lots in the blog - fuel mix, interchange, and more!

part 2 will cover the fulsome western expansion of SPP's market, the Canada of it all, wider western challenges, and pondering the implications to Mid-C of split market participation among its constituent parts

blog.gridstatus.io/western-mark...

part 2 will cover the fulsome western expansion of SPP's market, the Canada of it all, wider western challenges, and pondering the implications to Mid-C of split market participation among its constituent parts

blog.gridstatus.io/western-mark...

CAISO's EDAM and SPP's Markets+ Arrive to Tame the Wild West

With new day-ahead Western markets just over the horizon, it's time to take stock of the field of play. Who's joining what, what do these aggregations look like, and what does it mean for the wider We...

blog.gridstatus.io

October 23, 2025 at 5:43 PM

lots in the blog - fuel mix, interchange, and more!

part 2 will cover the fulsome western expansion of SPP's market, the Canada of it all, wider western challenges, and pondering the implications to Mid-C of split market participation among its constituent parts

blog.gridstatus.io/western-mark...

part 2 will cover the fulsome western expansion of SPP's market, the Canada of it all, wider western challenges, and pondering the implications to Mid-C of split market participation among its constituent parts

blog.gridstatus.io/western-mark...

people get excited about price spikes in the real-time market, but most energy clears in the day-ahead, here's a look at CAISO's scheduled demand vs actual, typically the variation is within +/- 5%

October 23, 2025 at 5:43 PM

people get excited about price spikes in the real-time market, but most energy clears in the day-ahead, here's a look at CAISO's scheduled demand vs actual, typically the variation is within +/- 5%

the West may not have a comprehensive RTO, or two, but it's had quite a few administrative layers over the years

October 23, 2025 at 5:43 PM

the West may not have a comprehensive RTO, or two, but it's had quite a few administrative layers over the years

CAISO and SPP have new day-ahead markets (each of which includes real-time balancing markets) coming into service over the next 2 years, while AESO (Alberta) is also restructuring their market (similar to Ontario [IESO] earlier this year)

October 23, 2025 at 5:43 PM

CAISO and SPP have new day-ahead markets (each of which includes real-time balancing markets) coming into service over the next 2 years, while AESO (Alberta) is also restructuring their market (similar to Ontario [IESO] earlier this year)

