www.gridstatus.io/insights/344...

ERCOT also got a 202(c) yesterday to force backup power on

www.gridstatus.io/insights/344...

HQ is still struggling today

www.gridstatus.io/insights/344...

and more, check out the feed www.gridstatus.io/insights

www.gridstatus.io/insights/344...

ERCOT also got a 202(c) yesterday to force backup power on

www.gridstatus.io/insights/344...

HQ is still struggling today

www.gridstatus.io/insights/344...

and more, check out the feed www.gridstatus.io/insights

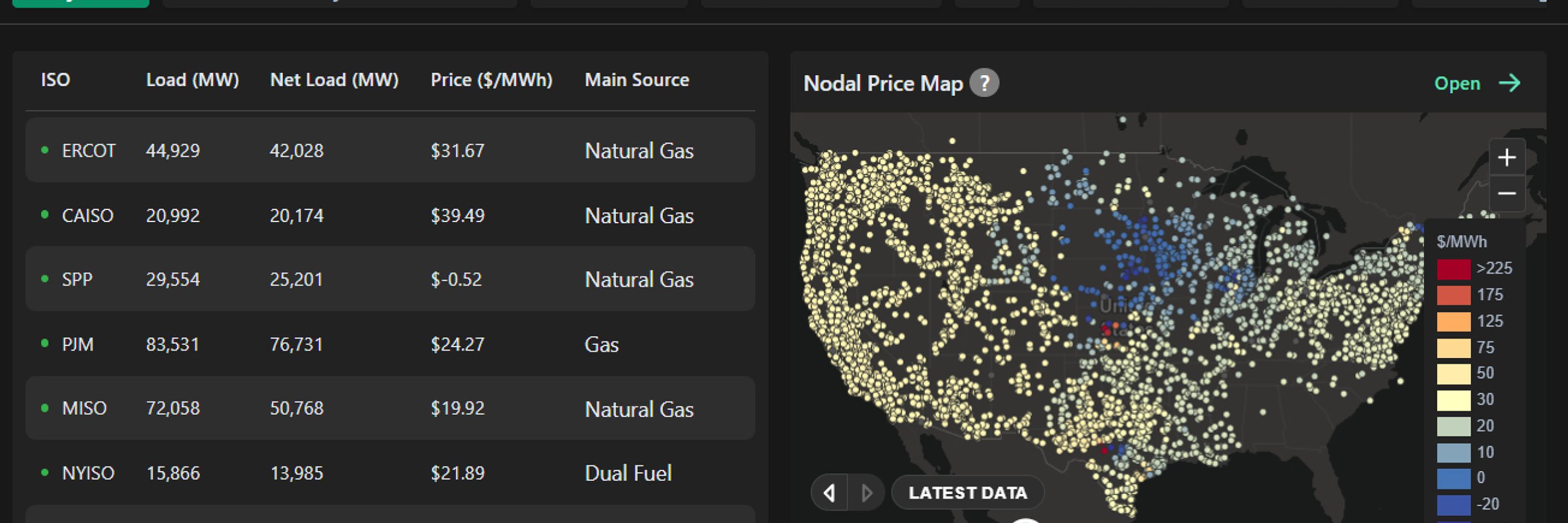

Started early this morning with looks at the spread of day-ahead LMPs across all locations in any particular hour

www.gridstatus.io/insights/342...

then followed up with 4 market pairings, e.g. www.gridstatus.io/insights/342...

Started early this morning with looks at the spread of day-ahead LMPs across all locations in any particular hour

www.gridstatus.io/insights/342...

then followed up with 4 market pairings, e.g. www.gridstatus.io/insights/342...

We've made two winter hazards and grid condition dashboards publicly available to anyone with a free account

Outlook: www.gridstatus.io/dashboards/c...

Ops: www.gridstatus.io/dashboards/d...

We've made two winter hazards and grid condition dashboards publicly available to anyone with a free account

Outlook: www.gridstatus.io/dashboards/c...

Ops: www.gridstatus.io/dashboards/d...

🔌💡

www.gridstatus.io/insights/336...

🔌💡

www.gridstatus.io/insights/336...

we'll be posting more at www.gridstatus.io/insights

we'll be posting more at www.gridstatus.io/insights

insidelines.pjm.com/pjms-updated...

insidelines.pjm.com/pjms-updated...

www.gridstatus.io/insights

www.gridstatus.io/insights

This is mostly driven by climate, historical prices, and year of industrialization/electrification 🔌💡

This is mostly driven by climate, historical prices, and year of industrialization/electrification 🔌💡

www.gridstatus.io/insights/310...

www.gridstatus.io/insights/310...

We’ll be posting live updates on Grid Status Insights as we explore outcomes today and over the weekend.

Through the morning peak we’ve already seen real-time AS prices remain far lower than their day-ahead spike

www.gridstatus.io/insights/top...

We’ll be posting live updates on Grid Status Insights as we explore outcomes today and over the weekend.

Through the morning peak we’ve already seen real-time AS prices remain far lower than their day-ahead spike

www.gridstatus.io/insights/top...

www.gridstatus.io/insights

www.gridstatus.io/insights

Earlier this year we noticed that flows into the US, and particularly New York, had dropped off, years before the threat of tariffs

blog.gridstatus.io/more-hqs-tha...

