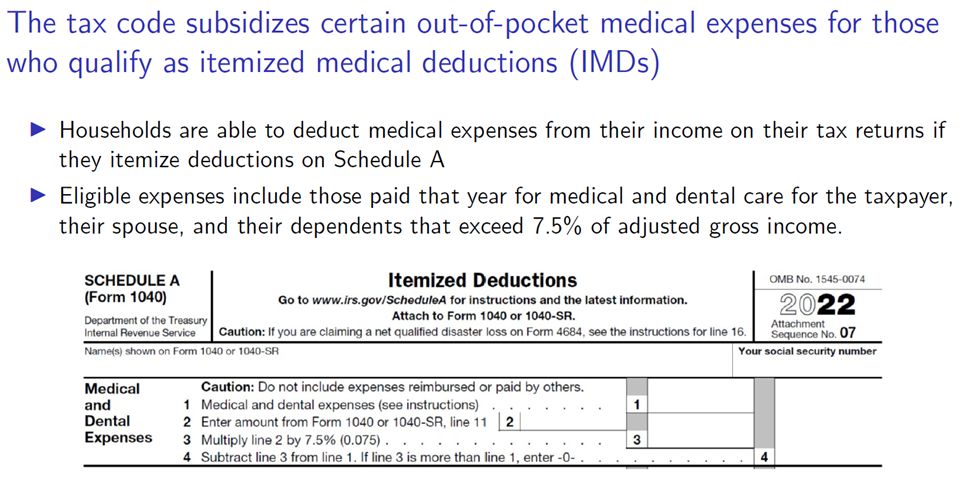

First, what is this subsidy? If you spend more than 7.5% of AGI on out-of-pocket medical spending, the excess can be included in your itemized deductions. Your itemized medical deduction (IMD) reduces your tax liability by reducing your taxable income:

2/

2/

December 2, 2024 at 3:14 PM

First, what is this subsidy? If you spend more than 7.5% of AGI on out-of-pocket medical spending, the excess can be included in your itemized deductions. Your itemized medical deduction (IMD) reduces your tax liability by reducing your taxable income:

2/

2/

Do we need an econ joke as the price of entry?

November 24, 2024 at 2:06 PM

Do we need an econ joke as the price of entry?

Great idea -- please add!

November 19, 2024 at 11:42 AM

Great idea -- please add!