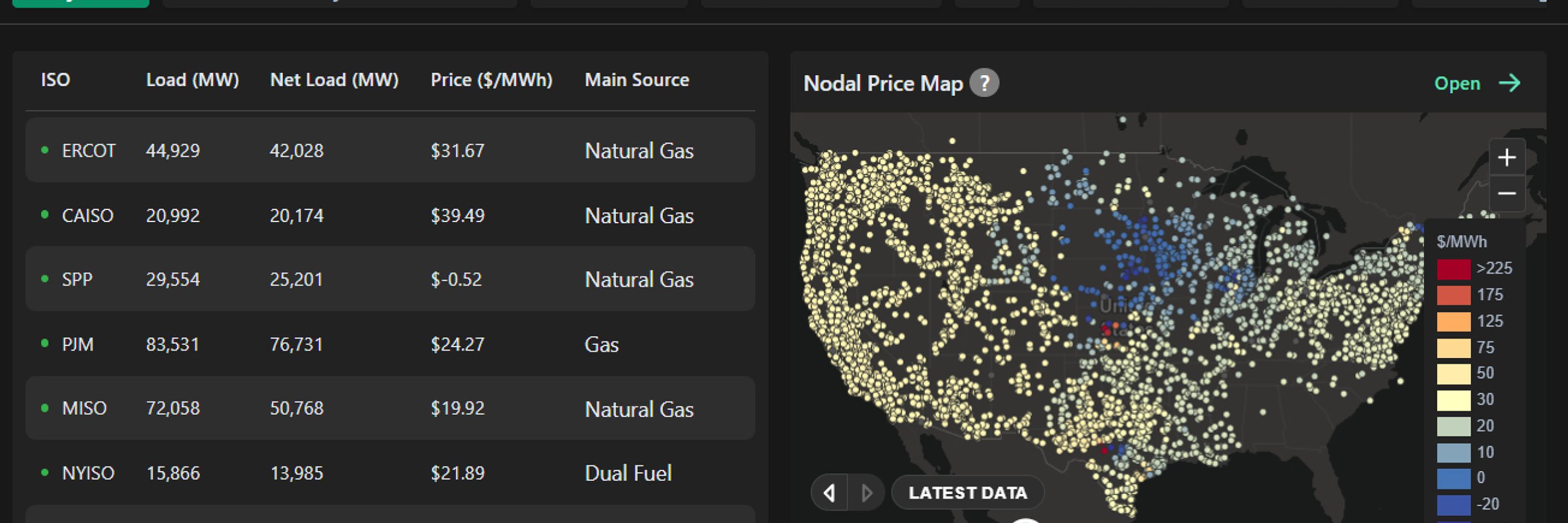

As the energy transition continues, access to real-time information across markets is increasingly important. Track net load price spikes across the country and keep an eye on our ISO-NE live page this winter to see how the region adapts to operations without coal

www.gridstatus.io/live/isone

www.gridstatus.io/live/isone

ISONE Live Dashboard and Price Map | Grid Status

Real-time grid conditions and LMP price map for ISONE on Grid Status

www.gridstatus.io

October 16, 2025 at 1:21 PM

As the energy transition continues, access to real-time information across markets is increasingly important. Track net load price spikes across the country and keep an eye on our ISO-NE live page this winter to see how the region adapts to operations without coal

www.gridstatus.io/live/isone

www.gridstatus.io/live/isone

Apart from internal generation, imports from Hydro Québec have declined in recent years, even as a new HVDC tie line is nearing completion. A further drop in flows from HQ may put additional pressure on the region’s ties with New Brunswick, which still has coal in its generation fleet.

October 16, 2025 at 1:21 PM

Apart from internal generation, imports from Hydro Québec have declined in recent years, even as a new HVDC tie line is nearing completion. A further drop in flows from HQ may put additional pressure on the region’s ties with New Brunswick, which still has coal in its generation fleet.

ISO-NE has benefited from state-level policy that led to the widespread BTM solar, cutting deeply into summer demand. But winter is another story. Gas supply constraints plague the region, which relies on plants with onsite storage, such as oil, coal, and the recently retired LNG-fueled Mystic

October 16, 2025 at 1:21 PM

ISO-NE has benefited from state-level policy that led to the widespread BTM solar, cutting deeply into summer demand. But winter is another story. Gas supply constraints plague the region, which relies on plants with onsite storage, such as oil, coal, and the recently retired LNG-fueled Mystic

While seen as an important milestone in New England’s decarbonization, Merrimack’s retirement comes at a time when ISO-NE is under increasing supply pressure. Offshore wind, one of the region’s few local resources, has been slow to scale and is under active attack from the federal government.

October 16, 2025 at 1:21 PM

While seen as an important milestone in New England’s decarbonization, Merrimack’s retirement comes at a time when ISO-NE is under increasing supply pressure. Offshore wind, one of the region’s few local resources, has been slow to scale and is under active attack from the federal government.

Looking West, CAISO technically also doesn't have a coal plant, but the LA Department of Water and Power is involved in the Intermountain power station in Utah, one of those CAISO != California moments

October 16, 2025 at 1:21 PM

Looking West, CAISO technically also doesn't have a coal plant, but the LA Department of Water and Power is involved in the Intermountain power station in Utah, one of those CAISO != California moments

Merrimack, New England’s last coal-fired power plant, retired in September, well ahead of a scheduled 2028 deactivation, marking the end of coal generation in the region. After a decadal decline, ISO-NE joins neighboring NYISO, as well as IESO, one step further, in having retired its coal

October 16, 2025 at 1:21 PM

Merrimack, New England’s last coal-fired power plant, retired in September, well ahead of a scheduled 2028 deactivation, marking the end of coal generation in the region. After a decadal decline, ISO-NE joins neighboring NYISO, as well as IESO, one step further, in having retired its coal

PJM’s market monitor estimates that consumers are on the hook for billions in higher capacity prices due to forecasted data center load growth alone, and bullish load forecasts without firm capacity will likely send these estimates even higher in next year’s uncapped auction.