Earlier this year we noticed that flows into the US, and particularly New York, had dropped off, years before the threat of tariffs

blog.gridstatus.io/more-hqs-tha...

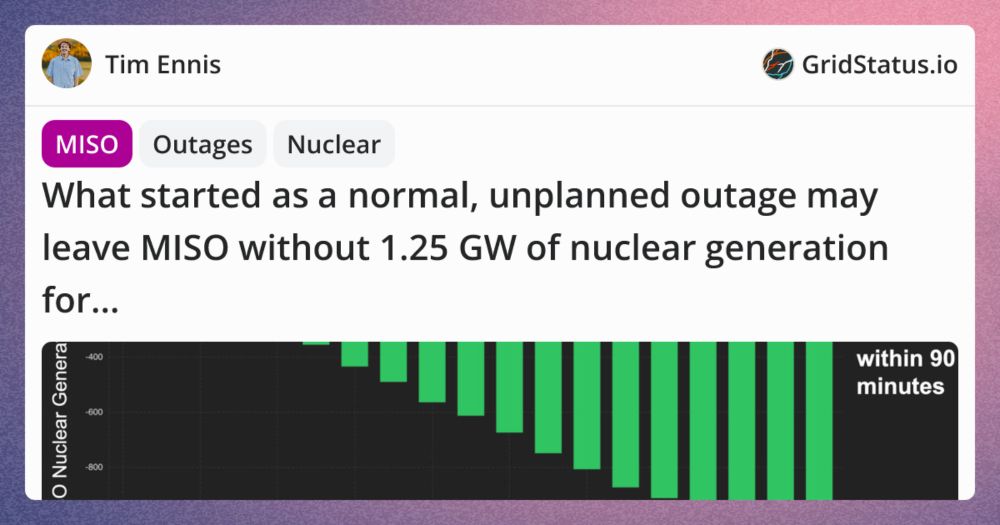

Read more at Grid Status Insights:

www.gridstatus.io/insights/280...

Read more at Grid Status Insights:

www.gridstatus.io/insights/280...

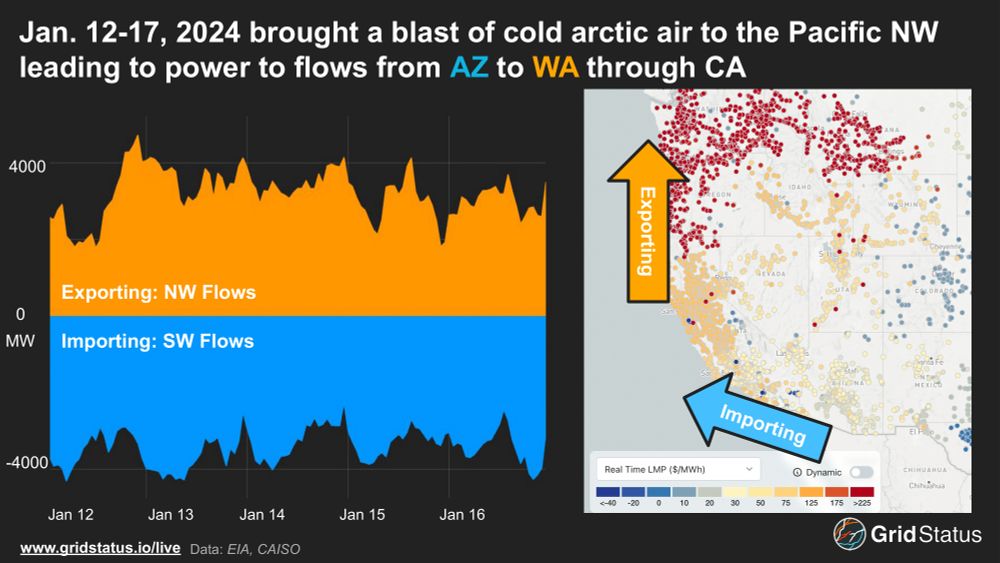

check it out and track live outcomes on www.gridstatus.io/live

check it out and track live outcomes on www.gridstatus.io/live

this time we focus on SPP West, the undecideds, Canada, and risks in the West

blog.gridstatus.io/western-mark...

this time we focus on SPP West, the undecideds, Canada, and risks in the West

blog.gridstatus.io/western-mark...

Over the past 9 years, real-time load has underperformed almost all of PJM’s forecasts over the evening peak, precisely during prime trick-or-treating hours 🔌💡

Over the past 9 years, real-time load has underperformed almost all of PJM’s forecasts over the evening peak, precisely during prime trick-or-treating hours 🔌💡

part 2 will cover the fulsome western expansion of SPP's market, the Canada of it all, wider western challenges, and pondering the implications to Mid-C of split market participation among its constituent parts

blog.gridstatus.io/western-mark...

part 2 will cover the fulsome western expansion of SPP's market, the Canada of it all, wider western challenges, and pondering the implications to Mid-C of split market participation among its constituent parts

blog.gridstatus.io/western-mark...