The RMP will run ample into Apr 15th historical low liquidity season.

www.newyorkfed.org/markets/dome...

The RMP will run ample into Apr 15th historical low liquidity season.

www.newyorkfed.org/markets/dome...

(ESTA is for most developed countries EU, JP Austr etc)

www.govinfo.gov/content/pkg/...

Also cf PLTR i guess 🤢

bsky.app/profile/fron...

(ESTA is for most developed countries EU, JP Austr etc)

www.govinfo.gov/content/pkg/...

Also cf PLTR i guess 🤢

bsky.app/profile/fron...

long VX1 if VX1>VX2 w 2-day lag

and

short VX1 if VX1

h/t @moontower.bsky.social + Ceph + RobotJames x.com/krisabdelmes...

As of this post Nov>Dec but settles in am tmrw and Dec

long VX1 if VX1>VX2 w 2-day lag

and

short VX1 if VX1

h/t @moontower.bsky.social + Ceph + RobotJames x.com/krisabdelmes...

As of this post Nov>Dec but settles in am tmrw and Dec

Maybe early Aug 2024 Nikkei scare to US equities scare repeat in Nov 2025?

Maybe early Aug 2024 Nikkei scare to US equities scare repeat in Nov 2025?

50% of this activity comes from retail traders.

Net gamma resulting de minimis.

Mar-Apr tariff ‘crash’ showed prudent pullback in 0DTE activity.

So …yes but no.

storage.pardot.com/77532/174619...

50% of this activity comes from retail traders.

Net gamma resulting de minimis.

Mar-Apr tariff ‘crash’ showed prudent pullback in 0DTE activity.

So …yes but no.

storage.pardot.com/77532/174619...

Not saying wrong, just haven’t seen it on the metrics I watch.

Curious

Here’s one free dashboard as of 2025-10-18, h/t volvibes.substack.com/p/spx-atm-op...

Not saying wrong, just haven’t seen it on the metrics I watch.

Curious

Here’s one free dashboard as of 2025-10-18, h/t volvibes.substack.com/p/spx-atm-op...

・ ゚*

・。

*・。

*.。

。・

°*. ゚

make it so

and make it so hard.

。。 ・

。 ・゚

。°*.

。*・。

・ ゚*

・。

*・。

*.。

。・

°*. ゚

make it so

and make it so hard.

。。 ・

。 ・゚

。°*.

。*・。

The “Marko Kolanovic gets vindicated” analog

(for lulz except if 0DTE breaks + DJT does not TACO again then serious)

bsky.app/profile/fron...

The “Marko Kolanovic gets vindicated” analog

(for lulz except if 0DTE breaks + DJT does not TACO again then serious)

bsky.app/profile/fron...

30 June 2008 MS initiating LEH Lehman Brothers with Overweight

😅

media.licdn.com/dms/document...

30 June 2008 MS initiating LEH Lehman Brothers with Overweight

😅

media.licdn.com/dms/document...

Otherwise, had some chat around BDC / priv credit / HYG w specialists. See excerpt. TL;DR on watch but not systemic yet

www.ft.com/content/8d47...

Otherwise, had some chat around BDC / priv credit / HYG w specialists. See excerpt. TL;DR on watch but not systemic yet

www.ft.com/content/8d47...

x.com/cmdropatlarg...

x.com/cmdropatlarg...

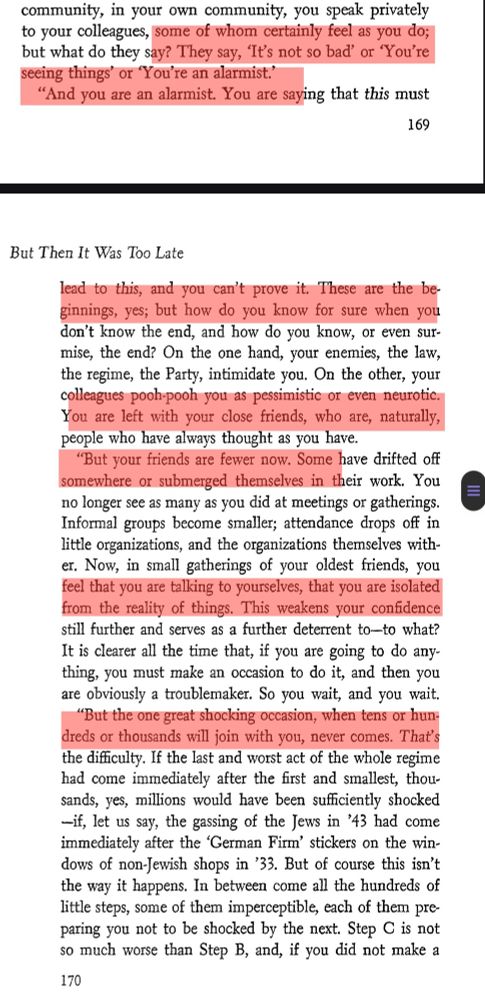

Slowly, then all at once. - Twain

1001 days in the life of the turkey. - Taleb

+ 4visuals from my other acc. Seem pertinent.

Slowly, then all at once. - Twain

1001 days in the life of the turkey. - Taleb

+ 4visuals from my other acc. Seem pertinent.

Heck I’m bearish as well but I wish it was so easy and broad

Long many single names in biotech but short indices and long Fed funds.

Heck I’m bearish as well but I wish it was so easy and broad

Long many single names in biotech but short indices and long Fed funds.

Connect Bluesky

Enter your Bluesky handle and app password to unlock posting, likes, and your Following feed.

Need an app password? Open Bluesky, go to Settings > App passwords, and create a new one.

Connect with Bluesky

Sign in with your Bluesky account to unlock posting, likes, and your Following feed.