October 10, 2025 at 1:33 PM

PJM’s market monitor estimates that consumers are on the hook for billions in higher capacity prices due to forecasted data center load growth alone, and bullish load forecasts without firm capacity will likely send these estimates even higher in next year’s uncapped auction.

At an RTO level, large load forecasts from all LSE/LDC presentations in September anticipate nearly 85 GW of growth over the next decade, approaching 100 GW in total by 2035.

This rapid expansion will strain an already tense environment.

This rapid expansion will strain an already tense environment.

October 10, 2025 at 1:33 PM

At an RTO level, large load forecasts from all LSE/LDC presentations in September anticipate nearly 85 GW of growth over the next decade, approaching 100 GW in total by 2035.

This rapid expansion will strain an already tense environment.

This rapid expansion will strain an already tense environment.

Dominion, home to the world’s largest existing data center market, continues to lead the way with large load demand rising from ~7,200 MW today to ~24,000 MW in 2035.

While large, this is a far more gradual increase compared to DAY or PPL, whose forecasts have ballooned in just the last year.

While large, this is a far more gradual increase compared to DAY or PPL, whose forecasts have ballooned in just the last year.

October 10, 2025 at 1:33 PM

Dominion, home to the world’s largest existing data center market, continues to lead the way with large load demand rising from ~7,200 MW today to ~24,000 MW in 2035.

While large, this is a far more gradual increase compared to DAY or PPL, whose forecasts have ballooned in just the last year.

While large, this is a far more gradual increase compared to DAY or PPL, whose forecasts have ballooned in just the last year.

AEP has revised its 2030 forecast down significantly, from 17,890 MW last year to 9,296 MW this year.

AEP-Ohio alone accounts for over 5 GW of this reduction, largely driven by tariff changes requiring large loads to prepay for a portion of expected usage.

AEP-Ohio alone accounts for over 5 GW of this reduction, largely driven by tariff changes requiring large loads to prepay for a portion of expected usage.

October 10, 2025 at 1:33 PM

AEP has revised its 2030 forecast down significantly, from 17,890 MW last year to 9,296 MW this year.

AEP-Ohio alone accounts for over 5 GW of this reduction, largely driven by tariff changes requiring large loads to prepay for a portion of expected usage.

AEP-Ohio alone accounts for over 5 GW of this reduction, largely driven by tariff changes requiring large loads to prepay for a portion of expected usage.

While the RTO is bound to continue seeing load growth, these forecasts warrant skepticism, particularly when compared to other zones within PJM.

October 10, 2025 at 1:33 PM

While the RTO is bound to continue seeing load growth, these forecasts warrant skepticism, particularly when compared to other zones within PJM.

In Ohio, Dayton anticipates an increase from its existing 35 MW of large load to over 6,335 MW in just 6 years, a ~18,000% jump.

PPL reports more than 15 GW of large loads by 2035 in comparison to 248 MW today, almost 5 GW more than COMED, a zone that today serves 2-3x the total demand.

PPL reports more than 15 GW of large loads by 2035 in comparison to 248 MW today, almost 5 GW more than COMED, a zone that today serves 2-3x the total demand.

October 10, 2025 at 1:33 PM

In Ohio, Dayton anticipates an increase from its existing 35 MW of large load to over 6,335 MW in just 6 years, a ~18,000% jump.

PPL reports more than 15 GW of large loads by 2035 in comparison to 248 MW today, almost 5 GW more than COMED, a zone that today serves 2-3x the total demand.

PPL reports more than 15 GW of large loads by 2035 in comparison to 248 MW today, almost 5 GW more than COMED, a zone that today serves 2-3x the total demand.