https://www.gopishahgoda.org

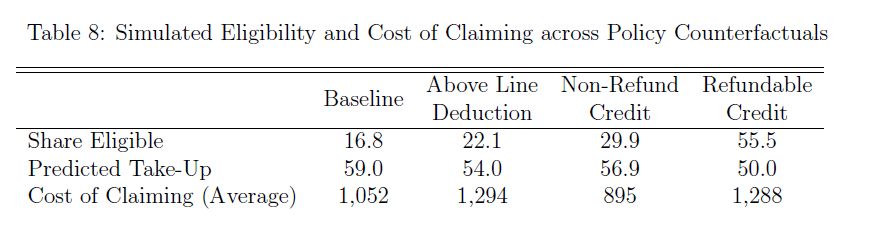

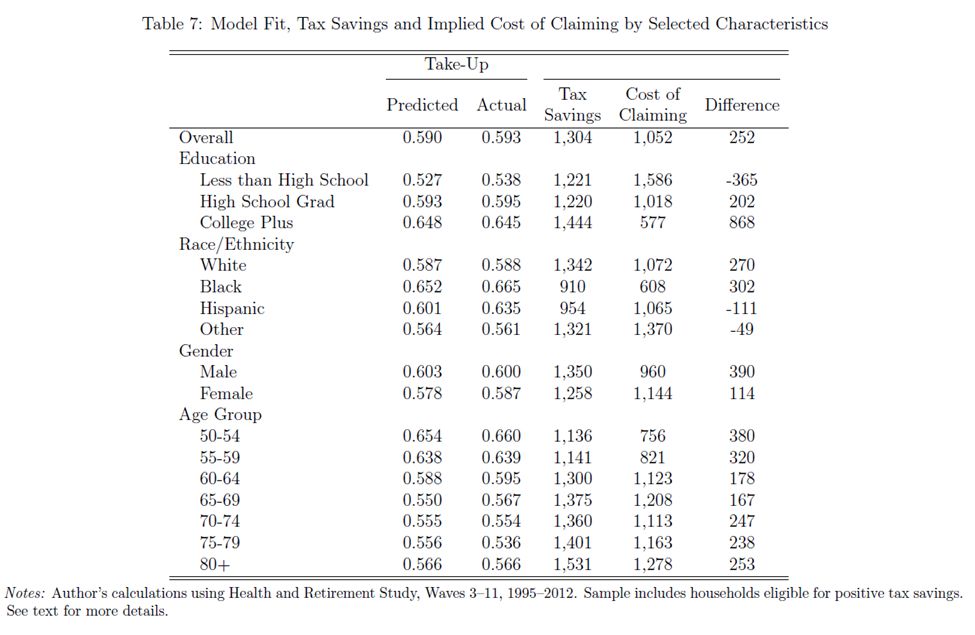

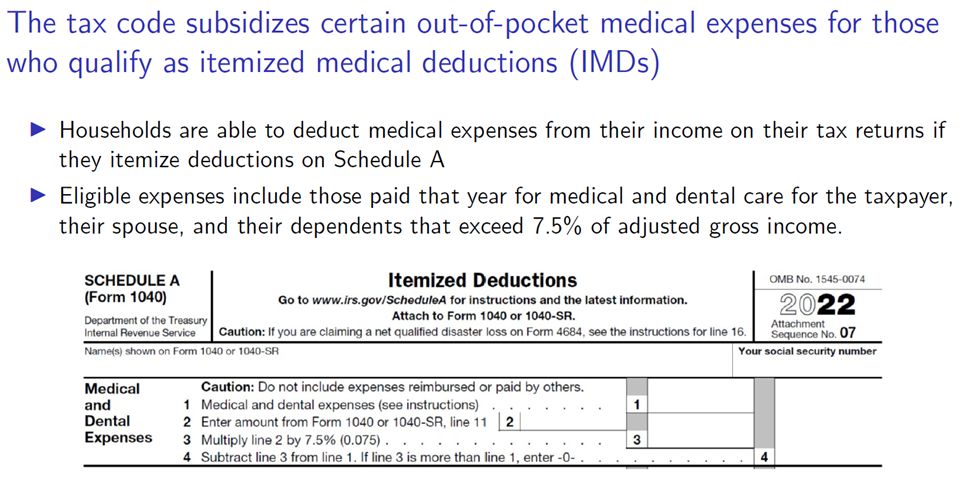

In conclusion, subsidizing medical expenses through the tax code imposes significant economic burdens, reducing the net subsidy available to taxpayers. 10/

In conclusion, subsidizing medical expenses through the tax code imposes significant economic burdens, reducing the net subsidy available to taxpayers. 10/

9/

9/

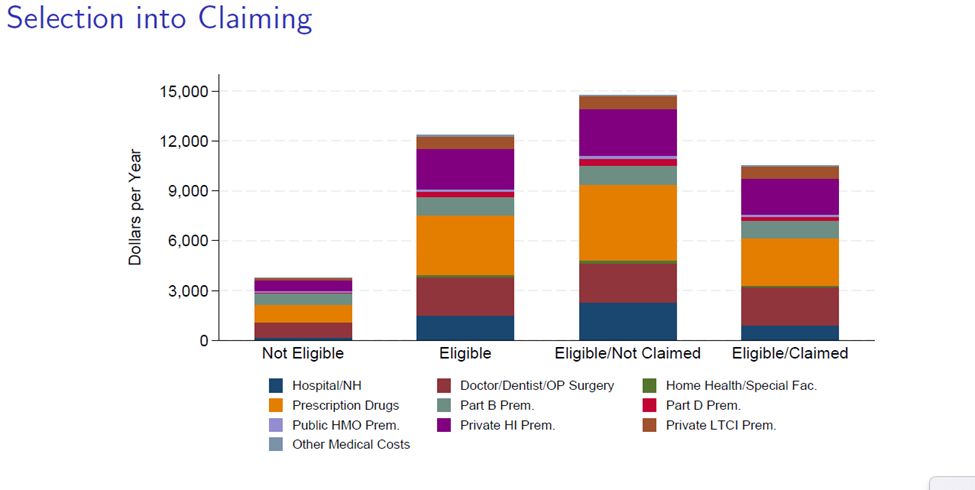

2/

2/